- Home

- »

- Advanced Interior Materials

- »

-

Europe & Middle East Composites Market Size Report, 2030GVR Report cover

![Europe & Middle East Composites Market Size, Share & Trends Report]()

Europe & Middle East Composites Market Size, Share & Trends Analysis Report By Fibers (Glass Fibers, Carbon Fibers), By Resins, By End Use (Automotive & Transportation, Electrical & Electronics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-442-6

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

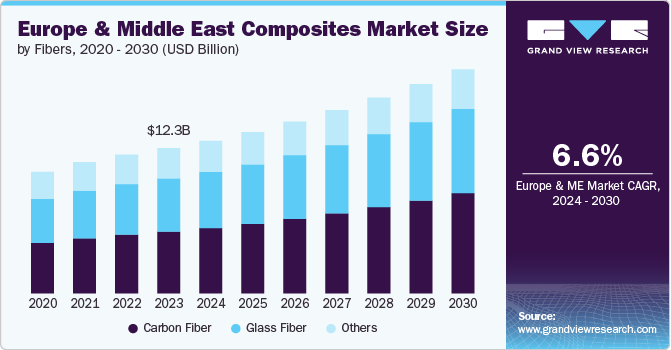

The Europe & Middle East composites market size was estimated at USD 12.31 billion in 2023 and is projected to grow at a CAGR of 6.6% from 2024 to 2030. Increasing demand for composites in the automotive industry is anticipated to boost the market growth over the forecast period. The rising fuel prices have triggered the need for fuel-efficient vehicles. Composites are most widely utilized as the replacement for aluminum, wood, and steel on account of their higher strength-to-weight ratio. The growing environmental concerns and stringent regulations regarding pollution control have forced automotive manufacturers to enhance their technologies and develop vehicles having low pollution. One of the most important factors affecting fuel efficiency and vehicular pollution is the overall weight of the vehicle.

The presence of stringent environmental regulations in Europe has forced automotive manufacturers to include composites in automotive production. Globally, especially in Europe, regulations are forcing OEMs to significantly reduce the CO2 emissions caused by vehicles. For instance, in Europe, regulations to reduce the annual average emission from vehicles by about 140 g of CO2 per km to 95 g CO2 per km are expected to benefit the adoption of composites. The high cost of composites has limited their application scope to premium segment cars. However, key players are conducting extensive R&D activities to develop low-cost composite grades with similar mechanical properties as that of the high-cost variants. This is expected to spur the demand for composites in the automotive industry over the forecast period.

Composites are produced using a combination of fibers and matrices. Matrices are generally made of resins including thermoplastics, epoxy, or polyester. One of the major advantages of high-performance composites is their lower mass content as compared to steel and iron. Due to this, a fewer number of materials such as fasteners and joints are required to hold the product together. This not only decreases the overall weight of the product but also increases its stiffness, making it stronger.

High-performance composites are characterized by a low CTE (coefficient of thermal expansion), which means their performances are not impacted by extreme temperatures and pressures. This property is of particular importance in industrial applications where machines are subjected to extremely high temperatures.

High-performance composites find increased applications in renewable energy generation sources such as windmills and solar cells on account of their high strength and low weight. These materials are resistant to frequent wear and tear, resulting in lowering the lifecycle costs of energy plants.

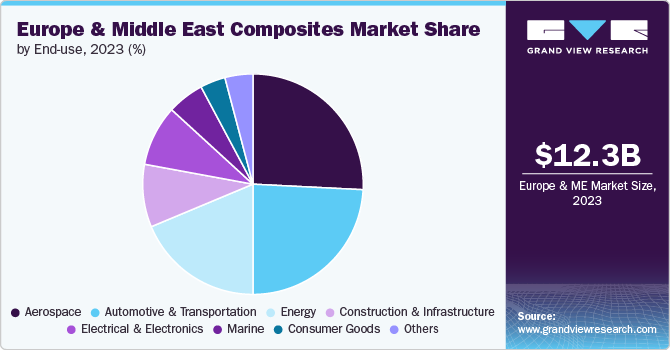

Aerospace is one of the fastest-growing sectors in the global composites market. High-performance materials are required to be used in aircraft, rockets, satellites, and missiles in the aerospace industry. The consumption of composites in the aerospace industry is increasing owing to their lightweight and high rigidity. The U.S. and Europe are the key markets in the aerospace & defense sector with the demand being driven by aircraft manufacturers such as Boeing and Airbus.

