Europe, Middle East & India OTC Multivitamins And Minerals Supplements Market Size, Share & Trends Analysis Report By Ingredient, By Form, By Functionality, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-232-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

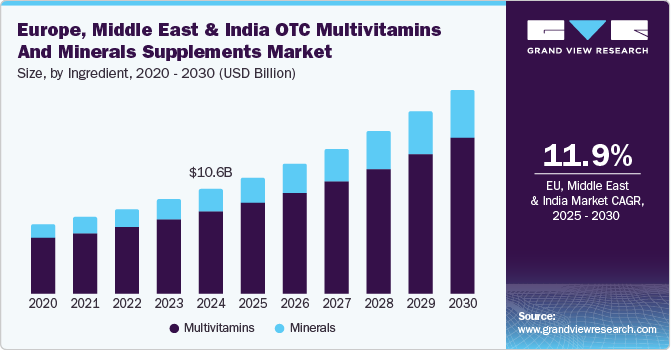

Europe, Middle East & India OTC multivitamins and minerals supplements market size was valued at USD 10.60 billion in 2024 and is projected to grow at a CAGR of 11.9% from 2025 to 2030. The large presence of an aging population in Europe, increasing focus on extended longevity, demand for products and supplements that enable individual functional abilities, growing prevalence of chronic diseases, rising need for palliative care in multiple countries, and changing lifestyles leading to enhanced requirements of multivitamins & minerals supplements are fueling the growth of this market.

According to Eurostat, in January 2023, the population of the EU was nearly 448.8 million, and individuals aged 65 years and more accounted for 21.3 % of the total population. This has stimulated the demand for dietary supplements and nutritional health products. Availability of multiple products, especially formulated and developed for a specific group of people, such as multivitamins for women over the age of 50, multivitamins for young adults, multivitamins for kids, and others, develops a significant influence on the growth of this market.

Demand for over-the-counter multivitamins and mineral supplements is also fueled by factors such as the large number of individuals participating in the workforce, changed lifestyles, increasing urbanization and the growing prevalence of stress and anxiety, the rise in cases of vitamin deficiencies in numerous countries, and growing awareness regarding the role of vitamins and minerals in overall human well-being.

Increasing inclination towards self-medication in case of primary-level health problems, strong regulations regarding formulation, labeling, marketing, and delivery of OTC supplements, and growing focus among individuals and families on enhancing functional abilities such as stamina, visual acuity, creative thinking, communication, motor and sensor capabilities, and others are also contributing to the increasing demand for the OTC multivitamins and minerals supplements in Europe, Middle East, and India.

According to the World Health Organization (WHO), deficiencies such as iron, iodine, and vitamins are most common worldwide. In addition, the prevalence of chronic diseases such as diabetes, hypertension, Gastrointestinal (GI) cancers, and others are stimulating the demand as individuals become increasingly aware of the significant benefits associated with consuming multivitamins and mineral supplements.

Ingredient Insights

Based on ingredients, multivitamins dominated the market with a revenue share of 78.5% in 2024. This is attributed to the growing cases of vitamin deficiencies in numerous regions, rapid lifestyle changes, and increasing urbanization, which have significantly influenced dietary habits, exposure to potential risks of adopting infections and dietary ailments, and more. The rising occurrence of inflammatory diseases such as obesity, fatigue, Myalgia, Rheumatoid arthritis, and others, the large presence of the aging population, increasing health consciousness among consumers, positive regulatory scenarios, and innovation in the industry are also adding growth opportunities for this market.

The minerals segment is projected to grow at the highest CAGR from 2025 to 2030. The growth of this segment is primarily influenced by factors such as enhanced availability and accessibility facilitated by effective distribution, growing awareness regarding the significance of minerals in human health, increasing focus of individuals and families on preventive healthcare, presence of organic and natural products, and availability of customized and personalized nutrition products in the market. The commonly consumed supplements are associated with minerals such as iodine, calcium, magnesium, iron, and others.

