- Home

- »

- Pharmaceuticals

- »

-

Europe Medical Foods Market Size And Share report, 2030GVR Report cover

![Europe Medical Foods Market Size, Share & Trends Report]()

Europe Medical Foods Market Size, Share & Trends Analysis Report By Route Of Administration (Oral, Enteral), By Product (Powder, Pills), By Application, By Module, By Sales Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-943-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Europe Medical Foods Market Size & Trends

The Europe medical foods market size was estimated at USD 6.15 billion in 2024 and is projected to grow at a CAGR of 2.94% from 2025 to 2030. The growth is attributed to the presence of a large elderly population in Europe, which is at a high risk of various diseases, such as cardiovascular, respiratory, and other chronic diseases. For instance, as per a 2022 publication by the European Parliament, Chronic Kidney Disease (CKD) imposes a substantial burden on society and individuals. In addition, CKD affects around 100 million people, with projections indicating that it is expected to become the fifth leading cause of global mortality by 2040 in the region.

The prevalence of cancer, autoimmune diseases, and other medical conditions is rising in Europe. The rise in malnourished and underweight people is expected to boost the demand for medical foods. According to Specialized Nutrition Europe, around 40% of the adult hospital patients in the European Union (EU) are malnourished. The economic burden of malnourishment is estimated at USD 136.8 billion (EUR 120 billion) across Europe.

Moreover, effective reimbursement policies for enteral feeding products have supported the market growth. The reimbursement and prescription of enteral nutrition are covered by Volume Five of the Social Legislation Code (Social Code Book No. 5). According to the legislation code, the cost of Home Enteral Nutrition (HEN) is fully funded by national or private health insurance in high-income countries, such as the UK, Spain, Germany, Italy, France, Spain, and Switzerland.

Furthermore, increasing incidence of targeted diseases and advancements in drug development are expected to drive the demand for disease-specific formulas. Clinical nutrition is increasingly used for the personalized treatment of diseases, such as cancer and cystic fibrosis. These conditions require special nutrition to avoid any kind of drug interaction. For instance, in the case of cystic fibrosis, special digestive enzyme capsules are administered. The nature of these digestive enzymes can vary in individuals.

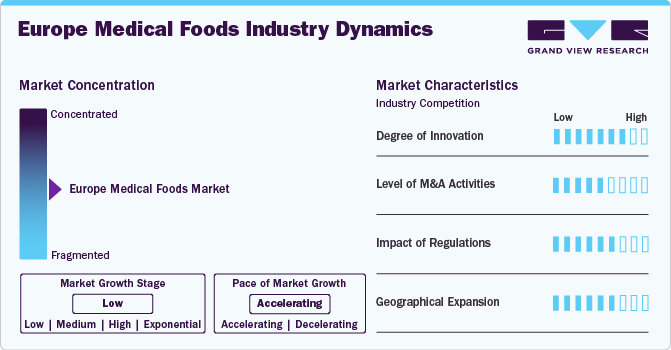

Market Concentration & Characteristics

The degree of innovation is high in the Europe medical foods industry. Leading manufacturers are focusing on increasing the application scope of the products and are targeting different population cohorts to gain large market shares. For instance, in March 2023, RELIEF THERAPEUTICS Holding SA launched its latest PKU GOLIKE BARs across Europe. These bars, designed for the dietary management of phenylketonuria (PKU), are part of the PKU GOLIKE product line, which utilizes the company's proprietary Physiomimic Technology. This technology enables a prolonged-release formulation of amino acids, providing next-generation medical foods to improve PKU management by offering sustained nutritional support.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in February 2022, Nestlé acquired Orgain, a key player in plant-based nutrition. This acquisition complemented Nestlé Health Science's existing portfolio of nutrition products that support healthier lives.

The information and compositional requirements for Food for Special Medical Purposes (FSMP) are generally governed by Regulation (EU) No 609/2013. By September 25, 2015, it was governed by Commission Delegated Regulation (EU) 2016/128, specifically, European Parliament’s supplementing Regulation (EU) No 609/2013 and of the Council about the specific information & compositional requirements for FSMP. The provisions established in Regulation (EU) No 609/2013 have been mandatory since July 20, 2016.

Geographic expansion drives the Europe medical foods industry by enabling access to diverse resources, increasing market penetration and revenue, and fostering regulatory compliance and standardization. For instance, in September 2023, Danone announced a USD 51.22 million (EUR 50 million) investment to expand its existing plant in Opole, Poland, to produce medical nutrition products. This facility would cater to individuals with special dietary needs. The expansion follows Danone's acquisition of the Polish medical nutrition company Promedica earlier in the year, marking a strategic move to strengthen its position in the medical nutrition sector.