The commercial aviation industry has increased the utilization of composites to around 50% of the total aircraft weight. Airbus A350 is built utilizing 52% CFRP, while Boeing 787 Dreamliner is built using 50% CFRP by weight. The surge in demand for commercial aviation is expected to drive the Europe and Middle East composites market over the forecast period.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the industry is accelerating. The market is characterized by intensive competition, with the major players in the market dominating the market trends. Prominent players have patented technologies used for composites manufacturing. Various initiatives such as technology innovations, research & development, partnerships, and merger & acquisitions to manufacturing cost-effective and lightweight composite products have been undertaken by the key market players.

Leading players in the market are integrating across the value chain to reduce overall operational costs for composite products. For instance, prominent vendors, including Toray Industries, Teijin Limited, and Owens Corning, are integrated at various stages of the value chain, including raw material procurement, manufacturing, and distribution. Owens Corning, Toray Industries, Hexcel Corporation, Cytec Industries (Solvay S.A.), and Teijin Ltd. are among the major manufacturers and suppliers of composites in the global market for various end-use sectors.

Composite products play an essential role in the manufacturing of automotive and aircraft parts. Growing concerns regarding fuel consumption and CO2 emission levels have prompted manufacturers to use carbon fiber composite materials as substitutes for metal components. Technological innovations to minimize the manufacturing cycle time are expected to propel the usage of composites in the automotive sector.

Fiber Type Insights

Based on fibers, the glass fiber segment dominated the market in terms of volume in 2023. This segment was valued at USD 4.49 billion in 2023 and is expected to reach USD 7.14 billion by 2030, growing at a CAGR of 7.0% from 2024 to 2030. This segment is driven by superior product properties such as low thermal expansion, high stiffness, high-temperature tolerance, high chemical resistance, and low weight compared to metals, making it popular for industrial and manufacturing applications.

Carbon fibers are characterized by a high strength-to-weight ratio, high temperature tolerance, high stiffness, low thermal expansion, and high chemical resistance. Owing to these properties, carbon fiber has applications in construction and building, sporting equipment, and military & defense. Carbon fiber consists of carbon atoms that are bonded together in crystals aligned parallel to the fiber, and these fibers are combined with other materials to form a composite. Carbon fiber reinforced polymer is formed when carbon fiber is molded with plastic resin. In both interior and exterior applications, sandwich structures made of carbon fiber-reinforced polymer composite materials are widely used in the aircraft sector. The CFRP composites are lightweight and have a high tensile strength. They are more fuel-efficient, require less upkeep, and help OEMs adhere to the strict environmental laws in Europe and North America.

Resin Insights

Based on resins, the thermoset segment dominated the market with a revenue share of 53.9% in 2023. This segment is driven by its superior characteristics such as exceptional mechanical properties and durability. Thermoset resins provide high strength-to-weight ratios and rigidity, making them ideal for applications requiring structural integrity and dimensional stability across varying environmental conditions.

The demand for thermoset resins is influenced by several significant factors that cater to diverse industrial needs. Thermoset resins, such as polyester, vinyl ester, epoxy, and others, are highly sought-after for their exceptional mechanical properties and durability. These resins offer high strength-to-weight ratios and rigidity, making them ideal for applications requiring structural integrity and dimensional stability across varying environmental conditions.

Thermoplastics or thermoplastic resins are a type of polymer that can be melted and reshaped multiple times without undergoing permanent chemical changes. This makes them ideal for applications requiring molding or shaping. Unlike thermosetting polymers, thermoplastics can be recycled and are considered more eco-friendly. Thermoplastics are widely used for their ability to provide lightweight solutions, crucial in the automotive, aerospace, and transportation industries. Their weight reduction capabilities contribute to improved fuel efficiency and overall performance, aligning with stringent environmental regulations.

End Use Insights

Based on end use, automotive & transportation was the largest segment for the consumption of composites in terms of volume in 2023 and is likely to continue its dominance over the forecast period. Composites offer advantages such as fuel saving to the transportation sector as they are significantly lightweight, which helps improve overall fuel efficiency.

