- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Recycled Plastics Market Size, Industry Report 2030GVR Report cover

![Europe Recycled Plastics Market Size, Share & Trends Report]()

Europe Recycled Plastics Market Size, Share & Trends Analysis Report By Source (Bottle, Foams, Films), By Product (Polyethylene, Polypropylene), By End-use (Packaging, Building & Construction), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-286-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Europe Recycled Plastics Market Trends

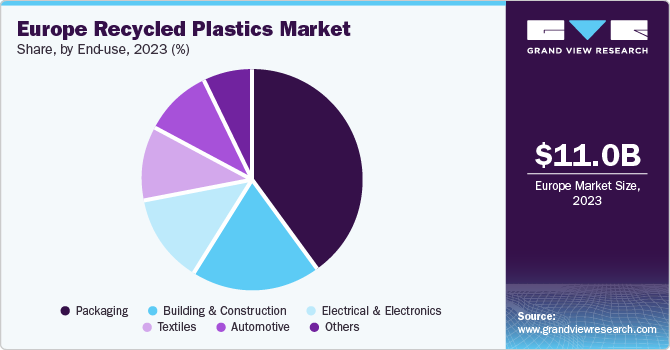

The Europe recycled plastics market size was estimated at USD 11.04 billion in 2023 and is projected to grow at a CAGR of 9.6% from 2024 to 2030. The growing environmental awareness among customers and organizations, rigid regulations encouraging recycling, rising demand for sustainable packaging, and a switch towards circular economy practices are some of the major drivers propelling the market growth. Europe leads in its overall efforts to manage plastic, as most EU nations are wealthy and are keen to invest in research and innovation. Europe recycled 12,409.43 kilotons of plastic in 2023. Consumer preferences for eco-friendly products and increasing emphasis on reducing waste contribute to the growing market.

In 2022, the European Association of Plastic Manufacturers stated that plastic waste recycling has grown to 80% in the last ten years. Plastic is used across packaging, construction, electronics, and automotive industries. Government bodies emphasize recycling and incentivize organizations that adopt them to reduce the vast amount of litter produced and increase landfill space. For instance, the EU aims to target 25% recycled content in plastic bottles by 2025 and 30% by 2030 to reduce plastic marine litter. In October 2022, the New Regulation (EU) 2022/16161 was announced. As per the new rule, only plastics made using approved recycling technologies or novel technologies that have been notified and contain repurposed polymers are to be sold from July 10, 2023.

Consumers are becoming aware of environmental concerns and focusing on a product’s sustainability, packaging, and various environmental aspects. This makes it highly crucial for companies to present themselves as an eco-friendly organization to sustain for the long run and earn tax benefits. Construction materials such as polyvinyl windows, composites, roofing tiles, and fencing often use recycled plastics for their products. For instance, around 45% of recycled plastic consumption in the EU, Switzerland, the UK, and Norway is used in the construction sector.

The critical benefit organizations derive is that the energy spent on reprocessing is way less than the energy consumed on creating their non-recycled counterparts. For instance, a study by environmental consultant Jeffrey Morris revealed that manufacturing products from a ton of recyclables consumes 10.4 million Btu. In contrast, virgin materials necessitate 23.3 million Btu for the same process. Recycling eases the requirement of procuring and processing raw materials, saving energy and contributing to a circular economy. There is near to no waste for the organization.

Market Concentration & Characteristics

The market growth stage is high, with an accelerating pace. The recycled plastics industry in Europe is characterized by innovation and sensitivity towards the environment. Technologies like depolymerization, pyrolysis, and gasification are gaining traction in chemical recycling.

The depolymerization process breaks down polymers into their monomer units, which can then be used to produce new products. For instance, Yoplait, a top yogurt producer, enhances environmental sustainability by recycling yogurt pots into depolymerized polystyrene for improved packaging eco-friendliness.

The industry is moderately concentrated as only a few players dominate the market, small players with less capital are also operating in the sector. Companies are undertaking various strategies, including mergers and acquisitions. In February 2024, LyondellBasell Industries Holdings B.V. acquired rigid recycling processing lines from PreZero, a global waste management service provider.

