- Home

- »

- Advanced Interior Materials

- »

-

Europe Passive Fire Protection Market Size, Report, 2030GVR Report cover

![Europe Passive Fire Protection Market Size, Share & Trends Report]()

Europe Passive Fire Protection Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Cementitious Materials, Intumescent Coatings), By End-use (Oil & Gas, Construction), By Country, And Segment Forecast

- Report ID: GVR-1-68038-003-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

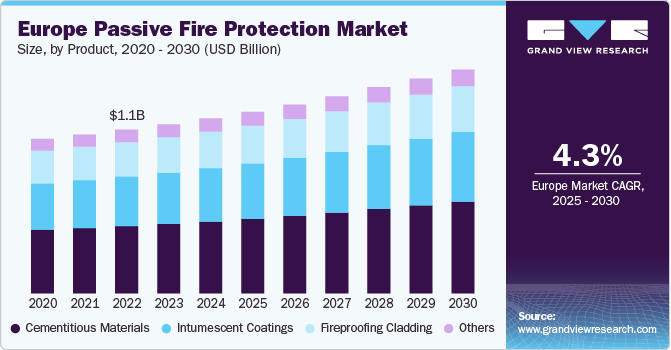

The Europe passive fire protection market size was estimated at USD 1.17 billion in 2024 and is anticipated to grow at a CAGR of 4.3% from 2025 to 2030. The market is witnessing significant demand growth, driven by stringent building codes and regulations to enhance construction safety standards. Increasing awareness of fire hazards and the need for retrofitting older structures is propelling investments in fire-resistant materials and systems. Key sectors such as commercial, residential, and industrial construction are adopting advanced fire protection solutions, further fueled by the rise of sustainable building practices. As Europe focuses on reducing carbon footprints, integrating passive fire protection in green buildings is becoming increasingly essential, contributing to the market's positive trajectory.

Regulatory changes and evolving safety standards increasingly shape the demand for passive fire protection in Europe. As countries implement more rigorous fire safety legislation, the market sees heightened investment in fire-resistant materials and innovative design solutions. Growth is also driven by the expansion of infrastructure projects, particularly in urban areas, where mixed-use developments require robust fire protection strategies. Furthermore, technological advancements lead to more effective passive fire protection systems, enhancing their appeal in new constructions and refurbishment projects. The emphasis on sustainability and energy efficiency in building design also prompts architects and builders to prioritize passive fire protection as a critical component of overall safety and compliance.

Drivers, Opportunities & Restraints

The primary market driver in Europe is the tightening of fire safety regulations and building codes across the region. As governments enforce stricter standards to enhance safety in both commercial and residential buildings, there is an increased demand for fire-resistant materials and systems. This regulatory push is further amplified by rising awareness of fire risks, leading architects and builders to prioritize passive fire protection solutions in their designs, thus fostering market growth.

The high cost associated with advanced fire protection systems and materials is a significant restraint in the European market. The initial investment required for installation and compliance with stringent regulations can deter some developers, especially in the face of budget constraints in various construction projects. In addition, a lack of awareness and expertise in implementing effective passive fire protection measures can further inhibit market expansion.

The market presents substantial opportunities in retrofitting, where older buildings require modernization to meet current safety standards. As European cities increasingly focus on upgrading their infrastructure, there is a growing need for passive fire protection solutions that can be integrated into existing structures. Furthermore, the rise of sustainable building practices creates avenues for innovative fire protection technologies that align with green building certifications, appealing to environmentally conscious developers and property owners.

Product Insights

The demand for the intumescent coatings product segment is expected to grow at a significant CAGR of 4.6% from 2025 to 2030 in terms of revenue.

The cementitious materials product segment led the market and accounted for a share of 41.1% in 2024.The demand for cementitious materials in the European market is rising due to their effectiveness in providing fire resistance and thermal insulation. These materials are widely used in construction for fireproofing structural elements, such as beams and columns, owing to their durability and ease of application. With the growing focus on safety regulations and the need for robust fire protection in new and retrofitted buildings, cementitious fire protection products are increasingly favored for their cost-effectiveness and performance, making them a critical component in modern construction practices.

