- Home

- »

- Beauty & Personal Care

- »

-

Europe Luxury Hair Care Market Size, Industry Report, 2030GVR Report cover

![Europe Luxury Hair Care Market Size, Share & Trends Report]()

Europe Luxury Hair Care Market Size, Share & Trends Analysis Report By Product (Shampoos, Conditioners), By Price Range (USD 30 To USD 65, USD 65 To USD 100), By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-232-3

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Europe Luxury Hair Care Market Trends

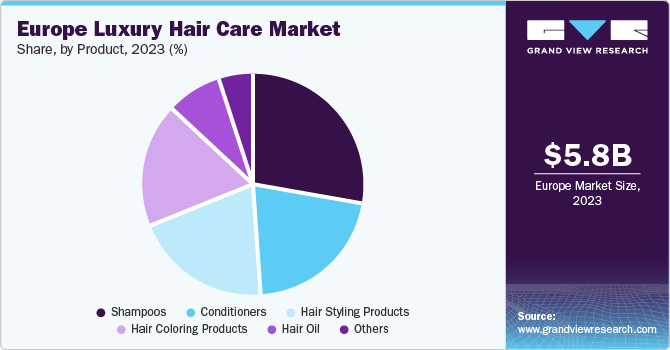

The Europe luxury hair care market size was estimated at USD 5.80 billion in 2023 and it is projected to grow at CAGR of 9.1% from 2024 to 2030. Young customers, social media influences, running trends in beauty industry, changing patterns of purchases, overall impact of external drivers such as branding and ambassadors primarily drive this premium price-range market. In Europe, these products are effectively distributed through beauty salons and by hair care experts.

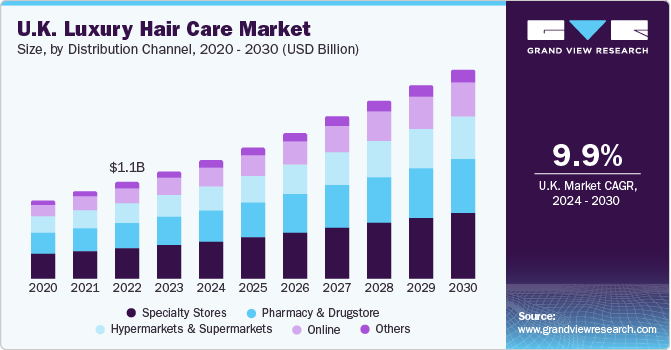

The UK market accounted for a share of 5.81% of the global luxury hair care market in 2023. This market is constantly changing on the basis of demands and interests of consumers. The luxury hair care treatments, products used in this are developed according to needs and wants of customers, which are usually identified by surveys, and analysis of historical data regarding consumption. Based on the interpretation of the available data, manufacturers decide upon several factors such as ingredients used in the making, packaging strategies, distribution strategies and more.

Increased accessibility of contextual data has played vital role in enhancing strategic positioning of the product portfolios. These products are sold through various channels such as salons, supermarkets & hypermarkets, pharmacies and more. These places are easily accessible for users. In addition, the increased awareness regarding the personal hygiene, growing trend to put in conscious effort towards hair care, extensive range of portfolios offered by the companies are some of the key factors in generating projected growth for the luxury hair care market in Europe.

The market is poised with numerous opportunities as the products and services associated with the industry are constantly getting overwhelming demand from the young customers. Use as well as exclusion of certain ingredients influence purchase decisions in this market. For instance, “no ammonia” is one of the key features used by many companies that sell hair colours and hair colour creams. Increasing preferences towards sustainably developed products is also playing significant role in the industry.

Market Concentration & Characterization

The European luxury hair care industry is growing at accelerating pace and growth stage is identified as high. This industry is characterized by the presence of market leaders, innovators and other key companies, which have been in the business for many years. In addition, existence of new entrants and the companies that are entering the market through mergers and acquisitions is developing extremely competitive scenario in the industry.

