- Home

- »

- Medical Devices

- »

-

Europe Medical Affairs Outsourcing Market, Report, 2030GVR Report cover

![Europe Medical Affairs Outsourcing Market Size, Share & Trends Report]()

Europe Medical Affairs Outsourcing Market Size, Share & Trends Analysis Report By Services (Medical Writing & Publishing, Medical Monitoring), By Industry, By Medical Devices Type, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-872-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The Europe medical affairs outsourcing market size was estimated at USD 345.7 million in 2024 and is projected to grow at a CAGR of 12.0% from 2025 to 2030, driven by the increasing complexity of regulatory requirements and companies seek specialized expertise through outsourcing. In addition, the need for cost efficiency allows organizations to allocate resources more effectively. Moreover, the growing demand for real-time data and insights from healthcare professionals drives the outsourcing trend. Therefore, emphasizing enhancing patient outcomes through improved medical communications and education further encourages organizations to partner with external service providers for their medical affairs functions.

The increasing complexity of regulatory requirements drives the medical affairs outsourcing market. As regulations evolve and become more stringent, companies navigate intricate compliance landscapes that demand specialized knowledge and expertise. Moreover, outsourcing to experienced partners allows organizations to ensure adherence to these regulations while minimizing risks. Therefore, this strategic approach enables companies to focus on their core competencies while maintaining high standards in medical affairs.

The demand for real-time data is crucial as healthcare professionals rely on timely insights to make informed decisions. This urgency forces companies to outsource data management and analysis to specialized providers who can deliver accurate and prompt information. Furthermore, by leveraging external expertise, organizations can ensure they meet the market's evolving needs. Therefore, this approach enhances their ability to support healthcare professionals effectively and improve patient care outcomes.

Services Insights

The medical writing & publishing segment dominated the market, with a revenue share of 33.8% in 2024, due to the stringent regulatory requirements that demand high-quality documentation. In addition, the growing demand for scientific publications and clinical trial reports requires specialized skills and expertise that many companies prefer to outsource. Moreover, accurate and timely medical writing is essential for effective communication with healthcare professionals and regulatory bodies. Therefore, organizations increasingly rely on external partners to ensure compliance and maintain high standards in their documentation processes.

The medical science liaisons (MSLs) segment is projected to witness the fastest CAGR of 12.6% over the forecast period, attributed to the rising demand for expert engagement with healthcare professionals. In addition, as therapies become more complex, companies require MSLs to communicate nuanced scientific information effectively. Moreover, the focus on building strong relationships with key opinion leaders (KOLs) drives organizations to invest in MSL resources. Therefore, the growing emphasis on real-time insights and strategic input further accelerates the demand for outsourced medical science liaisons (MSLs) services.

Industry Insights

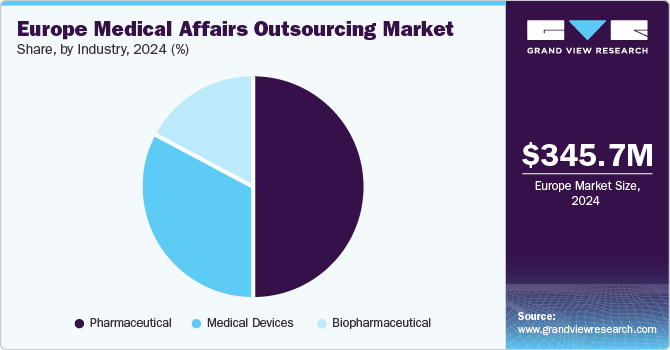

The pharmaceutical segment dominated the market with the largest revenue share of 50.2% in 2024, due to its substantial investments in research and development, demanding strong medical affairs support. In addition, the strict regulatory environment requires comprehensive documentation and communication strategies that are often outsourced for efficiency. Moreover, the need for effective engagement with healthcare professionals drives demand for specialized services. Therefore, pharmaceutical companies increasingly rely on external partners to navigate these complexities and enhance their market presence.

The biopharmaceutical segment is projected to grow at a CAGR of 14.5% over the forecast period, attributed to due to the rapid growth of innovative therapies and personalized medicine. In addition, the increasing complexity of biopharmaceutical products requires specialized medical affairs support to communicate scientific data effectively. Moreover, the rising demand for real-world evidence and post-market surveillance enhances the need for tailored services in this sector. Therefore, biopharmaceutical companies are increasingly outsourcing medical affairs functions to optimize their operations and meet evolving market demands.

Medical Device Type Insights

The therapeutic medical devices segment dominated the market with the largest revenue share of 59.1% in 2024, due to the growing demand for advanced treatments in chronic and complex conditions such as diabetes, cardiovascular diseases, and oncology, therapeutic devices require extensive clinical trials, regulatory compliance, and post-market surveillance. This complexity is attributed to a higher need for outsourcing to specialized service providers. In addition, the greater regulatory scrutiny and the demand for extensive support services increase reliance on external expertise. Furthermore, the continuous innovation and complexity in therapeutic devices further accelerate the growth of outsourcing in this sector.

The diagnostic medical devices segment is projected to grow at a CAGR of 12.2% over the forecast period, attributed to the growing demand for early disease detection, personalized medicine, and non-invasive diagnostic technologies. This demand is attributed to advancements in molecular diagnostics, imaging systems, and point-of-care devices, which increase regulatory complexity. Moreover, expanding telemedicine and home diagnostics contributes significantly to the increasing demand for diagnostic devices.

