Europe Outdoor Apparel Market Size, Share & Trends Analysis Report By Apparel Type (Casual Wear, Fashion Wear), By Product Type, By Fabric Type, By End-use, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-277-5

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The Europe outdoor apparel market size was estimated at USD 17.80 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. The increasing popularity of outdoor activities such as hiking, camping, and rock climbing is one of the driving factors for the industry. As more people are getting interested in enjoying nature and outdoor adventures, they need the right gear to stay comfortable and safe. This has led to a rise in the demand for high-quality outdoor apparel that can withstand harsh conditions and provide reliable protection from uncertain harmful elements.

Another key factor driving the market growth is the increasing emphasis on sustainable and eco-friendly products. Many consumers are looking for outdoor apparel that is made from sustainable materials and produced in an environmentally responsible way. It has led to the emergence of several brands, such as Cotopaxi, Ten Tree International Inc., Reformation, and For Days, Inc., which offer eco-friendly outdoor apparel and accessories.

Major players in the market are investing heavily in research and development to introduce new and innovative outdoor apparel. For instance, in June 2022, Under Armour, Inc. introduced the UA Flow Synchronicity running shoes for women. Compared to shoes made from a men's model, this better supports the arch and secures the heel. The materials used to make the shoe are eventually ground down and recycled to be used in new products.

The use of sustainable materials in the apparel industry, such as fibers made from wood pulp, cotton cuttings, and agri-food by-products is increasing. Recycled fibers and recycling technologies are also being utilized. European brands and retailers are demanding recycled content in their products to align with EU regulations promoting a circular economy.

In September 2022, Nike launched a sustainable fabric called Nike Forward, which is made using a needle-punching process and at least 70% recycled content. This fabric is created in fewer steps and with reduced carbon emissions compared to traditional Nike knit fleece. The first product made with Nike Forward was a sleek, entirely recyclable unisex hoodie.

In 2022, Adidas partnered with material startups like Infinited Fiber Company, Spinnova, and Pond to create eco-friendly materials from natural sources, aiming to replace fossil-based plastics. The company successfully introduced a small apparel collection in the fall, incorporating at least 60% recycled cotton waste and 40% organic cotton, in collaboration with Infinited Fiber Company and the EU-funded New Cotton project. This initiative transforms textile waste into a cotton-like man-made cellulosic fiber.

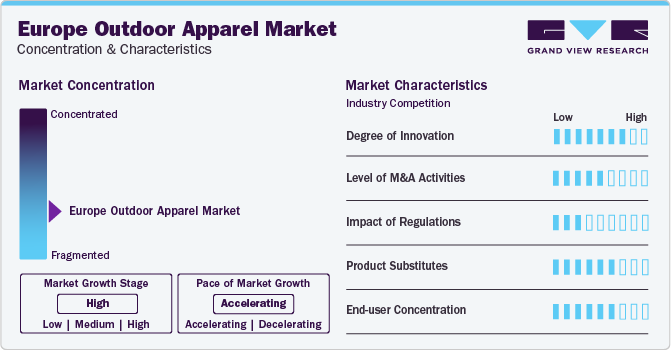

Market Concentration & Characteristics

Innovation is driving growth in the outdoor apparel industry in Europe. Companies are developing new materials and technologies that enhance the performance and durability of outdoor apparel. Many outdoor clothing brands now use advanced fabrics that provide better moisture-wicking & insulation properties and enhanced breathability & waterproofing.

The market has been experiencing a notable surge in merger and acquisition activities, and strategic realignment efforts. In 2020, VF Corporation, a major player in the outdoor apparel market, acquired Supreme, a renowned streetwear and lifestyle brand. This strategic acquisition allowed VF Corporation to expand its reach into urban outdoor fashion and attract a younger demographic.

The market is significantly influenced by stringent regulatory frameworks governing manufacturing standards, sustainability practices, and consumer safety measures. Regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) impose strict guidelines on the use of chemicals in textile production, ensuring environmental protection and consumer health.