In addition, the industry is characterized by the presence of influencers who often belong to backgrounds where these products are used for their businesses, such as salons. These influencers are from places such as as salon, beauty and care centres, skin care clinics, and others. They tend to prescribe and recommend products to consumers and play important role in many purchase decisions.

Degree of innovation is high in the industry. Innovation is primarily driven by manufacturer’s effort to attain product differentiation as the industry is filled with large number of companies who operate in cosmetics and hair care. These innovations are often related to ingredients, packaging, colours, size of packs, distribution strategies, advertising strategies, and advanced contents of the products. The innovation helps companies to develop competitive edge over others. For instance, new products launched in the market in June 2023 include the Repair Bond + Rescuplex collection, which includes shampoo, conditioner, leave-in treatment, and hair mask by Marc Anthony, and Lush & Coily collection by Suave.

The level of M&A (mergers & acquisitions) is moderate in the industry. Often multinational companies acquire other organisations to extend their product portfolio or enhance their presence in particular segment of the industry. In addition, to enter new regional market, acquisition is one of the commonly adopted strategic move by numerous companies. These deals are well discussed and finalised on the basis of clauses as well as costs proposed by both parties. Furthermore, the companies acquire manufacturing plants and production units of other companies in some case. The technology exchange and collective effort for innovation is also one of the key motives behind these strategies.

Threat of substitutes is at medium level. The primary threat for this industry is counterfeit goods that are been distributed in the market. Impact of regulations is also at moderate level. The food & drug as well as consumer product authorities of the region provide certain regulations for the industry including for manufacturing processes, clear labelling, use and exclusion of certain elements, advertisements and more.

Distribution Channel Insights

Luxury hair care product sales through specialty stores accounted for a revenue share of 31.3% in 2023. The industry is primarily driven by such specialty stores that offer special range of products coupled with in-person assistance provided by company or store executives. They help customers by understanding their specific need and identifying the suitable products for it out of wide range of products. Owing to increasing number of companies entering this market, it is challenging for customers to choose one product out of multiple alternatives developed and presented as solution for the exact same problem. Such stores are often located in urbanized areas where the working population and students tend to shop.

Online sales are expected to grow at a CAGR of 10.2% from 2024 to 2030. The online shopping experience is private and aided by discount offers as well as doorstep deliveries. These aspects assist the upward trends for the growth and generate greater demands.

Product Insights

Shampoos accounted for a revenue share of 27.9% in 2023. Young consumers who tend to consider hair care treatments as integral part of their personal hygiene routine primarily drive the market. Customers across different groups face multiple hair related problems such as dandruff, scalp issues, dry hair, loss of hair and more. Companies offer solutions for such issues through shampoos and related products. In addition, rising pollution levels across the globe, time spent in road travels are some of the factors, which fuels the increasing demand for the shampoos.

The demand for hair coloring products in the region is projected to grow at CAGR of 10.2% from 2024 to 2030. Increased awareness about ill-effects caused by chemicals used in hair colouring products has resulted in growing demand for organic and natural colours for hair. In addition, in modern world, many manufacturers are developing new products with the help of technology and innovation to replace current portfolios of chemically developed hair colours. Some of the common hair colours preferred by the consumers include Ombre, Blonde, Burgundy, Honey Blonde, Highlights, Brown and others.

Price Range Insights

Luxury hair care products ranging from USD 30 to USD 65 accounted for a share of 39.2% in 2023. The consumers often prefer luxury hair care products offered in this price range for their fragrances or the special ingredients used in them. These products are generally designed for particular problem area such as split ends or strengthening of hair. Consumers usually buy products from this range at hypermarkets, pharmacies and supermarkets as well.

The demand for luxury hair care products ranging from USD 65 to USD 100 is expected to grow at a CAGR of 10.0% from 2024 to 2030. The market is poised with lucrative opportunities as products from this range are often specifically designed for group of customers who perceive hair care as integral part of their lifestyle and tend to spend more on products and services associated with it, on frequent basis. This includes hair sprays and similar products characterised by ingredients such as algae extract, centella asiatica (hydrocotyl) extract, caffeine, rosmarinus officinalis (rosemary) leaf extract and more.

