- Home

- »

- Clothing, Footwear & Accessories

- »

-

Europe Licensed Sports Merchandise Market, Report, 2030GVR Report cover

![Europe Licensed Sports Merchandise Market Size, Share & Trends Report]()

Europe Licensed Sports Merchandise Market Size, Share & Trends Analysis Report By Sport (Football, Rugby, Formula 1, Basketball, Cricket), By Product (Sports Apparel, Sports Footwear), By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-449-5

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

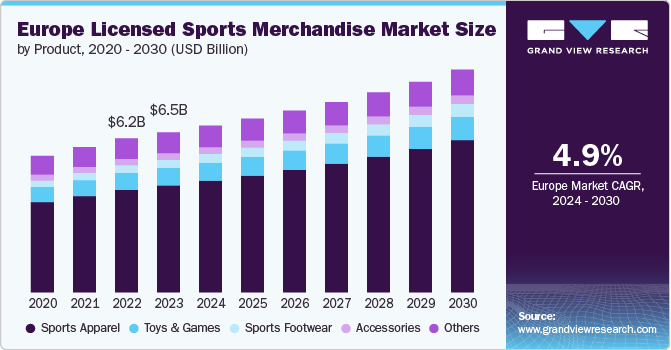

The Europe licensed sports merchandise market size was estimated at USD 6.47 billion in 2023 and is projection to grow at a CAGR of 4.9% from 2024 to 2030. The market in Europe is primarily driven by several key factors. Firstly, the growing popularity and widespread appeal of sports across the region play a significant role. Sports such as football (soccer), rugby, basketball, and Formula 1 enjoy a massive fan base in Europe, leading to a high demand for licensed merchandise associated with these sports.

The other factor driving the market is fans' strong emotional connection and loyalty toward their favorite teams and athletes. Supporters often express their passion by purchasing licensed merchandise, including jerseys, caps, scarves, other apparel, and accessories like keychains, mugs, and flags. This emotional attachment drives the market as fans seek to demonstrate their allegiance and identify with their beloved teams.

The rise of social media and digital platforms has significantly amplified the reach and influence of sports and athletes. Sports stars now have millions of followers on various social media platforms, allowing them to connect directly with their fans. This digital landscape provides an opportunity for licensed merchandise to be showcased and promoted, leading to increased sales and market growth.

Major sporting events hosted in Europe, such as the FIFA World Cup, UEFA European Championship, and various international tournaments, act as catalysts for the licensed sports merchandise market. These events attract a massive global audience and generate tremendous excitement, creating a surge in demand for licensed products associated with the participating teams and players.

Market Concentration & Characteristics

The degree of innovation in the licensed sports merchandise industry in Europe is marked by advancements in customization, sustainability, and technology integration. Brands are increasingly adopting eco-friendly materials and manufacturing processes, responding to consumer demand for sustainable products. Customized merchandise, including personalized jerseys and fan gear, has become popular, leveraging digital platforms and 3D printing technologies for on-demand production.

The level of mergers and acquisitions (M&A) in the licensed sports merchandise industry in Europe has been moderately active, driven by the need for market consolidation, portfolio expansion, and technological capabilities. Major sports leagues, clubs, and licensing companies have seen M&A activity as a way to enhance distribution channels, enter new markets, and strengthen e-commerce platforms.

Regulations have a significant impact on the licensed sports merchandise industry in Europe, particularly concerning intellectual property rights, sustainability standards, and labor laws. Strict enforcement of copyright and trademark laws protects the intellectual property of sports teams and leagues, ensuring that only licensed products can be sold while helping combat counterfeit goods.

In the licensed sports merchandise industry in Europe, product substitutes come in the form of unlicensed or counterfeit merchandise, generic sports apparel, and unofficial fan gear. Counterfeit goods, often sold at lower prices, pose a significant challenge by offering consumers similar-looking items without official branding or quality guarantees. Generic sports apparel, such as non-branded jerseys and fan clothing, also provides a cost-effective alternative for consumers who prioritize function over official association with teams.

End-user concentration in the licensed sports merchandise industry in Europe is highly segmented, with a strong focus on dedicated sports fans, particularly those of popular football (soccer) clubs, which dominate the market. Major football leagues like the Premier League, La Liga, and Bundesliga have a large, loyal fan base that drives demand for official merchandise such as jerseys, accessories, and collectibles.

Product Insights

The sports apparel segment led the market with the largest revenue share of 66.8% in 2023. The strong fan culture surrounding sports plays a crucial role in driving the market growth. Europe has a rich history and passion for various sports, including football (soccer), rugby, cricket, tennis, and more. Fans are deeply attached to their favorite teams and athletes, and wearing licensed sports apparel allows them to express their support and affiliation. Sporting events, such as league matches and international tournaments, draw large crowds, and fans eagerly adopt merchandise featuring their beloved teams' logos, colors, and names.