Country Insights

Europe is witnessing an increased demand for specialized medical affairs services, driven by a growing emphasis on real-world data to support regulatory submissions and market access.Moreover, adopting advanced technologies, including artificial intelligence and big data analytics, transforms medical affairs operations and enhances data management and decision-making processes. In addition, pharmaceutical companies are focusing more on patient engagement strategies, leading to a need for outsourced services that can effectively gather and analyze patient insights. Therefore, these interconnected trends significantly shape the Medical Affairs Outsourcing Market landscape in Europe.

Germany Medical Affairs Outsourcing Market Trends

Germany medical affairs outsourcing market dominated the Europe market and held a market share of 54.4% in 2024, attributed to its robust pharmaceutical industry, which is one of the largest in Europe, raising a high demand for specialized medical affairs services. Moreover, the country's strong regulatory framework ensures compliance, prompting companies to seek outsourcing partners with expertise in navigating complex regulations. Inaddition, it emphasizes innovation and research facilitates collaborations that enhance the efficiency of clinical trials and data management. Furthermore, a well-developed healthcare infrastructure and access to skilled professionals further strengthen Germany’s position in this market.

France Medical Affairs Outsourcing Market Trends

France medical affairs outsourcing market is expected to register the fastest CAGR of 12.2% over the forecast period, due to increasing demand for pharmaceutical services. Moreover, the growing emphasis on patient-centric approaches and real-world evidence, supported by initiatives from the French Health Data Hub, is boosting demand for specialized medical affairs services. In addition, the French government allocated approximately USD 9.71 billion to research and development in 2021, further encouraging outsourcing in this area (Ministère de la Santé). Therefore, a favorable regulatory environment promotes efficient compliance, making outsourcing an attractive option for pharmaceutical companies.

Italy Medical Affairs Outsourcing Market Trends

Italy medical affairs outsourcing market is expected to register a significant CAGR over the forecast period, driven by an increasing focus on innovative therapies and personalized medicine alongside a complex regulatory environment requiring specialized medical affairs support. Moreover, it invested over USD 6.47 billion in healthcare research and development in 2021 (Ministero della Salute), further boosting demand for outsourcing services. Furthermore, its well-established healthcare infrastructure enhances collaboration between pharmaceutical companies and outsourcing providers. Therefore, these factors collectively raise strong market growth in the region.

Key Europe Medical Affairs Outsourcing Company Insights

Some key companies operating in the market include THE MEDICAL AFFAIRS COMPANY, Ashfield Healthcare., ZEINCRO Group, Indegene, and, ICON plc. Companies are implementing strategic initiatives, including mergers, acquisitions, and services launches, to expand their market presence and address evolving healthcare demands through medical affairs outsourcing.

-

The Medical Affairs Company offers comprehensive outsourcing solutions for medical affairs, including strategic consulting, medical writing, and regulatory support. Their new launch in the medical affairs outsourcing market focuses on innovative technologies and services that enhance operational efficiency and data management. This initiative aims to streamline processes for pharmaceutical and biotech companies, ensuring compliance and effective communication.

-

Ashfield Healthcare offers a comprehensive range of medical affairs services, including strategic consulting, medical communications, and training solutions. Their recent medical affairs outsourcing market launch focuses on innovative digital solutions to enhance operational efficiency and data management. This initiative aims to streamline processes for pharmaceutical and biotech companies, ensuring effective stakeholder engagement and compliance.

Key Europe Medical Affairs Outsourcing Companies:

- THE MEDICAL AFFAIRS COMPANY

- Ashfield Healthcare

- ZEINCRO Group

- Indegene

- ICON plc

- IQVIA

- Syneos Health

- PPD Inc

- Wuxi AppTec

- SGS SA

View a comprehensive list of companies in the Europe Medical Affairs Outsourcing Market

Recent Developments

-

In June 2024, IQVIA launched the “One Home” clinical trial technology platform, designed to address common challenges clinical trial sites face. This platform streamlines processes and reduces administrative burdens, allowing sites to focus more on patient care and data integrity. By integrating various tools and technologies, “One Home” enhances efficiency and improves collaboration among stakeholders. Therefore, it aims to accelerate clinical trial timelines and improve participant experiences.

Europe Medical Affairs Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 379.6 million

Revenue forecast in 2030

USD 669.1 million

Growth rate

CAGR of 12.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Services,Industry, Medical Devices Type, Region

Country scope

Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway

Key companies profiled

THE MEDICAL AFFAIRS COMPANY; Ashfield Healthcare; ZEINCRO Group; Indegene; ICON plcIQVIA; Syneos Health; PPD Inc; Wuxi AppTec; SGS SA.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, countryal & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Medical Affairs Outsourcing Market Report Segmentation

This report forecasts Europe, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Europe medical affairs outsourcing market report based on services, industry, medical devices type, and country:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Writing & Publishing

-

Medical Monitoring

-

Medical Science Liaisons (MSLs)

-

Medical Information

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Biopharmaceutical

-

Medical Devices

-

-

Medical Devices Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Medical Devices

-

Diagnostic Medical Devices

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."