- Home

- »

- Advanced Interior Materials

- »

-

Europe Limestone Market Size, Share & Growth Report 2030GVR Report cover

![Europe Limestone Market Size, Share & Trend Report]()

Europe Limestone Market (2025 - 2030 ) Size, Share & Trend Analysis Report By End Use (Construction, Iron & Steel, Agriculture, Chemical, Others), By Country And Segment Forecasts

- Report ID: GVR-4-68040-124-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Limestone Market Size & Trends

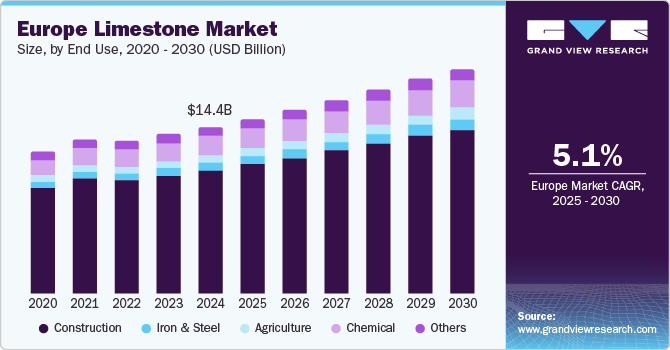

The Europe limestone market size was estimated at USD 14.42 billion in 2024 and is expected to expand at a CAGR of 5.1% from 2025 to 2030. The growth is expected to be favorably impacted by using fertilizers in agriculture to feed the growing population. In addition, the rising demand for green buildings owing to green energy initiatives worldwide is another prominent driver. Governments worldwide have been pushing toward aligning with decarbonization goals per the 2021 Paris Agreement. This has augmented the popularity and construction of aesthetically pleasing buildings with construction materials having a low carbon footprint.

Drivers, Opportunities & Restraints

As per the European Environment Agency, Europe's building stock is characterized by aging, which has implications for the health and well-being of numerous individuals. Approximately 15% of Europeans reside in dwellings with issues like leaky roofs or damp walls, floors, or foundations, while up to 39% of the population lives in buildings with rot in the window frames or floors. This is expected to propel the demand for home renovation and new building construction, which is expected to augment the demand for limestone in the coming years.

The global food crisis is intensifying due to climate change, rapid population growth, water scarcity, and soil degradation. The World Bank’s Global Report on Food Crises 2023 states that over a quarter of a billion people in 58 countries face acute food insecurity and urgently need food assistance. As a result, countries invest in boosting their agricultural production, which demands substantial amounts of high-quality fertilizers. This trend is likely to create new opportunities for limestone manufacturers.

However, stringent laws and regulations regarding the mining sector hinder market growth. The limestone extraction process severely impacts the environment, as mining and further processing lead to air, soil, and water pollution, depletion of natural flora and fauna, degradation of agricultural land, and landscape changes. denudation of forests.

End Use Insights

Limestone is used to produce mortar, construction aggregates, cement, tiles, plaster, and other building materials. Construction and infrastructure demands are high in European countries, largely due to the European Union's ambitious policy agenda since 2008, which sets targets for enhancing energy efficiency, increasing renewable energy, and reducing greenhouse gas emissions.

Crushed limestone and agricultural lime are mainly used to correct the soil's acidity for agricultural purposes. Too much acidic soil can increase plant toxicity and thus reduce crop yield. Limestone reduces erosion and improves drainage. It also acts as a source of calcium ions that are helpful for plant growth. The product is the most effective soil amendment solution for raising pH levels to enhance crop yield, health, and growth.

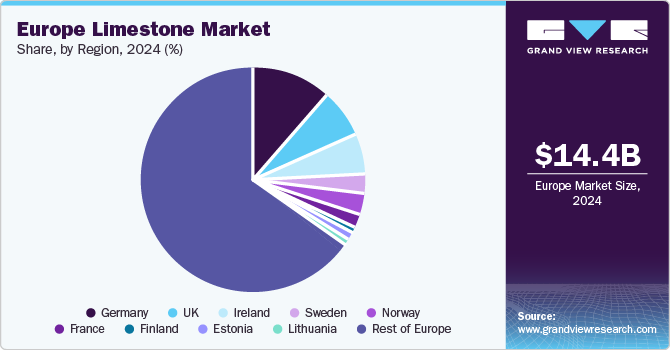

Regional Insights

Germany Limestone Market Trends

The Germany limestone market to witness significant growth, the expansion of residential and non-residential construction sectors is projected to remain a key factor for the growth of limestone demand. The growth of non-residential construction in Germany is fueled by investments from the private sector, which, in turn, directly connects with the country's overall economic growth. Increasing industrial production and significant public investment are projected to positively impact the non-residential construction sector.