The sports footwear segment is projected to grow at the fastest CAGR of 6.9% from 2024 to 2030. Growth in the licensed sports footwear industry is driven by a combination of brand loyalty, fashion trends, and the increasing focus on athleisure. Consumers are drawn to footwear associated with their favorite sports teams, athletes, and leagues, making exclusive licensing deals with major sports brands (such as Nike, Adidas, and Puma) crucial for driving sales. The growing popularity of sneakers as both athletic and lifestyle footwear fuels demand, particularly for limited-edition or signature collections linked to iconic athletes or teams.

Sport Insights

Based on sport, the football segment led the market with the largest revenue share of 66.7% in 2023. A primary driver for football licensed sports merchandise is the exclusivity and authenticity that come with officially licensed products. Fans are drawn to merchandise that is directly associated with their favorite teams and players, as it offers a sense of legitimacy and connection to the sport. Major football events, such as the FIFA World Cup, UEFA Champions League, and domestic leagues, create significant spikes in demand for licensed gear. Partnerships between football clubs and major sports brands (e.g., Adidas, Nike) enhance product appeal, while digital platforms and e-commerce have made it easier for fans to access licensed merchandise globally.

The Formula 1 segment is projected to grow at the fastest CAGR of 4.9% from 2024 to 2030. A key driver for Formula 1 licensed sports merchandise is the sport’s global fan base, fueled by the high visibility of races and the strong emotional connection fans have with their favorite teams, drivers, and racing culture. The increasing popularity of Formula 1, bolstered by media coverage, social media engagement, and the Netflix series Drive to Survive, has expanded its fan reach and intensified demand for licensed merchandise. Partnerships between teams and luxury or high-performance brands (e.g., Ferrari, Mercedes, Red Bull) elevate the status of the merchandise, appealing to fans who want to associate with both the sport and its premium image.

Distribution Channel Insights

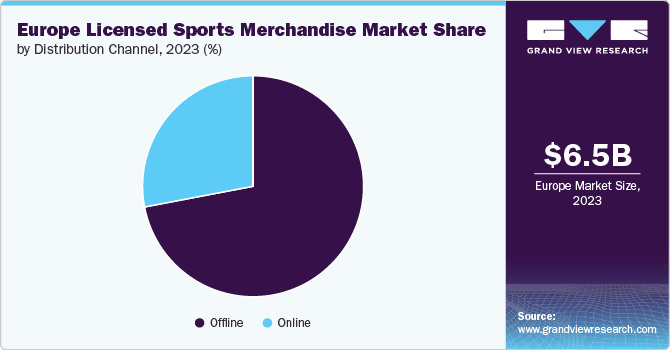

Based on distribution channel, the offline segment led the market with the largest revenue share of 71.7% in 2023. Consumers in Europe still prefer purchasing products from physical stores in order to check the quality of the products before purchasing them. Offline distribution channel possesses a higher market value as physical stores provide a unique opportunity for customers to have face-to-face interactions with sales associates who can provide personalized assistance and product recommendations, as well as answer any questions. Customers can see, touch, and try on licensed sports merchandise, allowing them to assess the quality, fit, and aesthetics before making a purchase.

The online segment is projected to grow at the fastest CAGR of 7.3% from 2024 to 2030. The availability of easy payment options and favorable refund policies have contributed to a shift in consumer preference toward online shopping.

To reach mass consumers, companies operating in the market are increasingly focusing on online channels. Companies are also designing user-friendly sites and partnering with online retail giants such as Amazon, resulting in increased sales through the online channel.

In May 2023, Fanatics and Sky Sports, a prominent sports broadcaster in Europe, announced a partnership to launch an online sports merchandise shop. This shop will cater to sports fans across several European countries, including the UK, Germany, Ireland, Austria, Italy, and Switzerland. The partnership will be powered by Fanatics, a well-known provider of licensed sports products.

Country Insights

UK licensed sports merchandise Market Trends

The licensed sports merchandise market in the UK accounted for a market with the revenue share of 33.7% in 2023. The market in the UK is primarily driven by the immense popularity and passion for sports among the population. The UK has a strong sporting culture, with football (soccer), rugby, cricket, and Formula 1 racing being particularly cherished by fans.

The media plays a significant role in fueling the market growth for licensed sports merchandise. Television coverage, sports websites, and social media platforms provide extensive exposure to sports teams and athletes, generating excitement and boosting fan engagement. Major sporting events, such as the Premier League, Six Nations Championship, Ashes series, and Wimbledon, capture the nation's attention, resulting in increased demand for licensed merchandise as fans seek to commemorate these memorable moments

Germany Licensed Sports Merchandise Market Trends

The licensed sports merchandise market in Germany is projected to grow at the fastest CAGR of 4.8% from 2024 to 2030. The market is primarily driven by the country's passionate sports culture and the strong fan base for various sports teams and leagues. Germany is known for its love for football (soccer), and the popularity of the Bundesliga, the top-tier football league, which plays a significant role in fueling the demand for licensed sports merchandise.

