- Home

- »

- Pharmaceuticals

- »

-

Europe Ophthalmic Drugs Market Size, Industry Report 2030GVR Report cover

![Europe Ophthalmic Drugs Market Size, Share & Trends Report]()

Europe Ophthalmic Drugs Market Size, Share & Trends Analysis Report By Drug Class, By Disease, By Dosage Form, By Route Of Administration, By Type, By Product, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-314-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Ophthalmic Drugs Market Trends

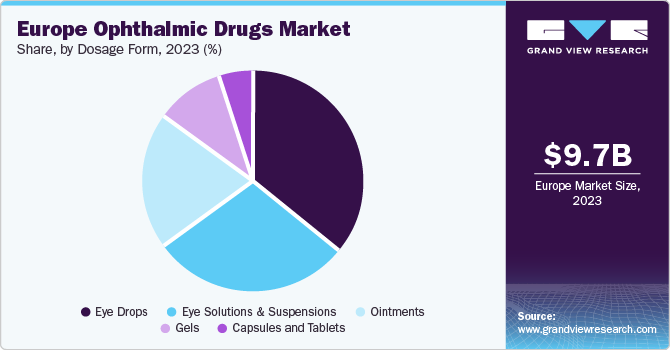

The Europe ophthalmic drugs market size was estimated at USD 9.65 billion in 2023 and is anticipated to grow at a CAGR of 7.9% from 2024 to 2030. The region is anticipated to contribute substantially to the market expansion in the coming years, owing to the rapidly aging population in several economies. Furthermore, the widespread incidence of diabetes in people, particularly due to lifestyle issues, has increased the prevalence of diabetic retinopathy.

The European market for ophthalmic drugs accounted for a revenue share of 25.5% in the global ophthalmic drug market in 2023. The rapid growth of the pharmaceutical industry in the region, coupled with the presence of several major companies in this area, has driven the demand for these drugs. In addition, an increase in research funding from public and private organizations is expected to spur market expansion. For drug manufacturers, positive reimbursement policies are expected to play a key role in driving sales of their products in European economies.

The investment scenario in ophthalmic drugs is highly promising, which is expected to keep the market in a healthy shape over the coming years. Investors are increasingly funding companies to support the clinical development of novel treatments for eye diseases. Several research studies are being ably supported by various sponsored programs that have helped enhance the development of novel therapeutics in the market. Moreover, rising R&D activities and spending by leading players are projected to augment industry expansion during the projected period.

Advancements in drug delivery systems are expected to become another decisive market driver. Gene therapy has rapidly emerged as a high-potential drug-delivery mechanism. It allows patient cell manipulation to produce specific therapeutic entities using viral or non-viral vectors in both in-vitro and in-vivo settings. Gene therapy is particularly beneficial in diagnosing and treating conditions, such as neurovascular retinal disorders and retinoblastoma, as well as hereditary ophthalmic issues, such as retinitis pigmentosa. However, further research is still needed to optimize and expand the application of gene therapy across ophthalmic indications.

Drug Class Insights

The anti-VEGF agent drug class segment accounted for the largest revenue share of 32.8% in the European market for ophthalmic drugs in 2023. Anti-VEGF (Vascular Endothelial Growth Factor) agents are a class of therapeutics that inhibit angiogenesis and edema and are widely utilized in the ophthalmology space to treat eye problems that result in swelling or cause new blood vessel growth around retinas. These agents have been introduced as a novel therapy to inhibit the progression of wet age-related macular degeneration (AMD), diabetic macular edema (DME), and macular edema secondary to retinal vein occlusion (RVO). Introduction of differentiation therapies due to their novel mechanisms of action, such as Macugen (pegaptanib), Lucentis (ranibizumab), and Avastin (bevacizumab), have further spurred market growth. These products have shown significant evidence of preventing vision loss and eventually improving vision.

