- Home

- »

- Consumer F&B

- »

-

Europe Meat Snacks Market Size & Share, Report, 2030GVR Report cover

![Europe Meat Snacks Market Size, Share & Trends Report]()

Europe Meat Snacks Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Jerky, Meat Sticks, Pickled Sausages, Ham Sausage, Pickled Poultry Meat), By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-1-68038-450-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Meat Snacks Market Size & Trends

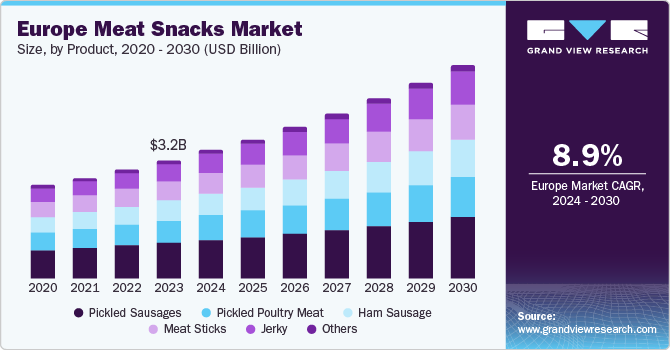

The Europe meat snacks market size was valued at USD 3.17 billion in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. Growing consumer awareness and demand for nutritional ingredients, coupled with major regional manufacturers' extensive marketing and branding efforts, is expected to propel market growth.

Moreover, an increasing emphasis on elevating protein intake among millennials is anticipated to be a major industry driver, as the young generation perceives meat snacks as a healthier alternative to the existing range of products. Additionally, working professionals' busy lifestyles and hectic schedules have driven a preference for convenient and healthy food options. Innovative product offerings by manufacturers to this consumer base are expected to drive substantial demand for meat snacks, leading to market growth.

The fitness market in Europe has substantially expanded in the post-pandemic period through an increase in the number of new memberships in gyms and fitness clubs. Increased health consciousness among the older demographics has led to adopting healthy lifestyles, fitness, and good diet practices. Meanwhile, the younger population has become increasingly health-conscious, and the economies of Sweden, Norway, Denmark, and Switzerland lead this. As a result, manufacturers are responding with innovative meat snacks that are lower in fat and calories and contain higher amounts of protein. With a variety of flavors and tastes available in these offerings, meat snacks have become a more preferred option over conventional junk food among consumers. Thus, an increasing focus on healthier snacking habits is expected to fuel market expansion in this region.

Rising disposable income levels among European citizens have enabled consumers to spend more on premium and convenience food options. High-priced meat snacks are perceived as offering greater nutritional value with good taste. Anticipating the growth potential of this market, an increasing number of major European meat snack manufacturers are acquiring smaller regional businesses to expand their reach. For instance, in May 2023, Danish Crown announced that its subsidiary DAT-Schaub had completed the acquisition of two Dutch companies, SELO Verpakking, and SELO Belgium, which specialize in the sales of artificial casings for sausage. With this strategic move, the company has expanded its market presence in the Benelux (Belgium, Netherlands, and Luxembourg) region. Such initiatives are expected further to boost the frequency of activities in this market.

Product Insights

Pickled sausages led the market with a revenue share of 29.5% in 2023. This high share can be attributed to pickled sausage's unique characteristics and flavor. These snacks represent a distinct category within the meat snacks segment, achieved through the specialized preservation and flavoring technique of pickling. The process involves marinating sausages in a brine solution, typically composed of vinegar, salt, and spices. It infuses the meat with a characteristically tangy and spicy flavor. Beyond enriching the taste experience, pickling serves the crucial purpose of extending the product's shelf life. It translates to a convenient and enduring snacking option for consumers in Europe.

Jerky is expected to register the fastest CAGR over the forecast period. The high demand for jerky is fueled by its perceived health benefits, such as high protein content, low fat, and minimal processing requirements. Additionally, the versatility of jerky products, available in various flavors and textures, has catered to the needs of European consumers seeking diverse and exciting snack experiences. The growing trend of fitness and wellness, particularly among younger demographics in the region, has further driven the demand for jerky as a post-workout snack or energy booster. Athletes, such as weightlifters and runners, are notable consumers of this meat snack, as it is a rich source of protein. These factors have led to growing demand for jerky in Europe.

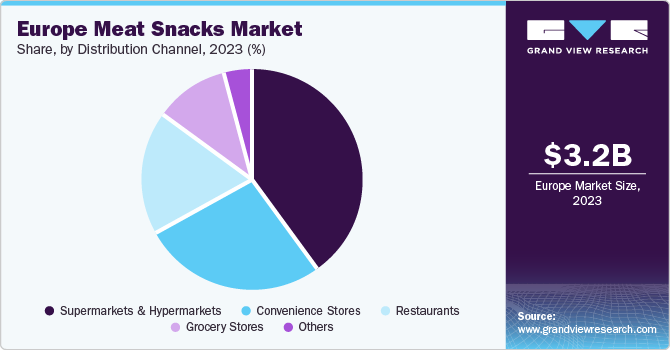

Distribution Channel Insights

Supermarkets and hypermarkets accounted for a leading market share in 2023. It is owing to the extensive presence of supermarket retail chains across Europe. For instance, Schwarz Group (Germany), Tesco (UK), and Carrefour (France) are some major names in the regional retail chain business. These stores offer a variety of meat snacks catering to diverse consumer preferences. Additionally, the one-stop shopping experience simplifies the buying process for busy consumers seeking convenient snacking options. These retail chains leverage promotional strategies such as discounts and bundled offerings to drive sales of meat snacks. Attractive shelf placement and dedicated snack sections enhance product visibility and encourage impulse purchases.