Composites have diverse applications across the automotive industry, including trailers, trucking, trains, buses, motorcycles, and subways. These applications use composites to create robust and lightweight components, effectively replacing traditional metal usage. While possessing comparable stiffness and strength to metals, composites offer the added advantage of being significantly lighter, facilitating the production of lightweight parts.

The electrical & electronic end-use segment is expected to grow at a rapid rate due to the capability of composites to provide lightweight and cost-effective solutions for the industry. The heat resistant quality of the material has encouraged its adoption in electronic goods as they are subjected to overheating. Furthermore, the material is used to manufacture meter boxes, electrical housing, switch panels, handheld devices, and laptops.

Regional Insights

The well-established automotive, aerospace & defense, construction, and electronics industries are expected to boost the demand for composites over the forecast period. The increasing demand for cost-effective and high-performance composites in renewable energy production is expected to boost the composites market in Europe. This demand for composites is largely dominated by Western European countries, owing to the presence of large-scale manufacturing industries. The well-established automotive, aerospace & defense, construction, and electrical & electronics industries are expected to drive industry growth in the European market.

The composites market in Germany has witnessed remarkable growth in recent years. A strong emphasis on lightweight materials in automotive manufacturing to enhance fuel efficiency and reduce emissions is fostering a conducive environment for the growth of the composites market in the country. Composites, known for their high strength-to-weight ratio and design flexibility, play a crucial role in achieving these goals, particularly in components such as car bodies, interiors, and structural parts.

France composites market is supported by the presence of well-established industries, including automotive, building & construction, and aerospace. The presence of large players in the automotive and aerospace industries in the country such as Airbus SE, Babolat, and Bugatti Automobiles S.A.S., coupled with favorable government regulations, is anticipated to propel the market growth over the forecast period.

Middle East Composites Market Trends

The composites market in the Middle East held a significant revenue share in 2023. The growing construction & infrastructure industry in the Middle East is projected to boost the demand for composites over the forecast period. In addition, increasing public & private investment in infrastructure development is expected to boost the demand for composites in the coming years. The growing demand for composites from the automotive sector, rising defense budgets of various countries, and increasing demand from the electronics industry are the major factors influencing the composites market positively in the Middle East & Africa.

Saudi Arabia composites market is growing due to its construction industry, which was leading in the Middle East, valued at USD 70.3 billion, and it is expected to grow to USD 91.3 billion by 2029. This expansion is driven by Saudi Arabia’s Vision 2030 National Development Plan, which highlights significant government investments in infrastructure. The opportunities in the construction sector include master and urban planning, design for municipal projects, both interior and exterior, project management, and construction in various fields such as airports, ports, mixed-use and recreational complexes, tourism, healthcare, and educational facilities. As the market grows, there is an increasing demand for advanced building materials, particularly composites.

Key Europe & Middle East Composites Company Insights

Some of the key players operating in the market include Teijin Limited and Toray Industries, Inc.

-

Teijin Limited., founded in 1918 and headquartered in Tokyo, Japan, was previously known as Teikoku Jinzo-Kenshi Kaisha, Ltd. As the parent company of the Teijin Group, it oversees 167 subsidiaries and affiliates globally. Teijin Limited offers a broad range of products and services in sectors such as information and electronics, safety and protection, environment and energy, and healthcare.

-

Toray Industries, Inc., founded in 1926 and headquartered in Tokyo, Japan, operates through several business segments: Carbon Fiber Composite Materials, which focuses on carbon fibers and advanced composites; Fibers and Textiles, which produces nylon, acrylic fiber, polyester, textile products, and synthetic suede; Functional Chemicals, which produces nylon and ABS resins, polypropylene films, raw materials for synthetic fibers, and fine chemicals; Environment & Engineering, which provides construction & plant engineering services and manufactures industrial and environmental equipment; Life Science, which deals with pharmaceutical and medical products; and Others, offering analysis, survey, research, and information processing services.

Veplas Group and China Jushi Co., Ltd., Inc. are some of the emerging market participants.

-

Veplas Group was established in 1978 and is headquartered in Velenje, Slovenia. The group operates primarily in the eastern part of Central Europe through its units: Veplas Lak d.o.o., Veplas Media d.o.o., Veplas Hrvatska d.o.o., and Veplas Trženje d.o.o. It manufactures assembled composite instrument panels for helicopters, interior parts for aircraft, automotive glass and carbon fiber parts for sports cars and motorcycles, glass fiber (GRP) and carbon fiber (CRP) parts for motorhomes, polyester interior parts for trains and rail infrastructures, parts for buses, luxury motor yachts, and sailing boats.