The end-user concentration within the Europe outdoor apparel industry is notably diverse, encompassing distinct consumer segments with unique preferences and requirements. These segments include outdoor enthusiasts seeking high-performance gear for adventurous expeditions, urban outdoor consumers desiring stylish and functional apparel, sustainable and ethical consumers prioritizing eco-friendly products, and tourists/travelers requiring versatile and comfortable clothing for travel purposes.

Apparel Type Insights

Sports & activity wear apparel led the market and accounted for a share of 26.3% in 2023. There has been a substantial increase in awareness of leading a healthy and active lifestyle. Consumers are becoming more conscious of the benefits of regular physical activity in maintaining good health, managing stress, and preventing various chronic diseases. This awareness has led to a surge of people engaging in fitness and sports activities, thereby driving the demand for sportswear. To cater to the demand, several companies are launching unique sportswear styles. For instance, in February 2023, Adidas announced a new line, Adidas Sportswear. The new line includes dresses, jerseys, tracksuits, shoes, jackets, and jerseys. The label is available online, with early access already opened on the mobile app.

The fashion wear industry is projected to grow at the highest CAGR of 6.0% from 2024 to 2030. The changing fashion landscape, coupled with the increased influence of influencers and celebrities, has transformed how fashion trends emerge and spread. These figures have become powerful agents in shaping consumer preferences and driving the demand for fashion wear. This dynamics often fuels the fast fashion industry, where clothing brands rapidly produce affordable versions of trending designs, meeting the demand for the latest styles. In line with this trend, in October 2023, a key player in the industry, H&M, and 60’s French fashion icon Paco Rabanne collaborated to launch the Rabanne H&M collection, which includes accessories, menswear, accessories, womenswear, and home décor items. The collection was unveiled at the Silencio Club in Paris.

Product Type Insights

Top wear dominated the market with the largest revenue share in 2023. Top wear comprises clothing items such as shirts, jackets, sweaters, and other garments that cover the chest, arms, and upper back. This category of apparel experiences consistent demand due to changing fashion trends and the surge in online retail and e-commerce. The fashion industry is constantly evolving with new styles, colors, and designs, as companies increasingly focus on providing innovative products to capture consumer attention. This continuous evolution serves as a driving force, compelling consumers to frequently update their wardrobes and purchase the latest top wear to maintain a stylish appearance.

The bottom wear segment is projected to grow at a significant CAGR over the forecast period. The expansion of the bottom wear market is driven by the availability of a wide range of products. This extensive selection includes various clothing items such as pants, trousers, jeans, shorts, skirts, and leggings. The diversity in this range extends to cover an array of designs, from flares, straight-leg, skinny, and bootcut, to culottes, among others. This assortment is well-positioned to drive growth in the industry.

Fabric Type Insights

Polyester-based outdoor apparel dominated the market with the largest revenue share in 2023. The rise in demand for outdoor apparel made from polyester can be attributed to several factors, including its durability, strength, and versatility. Polyester's lightweight and wrinkle-resistance properties make it an ideal choice for clothing and textile manufacturing.

Nylon based outdoor apparel market is projected to grow at a significant CAGR over the forecast period. The increasing adoption of nylon in sports apparel production is a major factor driving the growth of the segment. Nylon is breathable, lightweight, and durable, making it the preferred material for sportswear. In comparison to fabrics such as polyester or cotton, nylon has superior abrasion resistance, making it less susceptible to wear and tear resulting from repetitive movements, which are common in various sports activities. This contributes significantly to the durability of sportswear items made from nylon, ensuring they maintain their performance and appearance over extended periods of active use.

End-use Insights

Men's outdoor apparel dominated the market with the largest revenue share in 2023. Factors like celebrity collaborations and the launch of exclusive collections within the men's fashion industry are fueling the demand for outdoor apparel among men. To drive sales from this demographic, market players are employing various strategies to engage consumers, including implementing promotional discounts, and collaborating with athletes and celebrities to launch menswear, all considered to impact and shape the purchasing behavior of men. In September 2023, UK-based supermarket Sainsbury’s announced the launch of its menswear collection in partnership with musician and actor Martin Kemp and its exclusively owned menswear brand Union Works.

