- Home

- »

- Sensors & Controls

- »

-

Europe Micro LED Market Size, Share, Industry Report 2030GVR Report cover

![Europe Micro LED Market Size, Share & Trends Report]()

Europe Micro LED Market Size, Share & Trends Analysis Report By Application (Display, Lighting), By End-use (Automotive, BFSI), By Display Pixel Density, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-297-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Europe Micro LED Market Size & Trends

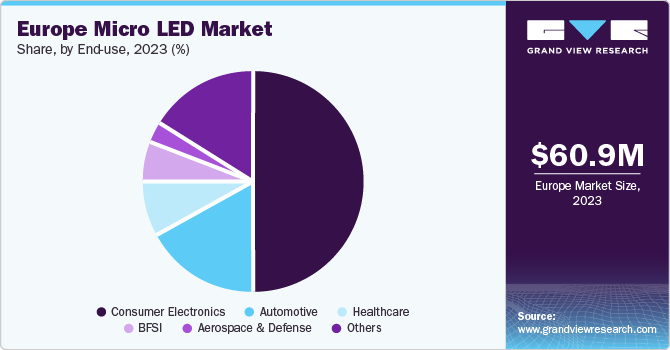

The Europe micro LED market size was valued estimated at USD 60.91 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 78.9% from 2024 to 2030. The rising demand for high-resolution displays drives the Europe micro LED market. Micro light-emitting diodes (LEDs) are an innovative display technology that provides low power consumption, high brightness, and superior image quality.

Micro light-emitting diodes (micro LEDs) are an advanced emissive display technology that offers significant advantages over organic LEDs and liquid-crystal displays. Micro LEDs provide higher brightness, improved color reproduction accuracy, smaller minimum pixel size, and longer lifespan, making them an advantageous technology for various display applications. Their small size, featuring single-micrometer-emitter sizes and pixel pitches, makes it possible to develop innovative display applications, such as near-to-eye technologies and pico-projectors. Micro LED displays have the potential to revolutionize the visual display industry, creating new possibilities for high-quality, low-energy-consumption displays in various applications. The emergence of micro LED displays has opened up new opportunities for research and development and for businesses to explore new markets and applications.

Consumers are increasingly inclined towards displays that offer superior image quality, high brightness, and low power consumption. The emergence of mMicro LEDs as a technology that excels in meetingmeets these demands has prompted manufacturers and technology companies to invest substantially in developing and producing mMicro LED displays. This emphasis on innovation is driven by the need to remain competitive in the market and adapt to evolving consumer preferences.

Furthermore, the adoption of micro LED technology in smartwatches is driving advancements in display technology, enabling manufacturers to create thinner bezels, higher resolution screens, and customizable display features that enhance the aesthetics and performance of smartwatches. Micro LEDs offer better color accuracy, higher brightness levels, faster response times, and improved energy efficiency than traditional display technologies such as Liquid Crystal Display (LCD) or Organic Light-Emitting Diode (OLED). These advantages drive the demand for micro LED displays in smartwatches and position them as a key component in the evolution of wearable technology.

AdditionallyIn addition, the growing popularity of smartwatches as essential health and fitness tracking accessories is fueling the demand for advanced display technologies that can provide real-time data, detailed visuals, and interactive features. Micro LED smartwatch displays can offer always-on displays, customizable watch faces, health metrics tracking, and notifications with improved readability and clarity. These features enhance the utility of smartwatches as versatile devices for monitoring health, staying connected, and accessing information on the go. According to the Eurostat, 25.8% of the European Union population that used numerous internet-connected devices, including smartwatches and fitness bands, increased to 25.8% in 2023 from 17.1% in 2020.

