- Home

- »

- Electronic Devices

- »

-

Europe Pet Wearable Market Size, Industry Report, 2030GVR Report cover

![Europe Pet Wearable Market Size, Share & Trends Report]()

Europe Pet Wearable Market Size, Share & Trends Analysis Report By Technology (RFID, GPS), By Product, By Animal, By Component, By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-317-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Europe Pet Wearable Market Size & Trends

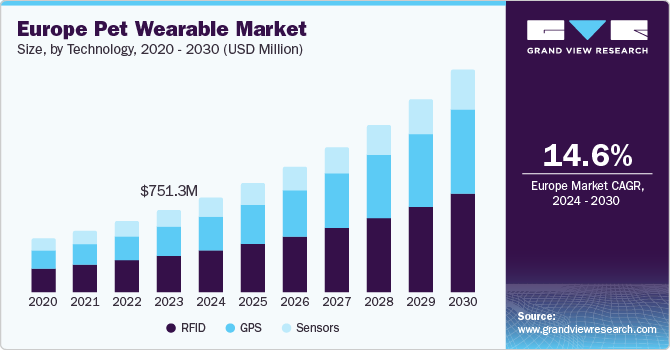

The Europe pet wearable market size was estimated at USD 751.3 million in 2023 and is anticipated to grow at a CAGR of 14.6% from 2024 to 2030. The market is growing due to increasing pet ownership, rising concerns over pet safety, and advances in miniaturization and smartphone integration. According to official figures provided by the European Pet Food Industry Federation (FEDIAF), the region has witnessed a growth in the adoption of pets, such as cats and dogs, as well as exotic birds and fish, leading to greater demand for solutions that can monitor them. Moreover, Europe is home to established market players, such as Datamars, known for offering a wide range of pet wearables and related software solutions, providing pet owners with more options, promoting confidence, attracting investment, and driving regional market growth.

The Europe pet wearables market accounted for a share of 27.8% of the global pet wearable market revenue in 2023. The rise in pet ownership and increased awareness regarding pet health significantly contribute to the product demand. As disposable income levels increase across the region, pet owners are increasingly motivated to invest in advanced pet care solutions, generating a growing demand for innovative wearables. Continuous development of pet wearables depends heavily on technological innovations, leading to advanced and user-friendly products. These innovations include integrating advanced sensors, data analytics, and wireless connectivity, enhancing the functionalities of pet wearables. For instance, incorporating GPS tracking enables real-time pet location monitoring, while health sensors provide insights into vital signs and activity levels. The user-friendly design ensures seamless integration into a pet owner's daily routine, promoting ease of use and accessibility.

Advances in the latest technologies, including sensing, Artificial Intelligence (AI), and Machine Learning (ML), play a crucial role in driving innovation and the development of new products offering extended battery life and improved connectivity features. Integrating modern sensing technology into pet wearables aids in gaining a deeper, more nuanced understanding of pets' behavior, health, and well-being. Moreover, miniaturization and extended battery life benefit pets and their owners alike. The improved battery life of these solutions has emerged as a substantial advantage to pet owners by annulling the need for frequent charging and guaranteeing uninterrupted pet activity monitoring over extended durations. The rising adoption of smart homes across developed economies, such as Germany, France, and the UK, is also expected to drive market growth in the coming years.

Technology Insights

The radio frequency identification technology segment accounted for the largest revenue share of 44.8% in 2023. The increasing adoption of pets, particularly in Germany, France, and the UK, has created a need to keep track of their health and activities at all times. Radio frequency identification (RFID) tags aid veterinary professionals and pet owners in identifying their pets while also helping them gather parameters, including heartbeat, pulse rate, calorie intake, and body temperature, which help analyze the health conditions of these animals. Therefore, the ever-growing requirement to monitor pets' health status and location in real time to ensure their well-being is expected to elevate the adoption of RFID-based wearable devices.

The GPS technology segment is anticipated to witness the fastest CAGR of 16.0% from 2024 to 2030. GPS tags are generally mounted on pet collars so that the real-time tracking of their location is possible and convenient. This technology enables owners to establish geo-fenced areas and alert them if their pets move out of this defined space. GPS technology can be installed easily on popular devices, such as smartwatches and smartphones, which display the accurate location of pets at all times. The high rate of adoption of such smart devices and the ease of technological integration of this technology is expected to increase consumer interest, thus driving segment growth in the region.

