- Home

- »

- Digital Media

- »

-

Europe Marketing Technology (MarTech) Market, Report, 2030GVR Report cover

![Europe Marketing Technology (MarTech) Market Size, Share & Trends Report]()

Europe Marketing Technology (MarTech) Market (2024 - 2030) Size, Share & Trends Analysis Report By Country, By Product, By Type, By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-320-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

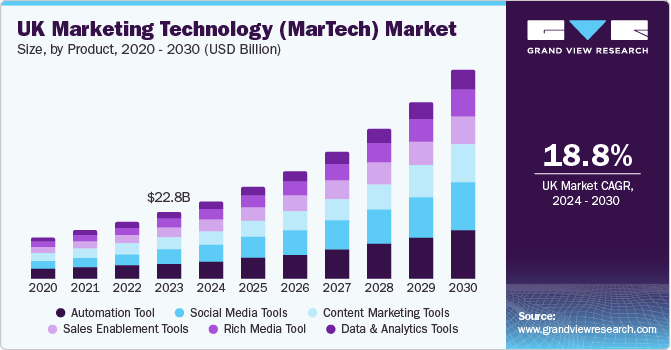

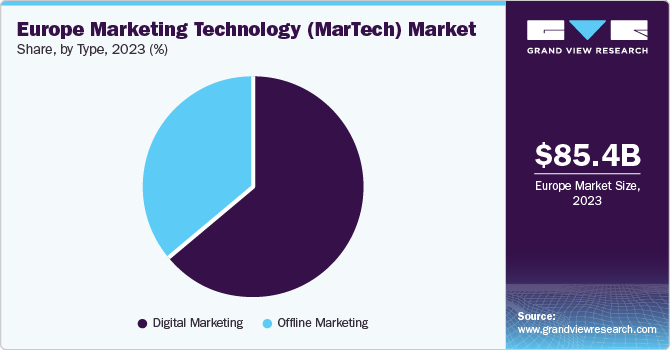

The Europe marketing technology (MarTech) market size was estimated at USD 85.37 billion in 2023 and is projected to grow at a CAGR of 18.8% from 2024 to 2030. The Europe MarTech market is expected to grow rapidly due to various factors, such as the rising adoption of digital marketing tactics, growing requests for tailored marketing approaches, and a strong focus on data-centric decision-making. Businesses are utilizing MarTech resources to enhance customer interactions, boost campaign performance, and achieve better returns on investment by leveraging data analytics and automation.

The surge in mobile marketing, social media platforms, and online commerce has fueled the demand for sophisticated MarTech solutions capable of seamless integration across diverse channels and delivering instant analytics, solidifying MarTech's pivotal role in contemporary marketing strategies across Europe.

Europe marketing technology market is driven by digital transformation, leading to adoption of marketing technologies to enhance customer engagement and improve operational efficiency. Demand for personalization drives the adoption of marketing technologies that enable companies to gather, analyze and utilize customer data to deliver tailored offerings. In March 2024 Adobe released Adobe Express, a mobile application integrating firefly generative AI and new mobile editing capabilities, which helps to generate creative content such as social media posts/posters. Creators can rapidly produce content with social media marketing teams for brand packaging for seamless partnership.

Artificial intelligence and automation technologies such as advanced analytics, predictive modeling and personalized content creation are driving the adoption of marketing technologies. Enhancing customer experience has become a priority to gain more competitive advantage. There is a growing demand for marketing technologies that enable seamless interactions, customer journey mapping and sentimental analysis.

Meta introduced updates to its Advantage+ and Shopping Ads, aimed at enhancing brand engagement, driving conversions, and delivering more personalized advertisements. These updates are designed to instil confidence in consumers, encouraging them to make purchases after viewing ads. The platform's advancements include features such as ad-level scheduling, budget scheduling, value optimization, cost per result & ROAS goal settings, custom events optimization, and creative asset enhancements. These updates empower advertisers to optimize their campaigns efficiently, target specific audiences based on behaviors and interests, and enhance ad performance through automation and AI-driven strategies.

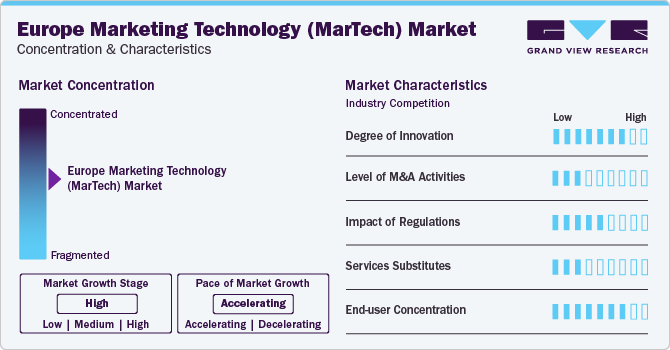

Market Concentration & Characteristics

The industry growth stage is currently high and the pace of market growth is accelerating. This market is characterized by a high level of innovation driven by continuous advancements in the software and the solutions. The rapid evolution of technology, combined with growing demand across various industries, creates a dynamic environment. The constant drive for innovation, fueled by emerging applications and enhanced user experiences, defines this market as highly innovative.

