Europe Pet Food Antioxidants For Meat Rendering Market Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-162-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

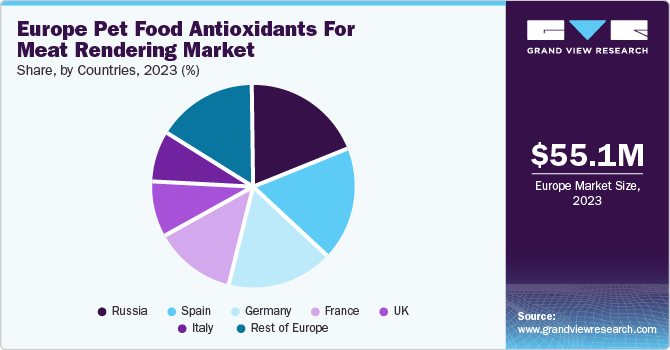

The Europe pet food antioxidants for meat rendering market size was valued at USD 55.07 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 1.7% in revenue from 2024 to 2030. This growth is attributed to increasing numbers of pet adoption globally fueling high demand for high-quality food, which in turn is driving the demand for antioxidants to ensure the longevity of products. Antioxidants play a vital role in meat rendering by preventing the oxidation of oils and fats in the rendered meat, helping maintain the nutritional value and quality of food products. The primary function of antioxidants is to inhibit the formation of free radicals, which can lead to rancidity and spoiling in the meat.

According to the European Pet Food Industry Federation (FEDIAF), Europe is one of the largest markets for the pet food industry, with around 340 million pets in the region. Europe accounts for approximately 30% of the total pet care and food sales globally, accounting USD 29.1 billion of value, with a value and volume growth of 5% and 3.5%, respectively. Key factors in market growth include an increase in the demand for premium products, mainly organic, raw, and natural products, depending on the owners’ choice.

The market in Europe is attractive for various international suppliers globally. The European industry contains approximately 200 production plants and 150 regional companies operating in the industry. Imports account for a high share, especially from the U.S., China, and Thailand. Other European countries, such as the Netherlands, Switzerland, and Poland, have emerged as prominent suppliers.

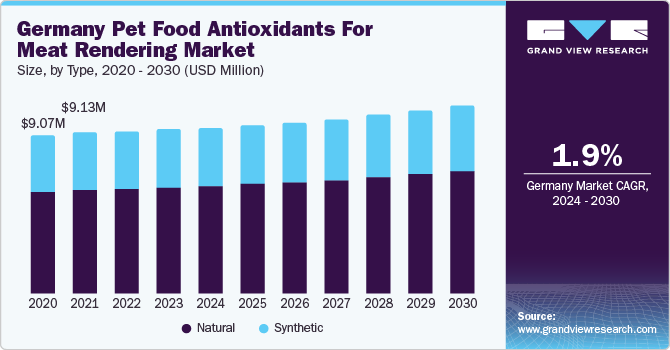

Country Insights

Russia held the largest revenue share of 19.42% in 2023. This is attributed to Russia’s dynamic pet industry, with an increase in the number of adoptions due to rising disposable incomes. One of the most significant transformations in the country’s pet food production landscape has been the development of domestic production plants such as AlphaPet and Limkorm, launched in 2022.

The sanctions levied on Russia due to the ongoing conflict in Ukraine have had a negative effect on the Russian pet food industry in the form of disruption of supply chains. For instance, in November 2022, Nestle postponed the construction of its pet food production facility in Novosibirsk, built with a budget of USD 165 million. The country has also witnessed an increase of up to 32% in prices of imported brands in 2022 compared to the last year, triggering a switch in customer preference towards local brands.

Spain holds a significant position due to the large population of dogs (9.3 million) and cats (5.8 million), forming the fourth and eighth largest in Europe, respectively, as per European Pet Food Industry Federation (FEDIAF). The expansion of e-commerce medium after COVID-19 and a number of pet shops (3000) in the country have been drivers of the market in Spain, thereby contributing to the increase in consumption of antioxidants used for the preservation of meat-based products.

