- Home

- »

- Clinical Diagnostics

- »

-

Europe Point Of Care TB And Drug-resistant TB Testing Market, Report, 2030GVR Report cover

![Europe Point Of Care TB And Drug-resistant TB Testing Market Size, Share & Trends Report]()

Europe Point Of Care TB And Drug-resistant TB Testing Market Size, Share & Trends Analysis Report By Test (Molecular Diagnostics, Immunoassays), By End Use (Clinics & Hospitals), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-453-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

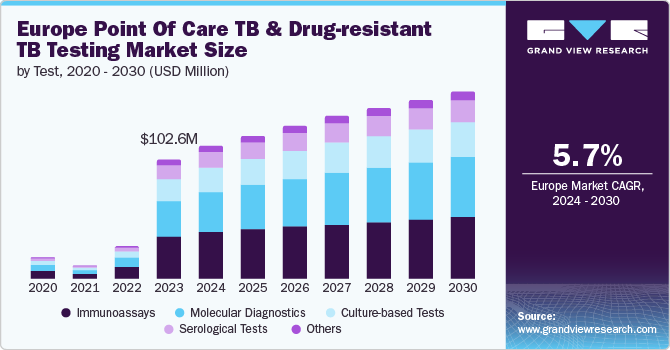

The Europe point of care TB and drug-resistant TB testing market size was estimated at USD 102.6 million in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. The high prevalence of TB and DR-TB in Europe, coupled with increasing governmental and organizational initiatives, is a primary driving force for this market's expansion. As per the European Centre for Disease Prevention and Control (ECDC), the incidence of TB in the WHO European Region increased in 2022, with over 170,000 new cases reported, up from 2021. This rising trend underscores the persistent challenge of TB in Europe and highlights the critical need for advanced diagnostic solutions.

Tuberculosis (TB) still remains a significant public health issue in Europe, with drug-resistant forms, especially multidrug-resistant TB (MDR-TB) and extensively drug-resistant TB (XDR-TB), posing even more critical challenges. The World Health Organization (WHO) notes that about 10% of global TB cases are drug-resistant, reflecting a vital need for rapid and effective diagnostic testing in Europe to manage and contain the disease effectively. As per the European Centre for Disease Prevention and Control, 4.9% of TB cases showed rifampicin resistance or multidrug resistance (RR/MDR) based on drug susceptibility testing. Among MDR-TB cases that underwent further testing, 26.9% were identified as pre-extensively drug-resistant (pre-XDR), and 10% were classified as extensively drug-resistant (XDR).

Regarding HIV, 21 countries IN Europe reported HIV status for 73.6% of their TB cases, with 4.1% of these cases being HIV-positive. Treatment outcomes also vary, with a success rate of 64.0% for all TB cases reported in 2021, 54.0% for HIV-co-infected TB cases in the same year, 52.5% for RR/MDR-TB cases from 2020, and 22.2% for pre-XDR-TB cases reported in 2020. These statistics underscore the ongoing challenge of managing TB, especially in the context of drug resistance and co-infection with HIV.

Recent technological advancements have significantly driven the point of care (PoC) TB and DR-TB testing market. Innovations such as rapid molecular diagnostic tests, including GeneXpert and Loop-mediated Isothermal Amplification (LAMP), have greatly improved the speed & accuracy of TB diagnosis. Compared to the several weeks traditionally required for culture-based methods, these tests can provide results within a few hours. The adoption of these rapid diagnostic technologies in Europe is facilitated by their ability to offer real-time results, which are essential for prompt treatment initiation and effective control of TB outbreaks.

Increased public awareness and educational efforts about tuberculosis (TB) and drug-resistant TB (DR-TB) are driving the demand for advanced diagnostic tools. Public health campaigns emphasize the significance of early detection and the effectiveness of point-of-care (PoC) tests. The European Union's Action Plan to Combat Antimicrobial Resistance (AMR) and the European Tuberculosis Surveillance Network are crucial in coordinating TB control efforts. These strategies stress the need for timely and accurate diagnoses as part of a comprehensive TB management approach. The European Tuberculosis Surveillance Network collects and reports data electronically to the European Surveillance System (TESSy) and WHO's Tuberculosis Monitoring and Evaluation database, including data on treatment outcomes up to three years prior. The network's meetings focus on improving data interpretation and advocating for integrating PoC tests to strengthen disease surveillance and response.