The implementation of regulations such as the General Data Protection Regulation (GDPR) in Europe has significantly impacted the Marketing Technology (MarTech) market by necessitating strict data handling practices, transparency, and user consent in data collection and processing. This shift has led to a more consumer-centric approach within the MarTech industry, prompting companies to invest in innovative solutions for data security, consent management, and privacy-enhancing technologies. While initially posing challenges, GDPR compliance has ultimately fostered a culture of trust and accountability, benefiting both consumers and businesses by prioritizing individual privacy rights and ethical data usage in marketing strategies.

The trend toward digital marketing has witnessed a notable rise in the adoption of Software as a Service (SaaS) platforms and automation tools, which are gradually replacing traditional marketing services. This shift is driven by several factors, including the need for more efficient and cost-effective marketing strategies, the increasing complexity of digital marketing channels, and the demand for real-time analytics and performance tracking. Businesses across various sectors and industries are embracing these technologies to streamline their marketing efforts, enhance customer engagement, and achieve better ROI.

In September 20c23, Microsoft expanded the availability of its Copilot AI tool to more advertisers, allowing them to leverage AI-generated recommendations for creating assets like product images, headlines, and descriptions. This enhancement aims to simplify asset creation, save time, and inspire better-quality materials for marketing campaigns. By integrating Copilot into the Microsoft Advertising Platform, users can efficiently generate content tailored to their needs, enhancing productivity and creativity in ad creation processes.

The end-use concentration of SaaS platforms and automation tools varies significantly across different segments, including small businesses, enterprises, and marketing agencies. While some companies specialize in catering to specific niches within these segments, offering tailored solutions to address unique challenges, others target a broader customer base by providing comprehensive marketing automation suites. This diversification in offerings reflects the evolving landscape of digital marketing, where businesses of all sizes seek innovative tools and platforms to stay competitive and drive growth in an increasingly digital-driven marketplace.

Product Insights

Based on product, social media tools held the largest market share of 23.3% % in 2023. Social media tools offer a cost-effective solution compared to other marketing tools. Integrating social media tools with marketing technology can lead to the development of highly effective marketing campaigns. For instance, combining social media management tools with marketing automation platforms enables the creation of personalized and targeted campaigns. These integrated tools provide extensive data that can be leveraged to enhance the effectiveness of campaigns. In addition, the utilization of AI-powered Chatbots on social media platforms is on the rise, serving to deliver personalized customer service, interact with audiences, and boost conversion rates.

In January 2024, Adobe announced a new audio experience in Premiere Pro, which helps in faster editing with ease. AI-powered audio technology automatically detects and tags audio clips with dialogue, music, sound effects or ambient noise icons, giving editors quick access to the relevant tools for each audio content. This feature streamlines the editing process by making it easier to identify and organize different audio elements within a project, improving efficiency and workflow for content creators.

Sales enablement tools is expected to grow at the fastest CAGR over the forecast period due the adoption of sales enablement tools to streamline sales operations, enhance sales readiness, and provide valuable insights to ensure consistency among sales representatives.

Type Insights

The digital marketing segment held the largest market share in 2023. The rapid shift towards digitalization has revolutionized business operations and the implementation of business strategies. Digital marketing has emerged as a valuable asset for firms to engage with diverse stakeholders across multiple platforms like email, instant messaging, and social media.

Offline marketing is expected to grow at the fastest CAGR over the forecast period. This encompasses strategies such as print ads, billboards, direct mail, trade shows, and sponsorships. Such methods enable businesses to expand their reach and enhance brand recognition. For instance, billboards or print ads in local newspapers can boost visibility among individuals who are not frequently online. In addition, offline marketing facilitates direct interaction with customers, such as at trade shows or community gatherings, fostering relationships and driving lead generation.

Application Insights

Based on applications, the healthcare segment held the largest market share in 2023. The expansion of the segment is driven by the increasing adoption of chatbots within the healthcare industry. Within medical facilities, chatbots are employed to gather details on accredited physicians, their availability, pharmacy operating hours, and clinic locations. Patients utilize chatbots to articulate their health concerns, locate suitable healthcare providers, identify available appointment slots, and schedule or reschedule appointments efficiently. Moreover, chatbots seamlessly integrate with users' device calendars to offer timely reminders and updates regarding medical appointments.

Retail and e commerce is expected to grow at the fastest CAGR over the forecast period. Marketing technology is used to customize the shopping journey for customers. For instance, e-commerce businesses utilize data analytics software to monitor customer interactions and preferences, leveraging this information to provide tailored product suggestions and personalized promotions.

Country Insights

Germany held the largest market share in 2023. Germany's strong presence in the marketing technology sector is further underscored by its significant investment in digital solutions and its strategic focus on measuring advertising performance. In addition, Germany's robust economy, with a large number of IT companies and a thriving software sector contributes to its leading position in the European marketing technology.