The demand for intumescent coatings is gaining traction in Europe, driven by their unique ability to expand and form a protective char layer when exposed to high temperatures, effectively insulating structural elements from fire. These coatings are particularly popular in architectural applications due to their aesthetic flexibility and the minimal impact on the overall design of buildings. As more developers seek solutions combining fire safety with design considerations, the adoption of intumescent coatings is expected to rise, especially in high-rise and commercial buildings where fire resistance and visual appeal are essential.

End-use Insights

The demand for construction end-use segment is expected to grow at a significant CAGR of 4.7% from 2025 to 2030 in terms of revenue.

The construction end-use segment led the market and accounted for a share of 32.0% in 2024. The demand for passive fire protection in the construction industry is steadily increasing as safety regulations become more stringent and awareness of fire hazards grows. Builders and developers prioritize fire-resistant materials and systems to comply with evolving codes and ensure the safety of occupants. This trend is particularly evident in high-rise buildings, commercial spaces, and residential projects where the integration of passive fire protection is crucial for minimizing risk and enhancing overall safety. In addition, the push towards sustainable construction practices has further emphasized the need for effective passive fire protection solutions, making them an integral part of modern building design.

In the oil & gas industry, the demand for passive fire protection is critically driven by the high-risk nature of operations, where flammable materials and extreme conditions prevail. Companies increasingly implement advanced fire protection systems to safeguard personnel and assets against potential fire hazards. The emphasis on regulatory compliance and a proactive approach to risk management has led to significant investments in passive fire protection solutions, such as fire-resistant barriers and coatings for pipelines and storage facilities. As the industry continues to evolve and expand, especially in challenging environments, integrating robust passive fire protection measures remains essential to ensure operational safety and environmental protection.

Country Insights

France to witness fastest market growth at 5.2% CAGR

Germany Passive Fire Protection Market Trends

Germany accounted for 24.3% of the Europe market share in 2024. Germany has seen significant demand for passive fire protection systems in recent years, driven by stringent building codes, increased awareness about fire safety, and the ongoing construction boom in both residential and commercial sectors. As Europe's largest economy, Germany strongly emphasizes safety standards and the adoption of innovative fire protection solutions. This heightened demand is also spurred by renovating old buildings and the need to comply with the EU's energy efficiency directives, which often include upgrading fire safety measures.

France Passive Fire Protection Market Trends

In France, the demand for passive fire protection has been on an upward trajectory, fueled by rigorous regulatory requirements, a keen focus on safety within the construction sector, and a significant number of renovation projects across the country's urban and rural landscapes. France's commitment to enhancing fire safety in both new builds and existing structures is reflected in the comprehensive national building codes and standards that emphasize the importance of passive fire protection measures. This includes using fire-resistant materials, compartmentalization to prevent the spread of fire, and installing fire doors and barriers.

Key Passive Fire Protection Company Insights

Some key players operating in the European market include 3M, Hilti, and Hempel A/S.

-

3M, formerly known as the Minnesota Mining and Manufacturing Company, was incorporated in 1902 and is headquartered in Minnesota, U.S. The company is publicly traded on the New York Stock Exchange with the ticker code MMM. Its products are distributed globally through an extensive distribution network comprising direct and third-party supply channels such as retailers, wholesalers, dealers, distributors, and jobbers. 3M offers a wide range of firestop products, including sealants, tapes, foams, construction joint sprays, sound & smoke tapes, fire barrier pillows, and flexible wraps. The technology-driven company hugely invests in research & development activities to develop new products. In 2019, it invested USD 1.9 billion in its R&D activities worldwide. The company manages its expenses through commodity price swaps, price protection agreements, and negotiated supply contracts.