Micro LEDs are increasingly being utilized in general lighting devices, offering a range of benefits driving their adoption in this sector. One of the key advantages of using micro LEDs in general lighting devices is their high energy efficiency. Micro LEDs are known for producing bright light while consuming minimal power, making them an environmentally friendly and cost-effective lighting solution. By using micro LEDs in general lighting fixtures, consumers and businesses can reduce energy consumption, lower electricity bills, and contribute to sustainability efforts by minimizing carbon footprint. Moreover, the color accuracy, brightness control, and dimming capabilities make them ideal for general lighting applications that require precise illumination and ambiance control. Micro LEDs can deliver a wide range of color temperatures, color rendering indexes (CRI), and brightness levels to create different lighting moods and enhance visual comfort in indoor and outdoor spaces.

Market Concentration & Characteristics

The Europe micro LED industry is significantly concentrated in nature as micro LED displays are increasingly being integrated into smartphones, smartwatches, tablets, and AR & VR headsets by major technology companies. However, the growth stage of the industrymajor technology companies increasingly integrate micro LED displays into smartphones, smartwatches, tablets, and augmented reality (AR) and virtual reality (VR) headsets. However, the industry's growth stage is high, and the pace of industry growth is accelerating.

The market growth stage is high, and the pace is accelerating. The Europe micro LED market is characterized by a high degree of innovation, driven by continuous technological advancements and research in micro LED technology. European companies are investing significant research and development investments to improve display performance and manufacturing processes and create innovative micro LED applications. This innovative environment promotes competition and encourages the production of state-of-the-art products with exceptional image quality, brightness, and energy efficiency.

The Europe micro LED market is influenced by several factors, including the availability of substitute products. Organic Light-Emitting Diode (OLED) displays and traditional Liquid Crystal Display (LCD) screens are competing technologies that are some substitutes for micro LED technology. Although micro LEDs offer some advantages such as brightness, energy efficiency, and longevity, other display technologies like OLEDs are rapidly evolving, presenting features such as flexibility, thinness, and color vibrancy that are also quite appealing. The presence of viable substitutes creates a dynamic competitive landscape that fosters innovation, differentiation, and ongoing improvements in micro LED products to maintain their market relevance and competitiveness.

Application Insights

Based on the application, the market is bifurcated in terms ofregarding display and lighting. The display segment led the market with a share of over 82.1% in 2023. The increasing demand for AR & VR devices is driving the market growth. Micro LEDs are revolutionizing the Augmented Reality (AR) and Virtual Reality (VR) industries by offering advanced display solutions that enhance the immersive experiences provided by these technologies. The fast response times of micro LEDs make them ideal for AR and VR devices that require low latency and high refresh rates to reduce motion blur and provide smooth interactions. Micro LEDs can quickly switch on and off, enabling rapid image updates and reducing ghosting effects in fast-moving scenes, enhancing the overall visual clarity and realism in AR and VR environments. This responsiveness is crucial for creating engaging and interactive experiences that feel natural and lifelike to users.

The lighting segment is anticipated to grow at a significant CAGR over the forecast period, owing to the increasing demand for energy-efficient lighting solutions that offer superior performance and longevity. In automotive lighting applications, micro LEDs are used for various purposes, such as headlights, taillights, daytime running lights, interior lighting, and display panels. One of the key advantages of using micro LEDs in automotive lighting is their superior brightness and light output. Micro LEDs can produce intense, focused light beams that improve driver visibility, enhance road safety, and contribute to a modern and stylish vehicle design.

End-use Insights

Based on end-use, the consumer electronics segment led the market with the largest revenue share in 2023, owing to the rising demand for innovative television displays. The design flexibility of micro LEDs enables television manufacturers to create sleek and inventive TV designs with thin bezels, high pixel densities, and customizable display features. Micro LEDs can be arranged in custom configurations to create ultra-thin displays with uniform lighting, precise color reproduction, and dynamic contrast ratios that enhance the aesthetics of televisions. This design versatility allows for the development ofdeveloping cutting-edge TV models with immersive viewing experiences that captivate viewers and elevate the home entertainment experience.