France is expected to grow at the fastest CAGR over the forecast period. The French market's rapid advancement in marketing technology is driven by various factors, including a dynamic startup culture and the presence of prominent tech companies such as Dassault Systemes, BlaBlaCar, Criteo, OVH, and Deezer. Paris, as the largest tech hub in France, serves as a hub for technological innovation and entrepreneurial endeavors within the marketing technology sector. Also, France's robust growth in marketing technology is indicative of its strategic focus on leveraging digital solutions to enhance marketing strategies and drive business success.

Key Europe Marketing Technology (MarTech) Company Insights

Some of the key companies operating in the Europe Marketing Technology (MarTech) market are Google LLC, Microsoft Corporation, Adobe, Inc., Amazon Web Services, Inc. (Amazon.com, Inc.), Amdocs Limited, Apple, Inc.

Google LLC offers a comprehensive suite of marketing technology products that cater to various advertising needs. Google Ads, the company's online advertising platform, allows businesses to bid for displaying brief advertisements, service offerings, and product listings across Google's properties like search engines, mobile apps, videos, and non-search websites. AdMob serves as a mobile advertising network, while Google AdSense provides a contextual advertising program for web publishers. Google Ad Manager functions as an advertisement exchange platform, facilitating ad placements efficiently. The Google Marketing Platform integrates online advertising and analytics tools to enhance marketing strategies effectively.

Key Europe Marketing Technology (MarTech) Companies:

- Adobe, Inc.

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Amdocs Limited

- Apple, Inc.

- Buzzoole (Buzzoole Holdings Limited)

- FullCircl Ltd.

- Google LLC (Alphabet Inc.)

- Microsoft Corporation

- Oracle Corporation

- SAP SE

Recent Developments

-

In May 2023 Google Marketing Platform introduced a new API with enhanced capabilities, aiming to provide advertisers with improved tools for creating and managing ads. This update includes features that enable advertisers to optimize engagement, drive conversions, and deliver more personalized advertisements. By leveraging this new API, advertisers can access advanced functionalities that enhance their ability to tailor ads to specific audiences and improve overall campaign performance. The platform's goal is to empower brands to create more effective and targeted marketing strategies that resonate with consumers, ultimately boosting confidence and encouraging purchase decisions after viewing ads.

-

In February 2024 HubSpot's released innovative features such as advanced forecasting with AI, new integrations. These updates are aimed at streamlining operations, enhancing service tools, and revolutionizing digital marketing strategies. The introduction of AI-infused forecasting tools and enhanced service capabilities is set to empower users to create more personalized and effective marketing campaigns. Additionally, the updates aim to improve user experience by providing advanced functionalities that cater to the evolving needs of marketers and businesses in digital landscape.

-

In February 2023, Omnicom Media Group introduced TRKKN in UK. TRKKN, a Google platform-focused analytics, advertising tech, and cloud consultancy, is part of Omnicom's strategic move to meet the evolving demands of clients in the media landscape, offers consulting and managed services across the Google tech stack, specializing in artificial intelligence, machine learning, automation, and privacy solutions built on Google Cloud.

Europe Marketing Technology (MarTech) Report Scope

Report Attribute

Details

Market size value in 2023

USD 85.37 billion

Revenue forecast in 2030

USD 285.5 billion

Growth rate

CAGR of 18.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018- 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Country, product, type, application

Regional scope

Europe

Key companies profiled

Adobe, Inc.; Amazon Web Services, Inc. (Amazon.com, Inc.); Amdocs Limited; Apple Inc.; Buzzoole (Buzzoole Holdings Limited); FullCircl Ltd.; Google LLC (Alphabet Inc.); Microsoft Corporation; Oracle Corporation; SAP SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Marketing Technology Market Report Segmentation

This report forecasts revenue growth at region and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe Marketing Technology (MarTech) market report based on, product, type and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Social media tools

-

Content marketing tools

-

Rich media tool

-

Automation tool

-

Data & analytics tools

-

Sales enablement tools

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital marketing

-

Offline marketing

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecommunication

-

Retail & e-commerce

-

Healthcare

-

Media & entertainment

-

Sports & events

-

BFSI

-

Real Estate

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Frequently Asked Questions About This Report

b. The Europe marketing technology market size was estimated at USD 85.37 billion in 2023 and is expected to reach USD5 101.23 billion in 2024

b. The Europe marketing technology market is expected to grow at a compound annual growth rate of 18.8% from 2024 to 2030 to reach USD 285.51 billion by 2030

b. Based on product, social media tools held the highest market share of 23.3% in 2023. Social media tools offer a cost-effective solution compared to other marketing tools. Integrating social media tools with marketing technology can lead to the development of highly effective marketing campaigns.

b. Some key players operating in the Europe MarTech market include Adobe, Inc., Amazon Web Services, Inc. (Amazon.com, Inc.), Amdocs Limited, Apple Inc. (Alphabet Inc.), Buzzoole (Buzzoole Holdings Limited), FullCircl Ltd., Google LLC, , Microsoft Corporation, Oracle Corporation, SAP SE

b. The Europe marketing technology market experiences significant growth due to various factors, such as the rising adoption of digital marketing tactics, growing requests for tailored marketing approaches, and a strong focus on data-centric decision-making.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.