Route Of Administration Insights

The oral segment led the market and accounted for 76.1% of the total revenue in 2024. Increased preference for orally administered products, commercial viability, and supportive initiatives are key factors driving the demand for orally administered medical foods. Furthermore, the growing manufacturing of oral products in the form of pre-thickened products, powders, and pills is anticipated to fuel the segment. For instance, in January 2023, Nutricia launched its Fortimel PlantBased Energy, a plant-based oral nutritional supplement designed to address the nutritional requirements of individuals facing malnutrition or those at risk due to illness. This addition to the Fortimel portfolio leverages Nutricia's parent company, Danone's proficiency in plant nutrition. It further extends the range of Fortimel products, which are clinically proven medical nutrition solutions specifically developed to cater to the daily needs of patients.

The enteral route of the administration segment is expected to witness the fastest CAGR over the forecast years. The demand for enteral feeding formulas is rising due to the increasing prevalence of chronic diseases such as cancer and cardiovascular diseases, which results in various metabolic issues, leading to difficulty in consuming food during the treatment of these diseases. Moreover, according to Cambridge University, in 2020, it was estimated that over 23,000 adults receive community-based, long-term home enteral tube feeding in the UK. In addition, several surveys are being conducted in the UK on enteral feeding formulas, which is anticipated to boost the adoption of formulas in the country.

Product Insights

The powder segment held the largest market revenue share of 35.2% in 2024. Medical foods are most widely available in powder form, which can be administered through the oral route or enteral route by mixing with milk or water, as advised by the physician. Medical foods in the powdered formula are suitable for patients of all age groups, especially in the oral route. Owing to a high preference for powdered formulations due to ease of consumption, manufacturers are developing product categories in line with consumer preferences. For instance, in January 2022, Danone launched Souvenaid, a powdered version of a medical nutrition drink to support memory function in the early stages of Alzheimer's disease.

The liquid segment is anticipated to grow at the fastest rate during the forecast period owing to the rising adoption of liquid formulations in the pediatric and geriatric population, where the intake of solid formulations is limited or impossible and in case of clinically diagnosed dysphagia or when oral physiology is limited. Furthermore, liquid-formulated food helps maintain sufficient hydration and electrolyte balance, favoring segment growth. For instance, in October 2023, Nutricia, launched its medical nutrition beverage, Fortini + Mix Multi Fibre. The product features a well-balanced combination of fruit and vegetable ingredients, specifically designed to address the dietary needs of pediatric patients dealing with disease-related malnutrition and stunted growth.

Application Insights

The cancer application segment dominated the market with the largest share of 11.7% in 2024. According to Globocan 2022, there were approximately 4.5 million new cancer cases in Europe in 2022. Moreover, the region witnessed almost 2.0 million deaths due to cancer. Cancer weakens immunity and leads to malnutrition in 40% to 80% of cases. Thus, medical food administration is an effective option for restoring the nutritional balance in malnourished patients. Hence, the demand for medical foods in cancer treatments is expected to increase over the forecast period. Medical food administration is an effective option for restoring nutritional balance in malnourished patients. Consequently, the demand for medical foods in cancer treatments is expected to rise over the forecast period.

However, the Parkinson's Disease (PD) segment is expected to grow at the fastest CAGR during the forecast period. According to a BioMed Central Ltd. study in 2022, the estimated prevalence of PD was 43% in Italy. This statistic highlights the widespread impact of Parkinson's disease and highlights the urgent need for continued research, awareness, and support for individuals living with this neurodegenerative condition. Although there is no specific dietary treatment plan for managing it, some foods for medical purposes have shown potential for managing the disorder. Some commonly prescribed medical foods for Parkinson's disease contain omega-3 fatty acids, coenzyme Q, and vitamins D & B. In addition, ketogenic diet plans and probiotics have shown a positive impact and complemented pharmacotherapy.

Module Insights

The protein modules segment held the largest market share of 12.7% in 2024. Protein modules are used in severe infections, trauma, burns, malnutrition, post-surgery recovery, and critically ill patients. The increasing prevalence of chronic diseases, such as cancer, chronic kidney disease, and malnutrition, which require specialized nutritional interventions likely drive the segment growth. Patients undergoing treatments like chemotherapy or dialysis often suffer from muscle wasting and protein deficiencies, boosting demand for protein-enriched medical foods. In addition, the aging population, particularly in developed countries, further contributes to the need for protein modules to combat age-related muscle loss (sarcopenia).