The healthcare segment is expected to grow at a rapidthe highest CAGR over the forecast period. Wearable health monitoring devices have garnered significant attention in recent years, and micro-LED technology has emerged as a pivotal element in their development. Micro-LED displays offer numerous advantages over conventional display technologies, such as low power consumption, high brightness, and robustness, making them highly suited for wearable devices, including smartwatches, fitness trackers, and other health monitoring devices. By integrating micro-LED displays, wearable devices can provide users real-time health data, such as heart rate, blood oxygen levels, and step count. This information can be utilized to monitor overall health and well-being, detect early signs of illness, and facilitate timely intervention. Moreover, micro-LED-based wearables have the potential to enhance patient engagement and enable remote healthcare management, thereby revolutionizing the healthcare industry.

Display Pixel Density Insights

Based on display pixel density, the greater than 5000ppi segment held the largest revenue market share in 2023 due to increasing demand for displays with exceptional clarity, sharpness, and detail in applications such as high-performance gaming. There is a growing need among gamers for enhanced visual experiences that offer greater realism and immersion. With advancements in micro LED technology, displays with over 5000ppi can now deliver sharper and more detailed images without any visible pixilationpixelation. This development is particularly relevant to the esports market and competitive gamers, constantly seeking to gain an edge over their opponents through improved visuals.

The 3000ppi to 5000ppi segment is expected to witness significant growthgrow significantly over the forecast period owing to its enhanced viewing experience. The pixel density range of 3000ppi to 5000ppi represents a noticeable advancement in resolution compared to traditional displays. This range offers sharper images and finer details. It suits users who prioritize a high-quality viewing experience without requiring extreme pixel densities exceeding 5000ppi. It provides an ideal balance between image clarity and screen performance, making it an appealing option for those seeking an enhanced visual experience without sacrificing practicality.

Country Insights

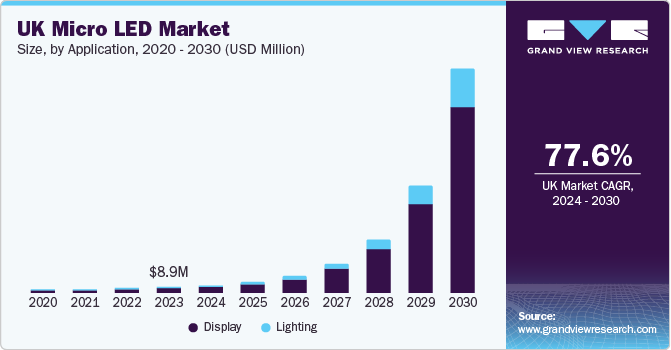

UK Micro LED Market Trends

The UK emerged as the dominant country in the region, accounting for 14.6% of the revenue share in 2023. With increasing awareness about environmental sustainability, there is a growing demand for energy-efficient display solutions in the UK. Micro LED technology offers significant energy savings compared to traditional display technologies, making it attractive for consumers and businesses seeking sustainable solutions.

Italy Micro LED Market Trends

The Italy micro LED market is expected to witness the fastest CAGR in the region over the forecast period. Italy has a discerning consumer base that values high-quality products, especially in the consumer electronics sector. Micro LED technology offers superior picture quality, enhanced brightness, and energy efficiency compared to traditional displays, making it well-suited for premium smartphones, TVs, and wearables. The demand for such high-end devices is expected to drive the adoption of micro LED displays in Italy.

Key Europe Micro LED Company Insights

Some of the key players operating in the market include IMEC, Plessey Semiconductors, Aledia, and others

-

IMEC is a world-leading research and innovation hub in nanoelectronics and digital technologies. IMEC’s primary focus is on developing advanced technologies for the semiconductor industry, including micro LEDs, which are poised to revolutionize various sectors like displays, communication, and sensing.

-

Plessey Semiconductor is a leading innovator in semiconductor technology, specializing in developing advanced optoelectronic solutions. It is renowned for its cutting-edge micro LED technology offerings, featuring exceptional brightness, color accuracy, and low power consumption.