Women's outdoor apparel is projected to grow at the highest CAGR over the forecast period. The segment is showcasing growth owing to improved gender balance, with a growing number of women in the workforce. According to World Bank data, women now make up about 39% of the global workforce, and this percentage has been steadily increasing over the last two decades, as reported by UN Women. As the female segment of society gains better internet access and greater decision-making independence, manufacturers are consistently offering fashionable products, contributing to market growth.

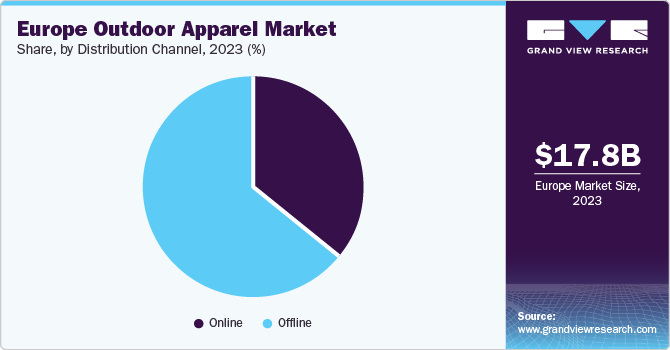

Distribution Channel Insights

The sales of outdoor apparel through offline channels dominated the market with the largest revenue share in 2023. Factors such as easy access and affordability are the major factors driving the demand for outdoor apparel through offline channels. Customers often visit supermarkets and department stores for their daily necessities. The presence of a wide range of outdoor apparel in these stores offers added convenience for shoppers, as they can easily browse and purchase apparel alongside their regular grocery shopping. This one-stop shopping experience can benefit customers who want to save time and effort.

The sales of outdoor apparel through online channels are projected to grow at the highest CAGR from 2024 to 2030. Direct-to-consumer (DTC or D2C) outdoor apparel brands can leverage competition, offer variety and innovation, employ targeted marketing campaigns, and engage with consumers directly through online channels. Many consumers prefer online shopping for outdoor apparel owing to its convenience and accessibility, coupled with user-generated content and reviews.

Country Insights

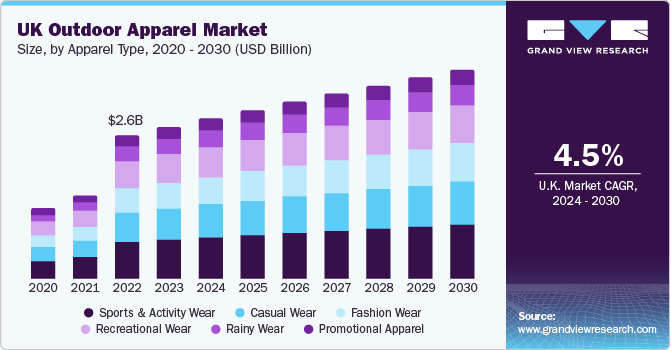

UK Outdoor Apparel Market Trends

The outdoor apparel market in the UK accounted for a share of 15.5% of the European industry in 2023. UK's diverse topography provides an ideal backdrop for outdoor activities. Hiking, cycling, running, and camping are popular pastimes for many residents in the region. According to the People and Nature Survey for England, in January 2022, 61% of adults in England reported having spent time outdoors in green and natural settings over the preceding 14 days, an increase from the 56% recorded in December. As the number of people participating in outdoor activities rises, there is a growing need for appropriate clothing designed to enhance comfort, offer protection, and provide functionality.

Germany outdoor apparel market is projected to grow at a CAGR of 4.7% from 2024 to 2030. The robust outdoor culture and thriving interest in outdoor activities among the population drive the demand for quality outdoor apparel suitable for various weather conditions and activities. Moreover, the emphasis on health and wellness, coupled with a trend toward active lifestyles, fuels the need for functional and stylish outdoor clothing.