Furthermore, the hypoallergic module segment is expected to grow significantly over the forecast period. The growth is driven by the increasing prevalence of food allergies and intolerances, especially among infants and individuals with chronic health conditions. Hypoallergenic medical foods cater to patients with specific dietary needs, such as those unable to tolerate proteins found in common foods like cow's milk or soy. These products are formulated to minimize allergenic responses and are crucial for managing conditions like severe food allergies, eosinophilic esophagitis, and gastrointestinal disorders. The rising awareness of food-related health issues and advancements in hypoallergenic formulations, such as amino acid-based or extensively hydrolyzed proteins, have significantly boosted demand.

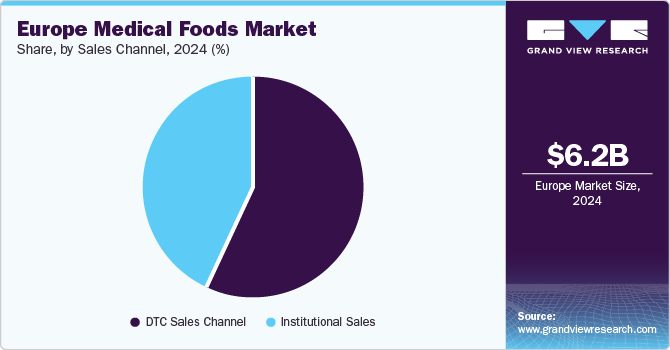

Sales Channel Insights

Direct-to-consumer (DTC) sales channel held the largest market share in 2024 and is expected to grow at the fastest CAGR during the forecast period. DTC sales have emerged as a significant channel within the market, providing opportunities for manufacturers to engage directly with consumers and tailor their offerings to meet specific health needs. DTC sales in the medical foods sector allow companies to bypass traditional retail channels and establish a direct relationship with end users. This model has gained traction due to its ability to provide personalized customer experiences and foster brand loyalty. By leveraging online platforms, companies can offer detailed product information, educational resources, and tailored recommendations based on individual health conditions.

The institutionalsales segment is anticipated to expand significantly over the forecast period. The segment's growth is driven by increasing recommendations from doctors to use medical foods. Institutions that purchase medical foods include hospitals, long-term care centers, hospices, clinics, and disability facilities. Since the consumption of medical foods is recommended under medical supervision, the revenue generated through institutional sales is the highest. In addition, training programs for healthcare professionals on the benefits of medical foods further enhance their adoption within institutions. As awareness grows among clinicians about the efficacy of these products in improving patient outcomes, institutional sales are expected to witness significant growth.

Country Insights

The medical foods market in the UK had a substantial share in 2024. The market is driven by a large geriatric population and the consequent rise in malnutrition in this region. According to the Office for National Statistics, in 2021, around 11 million people aged 65 and above were at risk of malnutrition in the UK. In addition, about one-third of the elderly people admitted to hospitals are at risk of malnutrition.

The Germany medical foods market is positively influenced by the increasing prevalence of cancer and the growing need for radiotherapy procedures. According to ESTRO-HERO (Health Economics in Radiation Oncology), the proportion of new cancer cases requiring radiotherapy is expected to increase by 15.2% from 2012 to 2025, while it is expected to increase by 16% in other European countries.

The medical foods market in France is driven by the rising geriatric population and growing burden of chronic diseases. According to an article published by Lemonde in 2023, around 26% of people are over 60, accounting for 1 in 4 inhabitants. Furthermore, the elderly population is anticipated to account for 33% of the total population by 2040.

Key Europe Medical Foods Company Insights

Some of the key players operating in the market include Danone, Nestlé, Fresenius Kabi AG, and Abbott. Key companies in the market are utilizing strategies like new product launches to enhance their market presence. For instance, in September 2020, Dutch Medical Food, headquartered in the Netherlands, entered the market, offering nutritional products for individuals requiring medical food. The company's focus on personalized medical foods aims to address specific dietary needs associated with various medical conditions.

Key Europe Medical Foods Companies:

- Danone

- Nestlé

- Abbott

- Targeted Medical Pharma Inc. (Physician Therapeutics LLC, a division of the company)

- Primus Pharmaceuticals Inc.

