- Home

- »

- Consumer F&B

- »

-

Europe Pea Protein Market Size, Industry Report, 2030GVR Report cover

![Europe Pea Protein Market Size, Share & Trends Report]()

Europe Pea Protein Market Size, Share & Trends Analysis Report By Product (Isolates, Concentrates), By Form (Dry, Wet), By Source, By Application (Food & Beverages, Animal Feed), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-323-3

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Europe Pea Protein Market Size & Trends

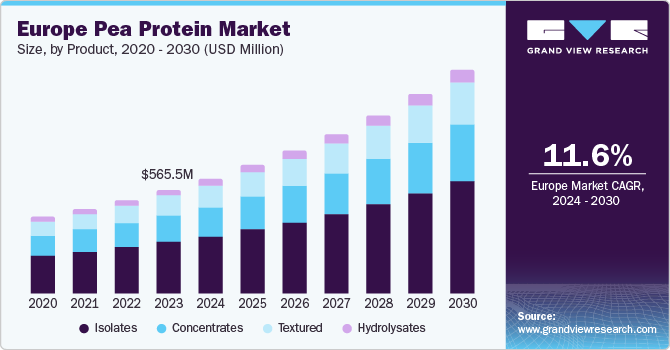

The Europe pea protein market size was estimated at USD 556.5 million in 2023 and is expected to grow at a CAGR of 11.6% from 2024 to 2030. Increasing market penetration of gluten-free foods in key markets including the UK and France on account of rising concerns over harmful effects associated with glutamic diseases is expected to favor the industry over the forecast years. Moreover, the rising popularity of sports nutrition products in Eastern European countries including Russia and Poland on account of newly launched protein-fortified powders in the market is projected to fuel product demand.

The Europe pea protein market accounted for a share of 26.2% of the global pea protein market in 2023. Europe's pea protein market is expected to witness steady growth over the forecast period owing to the rising consumer preference for vegan, vegetarian, or flexitarian diets and increasing awareness regarding health concerns, such as cancer, diabetes, and cardiovascular diseases, posed by animal-based proteins.

Product Insights

The pea protein isolates segment accounted for a revenue share of 49.9% in 2023. Pea protein isolates have non-allergic and good emulsification characteristics. Food & beverage manufacturers are attracted by these characteristics and adopted protein isolates as nutritional supplements in fruit mixes, energy drinks, bakery items, and meat products. The sports nutrition industry is expanding in developed countries, such as the UK and Germany, due to new product launches in the energy mix category.

The pea protein concentrates segment is projected to grow at a CAGR of 11.2% over the forecast period. The growing adoption of pea protein concentrates in the manufacturing base of baked goods in the UK, France, and Germany considering proximity with equipment manufacturers and easy access to rice and wheat as raw materials is expected to boost the application of pea protein concentrates in the coming years.

Source Insights

The yellow split segment accounted for a revenue share of 78.3% in 2023. Yellow peas are applied in the food industry in the form of ingredients that are added to energy bars, veggie burgers, ice cream, popcorn, yogurt, and milk, among others. Yellow peas are the major raw materials used to produce pea protein.

The other sources segment is anticipated to grow at a CAGR of 9.7% over the forecast period. The segment’s growth is attributed to the enhanced nutrition profiles, the need for product diversification, and flavor variations.

Application Insights

The food & beverages segment accounted for a revenue share of 11.6% in 2023. The growing competition among processed food & beverage companies is driving them to incorporate novel or healthy ingredients in their product to appeal to the health-conscious consumer base. This trend is anticipated to favor market growth.

The personal care & cosmetics segment is projected to grow at a CAGR of 11.9% over the forecast period. The personal care and cosmetics industry in the region is experiencing key trends, including a growing awareness of hygiene and beauty consciousness among consumers. Urban consumers are increasing their spending on high-quality products, which has contributed to the industry's growth in recent years.