France Limestone Market Trends

The France limestone market has witnessed a rise in investments in the wake of the upcoming 2024 Paris Olympics, which has a budget of EUR 3.8 billion (~USD 4.4 billion). The flourishing commercial sector is leading to a rise in the demand for cement and limestone in France. The construction funds have benefited from reconfiguring existing buildings and constructing new structures in France.

Estonia Limestone Market Trends

In Estonia, building permits in the country witnessed a decline of 3.2% in 2022 as compared to 2021. The construction activity is anticipated to be driven by increasing investments in infrastructure projects across the country. Development of projects such as the TERVIKUM Health Center in Viljandi and the Rail Baltic viaducts are anticipated to increase cement consumption, which would correspondingly improve limestone consumption during the forecast period.

Czechia Limestone Market Trends

Funding through the government to improve infrastructure is anticipated to open a window for expanding limestone demand in the country. For example, in July 2023, the European Commission approved a funding scheme for Czechia to support railway siding projects, including renovations, upgrades, and new construction. Such investments are expected to drive demand for limestone over the forecast period.

Key Europe Limestone Company Insights

Some of the key players operating in the limestone market include Nordkalk, CARMUSE, and Graymont.

-

Nordkalk is a producer of lime and limestone products, providing essential lime-based solutions to various sectors, including agriculture, water treatment, flue gas treatment, construction, coatings & adhesives, plastics & rubber, pulp & paper, metals & mining, glass & sugar, and garden among others.

-

CARMEUSE is a multinational mining company that mainly produces limestone and lime, along with a few dolomite offerings. Along with its product offerings, the company also provides engineering services to its customers. The company offers its products & services to iron & steel, non-ferrous, chemical, PCC and pulp & paper, agriculture, water & waste treatment, civil engineering, glass, flute glass, and building materials sectors. It mainly involves extracting and processing lime and dolomite for the aforementioned sectors.

Key Europe Limestone Companies:

- Nordkalk

- CARMEUSE

- Lhoist

- Sibelco

- Ognyanovo-K

- WIG Wietersdorfer Holding GmbH

- Franzefoss Minerals

- Graymont

- Kalkfabrik Netstal AG

- CARRIÈRES DU HAINAUT

Recent Developments

-

In May 2023, Lhoist and Breedon, Tarmac, and Aggregate Industries launched a new project to create a net zero future for the lime and cement industry. The project known as Peak Cluster is located in Peak District, England, and can potentially reduce emissions in the sector to ensure a net-zero and sustainable future for the industry.

-

In April 2022, Lhoist signed a Memorandum of Understanding (MoU) with Air Liquide to decarbonize the lime production plant located in Réty, France. After completing this project, Lhoist will be able to reduce carbon dioxide emissions by 600,000 tons per year by 2028.

Europe Limestone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.12 billion

Revenue forecast in 2030

USD 19.42 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use

Country scope

Germany; UK; Ireland; Sweden; Norway; France; Finland; Estonia; Lithuania; Latvia; Czechia; Poland; Belgium; Spain

Key companies profiled

Nordkalk; CARMEUSE; Lhoist; Sibelco; Ognyanovo-K; WIG Wietersdorfer Holding GmbH; Franzefoss Minerals; Graymont; Kalkfabrik Netstal AG; CARRIÈRES DU HAINAUT

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Limestone Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe limestone market report based on end use and region:

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Iron & Steel

-

Agriculture

-

Chemical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

Ireland

-

Sweden

-

Norway

-

France

-

Finland

-

Estonia

-

Lithuania

-

Latvia

-

Czechia

-

Poland

-

Belgium

-

Spain

-

-

Frequently Asked Questions About This Report

b. Some of the key vendors of the Europe limestone market are Nordkalk, CARMEUSE, Lhoist, Sibelco, Ognyanovo-K, WIG Wietersdorfer Holding GmbH, Franzefoss Minerals, Graymont, Kalkfabrik Netstal AG, and CARRIÈRES DU HAINAUT.

b. Growth of the construction industry and increasing utilization of fertilizers are anticipated to drive the growth of the Europe limestone market over the forecast period.

b. The Europe limestone market size was estimated at USD 14.42 billion in 2024 and is expected to reach USD 15.12 billion in 2025.

b. The Europe limestone market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach USD 19.42 billion by 2030.

b. Based on end use segment, construction held the largest revenue share of more than 73.0% in 2024 .

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.