Restaurants are anticipated to record a significant growth rate during the forecast period, owing to the presence of a vast network of restaurant chains across Europe. Restaurants are considered a vital distribution channel for meat snack manufacturers, as European consumers increasingly prefer snacking outside than indoors. They offer the convenience of healthy snacking along with the versatility of menus and customization, catering to individual needs and preferences for busy consumers with hectic lifestyles. With rising disposable income and a lack of time available for cooking, this segment is expected to continue its promising growth in the European meat snacks market.

Country Insights

Germany Meat Snacks Market Trends

Germany meat snacks market accounted for a substantial revenue share in the European region in 2023. With a large population and high disposable income, Germany is expected to remain a lucrative market for this industry. The rise in awareness about plant-based meat, availability of a variety of flavors and snack types, and demand for healthy meat snacks over chemically processed unhealthy meat is expected to propel growth further. In addition, the emergence of new players from domestic and international markets is expected to cater to German consumers' tastes and nutritional requirements, providing them with a range of products to choose from.

UK Meat Snacks Market Trends

The UK meat snacks market is expected to grow in the coming years. It is attributed to the increasing popularity of meat snacks and growing consumer awareness about healthy eating habits. Furthermore, rising fitness consciousness and a growing tendency to avoid junk food have further fueled market growth. As a result, new players are trying to launch their brands in the country to profit from this trend. For instance, in March 2024, the popular UK-based YouTube group 'Sidemen' collaborated with New World Foods (a part of Valeo Foods Group) to launch a high-protein and low-calorie meat snack brand called 'Sides.' They launched this line with three meat snacks - Buffalo Chicken, Korean BBQ Steak Strips, and Chipotle Steak Strips - exclusively across 1,000 One Stops and 3,000 Tescos.

Key Europe Meat Snacks Company Insights

Some key companies involved in the Europe meat snacks market include Meatsnacks Group, Cremonini S.p.A., and Jack Links EU, among others.

-

Meatsnacks Group is the UK's largest producer of jerky and biltong. It is known for producing the UK's first salmon jerky. Its notable brands include Texas Joe's, Wild West, KRAVE, Cruga Biltong, and Men's Health. With a variety of spices and flavors, MeatSnacks Group offers products catering to the needs of consumers across all categories.

-

Cremonini S.p. A. is the first private organization in Europe to develop beef and meat-based transformed products. Its products range from hamburgers to canned meat. Chef Express S.p.A. manages all of Cremonini's catering activities and provides catering services to airports, train stations, motorways, and hospitals.

Key Europe Meat Snacks Companies:

- Meatsnacks Group

- Cremonini S.p.A.

- Jack Links EU

- kingselitesnacks

- Danish Crown

- Kerry Group plc

- Campofrio Food Group

- Espuña

- Giuseppe Citterio S.p.A.

- Bell Food Group AG

Recent Developments

-

In April 2024, Kanematsu (Japan) entered into a partnership agreement with the Danish Crown (Denmark) to distribute sustainable pork products in Japan. Kanematsu's distribution channel will promote a sustainable meat supply chain with Danish Crown and its client companies to address the requirements of increasingly sustainability-conscious Japanese consumers.

-

In December 2023, IVS Group acquired the remaining 50% stake in Time Vending S.r.l., owned by Chef Express S.p.A. (Cremonini S.p.A.). IVS Group is developing automatic and semi-automatic vending machines to supply hot and cold drinks and snacks.

Europe Meat Snacks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.44 billion

Revenue forecast in 2030

USD 5.73 billion

Growth Rate

CAGR of 8.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, distribution channel, country

Country scope

Germany; UK; France; Italy; Switzerland; Austria; Spain; Benelux; Russia; Turkey

Key companies profiled

Meatsnacks Group; Cremonini S.p.A.; Jack Links EU; kingselitesnacks; Danish Crown; Kerry Group plc; Campofrio Food Group; Espuña; Giuseppe Citterio S.p.A.; Bell Food Group AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Meat Snacks Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe meat snacks market report based on product, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Jerky

-

Meat Sticks

-

Pickled Sausages

-

Ham Sausage

-

Pickled Poultry Meat

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Convenience Stores

-

Supermarkets & Hypermarkets

-

Grocery Stores

-

Restaurants

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Switzerland

-

Austria

-

Spain

-

Benelux

-

Russia

-

Turkey

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.