The gene and cell therapy segment is projected to advance at the fastest CAGR of 16.5% during the forecast period. These products are increasingly being considered to address eye-related disorders owing to the high efficacy rate of drugs, leading to substantial market expansion. Gene therapy addresses Inherited Retinal Diseases (IRDs) such as Leber congenital amaurosis (LCA) and retinitis pigmentosa by delivering functional copies of the defective gene into retinal cells to restore their function. Meanwhile, cell-based therapies involve transplanting retinal cells or stem cell-derived retinal cells into the eye to replace damaged or dysfunctional cells.

Disease Insights

The retinal disorders segment accounted for a dominant revenue share of 39.2% in 2023. The increasing prevalence of common disorders, such as diabetic retinopathy, AMD, and retinitis pigmentosa, as well as Best Vitelliform Macular Dystrophy (BVMD), inherited retinal dystrophies, choroideremia, and X-linked retinoschisis, is expected to drive the demand for ophthalmic drugs in the region. Furthermore, technological advancements and rising incidences of strategic collaborations are some other notable factors anticipated to propel market demand for the treatment of retinal disorders in the coming years. Among retinal disorders, macular degeneration contributes significantly to market growth, aided by the growing involvement of major market players and the increasing presence of pipeline products to address the condition.

The uveitis segment is projected to advance at a substantial CAGR over the forecast period. Uveitis is a leading cause of blindness and can be categorized into four types: anterior, intermediate, posterior, and panuveitis. The condition can be acute or chronic and has the potential for recurrence. According to an article by the National Institutes of Health, around 5-20% of incidences of legal blindness in Europe result from this disease. Uveitis can be treated with corticosteroids and injections around and inside the eye. Immunosuppressive agents, such as mycophenolate, methotrexate, and azathioprine, have also been effective. In the coming years, increased commercialization of existing products for new indications is expected to have a positive impact on the segment growth.

Route of Administration Insights

The topical administration segment accounted for a dominant share in 2023. This route of drug administration is widely practiced as it provides the benefits of non-invasiveness, increased patient compliance, and is easy to self-administer. Topical drug dosages generally include solutions, suspensions, and ointments. The easy availability of various drugs that can be delivered via the topical route is expected to act as a significant segment driver. For instance, oxymetazoline, tetrahydrozoline, phenylephrine, and naphazoline are available as over-the-counter ophthalmic decongestants. Through the topical mode, therapeutic agents can be administered directly to the site of action, resulting in high bioavailability. Additionally, drug manufacturers have developed various strategies to improve the efficiency of topical drug delivery that can maximize corneal drug absorption and minimize pre-corneal drug loss.

On the other hand, the local ocular administration route is anticipated to advance at a substantial CAGR in the coming years. The intraocular route of drug delivery enables the drug to enter the blood-retinal barrier directly, resulting in achieving a drug concentration peak. It helps achieve the highest intraocular bioavailability in the eye’s posterior segment tissues, including the macula or the cone-containing fovea. However, as this is a highly invasive drug administration technique, there are significant chances of contracting injection-induced complications, such as raised IOP, retinal hemorrhage, floaters, vitreous hemorrhage, transient blurry vision, retinal detachment, retinal tears, and endophthalmitis.

Type Insights

Prescription drugs are generally indicated to treat ocular diseases caused by bacteria & viruses, DES, retinal disorders, and glaucoma. Some notable drugs present in the market include Lotemax gel/ointment, Durezol, Zylet, Bepreve, and prescription artificial tears. Of these, Bepreve is an antihistamine that is indicated for the treatment of allergic conjunctivitis. A few prescription products incorporate lubricating and moisturizing agents that temporarily improve tear secretion. Prescription products are highly effective in treating ophthalmic disorders and, thus, are preferred over OTC products.

The OTC product segment is anticipated to register a lucrative CAGR from 2024 to 2030. The rising rate of generics' availability owing to patent exclusivity losses for major drugs is a significant growth driver. Furthermore, these drugs are relatively economical, making their purchase viable for middle- and low-income consumers in European economies. OTC drugs indicated for ophthalmic uses possess anti-infective, antibiotic, and anti-inflammatory properties. They are available commercially in various dosage forms, including gels, capsules, emulsions, eye drops, and ointments.