This industry is majorly incentivized by the government, making it attractive for any organization to enter this industry. As these regulations attract organizations due to tax benefits, subsidized products, good brand image, and more marketing, any changes in these could affect the company's interest.

The end-user concentration is high in the industry, as this product reduces the amount of waste that goes into landfills. End-users include waste management firms, customers looking for eco-friendly products, and organizations using refurbished polymers as raw materials to develop something new. Van Werven Plastic Recycling in Europe processes around 150 million kilos of post-consumer rigid plastics annually, transforming them into high-quality secondary raw materials for manufacturing, exemplifying the use of recycled plastics in the production cycle.

Product Insights

Polyethylene dominated the market in 2023 with the largest revenue share of 33.1%. This dominance can be attributed to the unique properties of the polymer, such as its lightweight, transparency, high levels of resistance, and impermeability towards microorganisms and liquids. It can also resist heat and abrasion, showcasing great flexibility, and remains fully recyclable. This makes it the ideal product for food and beverage industries as a packaging medium for laundry detergents, milk cartons, cutting boards, garbage bins, and various other applications. In February 2023, Repsol's investment in a new recycled plastics production line at the Puertollano Industrial Complex focused on producing plastics for non-food applications such as cleaning product containers and packaging sacks, aligning with sustainability goals and European regulations for increased recycled content in packaging by 2030.

Polypropylene is anticipated to grow at the fastest CAGR over the forecast period. It is used for packaging, creating fibers, textiles, and even parts for machinery. Its unique properties include fatigue resistance, elasticity, toughness, and durability. Apart from domestic and industrial applications such as such as furniture, gears, or packaging, they are also used in the medical sector as syringes, medical vials, petri dishes, pill containers, and specimen bottles. In 2019, Total's acquisition of Synova enhanced their plastic recycling efforts, focusing on producing high-quality recycled polypropylene (PP) for automotive applications, aligning with their commitment to sustainability and circular economy practices.

Source Insights

The plastic bottles segment dominated the market in 2023. The market based on source comprises bottles, films, foams, fibers, bags, and others. The plastic bottles occupy the most significant share as they are a massive part of post-consumer waste. Plastic containers are more familiar in the food & beverage industry due to the new technologies that have been launched and heat-resistant PET bottles that exist. For instance, Mondelēz International is leading the way in sustainability by transitioning Dairylea and Philadelphia cheese brands in the UK and Ireland to recyclable packaging, aiming to reduce virgin plastic by 25% and achieve 100% recyclable packaging by 2025. They are also pioneering chemical recycling and plan to include 5% recycled content in all plastic packaging by 2025.

Most bottles used in the industry are PET bottles, which are more prevalent in beverages, cosmetics, detergents, and sanitary products. According to the British Soft Drink Association's annual report for 2023, bottled water consumption in the UK was estimated at 2,810 volume milliliters in 2022. In March 2024, Itelyum and Plasta Rei revealed their joint venture to construct a chemical recycling facility in Cisterna di Latina, focusing on transforming PET waste from food packaging into 100% recycled PET granules of equal quality to virgin PET. This project targets a substantial decrease in CO2 emissions by reclaiming more than 95% of PET waste, demonstrating a dedication to environmental sustainability and creating profitable investment opportunities.

Polymer foams are another accelerating category, with high-density foams mainly used for construction materials, transportation, or furniture. At the same time, low-density foams are commonly used for sound insulation, impact absorption, and packaging materials. Their fundamental properties include durability, shock absorption, and insulating properties. They are lightweight and converted into films and sheets after heating. A new environmentally friendly polymer foam includes the development of a bio-based and biodegradable foam to replace polyurethane, with a project duration from May 2020 to April 2022 involving partners such as H&M and Bioextrax AB.

End-use Insights.

