- Home

- »

- Advanced Interior Materials

- »

-

Europe Rainscreen Cladding Market, Industry Report, 2030GVR Report cover

![Europe Rainscreen Cladding Market Size, Share & Trends Report]()

Europe Rainscreen Cladding Market Size, Share & Trends Analysis Report By Raw Material (Fiber Cement, Terracotta, Composite Material), By Application (Residential, Official, Commercial), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-313-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Europe Rainscreen Cladding Market Trends

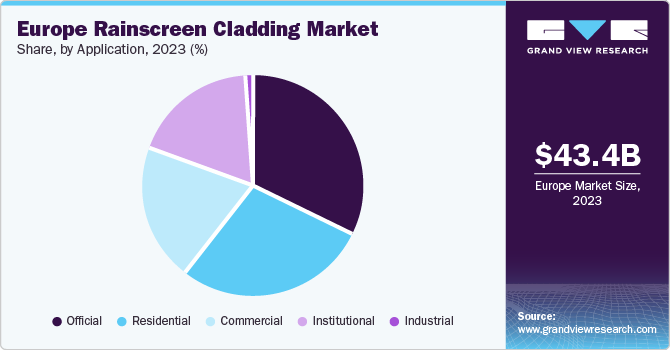

The Europe rainscreen cladding market size was estimated at USD 43.4 billion in 2023 and is anticipated to grow at a CAGR of 5.8% from 2024 to 2030. The increasing emphasis on energy-efficient buildings and the growing need for sustainable construction solutions are major growth catalysts. Enhanced aesthetic appeal and improved protection against environmental elements, such as rain, wind, and temperature fluctuations, further bolster the market's expansion. Technological advancements in materials and installation techniques make rainscreen cladding more accessible and cost-effective, fueling its adoption across residential, commercial, and industrial sectors.

The Europe rainscreen cladding market accounted for a share of 30.0% of the global rainscreen cladding market revenue in 2023. This market is significantly influenced by stringent regulations and standards aimed at enhancing building safety and energy efficiency. For instance, the EU's Energy Performance of Buildings Directive (EPBD) requires all new buildings to be highly energy-efficient, pushing the construction industry towards cladding systems that minimize energy consumption.

In addition, the Grenfell Tower fire in the UK prompted the introduction of more rigorous fire safety standards across Europe, such as the UK’s Building (Amendment) Regulations 2018, which ban the use of combustible materials in the external walls of high-rise residential buildings. Similarly, Germany's DIN 4102 and the European standard EN 13501-1 set strict fire classification requirements for construction materials, including cladding systems. These regulations not only ensure the safety and sustainability of buildings but also compel manufacturers to innovate and comply with high-performance criteria.

Raw Material Insights

The terracotta segment accounted for the largest revenue share of 33.9% in 2023. This dominance can be attributed to a convergence of aesthetic and functional attributes. Architects prefer terracotta's classic look, which seamlessly integrates with diverse architectural styles. Moreover, terracotta panels excel in thermal insulation and weather resistance, making them well-suited for various climates. As sustainability becomes a priority, terracotta's eco-friendly credentials further solidify its market position.

The metal-based rainscreen cladding segment is projected to register the fastest CAGR of 6.4% from 2024 to 2030. Metal cladding’s appeal lies in its modern aesthetics, versatility, and robustness. Metal panels can be customized to achieve various visual effects, from sleek and minimalist to bold and industrial. Moreover, advancements in metal fabrication techniques have improved their corrosion resistance and overall performance. As sustainable building practices gain traction, metal cladding systems are likely to see continued demand, especially in commercial and institutional projects.

Application Insights

Official buildings accounted for the largest revenue share, representing 32.1% of the market in 2023. This segment includes government offices, administrative centers, and public institutions. The widespread use of rainscreen cladding on official buildings stems from its practical advantages, including weatherproofing, thermal insulation, and improved aesthetics. Additionally, the demand for sustainable construction practices drives the adoption of rainscreen systems in official structures. As urbanization continues and governments invest in infrastructure, this segment is expected to maintain prominence.

The residential segment is projected to grow at a CAGR of 6.2% from 2024 to 2030. Homeowners, developers, and architects increasingly recognize the value of rainscreen cladding in residential construction. It provides improved energy efficiency, moisture management, and noise reduction. Moreover, rainscreen systems allow for creative façade designs, enhancing curb appeal. As sustainability becomes a priority for homeowners, the residential sector will drive the adoption of rainscreen cladding solutions.