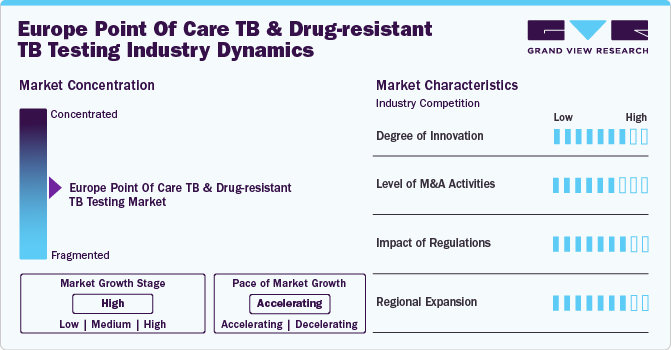

Market Concentration & Characteristics

The Europe market for point of care (PoC) TB and Drug-Resistant TB (DR-TB) testing is characterized by a high degree of innovation driven by ongoing technological advancements and research. Recent developments in diagnostic technologies, such as integrating next-generation sequencing (NGS) and rapid PCR assays, have revolutionized TB testing. NGS provides detailed genetic information, enhancing the detection of drug-resistant strains, while rapid PCR assays offer quick and accurate results, which is crucial for timely TB management. For instance, the GeneXpert MTB/RIF assay, endorsed by the World Health Organization (WHO), has been instrumental in detecting TB and rifampicin resistance within hours, significantly improving diagnostic speed and accuracy.

Mergers and acquisitions (M&A) in the European PoC TB and DR-TB testing market are actively reshaping the competitive landscape, driven by the need for technological advancement and market expansion. Recent notable activities include Danaher Corporation's acquisition of Cepheid to strengthen molecular diagnostic capabilities, including TB testing. In September 2023, Danaher announced it would provide Cepheid's Xpert MTB/RIF Ultra diagnostic test cartridges at a reduced cost of USD 7.97 each to the Global Fund to Fight AIDS, TB, and Malaria and eligible countries under Cepheid's Global Access Program. This initiative is part of a broader effort to enhance access to high-quality TB testing in underserved regions. Such strategic collaboration highlights the market's commitment to improving diagnostic accessibility and advancing public health efforts.

Regulations play a pivotal role in shaping the Europe PoC TB and DR-TB testing market, influencing the development and deployment of diagnostic technologies. The European Medicines Agency (EMA) and national health authorities enforce stringent diagnostic accuracy, safety, and efficacy standards. For instance, the in vitro diagnostic (IVD) regulations introduced by the European Union in 2022 mandate rigorous clinical evaluations and performance testing for TB diagnostic devices. These regulations ensure that only high-quality, reliable tests are available on the market, thus safeguarding patient health and improving diagnostic outcomes.

The regional expansion of the European PoC TB and DR-TB testing market is primarily driven by rising TB prevalence and the increasing demand for advanced diagnostic solutions. A critical development is the launch of the PASS to End TB initiative in May 2024 by the WHO Regional Office for Europe, in collaboration with global TB programs and USAID. This initiative, part of the "Regional Platform to End TB in Eastern Europe," aims to accelerate efforts to eliminate tuberculosis by 2030. It addresses the challenges intensified by the COVID-19 pandemic and ongoing humanitarian crises. The initiative focuses on improving TB surveillance and patient outcomes, crucial for achieving TB elimination goals. These efforts are expected to drive significant growth and regional expansion in the European PoC TB and DR-TB testing market as enhanced diagnostic capabilities and targeted interventions become increasingly vital.

Test Insights

The market is segmented into molecular diagnostics, immunoassays, culture-based, serological, and others, based on types of tests. In 2023, the immunoassays segment dominated the market with a substantial share of 34.9%. Immunoassays offer several advantages over other diagnostic methods, including rapid results and ease of use. They leverage antigen-antibody interactions to detect TB and DR-TB biomarkers, providing results within a short timeframe, which is crucial for prompt diagnosis and treatment. This rapid turnaround aligns with the urgent need for quick diagnostics to manage TB effectively. Their ability to detect specific antibodies or antigens related to TB infections enables healthcare professionals to quickly identify cases, which is particularly beneficial in high-prevalence regions like Europe.