Form Insights

OTC multivitamins and mineral supplements tablets held the largest revenue share of the Europe, Middle East & India OTC multivitamins & minerals supplements industry in 2024. This is attributed to factors such as ease of use, convenience, enhanced accessibility and availability through pharmacies and other points of sale, increasing innovation in the industry, and the rising focus of key market participants on enhanced customer engagements through offering a wide variety and diverse product portfolios while focusing on customer requirements and preferences. In addition, the use of excipients that facilitate tablet absorption and disintegration, longer shelf life, and increased availability are adding to the growth opportunities for this segment.

Liquid multivitamins and mineral supplements are projected to experience the fastest growth during the forecast period. Ease of consumption, increasing response from young adults and Gen Z consumers, enhanced absorption enabled by the liquid state of the product, variety of flavors available in the market, and innovation by multiple market participants are some of the key growth drivers for this market.

Functionality Insights

The bone & joint health segment dominated the market with the largest revenue share in 2024. The growth of this market is mainly influenced by factors such as significant growth in the aging population, growing focus of individuals on preventive healthcare, a large number of individuals participating in workforce activities, mostly desk jobs, availability of personalized nutrition solutions, innovation in delivery formulations, and enhanced accessibility through online platforms.

OTC multivitamins and minerals supplements for diabetes are anticipated to experience the highest CAGR from 2025 to 2030. Growing cases of diabetes, a large number of people who are diagnosed with pre-diabetic conditions, increasing availability, and recommendations from health professionals are mainly influencing the growth of this segment. According to the European Commission, nearly 33 million individuals are suffering from diabetes in the EU, and the count is projected to reach 38 million by 2030.

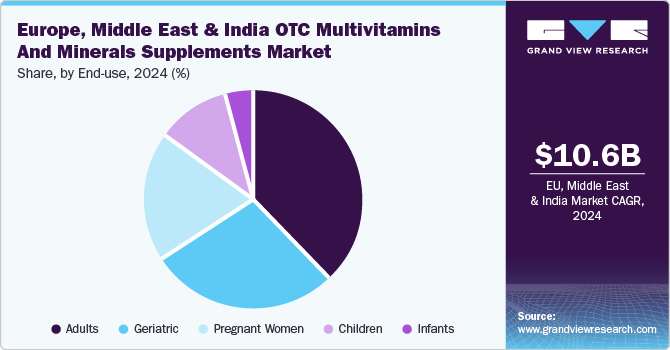

End Use Insights

The adults segment held the largest revenue share of the Europe, Middle East & India OTC multivitamins and minerals supplements market in 2024. Many young adults have been focusing on enhancing their functional abilities through consuming supplements. Increasing demands of changed lifestyles, growing stress and anxiety driven by the changing work cultures and rising competition among talent, effects of urbanized environment and associated dietary habits, availability of dedicated product portfolios, and enhanced accessibility through online portals are contributing to the growing demand. In addition, improved availability and accessibility of information add to the growth opportunities for this market.

The geriatric segment is projected to experience the fastest CAGR during the forecast period. The large share in the overall population of the Europe region, increasing demand for supplements that enhance functional abilities, the growing availability of dedicated portfolios, and rising prevalence of chronic diseases such as diabetes, hypertension, and others are primary factors influencing the demand for OTC multivitamins and minerals supplements for the geriatric population.

Regional Insights

Europe OTC Multivitamins And Minerals Supplements Market Trends

Europe dominated the market with a share of 62.6% in revenue of Europe, Middle East & India OTC multivitamins and minerals supplements industry. This market is primarily influenced by factors such as a large share of aging people in the overall population, enhanced availability of branded product portfolios through pharmacies and online portals, increasing consumption by young adults, and growing awareness regarding health & well-being and the role of multivitamins and mineral supplements in it.

Germany dominated the regional market in 2024 owing to the aging population contributing to increased demand for dietary supplements to address chronic health issues and nutrient deficiencies. Also, there is a rising preference for natural and organic products, with consumers becoming more selective about the ingredients in their supplements. This trend has led to increased demand for products free from artificial additives and tailored to specific dietary requirements, such as gluten-free or vegan options.

Middle East OTC Multivitamins And Minerals Supplements Market Trends

Middle East is anticipated to experience significant CAGR during the forecast period. This market is primarily influenced by factors such as increasing demand for applications in sports and fitness and weight management, growing availability of product portfolios offered by key global market participants, increasing awareness regarding the benefits provided by the products, and multiple families' focus on preventive healthcare measures.