In terms of end-use, the packaging segment held the largest share in 2023. The European continent continuously advances its technologies and requires suitable infrastructure to withstand the competition. The demand is increasing in Europe due to the convenience of using the product, its economical prices, and its adjustable appearance. The EU generated approximately 188.7 kilograms of packaging waste per individual in 2021. However, this quantity varied depending on the country, with Croatia producing only 73.8 kilograms per person, while Ireland produced 246.1 kilograms per person. This could create a tremendous raw material source. In November 2019, ALPLA acquired two Spanish recycling companies, Suminco and Replacal, to expand into HDPE recycling. This move aligns with ALPLA's goal of increasing the use of recycled post-consumer material in packaging production.

Urbanization and the challenge of catering to the growing population drive the need in the building and construction sector. The construction market is rapidly growing due to increasing infrastructure development projects, increased infrastructure spending, and a focus on sustainability and technological advancements. The recycled products are mainly used in insulation, window frames, piping, floor coverings, and interior design. The anti-corrosion properties provide pipes and underground and exterior cables with an extended life span of up to 100 and 50 years, respectively. They also offer significant Insulation from cold and heat, help prevent energy leakage, make households save energy, and reduce pollution.

Its application in the electrical & electronics industries is increasing significant. They provide electrical and mechanical resistance to the devices, fire safety, and resource efficiency while being lightweight. This makes them the best tool for the industry, hence the rapid growth. With new technologies and better connectivity, they could contribute to the circular economy by using repurposed materials. For instance, Philips in Europe is using recycled plastics in their electronic products and packaging to enhance sustainability. They are repackaging appliances in 100% recycled paper boxes and aim to quadruple their use of recycled materials by 2025.

Country Insights

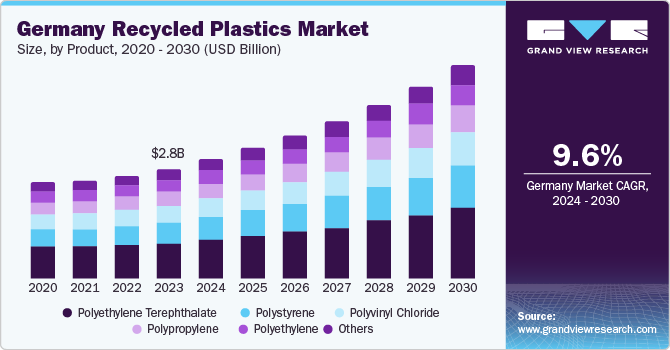

Germany Recycled Plastics Market Trends

Germany recycled plastics market dominated the Europe region in 2023. Germany has robust policies and a strong influence in changing the recycling dynamics in Europe. It has a well-developed infrastructure with advanced facilities that boost the efficiency and quality of the newly reprocessed materials.

Various initiatives undertaken by Germany’s government put manufacturers in charge of being accountable for their production and implementing waste management regulations. In May 2023, the German Federal Government approved the Single-Use Plastics Fund Act (also known as Einwegkunststofffondsgesetz - EWKFondsG) to introduce a national levy specifically for single-use plastics. This charge aims to prevent and reduce the harmful impact of single-use products on the environment.

UK Recycled Plastics Market Trends

The recycled plastics market in the UK is a lucrative industry and is anticipated to grow at a CAGR of 9.8% over the forecast period. It has introduced its ‘Extended Producer Responsibility Report (EPR)’ concept. EPR aims to make packaging producers accountable for their products, contributing towards a circular economy and using recyclable materials rather than throwing away waste.

France Recycled Plastics Market Trends

France recycled plastics market is expected to proliferate in the coming years due to the government reducing VAT on repurposed water bottles, so they cost less than products that are not recycled. Significant companies such as Veolia and Suez SA also collaborated with brands such as Nestle and Mars to increase their capacity.

Italy Recycled Plastics Market Trends

The recycled plastics market in Italy held a substantial share in 2023 owing to the Italian Legislative Decree 196/2021 ("Italian Decree") implementing the Single-Use Plastic Directive ("SUPD"). Italian tax designs provide dynamic incentives to increase repurposed content beyond 30%. The tax base is the total weight of the non-recycled content.

Key Europe Recycled Plastics Company Insights

Key players operating in the market are Veolia, Müller-Guttenbrunn Group, MBA Polymers, Inc, Paprec Group, Morssinkhod Rymoplast, Suez SA, Berry Global Inc.

