Europe Residential Solar PV Panels Market Size, Share & Trends Analysis Report, By Technology (Thin Film, Crystalline Silicon), By Grid Type, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-966-3

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

Market Size & Trends

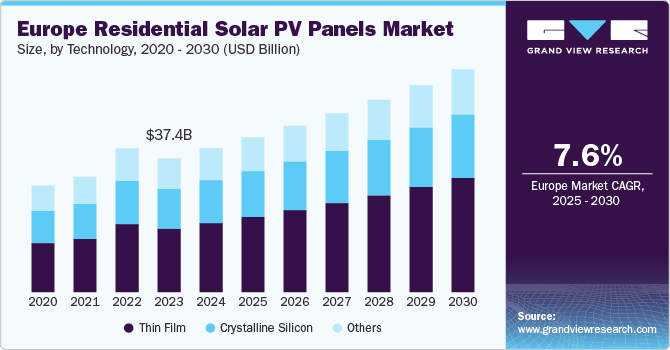

The Europe residential solar PV panels market size was estimated at USD 40,273.78 million in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2030. The market growth in Europe is driven by several key factors. Government policies and incentives play a crucial role, as many European countries have implemented ambitious renewable energy targets and financial support mechanisms to encourage solar adoption. In addition, the declining costs of solar technology have made installations more accessible and appealing to homeowners.

The government of the UK has set a net-zero electricity grid target by 2035 and plans to stop using fossil fuels for energy generation. The country has been issuing favorable policies to achieve this target. In January 2022, the government of the UK reduced the tax on solar PV panels and other renewable power generation products to promote the adoption of solar PV panels for residential applications. The value-added tax was reduced by 5% for the installation of residential solar PV panel systems.

Drivers, Opportunities & Restraints

The ongoing energy crisis, characterized by rising electricity prices and a push for energy independence, further motivates consumers to invest in solar solutions to reduce reliance on the grid and stabilize energy costs. Moreover, the increasing demand for decentralized energy generation aligns with a broader trend toward sustainability, prompting more households to adopt rooftop solar systems as a means of self-consumption and reduced carbon footprints.

With a significant portion of residential rooftops remaining unused, there is substantial potential for growth in rooftop solar installations. Countries like Germany, Spain, and Italy are leading this trend, supported by regulatory frameworks that encourage residential solar deployment.

Fluctuating electricity prices and the easing of the energy crisis may reduce the urgency for homeowners to invest in solar systems. In addition, high interest rates can create a difficult investment climate, impacting financing options for potential buyers.

Technology Insights

Based on technology, the thin film segment led the market with the largest revenue share of 48.03% in 2024. The market drivers in Europe are largely influenced by technological advancements and supportive government initiatives aimed at promoting renewable energy. Thin film solar panels, known for their lightweight and flexible design, offer significant advantages in terms of installation versatility and reduced costs, making them appealing for residential applications.

The increasing focus on reducing greenhouse gas emissions and transitioning to sustainable energy sources further fuels demand as countries seek to integrate more renewables into their energy mix. In addition, the rapid urbanization and rising energy needs across Europe create a favorable environment for the adoption of thin film technology, which can be produced quickly and at lower costs compared to traditional silicon-based panels. This combination of factors positions thin film solar PV as a competitive option in the growing European residential solar market.

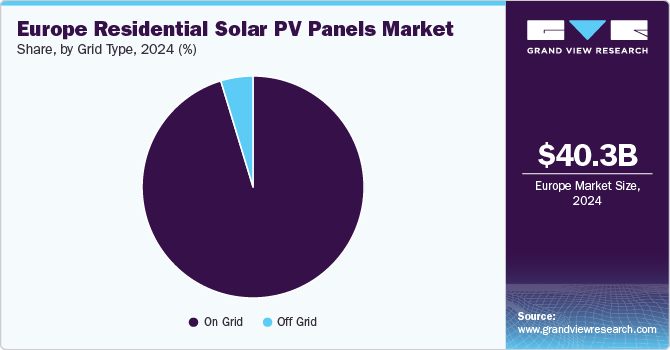

Grid Type Insights

Based on grid type, the on-grid segment led the market with the largest revenue share of 95.30% in 2024. The dominant position of the on-grid type segment can be attributed to the low operating cost of the on-grid system and grid-connected PV systems being able to transfer energy through the grid coupled with their non-complexity. On-grid PV systems have low operating costs as the excess electricity generated by them is transmitted to grids.

The off-grid type segment is projected to grow at a significant CAGR over the forecast period. Off-grid systems are self-sustaining systems as they store and save energy obtained from solar PV into batteries for use when grids face power outages. The rising energy demand from isolated locations worldwide, along with the formulation and stringent implementation of various regulatory policies for decentralizing the power generation sector, is expected to positively influence the growth of the off-grid type segment.