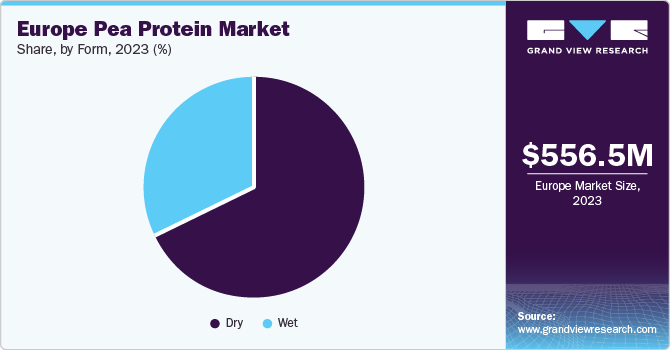

Form Insights

The dry pea protein segment accounted for a revenue share of 67.9% in 2023. The segment growth is attributed to the longer shelf life, higher protein concentration, convenience in handling & storage, and improved functionality. The manufacturing of pea protein through dry milling in combination with air classification helps retain the native functionality of protein ingredients.

The wet pea protein segment is expected to grow at a CAGR of 11.4% from 2024 to 2030. Wet pea protein maintains more of the natural properties and characteristics of whole peas, making it attractive to consumers looking for minimally processed whole food options. The wet pea protein offers simpler extraction techniques, which lead to lower production costs.

Country Insights

UK Pea Protein Market Trends

The UK pea protein market accounted for a revenue share of 22.9% in 2023. Increasing consumer awareness regarding a healthy lifestyle, a rising number of health and fitness centers, new product developments, and integration and consolidation of food technology are expected to drive the demand for pea protein in the country in the coming years.

Germany Pea Protein Market Trends

The pea protein market in Germany is projected to grow at a CAGR of 12.0% over the forecast period. A rise in the geriatric population in Germany and increasing use of plant protein products, such as pea, hemp, and soy, respectively, in sports nutrition applications, is likely to have a positive effect on its market over the next few years.

Key Europe Pea Protein Company Insights

Some of the key players operating in the market includeCOSUCRA, SOTEXPRO, and Roquette Frères

-

COSUCRA manufactures and distributes food ingredients including chicory soluble fiber, pea protein isolate, and pea fiber. Its functional ingredients are widely utilized in dairy products, fruit juices, dietary supplements, meat & savory products, and animal feed

-

SOTEXPRO manufactures and distributes functional ingredients for the food & beverage and animal feed industries. Sotexpro processes raw materials, such as faba bean, pea seed, and soya seed, for the production of functional ingredients

Key Europe Pea Protein Companies:

- COSUCRA

- SOTEXPRO

- Roquette Frères

- Cosucra Groupe Warcoing SA

- Kerry Group

- Ingredion Inc.

- Burcon NutraScience Corp.

- Glanbia Plc.

- Emsland Group.

- Farbest Brands

Recent Developments

-

In June 2023, Roquette Frères opened a new Food Innovation Center in France. The facility will provide formulators with various capabilities, including technical assistance, R&D support, state-of-the-art equipment, and scale-up testing, to accelerate product launches

-

In October 2019, COSUCRA announced its plans to open a new pea processing plant in Aarhus, Denmark to strengthen its position in the plant-based protein ingredients market

Europe Pea Protein Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD1,192.6 million

Growth rate

CAGR of 11.6% from 2024 to 2030

Historical period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, source, application, country

Country scope

Germany; UK; France; Italy; Spain; Sweden; The Netherlands

Key companies profiled

COSUCRA; SOTEXPRO; Roquette Frères; Cosucra; Groupe Warcoing SA; Kerry Group; Ingredion Inc.; Burcon NutraScience Corp.; Glanbia Plc.; Emsland Group.; Farbest Brands

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Europe Pea Protein Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe pea protein market report based on product, form, source, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Isolates

-

Concentrates

-

Textured

-

Hydrolysates

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Wet

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Yellow Split Peas

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Meat substitutes

-

Bakery goods

-

Dietary supplements

-

Beverages

-

Others

-

-

Personal Care & Cosmetics

-

Animal Feed

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

The Netherlands

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."