Country Insights

UK Luxury Hair Care Market Trends

The luxury hair care market in the UK accounted for a share of 21% in 2023. Young customers in the UK mainly influence this industry. These customers consider hair care as one of the significant parts of their personal hygiene routine. In addition, hair fall is one of key hair care problems in the country. As per a publication by the Harley Street Hair Transplant Clinics, in the UK, approximately 70% of men experience excessive hair loss and thinning by age 70, while 50% of women experience the same by age 50. Furthermore, the leading market participants have been inventing range of solutions for such problems based on research and development activities coupled by innovation. This add to the increasing revenue for the UK market.

France Luxury Hair Care Market Trends

The luxury hair care market in France is projected to grow at a CAGR of 10.4% from 2024 to 2030. Aspects such as increasing demand for high-end products primarily fuel this industry through enhanced innovation backed by substantial investments. In addition, growing disposable income the country is enabling buyers to prefer luxury hair care products over local brands with similar product range.

Key Europe Luxury Hair Care Company Insights

The market is characterized by some extremely competent key players who have been launching range of luxury care products for Europe market. Strategies such as innovation, new product development, increasing investments in research & development, diverse product portfolios are contributing to the highly competitive market.

Key Europe Luxury Hair Care Companies:

- L’Oréal Groupe

- Coty Inc

- Keraphlex

- The Estée Lauder Companies Inc.

- Procter & Gamble (Ouai)

- PHILIP KINGSLEY PRODUCTS LTD

- ICON Products

- Hair Rituel by Sisley

- LVMH (GUERLAIN)

- Leonor Greyl

Recent Developments

-

In May 2023, Guerlain, a heritage beauty brand owned by LVMH, unveiled its premium hair care line, marking its significant entry into the category since 1970.

-

In June 2023, L'Oréal Professionnel introduced an updated version of its iNOA hair colour. This was pioneering product for the company in no-ammonia hair colour segment of the industry.

Europe Luxury Hair Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.38 billion

Revenue Forecast in 2030

USD 10.78 billion

Growth Rate

CAGR of 9.1% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, distribution channel, price range, country

Regional scope

Europe

Country scope

UK, Germany, France, Italy, Spain

Key companies profiled

L’Oréal Groupe; Coty Inc.; Keraphlex; The Estée Lauder Companies Inc.; Procter & Gamble (Ouai); PHILIP KINGSLEY PRODUCTS LTD; ICON Products; Hair Rituel by Sisley; LVMH (GUERLAIN); Leonor Greyl

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Luxury Hair Care Market Report Segmentation

This report forecasts growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the report based on Europe luxury hair care market in product, distribution channel, and price range:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Shampoos

-

Conditioners

-

Hair Coloring Products

-

Hair Styling Products

-

Hair Oil

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drugstore

-

Specialty Stores

-

Online

-

Others

-

-

Price Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

USD 30 to USD 65

-

USD 65 to USD 100

-

USD 100 to USD 150

-

USD 150 to USD 200

-

Above USD 200

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe luxury hair care market size was estimated at USD 5.80 billion in 2023 and is expected to reach USD 6.38 billion in 2024.

b. The Europe luxury hair care market is expected to grow at a compound annual growth rate of 9.1% from 2024 to 2030 to reach USD 10.78 billion by 2030.

b. The UK dominated the Europe luxury hair care market with a share of 21% in 2023. This is attributable to the growing incidence of hair loss in the country, coupled with the growing demand for hair care products from men.

b. Some key players operating in the Europe luxury hair care market include L’Oréal Groupe, Coty Inc., Keraphlex, The Estée Lauder Companies Inc., Procter & Gamble (Ouai), PHILIP KINGSLEY PRODUCTS LTD, ICON Products, Hair Rituel by Sisley, LVMH (GUERLAIN), and Leonor Greyl.

b. Key factors that are driving the market growth include increasing instances of scalp-related problems, such as hair fall and itchiness, along with the rising consumer awareness of premium and niche hair care products through online platforms, magazines, and TV advertisements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."