Europe Pharmacovigilance Market Size, Share & Trends Analysis Report By Service Provider, By Product Life Cycle, By Therapeutic Area, By Process Flow, By End-use, By Type, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-319-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Pharmacovigilance Market Trends

The Europe pharmacovigilance market size was estimated at USD 1.9 billion in 2023 and is anticipated to grow at a CAGR of 7.4% from 2024 to 2030. The rising number of clinical trials and the need for novel drug development due to the high geriatric population and an increasing number of pharmaceutical & biotechnology firms are among the key factors driving the market growth.

The Europe pharmacovigilance market held a share of 26.0% of the global pharmacovigilance market. Europe is a favorable market for conducting phase I clinical trials due to a large foreign population, highly qualified staff, a better quality of services & infrastructure, and the ability to handle multiple-country clinical trials. According to the WHO, 13,066 clinical trials were registered in 2022 in the Europe region. Furthermore, The European Medicine Agency (EMA) formulated the Risk Management Plan (RMP) for the governance of the PV system. Every drug or biologic must receive approval for RMP before being commercialized. In addition, as per the new PV guideline by the Agency, under the law, all medicinal products would be subjected to stricter assessment and testing regarding their quality.

Growing activities related to drug development in different areas, such as personalized medicines, biosimilars, orphan drugs, companion diagnostics, and adaptive trial designs, are projected to boost the demand for PV services in the coming years. As companies venture into new areas, the need to comply with safety regulations increases the demand for specialized or end-to-end PV service providers with expertise in this field.

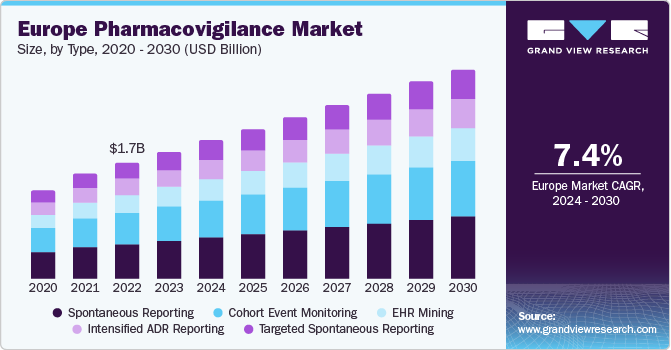

Type Insights

The spontaneous reporting segment dominated the market and accounted for the largest revenue share of 30.0% in 2023 due to regulatory changes, increased awareness, and technological advancements. In addition, efforts to educate the public and healthcare professionals have raised awareness. At the same time, digital tools and artificial intelligence (AI) have improved the efficiency of spontaneous reporting systems, enabling better monitoring of drug safety and thereby driving segment growth.

The targeted spontaneous reporting (TSR) segment is expected to grow at a CAGR of 7.9% from 2024 to 2030, owing to the need for more precise and comprehensive data on adverse drug reactions. TSR complements traditional spontaneous reporting systems by providing a more targeted and systematic method of collecting safety data, which improves the ability to recognize specific risk factors and high-risk groups.

Product Life Cycle Insights

The phase IV segment led the market and registered the largest revenue share of 75.9% in 2023. The increasing prevalence of chronic diseases and the need for more comprehensive safety data have led pharmaceutical companies to invest heavily in R&D and conduct more phase IV clinical trials. In addition, the growing focus on real-world evidence generation to improve drug usage and inform healthcare policies is further driving the segment growth.

The phase II segment is projected to grow at a CAGR of 7.6% from 2024 to 2030. This growth is driven by the strong foundation of biotechnology research institutions and medical centers in Europe, which provides a solid base for conducting these trials. Furthermore, the growing importance of producing real-world evidence to optimize drug usage and update healthcare policies is expected to contribute to segment growth.

Service Providers Insights

The contract outsourcing segment dominated the market and accounted for the largest share of 59.9% in 2023. This growth is attributed to the rise in adverse drug reactions (ADRs) related to pharmaceutical products. Furthermore, the benefits associated with pharmacovigilance outsourcing services, such as cost-effective services and low operational expenses, also contribute to segment growth.

The in-house service providers segment is expected to grow at a CAGR of 6.8% from 2024 to 2030. This growth is due to pharmaceutical companies increasingly opting for in-house pharmacovigilance operations for instant results and constant surveillance of marketed drugs. Furthermore, challenges faced by outsourced facilities, such as inexperienced professionals and quality management issues, have led some companies to bring pharmacovigilance activities in-house, thereby driving segment growth.

End-use Insights

The pharmaceuticals segment led the market and accounted for the largest revenue share of 41.5% in 2023. The segment's growth is driven by the emergence of biologics and biosimilars, increasing healthcare expenditures, and a surge in R&D investments. In addition, supportive regulatory frameworks and reimbursement policies improve the adoption of pharmaceuticals in the region, facilitating market growth. Furthermore, a rise in the incidence of chronic diseases and the need for high-quality drugs also contribute to segment growth.

The biotechnology companies segment is expected to grow at a CAGR of 8.1% from 2024 to 2030 due to the rise in R&D investments by biotech firms. Furthermore, supportive regulatory frameworks, such as the European Medicines Agency's (EMA) guidelines on pharmacovigilance, have improved the adoption of PV services among biotech companies operating in the region.

Therapeutic Area Insights

The oncology segment held the largest share of 26.5% in 2023. This growth is attributed to the growing emphasis on personalized medicine and the development of targeted therapies. In addition, supportive regulatory frameworks, such as the European Medicines Agency's (EMA) guidelines on pharmacovigilance for oncology drugs, have played a crucial role in driving the adoption of PV services in this therapeutic area.