France Licensed Sports Merchandise Market Trends

The licensed sports merchandise market in France is projected to grow at the fastest CAGR of 6.3% from 2024 to 2030. In France, growth in the licensed sports footwear industry is driven by a combination of national passion for sports like football, basketball, and rugby, as well as the increasing popularity of athleisure fashion. Football, being the most popular sport, significantly influences demand for licensed footwear, especially from major clubs like Paris Saint-Germain (PSG), whose partnerships with brands like Nike drive sales. The trend toward wearing sports footwear as everyday fashion, coupled with collaborations between sports brands and high-end French designers, also contributes to growth.

Key Europe Licensed Sports Merchandise Company Insights

Major players in the market focus on diversifying and expanding product offerings to cater to a wider customer base, capitalize on different sports and fan preferences, and gain a competitive advantage. Mergers and acquisitions are robust strategies within the licensed sports merchandise industry. Companies often acquire or merge with other firms to strengthen their market position, expand their distribution networks, diversify their product portfolio, and gain access to new licenses or intellectual properties.

Key Europe Licensed Sports Merchandise Companies

- Nike Inc.

- Adidas AG

- Puma SE

- Frasers Group

- Under Armour, Inc.

- Umbro (Iconix Brand Group)

- New Balance Athletics, Inc.

- Kappa (BasicNet S.p.A.)

- Mitre Sports International Ltd.

- Storelli Sports

Recent Developments

-

In May 2023, Puma SE secured an exclusive multi-year licensing agreement with one of the highest classes of international racing, Formula 1, to provide a newly designed collection of fanwear and supply uniforms to all the Formula 1 racers and staff at the circuit.

-

In September 2022, Fanatics and the Union of European Football Associations (UEFA) announced a long-lasting event retail, e-commerce, and licensing deal for national team football, covering both men's and women's games. This partnership extended the previous event retail partnership between UEFA and Fanatics and introduced new elements. Fanatics now has e-commerce rights as part of the agreement, allowing the company to manage and operate the online retail platform for UEFA's national team football merchandise.

Europe Licensed Sports Merchandise Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.74 billion

Revenue forecast in 2030

USD 9.00 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sport, product, distribution channel, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

Nike Inc.; Adidas AG; Puma SE; Frasers Group; Under Armour, Inc.; Umbro (Iconix Brand Group); New Balance Athletics, Inc.; Kappa (BasicNet S.p.A.); Mitre Sports International Ltd.; Storelli Sports

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Licensed Sports Merchandise Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe licensed sports merchandise market report based on sport, product, distribution channel, and country.

-

Sport Outlook (Revenue, USD Million, 2018 - 2030)

-

Football

-

Barcelona

-

Real Madrid

-

Bayern Munich

-

Liverpool

-

Man United

-

PSG

-

Arsenal

-

Chelsea

-

Juventus

-

Tottenham

-

Man City

-

Borussia Dortmund

-

Other UEFA Clubs

-

-

Rugby

-

Formula 1

-

Basketball

-

Cricket

-

Tennis

-

Ice Hockey

-

Boxing

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Apparel

-

T-Shirts & Tops

-

Sweatshirts & Hoodies

-

Jackets

-

Caps & Hats

-

Others

-

-

Sports Footwear

-

Toys & Games

-

Accessories

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Campus Bootstores

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. The Europe licensed sports merchandise market size was estimated at USD 6.47 billion in 2023 and is expected to reach USD 6.74 billion in 2024.

b. The Europe licensed sports merchandise market is expected to grow at a compounded growth rate of 4.9% from 2024 to 2030 to reach USD 9.00 billion by 2030.

b. Sports Apparel accounted for a share of over 66% of the Europe revenues in 2023. The strong fan culture surrounding sports plays a crucial role in driving the growth of the market. Europe has a rich history and passion for various sports, including football (soccer), rugby, cricket, tennis, and more.

b. Some key players operating in the Europe licensed sports merchandise market include Nike Inc., Adidas AG, Puma SE, Frasers Group, Under Armour, Inc., Umbro (Iconix Brand Group), New Balance Athletics, Inc., Kappa (BasicNet S.p.A.), Mitre Sports International Ltd., Storelli Sports

b. Key factors that are driving the Europe licensed sports merchandise market growth include growing popularity and widespread appeal of sports across the region play a significant role. Sports such as football (soccer), rugby, basketball, and Formula 1 enjoy a massive fan base in Europe, leading to a high demand for licensed merchandise associated with these sports.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."