- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Europe Paint Protection Film Market Size, Report, 2030GVR Report cover

![Europe Paint Protection Film Market Size, Share & Trends Report]()

Europe Paint Protection Film Market Size, Share & Trends Analysis By Material (Thermoplastic Polyurethane, Polyvinyl Chloride), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-312-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Europe Paint Protection Film Market Trends

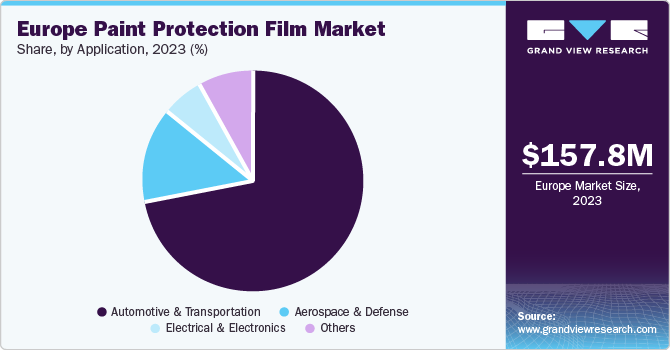

The Europe paint protection film market was estimated at USD 157.8 million in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. A key driver is the rising popularity of premium and luxury cars, which tend to have more delicate paint finishes that benefit from the protective film. The rising awareness of the advantages of paint protection films (PPFs) among car owners is also propelling the market growth. Furthermore, increasing disposable incomes allow consumers to invest more in car care, including paint protection.

The Europe paint protection film market accounted for a share of 31.6% of the the global paint protection film market revenue in 2023. The European Union (EU) has implemented regulations to ensure the safety, sustainability, and performance of PPFs and architectural paints available in the European market. These regulations include various directives and initiatives aimed at minimizing the environmental impact and enhancing consumer safety.

Material Insights

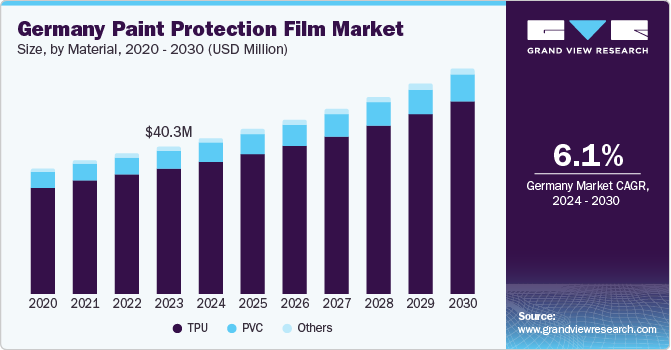

The thermoplastic polyurethane (TPU) segment dominated the market with a share of 83.5% in 2023. TPU is a versatile material known for its exceptional durability, flexibility, and resistance to abrasion, impact, and UV radiation. These properties make it an ideal choice for automotive paint protection films. As vehicles become more sophisticated and consumers seek long-lasting solutions, TPU-based films have gained traction.

The polyvinyl chloride (PVC) segment is projected to grow at a CAGR of 22.6% from 2024 to 2030. PVC films offer good chemical resistance, ease of installation, and cost-effectiveness. However, they may not match TPU’s self-healing capabilities or long-term durability. Despite this, advancements in PVC formulations and increased awareness about paint protection films are expected to drive demand for PVC-based solutions. As the automotive aftermarket continues to expand, PVC films will likely play a crucial role in meeting consumer needs for paint protection.

Application Insights

The automotive & transportation sector held the largest revenue share of 71.6% in 2023. This dominance is driven by the widespread adoption of paint protection films in the automotive industry. Vehicle owners increasingly recognize the value of protecting their investments by applying these films to their cars, trucks, and motorcycles. Paint protection films shield the vehicle’s exterior from scratches and environmental factors, preserving the original paint finish. As consumers become more conscious of aesthetics and long-term maintenance costs, the demand for high-quality paint protection films continues to rise. In addition, advancements in film technology, such as self-healing properties and enhanced clarity, contribute to the segment’s growth. Automotive manufacturers and aftermarket service providers play a pivotal role in driving this trend.

The electrical and electronics segment is projected to grow at a CAGR of 5.1% over the forecast period. Paint protection films are used to safeguard electronic devices, displays, touchscreens, and other sensitive surfaces in this segment. The adoption of paint protection films in the electrical and electronics industry aligns with the growing emphasis on product longevity and user experience.

Country Insights

Germany Paint Protection Film Market Trends

The Germany paint protection film market dominated the Europe regional market with a share of 25.5% in 2023. Germany has a robust automotive sector, with a high automobile demand, thereby driving product adoption. In addition, Germany hosts major paint protection film manufacturers and a network of skilled installers. These factors, coupled with rising awareness among consumers about the benefits of protective coatings, have fueled the product demand in Germany.

UK Paint Protection Film Market Trends

The UK paint protection film market is expected to grow at a CAGR of 5.2% from 2024 to 2030. The automotive industry in the UK, along with a growing preference for quality finishes, contributes to the market’s positive trajectory.

Key Europe Paint Protection Film Company Insights

Some of the key players operating in the market include 3M, BASF SE, XPEL, and Imerys S.A.

-

BASF SE plays a significant role in the market. With expertise in various industries, including automotive and coatings, BASF offers a range of products and solutions for the paint protection film industry

-

Imerys S.A. has a notable presence in the market. Imerys provides high-quality materials that contribute to the formulation of effective paint protection films

Key Europe Paint Protection Film Companies:

- 3M

- Eastman Chemical Company

- Avery Dennison Corporation

- Renolit SE

- DuPont de Nemours, Inc.

- BASF SE

- Saint-Gobain Group

- XPEL Inc.

- Imerys S.A.

- Hexis

Recent Developments

-

In February 2024, XPEL, Inc. launched several new asset protection products including its first-ever windshield protection film and additions to its surface care line, all available worldwide in Q3 2024

-

In June 2023, Hexis rolled out a new recycling program across its converting network in France, enabling the recovery of various film materials for industrial reuse through partnerships established by its QHSE team

-

In May 2024, Tint World Automotive Styling Centers partnered with XPEL to offer premium protective films and coatings for various applications to its growing international franchise network

Europe Paint Protection Film Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 228.2 million

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in million square meters, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, trends

Segments covered

Material, application, country

Country scope

Germany; UK; France

Key companies profiled

3M; Eastman Chemical Company; Avery Dennison Corp.; Saint-Gobain Group; Renolit SE; DuPont de Nemours, Inc.; BASF SE; Imerys S.A.; XPEL Inc.; Hexis

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Paint Protection Film Market Report Segmentation

This report forecasts revenue growth and volume at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe paint protection film market report based on material, application, and country:

-

Material Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Thermoplastic Polyurethane (TPU)

-

Polyvinyl chloride (PVC)

-

Others

-

-

Application Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Aerospace & Defense

-

Others

-

-

Country Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

UK

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."