The culture-based tests segment is expected to grow at the fastest CAGR of 5.7% during the forecast period. This growth is primarily fueled by recent advancements in technology and their significant advantages in diagnostic accuracy. Culture-based systems, such as the BACTEC MGIT 960 and 320 systems by BD, have improved the efficiency of detecting mycobacterium tuberculosis and assessing drug resistance. These automated systems enhance throughput and reduce the time required to obtain results, addressing the critical need for precise and timely diagnosis in TB management. The increased sensitivity and specificity of these tests enable healthcare providers to identify even low levels of bacterial growth, which is essential for accurate diagnosis and effective treatment planning. Additionally, the growing emphasis on managing drug-resistant TB strains is driving the demand for culture-based tests. These tests are crucial for accurately determining resistance profiles and guiding appropriate treatment regimens, particularly in rising MDR-TB and XDR-TB cases.

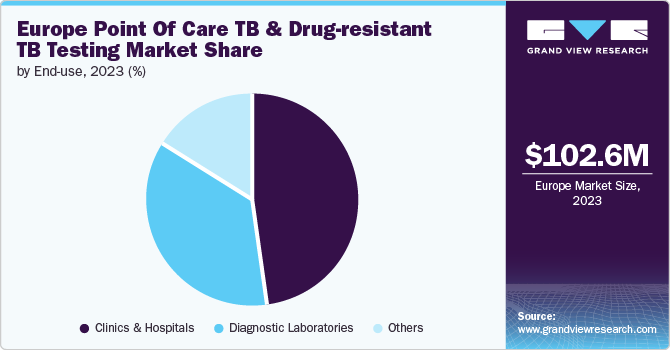

End Use Insights

In 2023, the clinics & hospitals segment dominated the market with the largest revenue share of 48.1%. Clinics and hospitals are primary settings for TB diagnosis and management due to their capacity to offer comprehensive diagnostic and treatment services. Clinics & hospitals are equipped with advanced diagnostic tools & technologies, such as molecular diagnostics and culture-based tests, which are essential for accurate TB and DR-TB detection. Hospitals handle severe and complex cases, including multidrug-resistant (MDR-TB) and extensively drug-resistant TB (XDR-TB), which require specialized diagnostic capabilities and treatment protocols.

This growth is driven by their critical role in performing comprehensive drug susceptibility tests to determine resistance patterns and guide effective treatment. The increasing demand for accurate resistance profiling leads to more significant investments in advanced diagnostic technologies. Innovations such as next-generation sequencing (NGS) and rapid PCR assays have significantly enhanced the speed and accuracy of TB and DR-TB detection. These technologies support high throughput testing and timely results, which are essential for effective TB management. Diagnostic laboratories are becoming central hubs for high-quality, standardized testing, ensuring reliable results and maintaining diagnostic standards, further fueling their expansion.

Country Insights

UK Point Of Care TB And Drug-Resistant TB Testing Market Trends

Key drivers fueling the UK PoC TB and Drug-Resistant TB (DR-TB) testing market include the increasing incidence of TB, alongside the rise in drug-resistant cases. This has further heightened the demand for efficient and rapid diagnostic solutions. According to the UK Health Security Agency, England reported over 4,300 new TB cases in 2022, reflecting a persistent challenge in TB management. The National Health Service (NHS) and Public Health England have been actively investing in advanced Point-of-Care (PoC) technologies to enhance early detection and management of TB. Initiatives such as the NHS Long Term Plan emphasize the integration of rapid diagnostic tools to improve TB outcomes and support public health efforts. Additionally, UK immigration regulations require tuberculosis testing for individuals from high-risk countries planning to stay in the UK for six months or more, further emphasizing the need for accessible and practical TB tests.

Germany Point Of Care TB And Drug-Resistant TB Testing Market Trends

The PoC TB and Drug-Resistant TB (DR-TB) testing market in Germany is thriving due to several driving factors. Germany has one of the highest TB incidences in Europe, with around 4,000 new cases reported in 2022, according to the Robert Koch Institute. The need for rapid and accurate diagnostics to address both TB and drug-resistant strains has led to increased adoption of advanced PoC technologies. The German Central Committee against Tuberculosis, which promotes innovative diagnostic methods and supports research and development in this area, is reflected in the German government's commitment to TB control.

Spain Point Of Care TB And Drug-Resistant TB Testing Market Trends

The Spain PoC TB and Drug-Resistant TB (DR-TB) testing market is experiencing significant growth driven by several key factors. Spain faces a substantial TB burden, with 3,754 cases reported in 2021, according to data from the National Epidemiological Surveillance Network. This high incidence has intensified the demand for advanced diagnostic solutions with rapid and accurate results. Recent advancements in the Spanish healthcare system, including integrating cutting-edge molecular diagnostics into routine testing protocols, have markedly enhanced TB management. As Spain continues to prioritize advancing diagnostic technologies, the PoC TB and DR-TB testing market is expected to expand, driven by the need for efficient and reliable diagnostic tools in the face of ongoing TB prevalence.