Country Insights

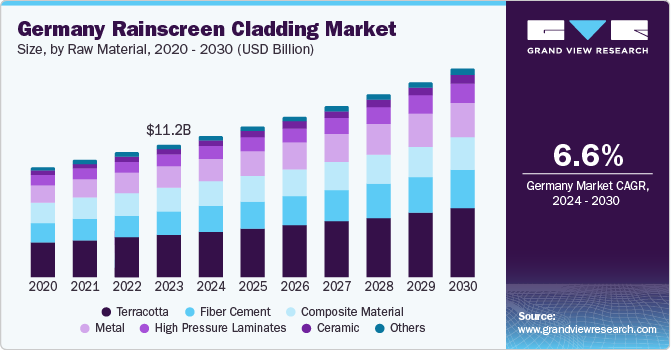

Germany Rainscreen Cladding Market Trends

Germany rainscreen cladding market dominated the region with the largest revenue share of 25.7% in 2023. Several factors contribute to Germany’s prominence in this sector. Firstly, the country has a robust construction industry, with a focus on sustainable and energy-efficient building practices. Rainscreen cladding systems align well with these goals, providing thermal insulation, weather protection, and aesthetic appeal. Secondly, Germany’s architectural landscape emphasizes modern design, where rainscreen cladding plays a crucial role in achieving sleek and visually appealing facades. As the market continues to evolve, Germany is likely to maintain its leadership position.

Turkey Rainscreen Cladding Market Trends

Turkey rainscreen cladding market is projected to experience the fastest growth of CAGR of 8.8% from 2024 to 2030. The Turkish construction industry has been expanding rapidly, driven by urbanization, infrastructure development, and commercial projects. Rainscreen cladding is gaining traction due to its ability to enhance building performance, reduce energy consumption, and provide architectural versatility. As Turkey invests in sustainable construction practices and modernization, the demand for rainscreen systems is expected to surge. Architects, developers, and manufacturers should closely monitor this dynamic market.

Key Europe Rainscreen Cladding Company Insights

Some of the key players operating in the market include 3M, BASF SE, XPEL, and Imerys S.A.

-

Danpal specializes in translucent and daylighting solutions for building envelopes. Their innovative polycarbonate panels are often used in rainscreen cladding systems, providing both aesthetics and functionality

-

Kingspan is a leading manufacturer of insulated panels and façade systems. Their rainscreen cladding products offer energy efficiency, fire resistance, and design flexibility, making them popular choices for commercial and residential projects

Key Europe Rainscreen Cladding Companies:

- Danpal

- Kingspan Group

- Sotech Optima

- Proteus Facades

- Euro Panels Overseas N.V.

- Cladding Corp

- CENTRIA

- Middle East Insulation LLC

- FunderMax

- Valcan

Recent Developments

-

In February 2024, Sotech released enhanced resources for its Optima TFC+ rainscreen cladding system, including updated 3D models and video content. The Optima TFC+ offers a competitive advantage over conventional secret fix rainscreen solutions by delivering a balance of aesthetics and performance at a cost-effective price point

-

In January 2024, In-Opera Facades Ltd. unveiled Dryklad, a next-generation rainscreen cladding support system that offers a compelling value proposition for architects, facade engineers, and building professionals, delivering superior thermal performance, enhanced construction efficiency, and cost optimization compared to conventional cladding methods

-

In October 2023, Brickability Group plc completed the acquisition of Topek Holdings Ltd. This acquisition helped strengthen Brickability's presence in the market for fire-compliant rainscreen systems and building refurbishments

Europe Rainscreen Cladding Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 64.3 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in million square meters, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, trends

Segments covered

Raw material, application, country

Key companies profiled

Danpal; Kingspan Group; Sotech Optima; Proteus Facades; Euro Panels Overseas N.V.; Cladding Corp.; CENTRIA; Middle East Insulation LLC; FunderMax; Valcan

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Rainscreen Cladding Market Report Segmentation

This report forecasts revenue and volume growth at region and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe rainscreen cladding market report based on raw material, application, and country:

-

Raw Material Outlook (Volume, Million Square. Meters; Revenue, USD Billion, 2018 - 2030)

-

Fiber Cement

-

Composite Material

-

Metal

-

High Pressure Laminates

-

Terracotta

-

Ceramic

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Official

-

Institutional

-

Industrial

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Austria

-

Poland

-

Belgium

-

Denmark

-

Turkey

-

Switzerland

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."