Animal Insights

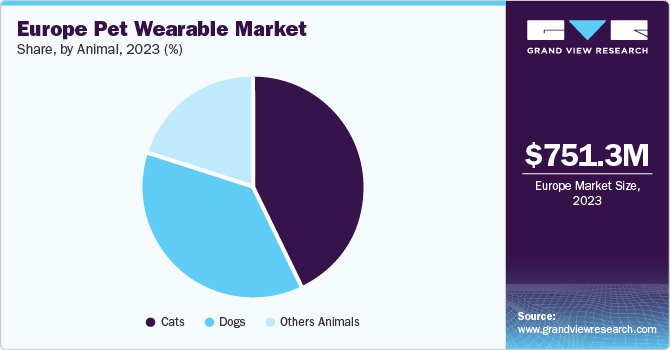

The cats segment accounted for the largest revenue share in 2023. As per data from the European Pet Food Industry Federation, as of 2022, cats were more popular than other animals among pet owners, with 127 million cats living in around 26% of regional households. Cat owners have frequently cited the need to keep track of their location so that they are not stolen or do not fall prey to wild animals. Moreover, there is also an increased demand for solutions that can consistently monitor the health of cats and quickly detect any underlying issues. Thus, the rapidly growing need for technologically advanced devices to monitor the well-being of these animals is expected to aid market expansion in the region.

The dogs segment is anticipated to advance at the fastest CAGR from 2024 to 2030. Due to their playful, energetic, and protective nature, dogs are increasingly becoming a popular choice as pets in both small and large European households. However, these animals are also prone to wandering off from their owners, which drives the need for devices, such as smart collars, to track their movements. Moreover, dogs are at a high risk of developing common canine disorders, such as distemper, Lyme disease, and Bordetella, creating an urgent need to keep track of their physical health.

Product Insights

The smart collar segment accounted for the leading revenue share of 42.6% in 2023. The increasing focus of pet owners on the well-being of their pets drives the product demand. Smart collars can track the location of pets in real-time with the help of GPS technology and can also undertake location tracking in areas with minimal Wi-Fi connectivity by using advanced cellular networking and various satellite constellations. Moreover, they provide instantaneous alerts regarding pet movement so that they do not move out of a pre-determined area without their owner’s guidance. In addition, smart collars can also effectively keep track of the health and vital parameters of pets, by monitoring their activity levels, heart rate, calories burnt, and overall behavior. Such a multitude of benefits provided by these products have aided in driving their demand.

The smart harness and vest segment is anticipated to advance at the fastest growth rate from 2024 to 2030. Smart harnesses and vests are gaining popularity in the market in major European economies, providing an extensive range of functionalities beyond their standard alternatives. These new solutions address both pet well-being and owner convenience, with features, such as real-time GPS monitoring and escape-proof features, for increased safety as well as remote teaching capabilities and data-driven insights for better behavioral management. In addition, integrated sensors for health monitoring and adaptable designs for comfort help enhance the attraction of smart harnesses and vests for prospective buyers.

Component Insights

The connectivity integrated circuits segment held the dominant revenue share in 2023. Due to the rising demand for comprehensive and convenient pet care solutions, connectivity integrated circuits (ICs) have become increasingly popular among advanced device manufacturers. These chips, through the integration of Bluetooth, WiFi, and sophisticated cellular capabilities, have improved the caring and monitoring capabilities of pet owners. WiFi chips provide features, such as live pet camera streaming and smart home integration within home networks. On the other hand, cellular chips offer real-time GPS tracking, remote vet consultations, and geo-fencing, even in on-the-go scenarios. Recognizing the benefits of both these chips, the market is moving towards hybrid connectivity options, enabling pet owners to seamlessly switch between these as per their requirements.

The processors segment is expected to witness a substantial growth rate from 2024 to 2030. There has been significant progress in the manufacturing of pet wearable products, as manufacturers are incorporating advanced technologies to improve their efficiency and accuracy. The adoption of edge computing in pet wearables is a notable trend, leveraging processors to perform data analysis directly on the device. This approach enhances real-time processing, reduces dependence on cloud services, and addresses privacy concerns by keeping sensitive data localized.

Application Insights

The identification & tracking application segment held the largest revenue share in 2023. The increasing incidences of pets getting lost or stolen due to lack of monitoring has presented a major avenue for pet wearable developers to integrate advanced identification & tracking features in their products. For instance, as per a report by Direct Line Pet Insurance, an estimated 2,300 dogs were reported to be stolen in the UK in 2023, which was a 6% increase over 2022. Other pets, such as birds and fish, also face a significant risk of being stolen, particularly if they are exotic. In addition, there is an increasing demand for tracking devices for popular pet birds, such as parrots and cockatoos, to locate them during emergencies.

The medical diagnosis & treatment segment is anticipated to advance at the fastest CAGR from 2024 to 2030. In recent years, consumers have been spending significantly on pet health diagnostics. A substantial number of pets fall prey to common health problems, such as skin allergies, obesity, infections, chronic kidney disease, arthritis, and excessive thyroid syndrome, which deteriorate their health rapidly and can lead to substantial veterinary expenses. Thus, pet owners have become more proactive in monitoring and keeping a real-time track of pet health by using wearables.

