Europe Protein Ingredients Market Size, Share & Trends Analysis Report By Product (Plant Proteins, Insect Protein), By Application (Food & Beverages, Animal Feed), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-318-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Europe Protein Ingredients Market Trends

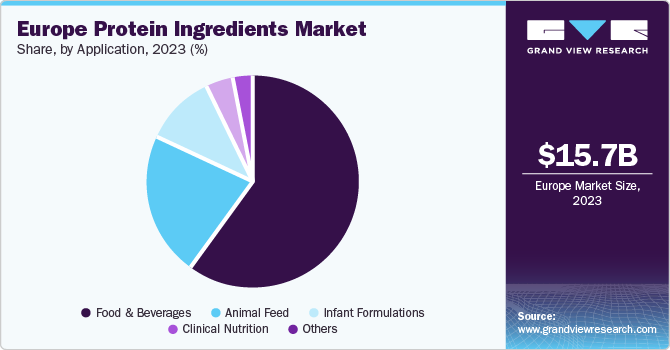

The Europe protein ingredients market size was estimated at USD 15.71 billion in 2023 and is anticipated to grow at a CAGR of 5.7% from 2024 to 2030. The food & beverages sector is expected to be one of the leading segments demanding protein ingredients due to the growing popularity of baked products, low-fat foods, and dairy products. Increasing demand for baked products and dairy products is likely to increase the use of plant & animal protein ingredients as a food additive to impart functional and nutritional value to food. Moreover, the incorporation of animal & plant proteins, especially pea, canola, and soy, in animal feed applications is likely to remain high, on account of their growing demand in the manufacturing of fish meal and pet food items in developed regional economies, such as Germany, France, and the UK.

The protein ingredients market in Europe accounted for a revenue share of 31.4% of the global protein ingredients market in 2023. The increasing use of proteins in the food and healthcare industry is predicted to fuel the demand for protein ingredients in Europe over the next few years.Increasing R&D expenditure by various companies on the development of protein ingredients from various sources in the region is further expected to indirectly fuel the animal & plant protein sector during the forecast years. According to a report by the Good Food Institute (GFI) Europe, the sales of plant-based food products in 13 European economies grew by 21% from 2020 to 2022, indicating strengthening consumer demand. Another study by ProVeg International stated that Germany has a significant share of plant-based food consumers and flexitarians, while the U.K. has shown substantial sales of plant-based meat and is home to a vegan & vegetarian population. As a result, continued initiatives by manufacturers to satisfy customer demands are expected to positively shape the protein ingredients market in the region.

A drastic change in consumer behavior when it comes to the quality and health impact of beverages, such as sports drinks, fruit juices, and bottled water, has further resulted in significant market advancement. For instance, brands operating in this space are incorporating clear whey protein isolates in their products as they lead to the development of clear beverages that can leverage transparent packaging to attract customers. In addition, the usage of clear whey proteins in sports drinks and protein beverages results in the development of low-lactose products containing all essential amino acids that meet the nutritional requirements of lactose-intolerant consumers.

Moreover, target consumers, such as athletes, prefer bottled water incorporated with proteins, as it provide several functional benefits. Clear whey protein isolates in bottled water combine the popularity of no-sugar water-based drinks with the functionality of proteins. Thus, this product meets the demand of modern consumers for convenient on-the-go, low-calorie, and tasty drinks with no preservatives, artificial flavors, and sugars that offer extra nutrition.

Product Insights

The animal/dairy protein segment accounted for the largest revenue share of 66.4% in 2023. The segment includes products, such as egg protein, whey protein concentrates, whey protein isolates, gelatin, and collagen peptides. The demand for animal protein ingredients is projected to witness substantial growth in the coming years, aided by the availability of extensive scientific evidence regarding their health benefits. For example, whey protein enhances immunity and nutritional status, while also increasing glutathione (GSH) levels in cancer patients undergoing chemotherapy.

Whey protein concentrates are used in numerous applications including the manufacturing of dairy desserts, beverages, and yogurt products. Furthermore, these concentrates are employed as a source of protein fortification for infant food and nutritional products. Thus, their versatility and usefulness have elevated their popularity and demand in key application areas.

The insect protein product segment is anticipated to advance at the fastest CAGR of 17.5% during the forecast period. The demand for these ingredients has risen sharply in recent years on the back of evidence provided by experts regarding their health benefits, which have been promoted by manufacturers. For instance, cricket offers 65% protein, which is much higher than that provided by beef (50%). Moreover, insect protein contains several useful amino acids, along with vitamins, unsaturated fatty acids, and minerals. Insect farming has emerged as a sustainable practice that has resulted in its steadily increasing adoption in Europe. The European Union is currently looking towards insects as an alternate source of livestock protein to reduce emissions, and as such, has been relaxing regulations and offering subsidies to manufacturers of insect-sourced food.