Product Insights

The branded ophthalmic drugs segment accounted for a dominant revenue share in 2023. This contribution can be attributed to the market exclusivity & high cost of branded drugs and a strong regional market presence of drug manufacturers. Moreover, the growing approval rate of novel therapies, such as cell & gene therapies, anti-VEGF, and biologics, is poised to improve the market position of these drugs further. Ophthalmic pharmaceutical organizations focus on strategic initiatives, including acquisitions, partnerships, and collaborations, to strengthen their pipeline with advanced clinical-stage candidates, boosting industry growth.

The generic ophthalmic drugs segment is anticipated to register the fastest CAGR over the forecast period. The main factor driving demand for generic variants is their cost-effectiveness compared to branded drugs. Furthermore, branded drugs are at constant risk of patent expiry, which provides opportunities for generic drug manufacturers to populate the market with their products. Generics are similar to their corresponding brand name drugs concerning safety, route of administration, dosage form, strength, performance characteristics, and quality. The increasing introduction of generic drugs and favorable government initiatives, coupled with stringent regulations by the European Medicines Agency (EMA), are expected to drive segment expansion in the coming years in European countries.

Dosage Form Insights

The eye drops segment accounted for the leading revenue share in the regional market in 2023. The increasing prevalence of retinal disorders in European economies, leading to the growing sales of ophthalmic drugs, has been the key factor driving sales of eye drops. These forms of medication are easy to use, economical, and have been indicated for a majority of eye-related disorders. In addition, the continued development of eye drops for treating rare eye disorders that have low prevalence rates but can negatively impact patient lives is expected to drive segment expansion.

The eye solutions & suspensions segment is anticipated to experience a substantial CAGR during the forecast period. The increasing prevalence of conditions such as AMD and dry eye syndrome among European citizens has driven the demand for this form of drug delivery. Common eye solutions, such as Ocuflox, Moxeza, and Neosporin, enable the direct delivery of drugs to the required area, providing a significant clinical advantage. Moreover, the presence of advanced technology for drug delivery that can help improve physicochemical stability & bioavailability is expected to boost market growth in the region.

Country Insights

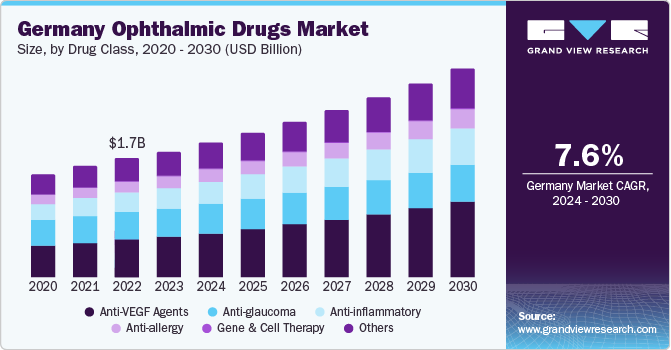

Germany Ophthalmic Drugs Market Trends

The ophthalmic drugs market in Germany accounted for a leading revenue share of 18.2% in 2023. The country has a significant blind population, most of which belong to the elderly demographic. Severe visual impairment due to conditions such as cataracts, glaucoma, and AMD has highlighted the need for effective ophthalmic drugs to be available widely for the German population. Furthermore, increasing demand for personalized medicines, a rise in the number of healthcare establishments catering to the geriatric population, and favorable government initiatives to raise awareness regarding eye-related disorders are anticipated to drive market growth. Growing partnerships between educational institutions and hospitals to gain insights into research & development are expected to propel the demand for ophthalmic drugs in Germany.

UK Ophthalmic Drugs Market Trends

The UK market for ophthalmic drugs is anticipated to witness the fastest growth rate of 8.7% during the forecast period. Changes in lifestyle and a growing aging population in the economy have led to the occurrence of several ophthalmic disorders in the population, which has subsequently increased the demand for pharmaceuticals. The country also has a substantial demographic that uses contact lenses, which is expected to boost sales of solutions and other accessories in the coming years. In addition, the growing demand for accurate, rapid, and sensitive diagnostic services and the prevalence of cataracts are factors anticipated to boost market expansion. According to the Royal National Institute of Blind People, an estimated 330,000 cataract operations are performed annually in England. A rise in the number of awareness programs and initiatives by public & private organizations is further expected to fuel growth.