Key Europe Outdoor Apparel Company Insights

The market is expected to witness moderate competition among the companies owing to the presence of numerous players across the industry. Owing to changing consumer trends, numerous companies are expanding their product portfolio to gain a competitive edge in the market. Some of the key market players in the Europe outdoor apparel market are Adidas AG, Columbia Sportswear Company, VF Corporation, Mizuno Corporation, Nike, Inc., PUMA S.E, Under Armour Inc., Patagonia, Inc., Arc'teryx, and Newell Brands.

Key Europe Outdoor Apparel Companies:

- Adidas AG

- Columbia Sportswear Company

- VF Corporation

- Mizuno Corporation

- Nike, Inc.

- PUMA SE

- Under Armour Inc.

- Patagonia, Inc.

- Arc'teryx

- Newell Brands

Recent Developments

-

In October 2023, Arc'teryx announced its plans to expand its retail presence in Covent Garden by opening a flagship store at 42 King Street, London, UK This expansion serves as a testament to the brand's continuous achievements and dedication to the region, contributing to Covent Garden's growing reputation as a prime destination for high-end retailers.

-

In February 2023, Adidas introduced a new label called "Sportswear" in collaboration with actress, producer, and style icon Jenna Ortega. This new line was designed to elevate everyday fashion by offering a variety of stylish outfits that incorporate cutting-edge performance technology. This new addition complemented the brand's existing performance and original labels.

-

In June 2023, Nike Inc. partnered with the performance-focused retailer Pro:Direct Sport. This initiative debuted on the Pro: Direct Sport mobile app within the UK and on the web platform in France. Through this collaboration, a range of personalized digital offerings and exclusive member-only products and experiences were made accessible to customers.

Europe Outdoor Apparel Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 18.83 billion |

|

Revenue Forecast in 2030 |

USD 25.04 billion |

|

Growth rate (Revenue) |

CAGR of 4.9% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Apparel Type, Product Type, Fabric Type, End-user, Distribution Channel |

|

Regional scope |

Europe |

|

Country scope |

UK, Germany, France, Italy, Spain |

|

Key companies profiled |

Adidas AG; Columbia Sportswear Company; VF Corporation; Mizuno Corporation, Nike; Inc.; PUMA S.E; Under Armour Inc.; Patagonia, Inc.; Arc'teryx; and Newell Brands |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Outdoor Apparel Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the Europe outdoor apparel market report based on apparel type, product type, fabric type, end-users, distribution channel, and countries:

-

Apparel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Casual Wear

-

Fashion Wear

-

Rainy Wear

-

Promotional Apparel

-

Recreational Wear

-

Sports & Activity Wear

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Top Wear

-

Bottom Wear

-

-

Fabric Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyester

-

Nylon

-

Cotton

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe outdoor apparel size was estimated at USD 17.80 billion in 2023 and is expected to reach USD 18.83 billion in 2024.

b. The Europe outdoor apparel is expected to grow at a compounded growth rate of 4.9% from 2023 to 2030 to reach USD 25.04 million by 2030.

b. Sports & Activity Wear apparel dominated the market in 2023 with a 26.3% share in revenue. There has been a substantial increase in awareness of leading a healthy and active lifestyle. Consumers are becoming more conscious of the benefits of regular physical activity in maintaining good health, managing stress, and preventing various chronic diseases. This awareness has led to a surge of people engaging in fitness and sports activities, thereby driving the demand for sportswear.

b. Some key players operating in Europe outdoor apparel market are Adidas AG, Columbia Sportswear Company, VF Corporation, Mizuno Corporation, Nike, Inc., PUMA S.E, Under Armour Inc., Patagonia, Inc., Arc'teryx, and Newell Brands

b. The growing emphasis on health and well-being has become a prominent factor driving the flourishing outdoor apparel market in Europe. In recent years, there has been a noticeable shift in people's lifestyles and priorities, with a strong focus on staying fit, maintaining good health, and seeking ways to enjoy the great outdoors. This shift has had a major impact on the outdoor apparel market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."