- Home

- »

- Clothing, Footwear & Accessories

- »

-

Europe Motorbike Riding Gear Market, Industry Report, 2030GVR Report cover

![Europe Motorbike Riding Gear Market Size, Share & Trends Report]()

Europe Motorbike Riding Gear Market Size, Share & Trends Analysis Report By Product (Helmets, Gloves), By Category (Mass, Premium), By Distribution Channel (Online, Offline), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-450-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Europe Motorbike Riding Gear Market Trends

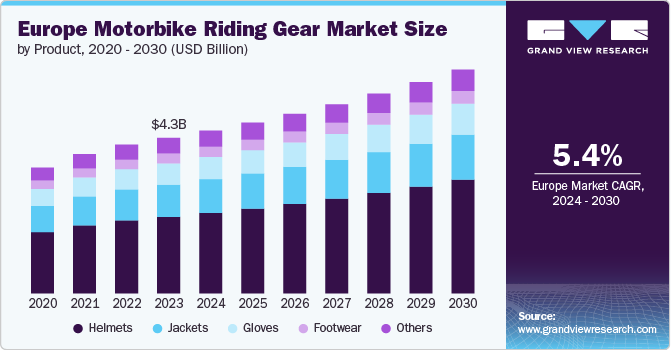

The Europe motorbike riding gear market size was estimated at USD 4.21 billion in 2023 and is expected to grow at a CAGR of 5.4% from 2024 to 2030. The European market is primarily driven by increasing safety awareness among motorcyclists. With the rise in motorcycle accidents, there is a growing emphasis on wearing protective gear, such as helmets, jackets, gloves, and boots, to reduce the risk of serious injuries. Moreover, governments across Europe have also implemented stringent regulations mandating the use of safety gear, further fueling the demand. The European Commission, for example, has introduced various directives aimed at improving road safety, which has had a direct impact on the adoption of riding gear.

Another significant factor driving the market is the increasing popularity of motorcycling as a leisure activity and a lifestyle choice. As more people take up motorcycling for recreation, there is a corresponding rise in demand for high-quality, stylish riding gear that not only provides protection but also enhances the rider's overall experience. The advent of advanced materials and technologies has also played a crucial role in the market's growth, with manufacturers developing gear that is more comfortable, durable, and effective in all weather conditions.

In addition, the rise of e-commerce and online retail platforms has made it easier for consumers to access a wide range of motorbike riding gear, often at competitive prices. This has opened up new avenues for market growth, as consumers can now compare products and prices from different brands and make informed purchasing decisions. Moreover, the increasing influence of social media and online communities has also contributed to market expansion, as motorcyclists share their experiences and preferences, encouraging others to invest in quality riding gear.

Furthermore, the region boasts advanced manufacturing facilities, particularly in countries like Germany, France, Italy, and the UK, which enhances the production and availability of high-quality motorbike riding gears. In Addition, in 2022, new motorcycle registrations in the five largest European markets such as France, Germany, Italy, Spain, and the UK reached 950,400 units, reflecting a slight increase of approximately 0.1% compared to 2021, which saw 949,480 units. Notably, Spain experienced a significant rise with 176,960 units, marking a 6.3% year-on-year increase, while the UK saw an increase of 1.9% with 109,300 units.

Product Insights

The helmet segment accounted for a revenue share of 49.26% in 2023. The market for helmets in Europe is driven primarily by stringent safety regulations, increasing awareness of rider safety, and a growing number of motorbike enthusiasts. European governments have implemented and enforced strict helmet laws, which compel riders to invest in high-quality, certified helmets. In addition, the rising popularity of motorcycling as a leisure activity, coupled with advancements in helmet technology such as improved materials, enhanced comfort, and integrated communication systems is encouraging riders to purchase premium helmets. The trend towards customization and stylish designs also plays a role in boosting helmet sales.

The gloves segment is expected to grow at a CAGR of 5.6% from 2024 to 2030. Consumer preferences for comfort and style are encouraging manufacturers to innovate with advanced materials and ergonomic designs, further fueling market growth. The rising trend of motorcycling as a lifestyle choice among younger demographics also plays a significant role in expanding the market. Moreover, manufacturers are increasingly incorporating high-performance materials such as Gore-Tex, Kevlar, and other breathable, waterproof fabrics to enhance comfort and protection. The use of smart textiles, including those that can monitor temperature and humidity, is also gaining traction, providing riders with tailored experiences during their travel.

Category Insights

Mass category accounted for a revenue share of 64.87% in 2023. European countries have stringent safety requirements that drive innovation in protective gear, leading to superior products. In addition, Europe's established motorcycle culture and frequent riding conditions, coupled with a well-developed market for high-performance gear, further contribute to the segment’s growth.

The premium segment is expected to grow with a CAGR of 6.5% from 2024 to 2030. Riders are willing to invest more in high-quality gear that offers advanced protection, superior materials, and innovative features, reflecting a shift towards prioritizing personal safety and long-term value. This segment also benefits from rising disposable incomes and a growing emphasis on the overall riding experience, leading consumers to choose high-end products that provide greater durability and advanced technology. This trend is further fueled by endorsements from professional riders and an expanding market for premium lifestyle products.