-

China Jushi Co., Ltd. manages four production facilities dedicated to fiberglass manufacturing. Three of these facilities are strategically situated in China: Sichuan, Jiangxi, and Zhejiang, while the fourth is located in Egypt. The company's product lineup includes C-glass and E-glass fiber items, catering to a variety of applications such as pipes, vessels, FRP profiles, wind energy components, automotive parts, and sports gear. Its composites, primarily centered on fiberglass, are created using the assembled roving technique.

Key Europe & Middle East Composites Companies:

- Teijin Limited.

- Toray Industries, Inc.,

- Owens Corning

- Veplas Group

- Huntsman Corporation LLC

- SGL Carbon

- Hexcel Corporation

- DuPont

- Saint-Gobain

- Solvay

- SABIC

- China Jushi Co., Ltd

- Kineco Limited

- 3B - the fibreglass company

- GULF GRC TRADING

- Nova Composites Manufacturing L.L.C

- IDI Composites International

Recent Developments

-

In 2022, SABIC launched a novel series of STAMAX long glass fiber polypropylene (PP) composites, incorporating recycled materials as part of its TRUCIRCLE portfolio. These pioneering composites, featuring mechanically recycled resins by SABIC, are engineered for deployment across a wide range of automotive applications. This included parts found within the vehicle’s interior and exterior, as well as its structural anatomy, marking a significant stride toward sustainable automotive manufacturing.

-

In November 2023, Solvay unveiled SolvaLite 716 FR, an advanced epoxy prepreg designed exceptionally for high-end Battery Electric Vehicles (BEVs). This innovative composite offers flame resistance, electromagnetic interference shielding, and a notable reduction in weight when compared to conventional composites and metals. Featuring a glass transition temperature of 145°C and a rapid cure time of just eight minutes, SolvaLite 716 FR enhances both fire safety and production efficiency.

Europe & Middle East Composites Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.94 billion

Revenue forecast in 2030

USD 18.99 billion

Growth Rate

CAGR of 6.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fibers, resins, end use, region

Regional scope

Europe; Middle East

Country scope

Germany, France, Poland, Slovakia, Czech Republic, Hungary, Lithuania, Saudi Arabia, UAE, Qatar, Israel, Egypt, Turkey

Key companies profiled

Teijin Limited., Toray Industries, Inc., Owens Corning, Veplas Group , Huntsman Corporation LLC , SGL Carbon, Hexcel Corporation, DuPont, Saint-Gobain, Solvay, SABIC, China Jushi Co., Ltd, Kineco Limited, 3B - the fibreglass company, GULF GRC TRADING, Nova Composites Manufacturing L.L.C, IDI Composites International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe & Middle East Composites Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe & Middle East composites market report based on fibers, resins, end-use, and region:

-

Resins Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Thermoset

-

Thermoplastic

-

-

Fibers Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Carbon Fiber

-

Glass Fiber

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Energy

-

Construction & Infrastructure

-

Aerospace

-

Marine

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Europe

-

Germany

-

France

-

Poland

-

Slovakia

-

Czech Republic

-

Hungary

-

Lithuania

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

Israel

-

Egypt

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The Europe & Middle East composite market size was estimated at USD 12.31 billion in 2023 and is expected to reach USD 12.94 billion in 2024.

b. The Europe & Middle East composite market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 18.99 billion by 2030.

b. The thermoset composites segment dominated the market with revenue of USD 6.63 billion in 2023 owing to its rising automotive production In Europe

b. Some of the key players operating in the Europe & Middle East composite market include Teijin Limited., Toray Industries, Inc., Owens Corning, Veplas Group , Huntsman Corporation LLC , SGL Carbon, Hexcel Corporation, DuPont, Saint-Gobain, Solvay, SABIC, China Jushi Co., Ltd, Kineco Limited, 3B - the fibreglass company, GULF GRC TRADING, Nova Composites Manufacturing L.L.C, IDI Composites International

b. The key factors that are driving the Europe & Middle East composite market include growing construction activities and automotive production around the world

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."