Country Insights

Germany Pet Wearable Market Trends

The pet wearable market in Germany accounted for the largest revenue share of 24.1% in 2023 in Europe. According to research by the German Pet Trade & Industry Association (ZZF) and the Industrial Association of Pet Care Producers (IVH), there were around 34 million pets in Germany, with cats leading, in terms of adoption. The interest in pet wearables offering digital identification and tracking features is growing substantially in Germany. Pet wearables provide GPS tracking for location monitoring and digital identification features based on microchips or QR codes that are particularly in high demand. German consumers prioritizing the safety and security of their companion animals find pet wearables highly beneficial, owing to the sense of reassurance and control over pet well-being that these products provide.

UK Pet Wearable Market Trends

The UK pet wearables market is anticipated to witness the fastest CAGR of 16.3% from 2024 to 2030. The UK boasts a high pet ownership rate, with almost half of the households possessing at least one pet. This substantial pet parent population stimulates product demand. In May 2022, the Pet Food Manufacturers Association (UK), based on a survey of nearly 9,000 households, reported that almost six in 10, or about 62% of households in the UK, had pets. At 13 million, dogs emerged as the most common pets, followed closely by cats with a population of 12 million. The growing population of pet owners is getting increasingly concerned about the safety and well-being of their pets, leading to a heightened awareness about pet wearable products.

Key Europe Pet Wearable Company Insights

Major companies involved in the development of innovative pet wearable products include Datamars, Loc8tor, Avid Identification Systems, and Felcana. These companies introduce solutions that make it convenient for pet owners to track the activity and health of their cats, dogs, or other pets.

-

Avid Identification Systems is a leading supplier of Radio Frequency Identification (RFID)-based products. The company manufactures and supplies pet microchips and recovery systems. Veterinarians, animal care providers, shelter managers, biologists, and conservationists leverage the company’s microchip technology to identify animals. The company also runs the ‘PETtrac’ pet recovery program that uses microchips. The company is represented in Europe via Avid Microchip de Espana, S.L. in Spain and Avid PLC in the UK

-

Loc8tor Ltd. is a British technology company that manufactures trackers and locating devices. Trackers offered by the company are used to locate children, pets, and other daily household items. The company provides a wide range of applications and products in more than 30 countries

Key Europe Pet Wearable Companies:

- Avid Identification Systems, Inc.

- DOGTRA

- Datamars

- Felcana

- Allflex Livestock Intelligence (a part of MSD Animal Health)

- Garmin Ltd.

- GoPro Inc.

- Latsen Technology Ltd.

- Loc8tor Ltd.

- Mars, Incorporated

- Petface by LeisureGrow Products Ltd

- Tractive

- Trovan Ltd.

Recent Developments

-

In May 2024, Tractive announced its partnership with Strava, a fitness-tracking application. As per this development, dog owners who use Tractive can automatically upload their walking activities to Strava to continuously monitor their active lifestyle and their pets. The History tab of this application would keep an accurate account of their walking statistics, including duration and distance covered. The partnership is aimed at improving the activity levels of both dogs and their owners

-

In May 2023, Datamars announced the acquisition of Kippy S.r.l., which develops GPS trackers and activity monitoring solutions for pets. The Italy-based company would form an important part of Datamars’ companion animal portfolio, which provides products for pet identification, activity, and health monitoring, as well as reunification solutions

Europe Pet Wearable Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.95 billion

Growth rate

CAGR of 14.6% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Technology, product, animal, component, application, country

Country scope

Germany; UK; France; Spain

Key companies profiled

Avid Identification Systems, Inc.; DOGTRA; Datamars; Felcana; Allflex Livestock Intelligence (a part of MSD Animal Health); Garmin Ltd.; GoPro Inc.; Latsen Technology Ltd.; Loc8tor Ltd.; Mars, Inc.; Petface by LeisureGrow Products Ltd; Tractive; Trovan Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Pet Wearable Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe pet wearable market report based on technology, product, component, animal, application, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RFID

-

GPS

-

Sensors

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Collar

-

Smart Camera

-

Smart Harness and Vest

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

GPS Chips

-

RFID Chips

-

Connectivity Integrated Circuit

-

Bluetooth Chips

-

Wi-Fi Chips

-

Cellular Chips

-

-

Sensors

-

Processors

-

Memory

-

Displays

-

Batteries

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Identification & Tracking

-

Behavior Monitoring & Control

-

Facilitation, Safety & Security

-

Fitness Monitoring

-

Medical Diagnosis & Treatment

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Spain

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."