-

MBA Polymers Inc. offers value engineering, plastic recycling, and potential evaporation services, specializing in creating recycled plastics from post-consumer durable goods such as electronics, appliances, and vehicles.

-

Veolia, a French multinational, specializes in environmental services such as water, waste, and energy management with a focus on sustainability and innovative solutions for global environmental challenges. The company's expertise lies in providing decarbonization, energy efficiency, waste treatment, and resource optimization services to address environmental concerns worldwide.

Key Europe Recycled Plastics Companies:

- Veolia

- Müller-Guttenbrunn Group

- MBA Polymers, Inc

- Paprec Group

- Morssinkhod Rymoplast

- Suez SA

- Berry Global Inc

- LyondellBasell Industries Holdings B.V.

- KW Plastics

- Jayplas

- Total Energies

- Borealis AG

- Rialti S.p.A.

- Iber Resinas SL

Recent Developments

-

In November 2023, the world’s largest recycling plant opens in Sweden with 95% success rate. It’s the most efficient recycling plant in Europe made with an investment of USD 95 million. This brings a revolution in the industry, as it makes plastic recycling easier, effective and also improves the quality of the plastic.

-

In June 2023, MBA Polymers, Inc. launched ABS products for the electronics, automotive, and construction industries to meet the demand for low-carbon products with the highest repurposed content (95%). UL-certified ABS4125 UL is used in various sectors, such as manufacturing, consumer goods, and even automobiles.

-

In June 2023,Borealis AG purchased Rialti S.p.A., a manufacturer of recycled polypropylene compounds, to increase the amount of PP compounds made from mechanical recyclers by 50,000 tons per year. This strategy would help both Borealis AG and Rialti S.p.A. coordinate their resources and utilize their capacity effectively.

-

In May 2023, Total Energies expanded their footprints in Europe by acquiring Iber Resinas SL. The waste derived from both the households and industries is recycled by Iber Resinas SL in their two plants situated near Total Energies stretched Valencia, Spain.

-

In 2022, Suez SA doubled its investments and revealed its three-pillar strategy for 2027: Focus on the Group's key activities and markets.Invest and innovate in solutions that differentiate the Group.Create value for all of the Group’s stakeholders.

Europe Recycled Plastics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 20.76 billion

Growth Rate

CAGR of 9.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, end-use, country

Regional scope

Europe

Country scope

Germany; UK; France; Italy; ROE

Key companies profiled

Veolia, Müller-Guttenbrunn Group; MBA Polymers, Inc; Paprec Group; Morssinkhod Rymoplast; Suez SA; Borealis AG; Rialti S.p.A.; Iber Resinas SL; Total Energies; Berry Global Inc; LyondellBasell Industries Holdings B.V.; KW Plastics; Jayplas

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Recycled Plastics Market Report Segmentation

This report forecasts revenue & volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe recycled plastics market report based on product, source, end-use, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Polyethylene Terephthalate

-

Polypropylene

-

Polyvinyl Chloride

-

Polystyrene

-

Others

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastic Bottles

-

Plastic Films

-

Polymer Foam

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Packaging

-

Electrical & Electronics

-

Textiles

-

Automotive

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Frequently Asked Questions About This Report

b. The Europe recycled plastics market size was valued at USD 11.04 billion in 2023.

b. The Europe recycled plastics market is projected to grow at a compound annual growth rate (CAGR) of 9.6% from 2024 to 2030 to 2030 to reach USD 20.76 billion by 2030

b. Polyethylene dominated the market and accounted for a share of 33.1% in 2023 owing to the unique properties of the polymer, such as its lightweight, transparency, high levels of resistance, and impermeability towards microorganisms and liquids. It can also resist heat and abrasion, showcasing great flexibility, and remains fully recyclable.

b. Key players operating in the market are Veolia, Müller-Guttenbrunn Group, MBA Polymers, Inc, Paprec Group, Morssinkhod Rymoplast, Suez SA, and Berry Global Inc., among others.

b. The growing environmental awareness among customers and organizations, rigid regulations encouraging recycling, rising demand for sustainable packaging, and a switch towards circular economy practices are some of the major drivers propelling the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."