-

Hilti was established in 1941 and is headquartered in Schaan, Liechtenstein. The company is engaged in producing and marketing drilling, fastening, and mounting equipment. In addition, it manufactures demolition and drilling tools, diamond coring & cutting tools, façade systems, measuring systems, modular support systems, construction chemicals, and anchoring & positioning systems.The company provides fire-stopping and passive fire protection solutions, including fire-stop foams, sealants, sprays, fire-stop mortars, coatings, cushions, wraps, collars, and bandages. It serves various industries, including mining, oil & gas, refineries, petrochemicals, construction & civil engineering, marine engineering, power, and electronics & telecommunication.

Mercor Tecresa, Daussan Group, Rudolf Hensel GmbH, Sharpfibre Limited, Thermoguard UK Ltd., and Teknos Group are some of the emerging players in the European market.

-

Mercor Tecresa, headquartered in Madrid, Spain, offers passive fire protection solutions focusing on smoke evacuation and fire resistance of materials. The company was founded in 1998 and later integrated into The Mercor Group in 2008. Its product offerings include smoke exhaust systems, fire dampers, mortars, thermal and acoustic insulation, sealing systems, fire protection panels, and intumescent paints. The company markets its products under various brands, including Tecwool, Tecbor, Tecplaster, Tecfill, AlveolTec, Tecsel, and Teclack-w.

-

Daussan Group manufactures high-temperature products and accessories for various industrial applications. The company was founded in 1936 and is headquartered in Woippy, France. It offers its products through three segments: refractories, engineering & services, and insulation & fire protection. Through the refractories segment, products offered include refractory concretes, sprayed and molded wear linings & boards, gunning products, pipe & pouring accessories, refractory insulating sleeves, ramming masses, taphole clays, and refractory mortars & glues.

Key Passive Fire Protection Companies:

- 3M

- RPM International Inc.

- Hempel A/S

- The Sherwin-Williams Company

- Hilti

- Mercor Tecresa

- Etex Group

- Rudolf Hensel GmbH

- Daussan Group

- Rolf Kuhn GmbH

Recent Developments

-

In December 2023, Hempel A/S launched an intumescent coating estimation software, HEET Dynamic. The software is designed to estimate intumescent coating on steel selections and assists engineers and estimators in quick and easy calculations of volume and thickness.

-

In February 2023, PPG Industries, Inc. launched an epoxy intumescent fire protection coating, PPG STEELGUARD 951, developed to fulfill modern architectural steel demands, offering up to three hours of cellulosic fire protection. In the case of fire incidents, the coating expands from a lightweight, thin film to a foam-like thick layer that protects the steel and maintains its structural integrity.

Europe Passive Fire Protection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.22 billion

Revenue forecast in 2030

USD 1.50 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Country scope

France; Germany; Italy; Spain; Russia; UK

Key companies profiled

RPM International Inc.; 3M; Hempel A/S; The Sherwin-Williams Company; Rudolf Hensel GmbH; Hilti; Etex Group; Daussan Group; Mercor Tecresa; Rolf Kuhn GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Passive Fire Protection Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe passive fire protection market based on product, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cementitious Materials

-

Intumescent Coatings

-

Fireproofing Cladding

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Construction

-

Industrial

-

Warehousing

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

France

-

Germany

-

Italy

-

Spain

-

Russia

-

UK

-

Frequently Asked Questions About This Report

b. Europe passive fire protection market size was estimated at USD 1.17 billion in 2024 and is expected to reach USD 1.22 billion in 2025.

b. The Europe passive fire protection market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2030 to reach USD 1.50 billion by 2030.

b. The construction end-use segment led the market and accounted for a share of 32.0% in 2024. The demand for passive fire protection in the construction industry is steadily increasing as safety regulations become more stringent and awareness of fire hazards grows.

b. Some of the key players operating in the Europe passive fire protection market include RPM International Inc., 3M, Hempel A/S, The Sherwin-Williams Company, Rudolf Hensel GmbH, Hilti, Etex Group, Daussan Group, Mercor Tecresa, Rolf Kuhn GmbH, among others.

b. Europe passive fire protection market is witnessing significant demand growth, driven by stringent building codes and regulations aimed at enhancing safety standards in construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.