Europe MDI-based PU Technical Insulation Market Size, Share & Trends Analysis Report By Product (Discontinuous Panels, Furniture Rigid Foam, Display Cases), By Application, By End Use, By Country, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-493-5

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

Report Overview

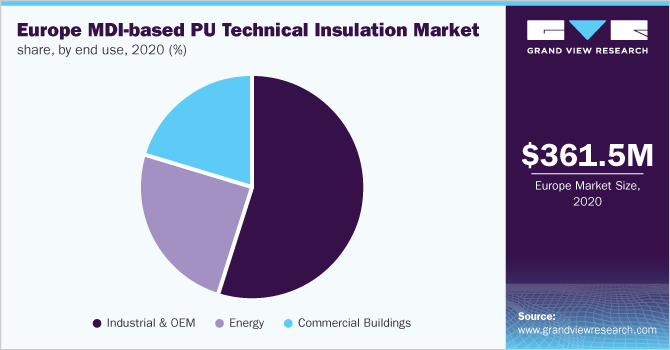

The Europe MDI-based PU technical insulation market size was estimated at USD 361.5 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.1% from 2021 to 2028. Rising investments towards the development of the cold chain sector have led to an increased usage of large-level refrigeration systems, thus driving the demand for MDI-based PU technical insulation over the forecast period. Europe was one of the worst-hit regions due to the pandemic in 2020, leading to the temporary closure of number of industrial projects, including the construction of new power generation plants and commercial buildings. The industry suffered a major setback, owing to the lack of product demand on account of delayed maintenance activities from the industrial sector.

Key raw materials including MDI and polyols are derived from crude oil. The pandemic also led to a sharp decline in crude oil prices, owing to a lack of demand. However, with the reopening of operations, crude oil prices witnessed a sudden jump in prices. This is expected to result in an increase in raw material prices, thereby leading to a short-term spike in product prices.

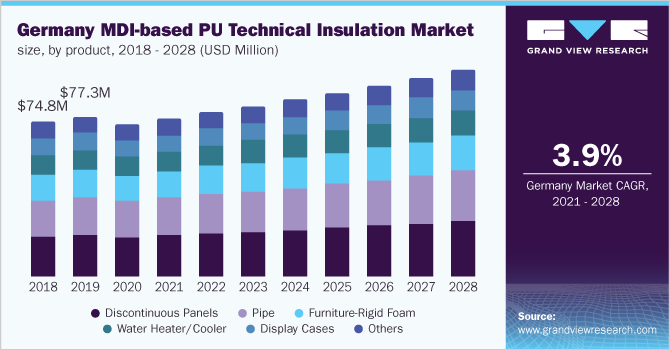

In Germany, the market for MDI-based PU technical insulation is expected to witness significant growth at a rate of 3.9% over the forecast period, owing to the significant product demand from the commercial construction sector in Germany. Commercial construction is presumed to observe a strong growth fueled by rising per capita income, low-interest rates, and a rising number of immigrants.

An increase in the power and energy consumption in Germany, Russia, Italy, U.K., and Belgium is expected to open new growth avenues in the market for MDI-based PU technical insulation. This can be attributed to factors such as increasing population, rise in the number of industrial facilities and commercial offices and buildings, and improvement in the healthcare sector.

Key manufacturers adopt backward integration strategies, such as collaborations with raw material suppliers to assert control over the quality of materials for enhanced strength of technical insulation materials. This helps them lower their transportation costs. Manufacturers offer customization options to industrial customers, as per long-term supply agreements, thus increasing the productivity.

Product Insights

Discontinuous panels led the market for MDI-based PU technical insulation and accounted for about 24% share of the revenue in 2020. This is attributed to wide product applications in cold storage formation and tank production coupled with growing demand from the construction industry. Durability and thermal characteristics offered by the product are further anticipated to ascend its penetration in construction applications.

