- Home

- »

- Medical Devices

- »

-

Europe Preclinical CRO Market Size, Industry Report, 2030GVR Report cover

![Europe Preclinical CRO Market Size, Share & Trends Report]()

Europe Preclinical CRO Market Size, Share & Trends Analysis Report By Model Type, By Service (Toxicology Testing, Bioanalysis & DMPK Studies), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-309-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Preclinical CRO Market Trends

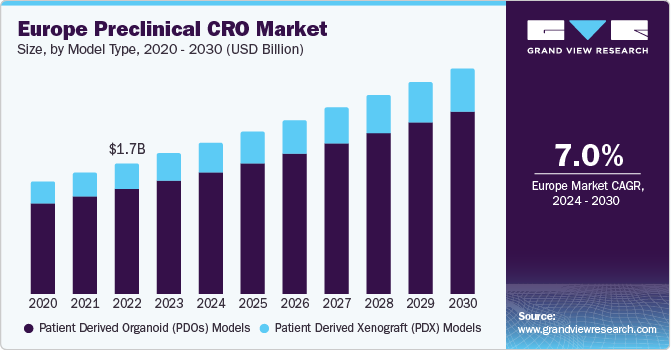

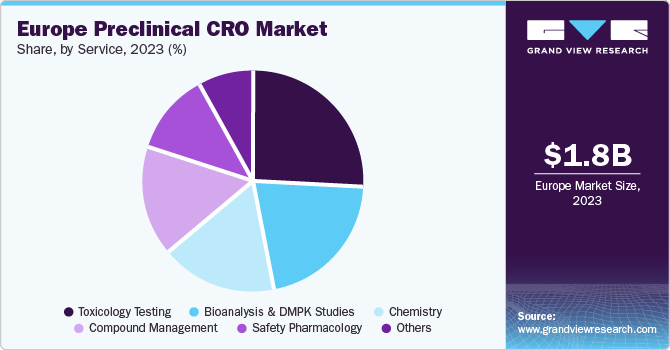

The Europe preclinical CRO market size was estimated at USD 1.8 billion in 2023 and is anticipated to grow at a CAGR of 7.0% from 2024 to 2030. This growth is attributed to the growing prevalence of chronic diseases and the need for novel and effective treatments. In addition, the growth in R&D spending by pharmaceutical and biotechnology companies, as well as the rising demand for specific testing services, contribute to the market's growth in the region. Furthermore, the presence of top revenue-generating pharmaceutical corporations and the growing outsourcing of clinical trials by small and mid-sized biotech companies is also expected to propel the market's expansion.

In 2023, the Europe region accounted for approximately 31.6% revenue share of the global preclinical CRO market. The preclinical CRO market in Europe is poised for significant growth in the coming years, driven by several key factors. The increasing prevalence of chronic diseases and the need for novel treatments have led to a surge in R&D spending by pharmaceutical and biotechnology companies. This, in turn, has driven the demand for preclinical CRO services as companies seek to accelerate the drug development procedure while reducing costs.

In addition, the presence of top revenue-generating pharmaceutical companies in Europe, such as F. Hoffmann-La Roche Ltd and Novartis, has contributed to the region's strong position in the preclinical CRO market. These companies often outsource their preclinical trials to local CROs, taking advantage of their expertise and resources.

Furthermore, the EMA plays a crucial role in regulating preclinical CRO services in Europe. Its recommendations for authorizing new medicines and active medicines have contributed to the growth of the market.

However, the market growth is not without challenges. The shortage of skilled professionals and the lack of standardization in regulations and guidelines pose potential obstacles to the market's expansion. Furthermore, strict norms and variations in GMP guidelines across different countries may hinder market growth in the coming years.

Despite these challenges, the preclinical CRO market in Europe is expected to continue its upward trajectory, driven by the increasing focus on drug development and the growing trend of outsourcing research activities to specialized CROs.

Model Type Insights

The patient derived organoid (PDOs) models led the market in 2023 with the largest revenue share of 80.6%. They are crucial for studying individual patient reactions to therapies and establishing precision medicine techniques. Furthermore, PDOs are easy to culture and provide a flexible tool for researching various diseases, including cancer, making them important in preclinical research, thereby driving the growth of the segment.

Patient-derived Xenograft models are expected to experience substantial growth in the coming years owing to the growing demand for customized medicine, developments in PDX technology, and rising investments in cancer research. Furthermore, the need for more precise and predictive cancer models for drug development and the emphasis on humanized models are also contributing factors.