The neurology segment is expected to grow at a CAGR of 7.5% over the forecast years owing to the rising prevalence of neurological disorders, such as Alzheimer's disease, Parkinson's disease, and multiple sclerosis, which has increased the demand for effective pharmacovigilance systems to monitor the safety and efficacy of neurological drugs. Furthermore, the development of new therapies, including biologics and gene therapies, for neurological conditions contributed to the segment growth.

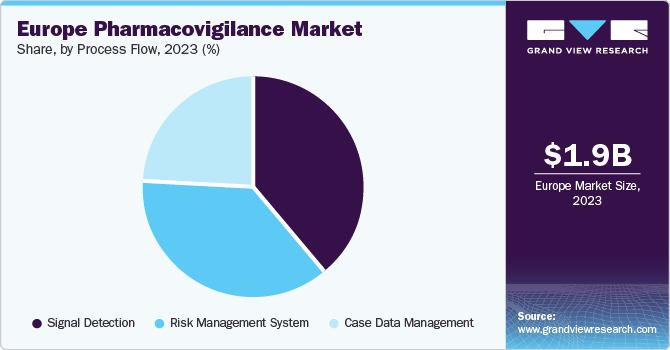

Process Flow Insights

The signal detection segment accounted for the largest share of 38.8% in 2023 due to the increased adoption of advanced data mining and statistical algorithms to analyze large volumes of adverse event data from various sources, including spontaneous reporting systems, electronic health records, and others. Furthermore, increasing focus on patient safety and the need to proactively identify potential drug safety issues further boost the demand for effective signal detection solutions.

The case data management segment is expected to grow at a CAGR of 7.6% from 2024 to 2030 owing to the increasing volume of adverse event reports, need for efficient data capture & processing, and rising requirement for robust signal detection & management processes. In addition, the implementation of regulatory guidelines and focus on patient safety drive the demand for effective case data management solutions, supporting segment growth.

Country Insights

Germany Pharmacovigilance Market Trends

The pharmacovigilance market in Germany dominated the regional market and accounted for the largest revenue share of 25.2% in 2023. This growth is attributed to the presence of government organizations, such as the Deutsche Forschungsgemeinschaft (DFG), which offers funding for clinical trials and has boosted the market. In addition, initiatives by the Federal Institute for Drug and Medical Devices (BfArM), such as the launch of the UAW-DB database to publish suspected adverse drug reactions, have streamlined the regulatory procedure and further propelled industry growth.

Spain Pharmacovigilance Market Trends

The Spain pharmacovigilance market is expected to grow at a CAGR of 7.9% from 2024 to 2030 owing to the rising incidence of adverse drug reactions (ADRs) and increasing prevalence of chronic diseases. The demand for drug development and clinical trials is driving the market growth. Furthermore, the presence of developed healthcare infrastructure and the implementation of regulatory guidelines contribute to market expansion.

Key Europe Pharmacovigilance Company Insights

Some of the key players operating in this market includeIcon Plc, Arithmos, Capgemini, Bayer AG, LINK Medical, and ANP Pharma.

-

ICON PLC is a global provider of PV services dedicated to ensuring the safety and efficacy of pharmaceutical products. With extensive expertise in regulatory compliance, data management, and risk assessment, the company supports pharmaceutical companies in meeting their pharmacovigilance obligations and maintaining a strong reputation in the industry

-

Bayer AG is a multinational pharmaceutical company with a strong commitment to pharmacovigilance. The company focuses on patient safety, regulatory compliance, and manages adverse event reporting, conducts risk assessments, as well as ensures compliance with international regulations

Key Europe pharmacovigilance Companies:

- ICON PLC.

- CAPGEMINI

- Arithmos

- QbD Group

- LINK Medical

- ANP Pharma

- Bayer AG

- AstraZeneca

- Mirpharm Group of Pharmaceutical Companies

- Congenix

Recent Developments

-

In February 2023, Arithmos solidified its expansion with the opening of its new corporate headquarters in Verona, Italy. The 700 square meters of office space in the industrial and business district serves as the main office and point of reference for employees and consultants. This strategic move enables Arithmos to maintain satellite offices in Bergamo, Rome, and Knutsford

Europe Pharmacovigilance Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 3.1 billion |

|

Growth rate |

CAGR of 7.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product life cycle, service provider, type, end use, therapeutic area, process flow, country |

|

Country scope |

Germany; France; UK; Italy; Russia; Spain; Sweden; Denmark; Norway |

|

Key companies profiled |

Dr. Reddy’s Laboratories Ltd.; Sun Pharmaceutical Industries Ltd.; Cipla Inc.; Aurobindo Pharma.; Asymchem Laboratories; Reyoung Pharmaceutical; CSPC Pharmaceutical Group Ltd.; Otsuka Pharmaceutical Australia Pty Ltd.; GC Biopharma Corp.; Chong Kun Dang Pharmaceutical Corp. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Pharmacovigilance Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe pharmacovigilance market report based on product life cycle, service provider, type, end use, therapeutic area, process flow, and country:

-

Product Life Cycle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pre-clinical

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Service Provider Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-house

-

Contract Outsourcing

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spontaneous Reporting

-

Intensified ADR Reporting

-

Targeted Spontaneous Reporting

-

Cohort Event Monitoring

-

EHR Mining

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceuticals

-

Biotechnology Companies

-

Medical Device Manufacturers

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Respiratory Systems

-

Other

-

-

Process Flow Outlook (Revenue, USD Billion, 2018 - 2030)

-

Case Data Management

-

Signal Detection

-

Risk Management System

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

France

-

UK

-

Italy

-

Russia

-

Spain

-

Sweden

-

Denmark

-

Norway

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."