Easy case formation, durability, and lightweight characteristics are expected to promote the use of display cases for various applications. In addition, the increasing consumer preferences towards products with specified information and advertisement is expected to increase the adoption of display cases by the industry players.

Pipe insulation products are expected to grow at a CAGR of 2.8% in terms of volume over the forecast period, on account of their high tensile strength, elongation values, abrasion and tear resistance, and low compression set. Moreover, resistance to several weather conditions is expected to create a wide scope for PU pipes in industrial applications.

The MDI-based PU insulation is used in products that have a characteristic of resistance to hot and cold temperatures, along with the capability to store them at the desired temperature. Thus, are accepted in the formation of water heater and cooler units. Increasing prominence for energy-efficient operations in industrial facilities is expected to adopt storage of water at desired temperatures.

Application Insights

The heating and plumbing application segment dominated the market for MDI-based PU technical insulation and accounted for the largest revenue share of 42.0% in 2020. This growth can be attributed to the wide usage of PU pipes in heat processing and chemical flow operations utilized for heating and plumbing application. In addition, PU sheets are widely used in tank assembly to store heated liquid items in industrial operations.

Rapid urbanization and a rise in demand for energy-efficient units are prominent factors driving the demand for HVAC installation. Several governments across the globe are promoting energy-efficient heating, ventilation, and air conditioning systems by offering incentives and rebates. This is likely to support industry growth in the upcoming future.

The growing importance of sound barriers in a work environment in light of reducing noise levels is likely to support the product demand in commercial constructions. Moreover, superior thermal resistance, fireproof properties, acoustic padding, and easy installation are the factors supporting product demand in commercial applications.

The refrigeration application segment is expected to witness significant growth over the projected time owing to rising demand for food and beverage storage facilities across the globe. Increasing consumption of preserved and packaged food products coupled with growing disposable income and increasing standard of living are the major factors driving the demand for refrigeration in the chain

End-use Insights

The industrial and OEM end-use segment dominated the market for MDI-based PU technical insulation and accounted for the largest revenue share of around 55.0% in 2020, owing to growing industrial operations in power generation plants, petrochemical refineries, EIP industries, gas transportation/storage. The demand for natural and petroleum gas across the globe has led to the establishment of an extensive storage and transportation infrastructure, leading to growth in product demand

The OEM industries are widely accepting technical insulation products to provide safety at the workplace. Insulation system provides long-term and immediate benefits, including protection of equipment, personnel, and system. It also provided enhanced efficiency of the machinery and process performance in the system, which results in a reduction in manufacturing and energy costs.

Growing concerns regarding energy management among the power generation industry across the globe are expected to drive industry growth over the forecast period. The increasing need for maintaining the chemical and mechanical properties of industrial products at high temperatures is likely to ascend the product demand in the energy sector.

Increasing commercial constructions for cold storage facilities and closed environment units for food and beverage and medical and pharmaceutical industries are expected to upscale the demand for technical insulation in commercial buildings. Government reforms to develop cold chains to make provision for COVID-19 vaccine storage are further expected to increase the demand for technical insulation products.

Regional Insights

Germany dominated the market for MDI-based PU technical insulation and accounted for the largest revenue share of around 20.0% in 2020. This growth is owing to various government initiatives to support industrial growth, coupled with growing demand from automobiles, aerospace, and machinery manufacturing. In addition, increasing consumer confidence and high investments by prominent construction companies are expected to trigger the product demand over the forecast period.

The government of the U.K. has launched various energy-efficiency regulations and initiatives, including Energy Company Obligation (ECO), to reduce the overall carbon emission, which, in turn, is projected to propel the product demand. Moreover, growing industrial production and development of facilities coupled with commercial construction industry growth in the country is likely to offer growth prospects to the industry.

Growing environmental concerns coupled with stringent energy-efficiency requirement regulations by the French government, including RT2012 and RT2020, are likely to boost the product demand owing to its ability to increase the energy efficiency of a structure. The government implemented its Energy Transition Act in August 2015 which is likely to support the industry growth.