Country Insights

UK Europe Residential Solar PV Panels Market Trends

UK dominated the Europe Residential Solar PV Panels market with the largest revenue share of 16.67% in 2024. The market drivers in the UK are significantly influenced by several key factors. High wholesale electricity prices have prompted homeowners to seek cost-effective solutions, making solar energy an attractive option for reducing energy bills. The supportive regulatory framework, including the elimination of the 'solar tax' and the introduction of automatic remuneration for surplus energy, has further incentivized installations.

The increasing cost of generating electricity using fossil fuels coupled with the carbon emission goals set up by different countries to reduce the emission of greenhouse gases is expected to propel the growth market. The countries in Europe have implemented favorable regulations and incentive schemes for the adoption of residential solar PV panels. The European Union has increased funding to promote R&D and manufacturing activity of solar PV panels, which is one of the major factors driving the region's growth.

The loans are tax-free and offer a low interest rate to incentivize people to set up a solar power system. Homeowners who generate more electricity than they consume can sell the surplus electricity back to power companies at a premium price of up to USD 0.203 per kWh.

Key Europe Residential Solar PV Panels Company Insights

The market is characterized by the presence of many local, regional, and global suppliers. It is very competitive, and every player is constantly competing for a greater share. Fierce competition, rapid technological advances, frequent changes in government policy, and strict environmental regulations are some of the key factors that can drive the industry’s growth. Vendors compete for cost, product quality, reliability, and aftermarket service. Providers need to offer cost-effective and efficient products to survive and succeed in a highly competitive market environment. Some prominent players in the European market include:

Key Europe Residential Solar PV Panels Companies:

The following are the leading companies in the Europe residential solar PV panels market. These companies collectively hold the largest market share and dictate industry trends.

- DAIKIN INDUSTRIES, Ltd.

- E.ON UK plc

- EDF Group

- Edison Spa

- Enel Spa

- Comp6

- ENGIE

- ENI Group

- Jinko Solar

- LG Electronics

- LONGi

- TotalEnergies

Recent Developments

-

In June 2024, Iberdrola and Exiom collaborated to establish Spain's first large-scale solar panel manufacturing facility, a project aimed at enhancing the country's position in the renewable energy sector, particularly in solar energy. This initiative reflects their commitment to attracting a portion of the renewable energy value chain to Spain, positioning the nation as a leader in this emerging industry within Europe. The factory is expected to play a crucial role in bolstering local production capabilities and supporting Spain's ambitious renewable energy goals.

-

In April 2023, Zolar, a leading digital platform for residential solar in Germany, has successfully secured USD 108 million in funding in collaboration with BNP Paribas, a prominent global financial institution. This partnership marks the introduction of "zolar Easypay," a new financing solution designed for residential solar consumers. With zolar Easypay, the company expands its offerings for German households, providing a flexible installment loan option for purchasing solar systems and related energy management products. This initiative aligns with zolar's mission to help customers save on energy costs by allowing them to choose between a one-time payment or a customizable monthly fee

Europe Residential Solar PV Panels Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 43,290.29 million |

|

Revenue forecast in 2030 |

USD 62.33 billion |

|

Growth rate |

CAGR of 7.6% from 2024 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in MWh, Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, Volume forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Technology, grid type, country |

|

Regional scope |

Europe |

|

France; Italy; Spain; UK; Germany; Poland; Portugal; Belgium |

|

|

Key companies profiled |

DAIKIN INDUSTRIES, Ltd.; ENGIE; E.ON UK plc; EDF Group; Enel Spa; ENI Group; Jinko Solar; LONGi; Trina Solar; TotalEnergies; LG Electronics; Edison Spa |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Residential Solar PV Panels Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe residential solar PV panels market report based on technology, grid type, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Thin Film

-

Crystalline Silicon

-

Others

-

-

Grid Type Outlook (Revenue, USD Million, 2018 - 2030)

-

On Grid

-

Off Grid

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

France

-

Italy

-

Spain

-

UK

-

Germany

-

Poland

-

Portugal

-

Belgium

-

-

Frequently Asked Questions About This Report

b. The Europe residential solar PV panels market size was estimated at USD 40,273.78 million in 2024 and is expected to reach USD 43,290.29 million in 2025.

b. The Europe residential solar PV panels market is expected to witness a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 62,328.05 million by 2030.

b. The thin film was the largest technology segment accounting for 48.03% of the total revenue in 2024 owing to its narrow design, durability, and flexible & lightweight materials.

b. Some of the major players include in the Europe residential solar PV panels market DAIKIN INDUSTRIES, Ltd., ENGIE, E.ON UK plc, EDF Group, Enel Spa, ENI Group, and Jinko Solar

b. Key factors driving the growth of the Europe residential solar PV panels market include the increasing demand for photovoltaic cells and favorable policies and regulations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."