Key Europe Ophthalmic Drugs Company Insights

Leading companies involved in the development of ophthalmic drugs in Europe include Pfizer, Novartis, Bayer AG, and Bausch Health Companies, among others.

-

Bausch Health manufactures & markets a broad range of branded & generic pharmaceuticals, medical devices, and OTC products. In 2013, Bausch + Lomb was formed as a different business unit for eye care. Its product portfolio is divided into contact lenses, contact lens care, dry eye products, allergy/redness relief, prescription pharmaceuticals, eye vitamins, vision accessories, and surgical products. The company has various manufacturing facilities across Europe (Germany, Poland, Ireland, and Serbia)

-

Bayer AG, headquartered in Germany, develops human and veterinary pharmaceuticals, human healthcare products, biotechnology products, and agricultural chemicals. The company’s consumer care division focuses on non-prescription medicines, dietary supplements, and dermatological products. The company has developed EYLEA, a type of injection that is extensively used for treating diabetic retinopathy, macular edema following RVO, DME, and wet age-related macular degeneration

Key Europe Ophthalmic Drugs Companies:

- AbbVie Inc.

- Alcon

- Bausch Health Companies Inc.

- Bayer AG

- Breye Therapeutics ApS

- Merck & Co., Inc.

- Nicox

- Novartis AG

- Oxurion NV

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

Recent Developments

-

In May 2024, Merck announced the imminent acquisition of the biotech company Eyebiotech Limited (EyeBio), through its subsidiary. EyeBio is involved in the development of a pipeline of preclinical and clinical candidates to prevent and treat vision loss due to retinal vascular leakage, which is a known risk factor for retinal disorders. EyeBio’s lead candidate, Restoret, is an investigational, tetravalent, tri-specific antibody that has been indicated for diabetic macular edema (DME) and neovascular AMD

-

In February 2024, Nicox SA announced an agreement with the Japanese pharmaceutical company, Kowa, for the development and commercialization of the former’s NCX 470 eye drop in Japan. The product has been developed for lowering intraocular pressure (IOP) in patients suffering from glaucoma or ocular hypertension. Through this development, Nicox aims to drive the global sales revenue of its lead product

-

In January 2024, Alcon announced positive top-line results from two pivotal Phase 3 clinical trials, COMET-2 and COMET-3, which evaluated the effectiveness and safety of AR-15512, a candidate treatment for signs and symptoms of dry eye disease (DED)

Europe Ophthalmic Drugs Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 16.41 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Drug class, disease, dosage form, route of administration, type, product, country

Country scope

Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Pfizer Inc.; Alcon; Novartis AG; Bausch Health Companies Inc.; Merck & Co., Inc.; Regeneron Pharmaceuticals Inc.; AbbVie Inc.; Bayer AG; Nicox; Breye Therapeutics ApS; Oxurion NV

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Ophthalmic Drugs Market Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe ophthalmic drugs market report based on drug class, disease, dosage form, route of administration, type, product, and country:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-allergy

-

Anti-inflammatory

-

Non-steroidal Drugs

-

Steroidal Drugs

-

- Anti-VEGF Agents

-

Anti-glaucoma

-

Gene & Cell Therapy

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry Eye

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Allergies

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Glaucoma

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Eye Infection

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Retinal Disorders

-

Retinal Disorder Treatment Market, By Type

-

Macular Degeneration

-

Diabetic Retinopathy

-

Others

-

-

Retinal Disorder Treatment Market, By Dosage Type

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

-

Uveitis

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Local Ocular

-

Subconjunctival

-

Intravitreal

-

Retrobulbar

-

Intracameral

-

-

Systemic

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription Drugs

-

OTC

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded Drugs

-

Generic Drugs

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."