Distribution Channel Insights

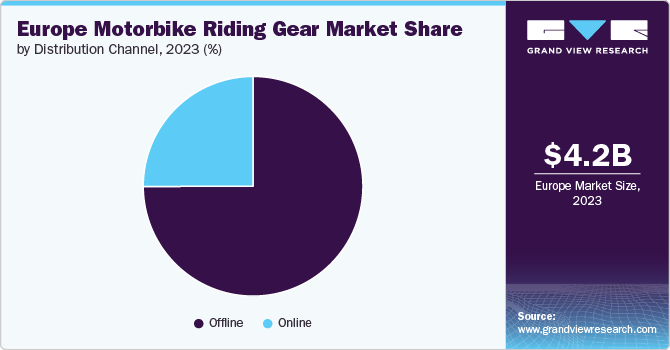

The sales through offline channels accounted for a revenue share of 75.03% in 2023. Offline channels offer customers the opportunity to physically examine and try on gear, which is crucial for items like helmets, jackets, and gloves where fit and comfort are paramount. Moreover, in-person shopping provides instant gratification and personalized service, enhancing the overall customer experience. Physical stores also often benefit from established customer trust and brand loyalty, further driving their dominance in sales. These factors collectively contribute to the substantial revenue share of offline sales in the motorbike riding gear market.

The sales through online channels are expected to grow with a CAGR of 7.3% from 2024 to 2030. Shoppers can easily browse a wide variety of products, compare prices, and access reviews from the comfort of their homes. The growth is also driven by advancements in e-commerce technology, including user-friendly interfaces and efficient delivery services. In addition, online platforms often offer competitive pricing, promotions, and a broader selection, which attracts a growing number of consumers who prefer the ease and efficiency of online shopping over traditional in-store experiences.

Country Insights

Germany Motorbike Riding Gear Market Trends

Germany motorbike riding gear market accounted for a revenue share of over 17.22% in 2023, driven by a strong motorcycle culture that emphasizes safety and high-quality gear due to stringent regulations. The country is home to innovative manufacturers producing advanced riding gear with cutting-edge features, further boosting demand. In addition, a robust retail infrastructure and e-commerce presence make gear easily accessible, while rising disposable incomes among younger demographics enhance spending on leisure activities like motorcycling.

UK Motorbike Riding Gear Market Trends

The motorbike riding gear market in the UK is expected to grow with a CAGR of 4.2% from 2024 to 2030. There is a unique trend in the resurgence of retro riding gear in the UK market. This is deeply rooted in the country's rich motorcycling heritage, with iconic brands like Triumph and Norton synonymous with classic design. Modern manufacturers are blending classic aesthetics with contemporary safety features, catering to both seasoned riders seeking to relive their motorcycling youth and younger enthusiasts drawn to the timeless elegance of vintage styles.

Key Europe Motorbike Riding Gear Company Insights

The market is characterized by the presence of numerous well-established players such as Alpinestars S.p.A, Dainese S.p.A, and Schuberth GmbH, KTM AG among others. The market players face intense competition from each other as some of them are among the top Europe motorbike riding gear manufacturers with diverse product portfolios for motorbike riding gears. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both regional and international consumers.

Key Europe Motorbike Riding Gear Companies:

- Alpinestars S.p.A

- Dainese S.p.A

- Schuberth GmbH

- KTM AG

- Bell Racing Europe SA

- REV’IT! Sport International B.V.

- Scorpion Sports Europe

- Fox Racing Inc.

- UFO PLAST S.r.l.

- Spidi Sport S.r.l.

Recent Developments

-

In February 2024, Husqvarna Motorcycles launched a new premium apparel collection for 2024, designed to enhance the riding experience with a blend of functionality and style. The collection features high-quality materials and innovative designs, catering to both on-road and off-road enthusiasts. This launch aligns with the growing trend in the motorbike riding gear market for premium, stylish, and functional apparel that meets the needs of modern riders.

-

In December 2023, BMW Motorrad unveiled its 2024 clothing collection, featuring 28 new products designed for safety, comfort, and style across various riding scenarios. The collection includes innovative designs such as the Sao Paulo helmet, London trousers, and Seoul GORE-TEX sneakers, all emphasizing practicality for everyday use and motorcycling.

Europe Motorbike Riding Gear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.40 billion

Revenue forecast in 2030

USD 6.05 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/ billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, category, distribution channel, country

Regional scope

Europe

Country scope

Germany; UK; France; Italy; Spain;

Key companies profiled

Alpinestars S.p.A; Dainese S.p.A; Schuberth GmbH; KTM AG; Bell Racing Europe SA; REV’IT! Sport International B.V.; Scorpion Sports Europe; Fox Racing Inc.; UFO PLAST S.r.l.; Spidi Sport S.r.l.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Motorbike Riding Gear Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe motorbike riding gear market report based on the product, category, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Jackets

-

Helmets

-

Gloves

-

Footwear

-

Others

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe motorbike riding gear market size was estimated at USD 4.21 billion in 2023 and is expected to reach USD 4.40 billion in 2024.

b. The European motorbike riding gear market is expected to grow at a compounded growth rate of 5.4% from 2024 to 2030, reaching USD 6.05 billion by 2030.

b. Helmets in motorbike riding gears held the largest share in the Europe motorbike riding gear market in 2023. There is a growing recognition of the importance of helmets in preventing head injuries and fatalities in motorbike accidents. Safety campaigns and education initiatives have raised awareness among riders about the crucial role helmets play in protecting their lives, leading to increased helmet usage.

b. Some key players operating in Europe motorbike riding gear market include Alpinestars S.p.A, Dainese S.p.A, Schuberth GmbH, KTM AG, Bell Racing Europe SA, REV’IT! Sport International B.V., Scorpion Sports Europe, Fox Racing Inc., UFO PLAST S.r.l., and Spidi Sport S.r.l.

b. The European motorbike riding gear market is primarily driven by increasing safety awareness among motorcyclists. With the rise in motorcycle accidents, there is a growing emphasis on wearing protective gear, such as helmets, jackets, gloves, and boots, to reduce the risk of serious injuries. Governments across Europe have also implemented stringent regulations mandating the use of safety gear, further fueling the demand. The European Commission, for example, has introduced various directives aimed at improving road safety, which has had a direct impact on the adoption of riding gear.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."