End-use Insights

The biopharmaceutical companies segment held the largest revenue share, 80.1%, in 2023. This growth is due to the growing trend of outsourcing services, quick technological developments, and rising urbanization. The demand for affordable and time-efficient drug development is also an important factor, as biotechnology and biopharmaceutical companies invest in R&D to enhance their research studies.

The government and academic institutes segment registered a significant revenue share in 2023 owing to the increasing trend of outsourcing preclinical services to Contract Research Organizations (CROs). Academic institutions and government entities play an essential role in the initial stages of discovery and development, and their rising dependence on CROs for specific expertise and cost-effective services fuels market growth.

Service Insights

The toxicology testing segment dominated the market in 2023 with a revenue share of 26.1%. Regulatory agencies' importance on safety and effectiveness assessments during drug development contributes to the segment growth. Furthermore, the availability of reputed biopharmaceutical corporations and CROs specializing in early drug discovery in the region supports market development.

The bioanalysis and DMPK studies held a substantial market share in 2023 owing to the increasing demand for pharmacokinetic services, mainly in supporting toxicology tests for IND-enabling studies. The growing importance of DMPK in assessing drug properties and the increasing applications of bioanalysis across the complete drug development continuum contribute to the growth of this segment.

Country Insights

UK Preclinical CRO Market Trends

The UK preclinical CRO market dominated and accounted for the largest market share of 25.0% in the European region in 2023. This growth is attributed to the country's substantial R&D spending, presence of major pharmaceutical businesses such as GlaxoSmithKline plc and AstraZeneca, and local presence of major early-stage development CROs such as Charles River Laboratories and Envigo. Furthermore, the UK's regulatory scenario, governed by the Medicines and Healthcare Products Regulatory Agency (MHRA), provides strategies and regulations for preclinical trials, safeguarding the quality and integrity of data.

Germany Preclinical CRO Market Trends

The preclinical CRO market in Germany witnessed significant growth owing to the improvements in technology and quality clinical resources, government initiatives for clinical research activities, and important investments in R&D. The pharmaceutical sector's high research strength and several clinical trials backed by research-based pharmaceutical companies also contribute to the market growth.

Key Europe Preclinical CRO Company Insights

Key players in the market include Eurofins Scientific, Atlant Clinical, ALS Food and Pharmaceutical, Davids Biotechnologie GmbH, and others.

-

Eurofins Scientific operates over 900 laboratories internationally and offers a portfolio of over 200,000 analytical approaches, concentrating on food, environment, pharmaceutical, and cosmetic product testing, as well as discovery pharmacology and agroscience services.

-

Atlant Clinical offers a full range of clinical trials (Phases I-IV) and relevant support services throughout Europe, Russia, the CIS, and the Baltic States. The company has strong expertise across all major therapeutic areas and is fully capable of successfully executing even the most challenging and demanding clinical trials.

Key Europe Preclinical CRO Companies:

- Eurofins Scientific

- Atlant Clinical

- ASSAY Clinical Research

- ALS Food and Pharmaceutical

- Comp5

- Davids Biotechnologie GmbH

- ABX-CRO advanced pharmaceutical services GmbH

- Charles River Laboratories International, Inc.

- ERBC Group.

Recent Development

-

In March 2024, ALS Limited agreed to acquire the remaining 51% interest in Nuvisan, a European-based CRO, at nil cost. Nuvisan generated USD 245 million in revenue in 2023. The acquisition aims to deliver earnings growth and maximum shareholder value, leveraging Nuvisan's strategic footprint in Western Europe and its capabilities in pre-clinical and clinical development services, as well as drug discovery services.

Europe Preclinical CRO Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.9 billion

Revenue forecast in 2030

USD 2.9 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historic data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Service, model type, end-use, country

Regional Coverage

Europe

Country Coverage

UK; Germany; France; Italy; Spain.

Key companies profiled

Eurofins Scientific; Atlant Clinical; ASSAY Clinical Research; ALS Food and Pharmaceutical; Davids Biotechnologie GmbH; ABX-CRO advanced pharmaceutical services GmbH; ERBC Group.; Diag2Tec.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Preclinical CRO Market Report Segmentation

This report forecasts revenue growth at a country level and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe preclinical CRO market report based on service, model type, end-use, and country.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Toxicology Testing

-

Bioanalysis & DMPK Studies

-

Chemistry

-

Compound Management

-

Safety Pharmacology

-

Others

-

-

Model Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Patient Derived Organoid (PDOs) Models

-

Patient Derived Xenograft (PDX) Models

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biopharmaceutical Companies

-

Government & Academic Institutes

-

Medical Device Companies

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."