Key Europe Point Of Care TB And Drug-resistant TB Testing Company Insights

The Europe PoC TB and Drug-Resistant TB testing market is characterized by the presence of several key players who dominate the landscape with substantial market share. These companies are leading the industry through a broad portfolio.

Key Europe Point Of Care TB And Drug-resistant TB Testing Companies:

- Cepheid (Danaher Corporation)

- Molbio Diagnostics

- Abbott Laboratories

- BD (Becton, Dickinson and Company)

- Roche Diagnostics

- Qiagen

- Lucira Health

- BioMérieux

- Thermo Fisher Scientific

- Fujifilm (Fujifilm Healthcare)

- MedMira

- SD Biosensor

- Trivitron Healthcare

Recent Developments

-

In July 2023, EMPE Diagnostics launched the mfloDx MDR-TB rapid test kit, a precise, quick, and inexpensive test that provides accurate information on Mycobacterium tuberculosis presence and genotypic resistance. It was approved by the CDSCO and is currently undergoing clinical testing in other nations

-

In June 2023, Sysmex Corporation launched a POC Testing (POCT) system to rapidly detect antimicrobial susceptibility in Europe. This system helps identify infections and assess which antibiotics are effective against them, specifically targeting urinary tract infections.

-

In February 2023, QIAGEN N.V. announced that its QuantiFERON-TB Gold Plus (QFT-Plus) test for tuberculosis (TB) received certification under the EU’s new In Vitro Diagnostic Medical Devices Regulation (IVDR) 2017/746. The QFT-Plus test, endorsed by the WHO, is known for its reliable detection of TB bacteria. This certification follows QIAGEN's earlier IVDR CE-marking for the ipsogen JAK2 RGQ PCR Kit and NeuMoDx Systems in late 2022, highlighting the company’s dedication to high diagnostic and regulatory standards.

-

In December 2022, Thermo Fisher Scientific introduced TrueMark Infectious Disease Research Panels, a suite of molecular research panels designed to detect and study a wide range of pathogens. These panels cover over 90 infectious diseases, including viral, bacterial, fungal, and parasitic infections. The TrueMark panels are aimed at providing researchers with accurate and comprehensive data, supporting contagious disease research and public health initiatives.

-

In August 2022, BD and Accelerate Diagnostics, Inc. entered into a definitive agreement to co-develop Accelerate’s rapid testing solution.

Europe Point Of Care TB And Drug-resistant TB Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 115.4 million

Revenue forecast in 2030

USD 161.05 million

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, end use, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Russia; Armenia; Azerbaijan; Belarus; Kazakhstan; Rest of Europe

Key companies profiled

Cepheid (Danaher Corporation); Molbio Diagnostics; Abbott Laboratories; BD (Becton, Dickinson and Company); Roche Diagnostics; Qiagen; Lucira Health; BioMérieux; Thermo Fisher Scientific; Fujifilm (Fujifilm Healthcare); MedMira; SD Biosensor; Trivitron Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Point Of Care TB And Drug-resistant TB Testing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe point of care (PoC) TB and drug-resistant TB testing market report based on test, end use, and country:

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular Diagnostics

-

Immunoassays

-

Culture-based Tests

-

Serological Tests

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics and Hospitals

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Russia

-

Armenia

-

Azerbaijan

-

Belarus

-

Kazakhstan

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe point of care TB and drug-resistant TB testing market was valued at USD 102.6 million in 2023 and is expected to reach USD 115.4 million in 2024.

b. The Europe point of care TB and drug-resistant TB testing market is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030 to reach USD 161.05 million by 2030.

b. In 2023, the immunoassays segment dominated the market with a substantial share of 34.9%. Immunoassays offer several advantages over other diagnostic methods, including rapid results and ease of use.

b. Some of the key players operating in this market include Cepheid (Danaher Corporation); Molbio Diagnostics; Abbott Laboratories; BD (Becton, Dickinson and Company); Roche Diagnostics; Qiagen; Lucira Health; BioMérieux; Thermo Fisher Scientific; Fujifilm (Fujifilm Healthcare); MedMira; SD Biosensor; Trivitron Healthcare.

b. The high prevalence of TB and DR-TB in Europe, coupled with increasing governmental and organizational initiatives, is a primary driving force for this market's expansion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."