Type Insights

The natural segment held the largest revenue share of 69% in 2023. This large share is attributed to a shift towards natural antioxidants such as vitamin C, vitamin E, and rosemary extract, reflecting a broader trend of customers preferring natural ingredient-based products in the pet food industry. Premium brands in Europe have introduced high-end products with natural ingredients as their unique selling proposition.

The growing emphasis on health and wellness has also increased the usage of natural antioxidants, encouraged by the stringent compliance on additives enacted by the European Union. These regulations have prompted manufacturers to use approved antioxidants in pet food products.

Another significant category of antioxidants employed in the European market consists of synthetic variants. The primary synthetic antioxidants utilized include butylated hydroxyanisole (BHT), butylated hydroxytoluene, tertiary butyl hydroquinone (TBHQ), propyl gallate (PG), and ethoxyquin. These synthetic antioxidants are synthesized in laboratories and are often blended with natural counterparts to enhance effectiveness and bolster stability.

Key Companies & Market Share Insights

The European market comprises regional as well as global players operating in the region, giving it a fragmented nature. The companies majorly focus on catering to dog and cat food products, as they form the major segments in pet industry in Europe. Various manufacturers are adopting different strategy initiatives such as new product launches, expansion, partnerships, and mergers & acquisitions to cater to the increasing demand for the product.

For instance, in October 2022, IQI trusted PetFood Ingredients and Astareal announced a new strategic partnership to introduce innovative health ingredients in the European market. The natural, algae-derived ingredient from AstaReal will be supported by IQI Petfood Ingredients, acting as a distributor of the former’s products in the whole European continent.

A significant portion of progress within the European pet food industry can be attributed to innovations. An illustrative example is the announcement made by Czech company Bene Meat Technologies in November 2023. The firm revealed that it had obtained a license to manufacture and sell pet nutrition products derived from lab-cultivated meat throughout the European Union. Since 2020, the company has been actively engaged in developing cultured meat production technology and stands as the inaugural recipient of a license from the European Feed Materials Register for its products.

Key Europe Pet Food Antioxidants For Meat Rendering Companies:

- Adisseo

- ADM

- Alltech

- AstaReal Group

- BASF SE

- Camlin Fine Sciences Ltd.

- Cargill

- DSM

- Kemin Industries, Inc.

- Novus International, Inc.

- Nutreco

Europe Pet Food Antioxidants For Meat Rendering Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 55.44 million |

|

Revenue forecast in 2030 |

USD 61.88 million |

|

Growth rate |

CAGR of 1.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in Tons, Revenue in USD Thousands, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type, region |

|

Regional scope |

Europe |

|

Country scope |

Germany; UK; France; Italy; Spain; Russia; Rest of Europe |

|

Key companies profiled |

Kemin Industries, Inc.; AstaReal Group; Camlin Fine Sciences Ltd.; Adisseo; Alltech; BASF SE; Novus International, Inc.; Nutreco; DSM; Cargill; ADM |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Pet Food Antioxidants For Meat Rendering Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe pet food antioxidants for meat rendering market report based on type and region:

-

Type Outlook (Volume, Tons; Revenue, USD Thousands, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousands, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe pet food antioxidants for meat rendering market size was estimated at USD 55.07 million and is expected to reach USD 55.44 million in 2024.

b. The Europe pet food antioxidants for meat rendering market is expected to grow at a compound annual growth rate (CAGR) of 1.7% from 2024 to reach USD 61.88 Million by 2030.

b. Russia dominated the Europe pet food antioxidants for meat rendering market with a market share of 19.42% in 2023. This is attributed to Russia’s dynamic pet industry, with an increase in the number of adoptions due to rising disposable incomes in the country.

b. The European market is dotted with regional as well as global players working in the region, giving it a fragmented nature. The companies majorly focus on catering to dog and cat food products, as they form the major segments in pet industry in Europe. Notably, the European market is currently dominated by key industry leaders such as Alltech, BASF SE and Nutreco.

b. Key factors that can be attributed to market growth include an increase in the demand for premium products, mainly organic, raw, and natural products, depending on the choice of owners.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."