-

Aledia is a French company specializing in developing and producing micro-LED technology. Aledia uses its proprietary micro-LED technology to create innovative solutions for next-generation displays and lighting applications. Aledia’s micro-LED offerings include displays for various applications such as augmented reality (AR), virtual reality (VR), automotive displays, and wearable devices.

Key Europe Micro LED Companies:

- Plessey Semiconductors

- Interuniversitair Micro-Electronica Centrum vzw (IMEC)

- X-Celeprint

- Jade Bird Display

- Vivid MicroLED

- ams OSRAM

- Polar Light Technologies

- Porotech

Recent Developments

-

In January 2024, Aledia, a France-based company, developed innovative technology for producing 3D GaN LEDs on 300 mm and 200 mm silicon wafers utilizing CMOS wafer-fabrication (fab) processes and tools. These LEDs, stated to be 25% cheaper than traditional planar LED chips, are ideal for micro-LED displays. With over USD 390 million raised, including a recent USD 131.4 million round announced in October 2023, Aledia plans to establish a USD 153.3 million LED production fab. Aledia's novel microLED platform, currently in R&D, targets 2µm RGB LEDs for AR applications.

-

In September 2023, the government of Germany and the state of Bavaria planned to provide more than USD 320 million in subsidies to ams OSRAM, a key optoelectronic research and development (R&D) firm, to support its operations in Regensburg. The objective is to create 400 high-tech jobs through the investment to expand R&D activities, construct new facilities, and finance several projects, including ultraviolet-C (UV-C) light-emitting diodes (LEDs), near-infrared (NIR) emitters, components for industry 4.0, and microLED displays. Notably, ams OSRAM has already commenced the construction of an 8-inch wafer pilot production line for micro LEDs at its Regensburg facility.

-

In May 2022, Foxconn and Porotech declared a partnership to develop energy-efficient and ultra-high-density MicroLED Microdisplays for wearable devices, augmented reality, and smart device applications. This collaboration aims to expedite research and product development of MicroLED technology, advancing AR applications to a new era and leveragingadvance AR applications to a new era, and leverage Foxconn's supply chain management strength during the mass production stage.

Europe Micro LED Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 81.22 million

Revenue forecast in 2030

USD 2,662.73 million

Growth rate

CAGR of 78.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, display pixel density, end-use, region

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

Plessey Semiconductors; Interuniversitair Micro-Electronica Centrum vzw (IMEC); X-Celeprint; Jade Bird Display; Vivid MicroLED; ams OSRAM; Hexagem; Polar Light Technologies; Porotech

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Micro LED Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Europe micro LED market researchreport based on the application, display pixel density, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Display

-

Television

-

AR & VR

-

Automotive

-

Smartwatch

-

Smartphone, Tablets, and Laptops

-

-

Lighting

-

General Lighting

-

Automotive Lighting

-

-

-

Display Pixel Density Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 3000ppi

-

3000ppi to 5000ppi

-

Greater than 5000ppi

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Healthcare

-

BFSI

-

Aerospace & Defense

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe micro LED market size was estimated at USD 60.91 million in 2023 and is expected to reach USD 81.22 million in 2024

b. The Europe micro LED market is expected to grow at a compound annual growth rate of 78.9% from 2024 to 2030 to reach USD 2,662.73 million by 2030

b. The greater than 5000ppi segment held the largest revenue share in 2023 due to increasing demand for displays with exceptional clarity, sharpness, and detail in applications such as high-performance gaming

b. Some key players operating in the Europe micro LED market include Plessey Semiconductors; Interuniversitair Micro-Electronica Centrum vzw (IMEC); X-Celeprint; Jade Bird Display; Vivid MicroLED; ams OSRAM; Hexagem; Polar Light Technologies; Porotech

b. Factors such as the rising demand for high-resolution displays drives the demand for micro LEDs in the region

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."