Application Insights

The food & beverages segment held a dominant revenue share of 60.1% in the Europe protein ingredients market in 2023. The increasing demand for protein ingredients owing to their properties, including their ability to act as a complexing/stabilizing agent, emulsifying salt, and flavor enhancer in the food & beverage industry, is expected to drive market expansion in the coming years. The bakery sector, for instance, makes use of various animal protein ingredients, such as whey protein concentrate, to manufacture diet truffles, superfood bites, protein brownies, and protein grazers. Utilization of whey protein aids in elevating the dough strength, dietary fiber content, moisture retention capacity, finished product volume, and texture of these items, elevating the overall quality.

The animal feed segment is expected to advance at the second-fastest CAGR of 5.4% from 2023 to 2030. The increasing cattle population in Europe and a steady focus on improving animal performance and output have led to the increased incorporation of protein ingredients in animal feed products. Both plant- and animal-based proteins are used in powder or liquid form in animal feed additives to provide essential nutrition to animals. The addition of these ingredients to feed mixtures improves the rate of weight gain in animals, prevents diseases and nutrient deficiencies in them, and improves feed digestion and conversion. Protein ingredients in animal feed provide various nutritious components, including amino acids, which are necessary for muscle building and improving vitamin and mineral intake.

Country Insights

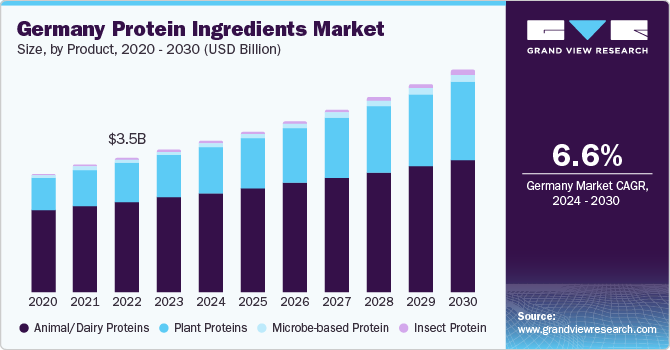

Germany Protein Ingredients Market Trends

The Germany protein ingredient market accounted for the largest revenue share in 2023. The rapidly rising demand for healthy ingredients from the food & beverage industry in Germany, along with growing awareness among German consumers about the benefits of protein-based food, has created significant market demand in the country. Furthermore, organizations, such as the German Association for Alternative Protein Sources (Bal-Pro), are taking initiatives to connect different entities involved in the alternative protein marketplace, such as private players and government bodies, to promote the use of alternative proteins. These initiatives, in turn, are expected to expand the penetration of plant-based proteins in the economy. Increasing awareness regarding health and weight management benefits offered by protein supplements, the rising geriatric population, and the surging demand for non-medical dietary supplements are some factors expected to boost the demand for protein ingredients.

UK Protein Ingredients Market Trends

The UK protein ingredient market is expected to advance at a substantial growth rate during the forecast period. Rising consumer focus on incorporating a dietary lifestyle that can address various lifestyle disorders, as well as concentrated efforts by marketers to drive sales of protein-based products, are driving market expansion in the region. There has been a steady demand for both plant- and animal-based proteins, with products, such as pea protein, soy protein, whey protein, and collagen being particularly popular among health-conscious citizens. Moreover, the insect protein industry has also shown promising growth, with government initiatives promoting sustainability & having a positive impact on this business, in recent years. As a result, the market is poised to remain key to the European region’s expansion in the coming years in this sector.

Key Europe Protein Ingredients Company Insights

Some notable organizations involved in developing protein ingredient solutions in Europe include Rousselot, Roquette, DSM, Ingredion, and Tessenderlo Group among others. These companies focus on acquisitions & geographical expansions and investments in R&D activities to develop better-quality products and to gain a higher market share.

-

Rousselot, headquartered in the Netherlands, operates as a subsidiary of Darling Ingredients, Inc. The company produces, markets, and sells gelatin and collagen. The company operates through three divisions - health & nutrition, biomedical, and functional ingredients. Rousselot’s protein ingredients find applications in food items such as dairy products, cereal bars, meat replacements, and ready-to-eat products, as well as in application areas such as pharmaceutical, photography, and (micro) encapsulation solutions.