The growth of the oil and gas industry in Italy is expected to warrant an increase in the use of insulation products, in turn, boosting the industry growth over the forecast period. In addition, the development of the oil downstream products manufacturing industry in the country is expected to propel the growth of the market for MDI-based PU technical insulation over the forecast period.

Key Companies & Market Share Insights

Significant presence through sales location and distribution is beneficial for the companies to enhance their overall positioning in the market for MDI-based PU technical insulation. A strong distribution network strengthens the company's position as it avails timely supply of the products offering desired customer satisfaction.

The market players aim to have a wider customer base spanning across the categories through collaboration, partnership with the distributors, or other supply chain elements such as construction project contractors, thereby having better penetration. Market players focus on distributing and expanding their production facilities to meet future demand from various applications. Some of the prominent players in the Europe MDI-based PU technical insulation market include:

-

Rockwool Insulation A/S

-

Owens Corning

-

Huntsman International LLC

-

Compagnie de Saint-Gobain S.A.

-

Knauf Insulation

-

Kingspan Group

-

NMC SA

-

SIG plc

-

Winco Technologies

-

Recticel Group

-

BRUGG GROUP AG

Europe MDI-based PU Technical Insulation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2021 |

USD 372.7 million |

|

Revenue forecast in 2028 |

USD 462.9 million |

|

Growth Rate |

CAGR of 3.1% from 2021 to 2028 |

|

Base year for estimation |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Volume in Kilotons; Revenue in USD million, and CAGR from 2021 to 2028 |

|

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end use, country |

|

Regional scope |

Europe |

|

Country scope |

U.K.; Germany; France; Spain; Italy; Poland |

|

Key companies profiled |

Rockwool Insulation A/S; Owens Corning; Huntsman International LLC; Compagnie de Saint-Gobain S.A.; Knauf Insulation; Kingspan Group; NMC SA; SIG plc; Winco Technologies; Recticel Group; BRUGG GROUP AG |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the Europe MDI-based PU technical insulation market report on the basis of product, application, end use, and country:

-

Product Outlook (Volume, Kiloton; Revenue, USD Million, 2017 - 2028)

-

Discontinuous Panels

-

Display Cases

-

Furniture Rigid Foam

-

Pipe

-

Water Heater/Cooler

-

Others

-

-

Application Outlook (Volume, Kiloton; Revenue, USD Million, 2017 - 2028)

-

Heating & Plumbing

-

HVAC

-

Acoustic

-

Refrigeration

-

-

End-use Outlook (Volume, Kiloton; Revenue, USD Million, 2017 - 2028)

-

Industrial & OEM

-

Energy

-

Commercial Buildings

-

-

Country Outlook (Volume, Kiloton; Revenue, USD Million, 2017 - 2028)

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Poland

-

Frequently Asked Questions About This Report

b. Europe MDI-based PU technical insulation market size was estimated at USD 361.5 million in 2020 and is expected to reach USD 372.7 million in 2021.

b. Europe MDI-based PU technical insulation market is expected to grow at a compound annual growth rate of 3.1% from 2021 to 2028 to reach USD 462.9 million by 2028.

b. Discontinuous panels led the Europe MDI-based PU technical insulation market and accounted for about 24% share of the revenue in 2020. This is attributed to wide product applications in cold storage formation and tank production coupled with growing demand from the construction industry.

b. Some of the key players operating in the Europe MDI-based PU technical insulation market include Rockwool Insulation A/S, Owens Corning, Huntsman International LLC, Compagnie de Saint-Gobain S.A., Knauf Insulation, Kingspan Group, NMC SA, SIG plc, Winco Technologies, Recticel Group, and BRUGG GROUP AG.

b. The key factors that are driving the Europe MDI-based PU technical insulation market include increasing power and energy requirements in the UK, Germany, Italy, Belgium, and France, coupled with rising investments towards the development of the cold chain sector leading to an increased usage of large level refrigeration systems.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."