- Fresenius Kabi AG

- Mead Johnson & Company, LLC

View a comprehensive list of companies in the Europe Medical Foods Market

Recent Developments

-

In November 2023, Danone launched its first medical nutrition product, Fortimel, for adults in China, categorized under foods for special medical purposes. This launch is a crucial component of Danone's strategy in China, aimed at utilizing its scientific expertise across all life stages and promoting the growth of the adult medical nutrition segment.

-

In September 2023, Danone announced a EUR 50 million (USD 53.78 million) line expansion of its production facility at Opole, Poland, to meet the increasing demand for medical nutrition worldwide. This move aims to enhance its position in the adult medical nutrition market, with the growing rate of chronic diseases and aging population. The expansion is anticipated to enable Danone to serve patients across the globe, as many people are expected to require medical nutrition at some point in their lives due to diseases such as cancer and stroke, which can result in malnutrition.

-

In March 2023, Danone acquired ProMedica, a Poland-based company that specializes in providing care services for patients in their homes. This acquisition is part of Danone's lucrative specialized nutrition market expansion strategy to strengthen its presence in Poland.

-

In February 2023, Neslte and EraCal Therapeutics entered into a research collaboration to identify novel nutraceuticals relevant to controlling food intake.

Europe Medical Foods Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.33 billion

Revenue forecast in 2030

USD 7.31 billion

Growth Rate

CAGR of 2.94% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Route of administration, product, application, module, sales channel, region

Country scope

UK, Germany, Spain, France, Italy, Denmark, Sweden, Norway, Poland, Netherlands, Portugal, Slovakia, Finland, Czech Republic, Hungary, Belgium

Key companies profiled

Danone, Nestlé, Abbott, Targeted Medical Pharma Inc. (Physician Therapeutics LLC, a division of the company), Primus Pharmaceuticals Inc., Fresenius Kabi AG, Mead Johnson & Company, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Medical Foods Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe medical foods market report based on route of administration, product, application, module, sales channel, and region.

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Enteral

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Pills

-

Liquid

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Kidney Disease

-

Minimal Hepatic Encephalopathy

-

Chemotherapy Induced Diarrhea

-

Pathogen Related Infections

-

Diabetic Neuropathy

-

ADHD

-

Depression

-

Alzheimer's Disease

-

Nutritional Deficiency

-

Orphan Diseases

-

Tyrosinemia

-

Eosinophilic Esophagitis

-

FPIES

-

Phenylketonuria

-

MSUD

-

Homocystinuria

-

Others

-

-

Wound Healing

-

Chronic Diarrhea

-

Constipation Relief

-

Protein Booster

-

Dysphagia

-

Pain Management

-

Parkinson's Disease

-

Epilepsy

-

Other Cancer related treatments

-

Severe Protein Allergy

-

Cancer

-

Cachexia

-

Other (debilitating conditions, COPD, etc.)

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 – 2030)

-

Online Sales

-

Retail Sales

-

Institutional Sales

-

-

Module Outlook (Revenue, USD Million, 2018 – 2030)

-

Amino Acid Module

-

Protein Module

-

Vitamin & Mineral Modules

-

Fatty Acid based Modules

-

Carbohydrate Modules

-

Fiber Modules

-

Ketogenic Modules

-

Peptide based Modules

-

Hypoallergic Modules

-

Others (Electrolyte Module, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

Poland

-

Netherlands

-

Portugal

-

Slovakia

-

Finland

-

Czech Republic

-

Hungary

-

Belgium

-

-

Frequently Asked Questions About This Report

b. The Europe medical foods market size was estimated at USD 6.15 billion in 2024 and is expected to reach USD 6.33 billion in 2025.

b. The Europe medical foods market is expected to grow at a compound annual growth rate of 2.94% from 2025 to 2030 to reach USD 7.31 billion by 2030.

b. Oral segment accounted for the largest market share of 76.1% of the total revenue in 2024. Increased preference for orally administered products, commercial viability, and supportive initiatives are key factors driving the demand for oral administered medical foods.

b. Some key players operating in the Europe medical foods market include Danone, Nestlé, Abbott, Targeted Medical Pharma Inc. (Physician Therapeutics LLC, a division of the company), Primus Pharmaceuticals Inc., Fresenius Kabi AG, Mead Johnson & Company, LLC

b. Key factors that are driving the Europe medical foods market growth include rise in the prevalence of chronic diseases, the rapidly growing geriatric population, and governmental authorities focusing on reducing malnutrition.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."