-

Tessenderlo Group, headquartered in Brussels, Belgium, is mainly engaged in developing solutions for valorizing bio-residuals and agriculture internationally. The company’s bio-valorization segment offers protein ingredients through its subsidiaries PB Leiner and Akiolis Group. The latter offers animal protein along with fat ingredients, while the former provides gelatin and collagen proteins that are utilized in the pharmaceutical, health & beauty, energy, and food industries.

Key Europe Protein Ingredients Companies:

- Rousselot

- ADM

- Tessenderlo Group

- Kewpie Corporation

- Roquette Frères

- CropEnergies AG

- Ingredion

- Givaudan

- Tate & Lyle

- DSM

- Glanbia PLC

- Barentz

- Prinova Group LLC

Recent Developments

-

In May 2024, Tate & Lyle announced the opening of its dietary fiber capacity at its Boleráz, Slovakia-based facility for its renowned non-GMO ‘PROMITOR Soluble Fibers’. The capacity expansion represents an investment of around USD 27 million and forms the initial phase of the company’s program to increase its fiber capacity and better serve its global and European customers

-

In May 2024, Roquette announced the launch of the fava bean protein isolate NUTRALYS Fava S900M for the European and North American markets. The product forms part of the company’s NUTRALYS plant protein portfolio and claims to offer 90% protein content in applications such as baked goods, non-dairy alternatives, and meat substitutes

-

In May 2023, Prinova Europe displayed a range of products focusing on the sports nutrition space at the Vitafoods Europe event held in Geneva. These included the enduracarb carbohydrate to improve athletic endurance and enhance performance; the Aquamin plant-based marine multimineral-complex product range; and the EAAlpha blend of essential amino acids to aid muscle protein synthesis. The company also displayed products in the wellness and lifestyle categories, including the ‘Radiance Retainer’ gummy; the ‘Move, Flex & Soothe’ joint health drink; the ‘Chill Out Chocolate’ drink; and the ‘Hydrate & Replenish’ functional hydration beverage

Europe Protein Ingredients Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 23.00 billion |

|

Growth rate |

CAGR of 5.7% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, application, country |

|

Country scope |

Germany; UK; France; Italy; Spain |

|

Key companies profiled |

Rousselot; ADM; Tessenderlo Group; Kewpie Corporation; Roquette Frères; CropEnergies AG; Ingredion; Givaudan; Tate & Lyle; DSM; Glanbia PLC; Barentz; Prinova Group LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Protein Ingredients Market Report Segmentation

This report forecasts volume and revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe protein ingredients market report based on product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plant Proteins

-

Cereals

-

Wheat

-

Wheat Protein Concentrates

-

Wheat Protein Isolates

-

Textured Wheat Protein

-

Hydrolyzed Wheat Protein

-

HMEC/HMMA Wheat Protein

-

-

Rice

-

Rice Protein Isolates

-

Rice Protein Concentrates

-

Hydrolyzed Rice Protein

-

Others

-

-

Oats

-

Oat Protein Concentrates

-

Oat Protein Isolates

-

Hydrolyzed Oat Protein

-

Others

-

-

-

Legumes

-

Soy

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

-

Pea

-

Pea Protein Concentrates

-

Pea Protein Isolates

-

Textured Pea Protein

-

Hydrolyzed Pea Protein

-

HMEC/HMMA Pea Protein

-

-

Lupine

-

Chickpea

-

Others

-

-

Roots

-

Potato

-

Potato Protein Concentrate

-

Potato Protein Isolate

-

-

Maca

-

Others

-

-

Ancient Grains

-

Ancient Wheat

-

Quinoa

-

Sorghum

-

Amaranth

-

Chia

-

Millet

-

Others

-

-

Nuts & Seeds

-

Canola

-

Canola Protein Isolates

-

Hydrolyzed Canola Protein

-

Others

-

-

Almond

-

Flaxseeds

-

Others

-

-

Animal/Dairy Proteins

-

Egg Protein

-

Milk Protein Concentrates/Isolates

-

Whey Protein Concentrates

-

Whey Protein Hydrolysates

-

Whey Protein Isolates

-

Gelatin

-

Casein/Caseinates

-

Collagen Peptides

-

-

Microbe-based Protein

-

Algae

-

Bacteria

-

Yeast

-

Fungi

-

-

Insect Protein

-

Coleoptera

-

Lepidoptera

-

Hymenoptera

-

Orthoptera

-

Hemiptera

-

Diptera

-

Others

-

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Bakery & Confectionary

-

Beverages

-

Breakfast Cereals

-

Dairy Alternatives (cheese, desserts, snacks, others)

-

Dietary Supplements/Weight Management

-

Meat Alternatives & Extenders

-

Snacks

-

Sports Nutrition

-

Others

-

-

Infant Formulations

-

Clinical Nutrition

-

Animal Feed

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."