Key Europe, Middle East & India OTC Multivitamins And Minerals Supplements Market Company Insights

Some of the key companies in the Europe, Middle East & India OTC multivitamins & minerals supplements market are Amway Corp., Abbott, GSK plc., Bionova, Herbalife International of America, Inc. and others. To address growing competition and increasing demand for the products, major market participants have adopted strategies such as innovation, diversification of product offerings, collaboration with other organizations, increasing digital footprint and more.

-

Amway Corp. offers a wide variety of products associated with multiple sectors, including nutrition, beauty, home, energy, and sports. Its nutrition portfolio includes protein, vitamins and minerals, Omega 3 and calcium, health supplements, energy drinks, traditional herbs, and more. Nutrilite is one of the significant brands offered by the company.

-

Abbott offers a diverse portfolio of diagnostics, nutritional products, medical devices, and branded generic medicine products. Its nutrition business portfolio includes both adult and pediatric nutrition. Its adult nutrition product portfolio features Ensure COMPLETE, Ensure Enlive Advanced Therapeutic Nutrition Shake, Ensure High Protein Therapeutic Nutrition Shake, Ensure Original Powder, Ensure Plus High Protein Therapeutic Nutrition, and others.

Key Europe, Middle East & India OTC Multivitamins And Minerals Supplements Companies:

- Amway Corp.

- Abbott

- Bayer AG

- Glanbia PLC

- GSK plc.

- Herbalife International of America, Inc.

- NU SKIN

- NOW Foods

- Bionova

- Bright Lifecare Private Limited

- Sun Pharmaceutical Industries Ltd.

- Nature's Sunshine Products, Inc.

- Nutra Essential OTC (Farmalider)

- Nature's Bounty

- Arkopharma

Recent Developments

-

In February 2024, Herbalife, a company specializing in nutrition products, launched GLP-1 Nutrition Companion, a newly developed food & supplement offering to assist users with GLP-1 and other weight management medication. The newly launched Vegan and Classic versions are available in the U.S. and Puerto Rico.

-

In June 2024, Sun Pharmaceutical Industries Limited successfully completed its merger with Taro Pharmaceutical Industries Ltd. This merger is anticipated to strengthen the company's capabilities and enhance its presence in various markets.

Europe, Middle East & India OTC Multivitamins And Minerals Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 11.78 billion |

|

Revenue forecast in 2030 |

USD 20.64 billion |

|

Growth rate |

CAGR of 11.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Ingredient, form, functionality, end use, region |

|

Regional scope |

Europe, Middle East |

|

Country scope |

Germany, U.K., France, Italy, Spain, Netherland, Switzerland, Austria, Saudi Arabia, Turkey, Egypt, UAE, Bahrain, Oman, Kuwait, India |

|

Key companies profiled |

Amway Corp.; Abbott; Bayer AG; Glanbia PLC; GSK plc.; Herbalife International of America, Inc.; NU SKIN; NOW Foods; Bionova; Bright Lifecare Private Limited; Sun Pharmaceutical Industries Ltd.; Nature's Sunshine Products, Inc.; Nutra Essential OTC (Farmalider); Nature's Bounty; ArkopharmaW |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe, Middle East & India OTC Multivitamins And Minerals Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe, Middle East & India OTC multivitamins and minerals supplements market report based on ingredient, form, functionality, end use and region:

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Multivitamins

-

Vitamin A

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

Vitamin K

-

Vitamin B

-

Thiamine

-

Riboflavin

-

Niacin

-

Pantothenic Acid

-

Biotin

-

B6

-

B12

-

Folate

-

-

-

Minerals

-

Iodine

-

Calcium

-

Magnesium

-

Potassium

-

Selenium

-

Manganese

-

Molybdenum

-

Phosphorus

-

Sodium

-

Chloride

-

Zinc

-

Iron

-

Copper

-

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Tablets

-

Capsules

-

Softgels

-

Gummies

-

Liquid

-

Others

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-Cancer

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Regional Outlook (Revenue, USD Million, 2018 – 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

-

Middle East

-

Saudi Arabia

-

Turkey

-

Egypt

-

UAE

-

Bahrain

-

Oman

-

Kuwait

-

-

India

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."