- Home

- »

- IT Services & Applications

- »

-

Europe Legal Technology Market Size, Industry Report, 2030GVR Report cover

![Europe Legal Technology Market Size, Share & Trends Report]()

Europe Legal Technology Market Size, Share & Trends Analysis Report By Solution (Software, Services), By End-user (Law Firms, Corporate Legal Departments), By Type, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-287-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Europe Legal Technology Market Trends

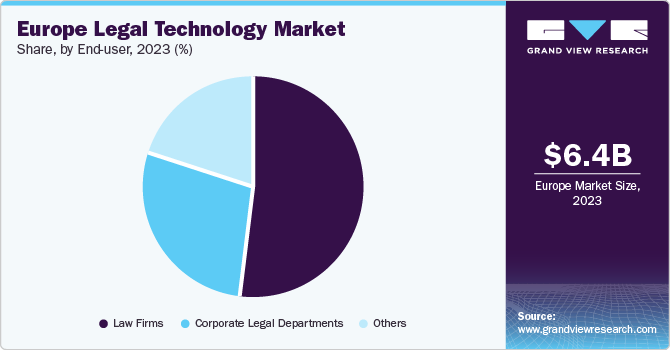

The Europe legal technology market size was estimated at USD 6.38 billion in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. Regulatory compliance requirements are a major growth driver for the European market. The region's stringent data protection regulations, such as the General Data Protection Regulation (GDPR), compel legal firms and corporate legal departments to invest in technology solutions that ensure compliance. It includes tools for data management, privacy protection, and cybersecurity. The need to navigate complex legal landscapes while following regulatory standards promotes the adoption of legal technology solutions.

The increasing demand for efficiency and productivity within the legal sector is driving the adoption of technology solutions. Law firms and legal departments focus on streamlining processes, reducing manual workloads, and delivering services more efficiently to remain competitive. Legal technology offers solutions such as case management software, document automation tools, and e-discovery platforms, which automate repetitive tasks, streamline workflows, and improve productivity. Legal professionals are increasingly adopting technology to improve efficiency and enhance client outcomes.

The increasing complexity of legal matters is driving the need for specialized technology solutions personalized for new challenges faced by legal professionals. As legal cases become more intricate and data-intensive, there is a growing demand for analytics tools, artificial intelligence (AI) solutions, and predictive modeling platforms to help lawyers analyze vast amounts of information, identify patterns, and make data-driven decisions. These advanced technologies enable legal professionals to gain deeper insights, mitigate risks, and provide more strategic counsel to their clients, driving the use of legal technology solutions. For instance, in March 2023, UK-based PwC partnered with AI startup Harvey, granting PwC Legal Business Solutions professionals access to the AI platform. Harvey uses natural language processing, machine learning, and data analytics to automate and improve legal work. The platform generates insights and recommendations based on large volumes of data, enabling PwC professionals to identify solutions faster.

The shift towards remote work and collaboration is driving technology uptake in the European legal sector. The COVID-19 pandemic accelerated the adoption of digital tools for communication, collaboration, and document management among legal professionals. Virtual court hearings, online document-sharing platforms, and cloud-based collaboration tools became essential for maintaining productivity and continuity in legal operations. There is a growing demand for technology solutions that support seamless collaboration and access to legal resources as remote work integrates into legal practice.

Market Concentration & Characteristics

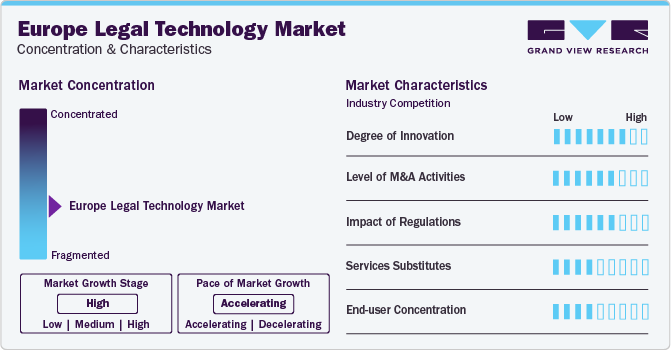

The Europe legal technology industry is significantly fragmented in nature. However, the growth stage of the industry is high with an accelerating pace. The market is characterized by rapid technological advancements fueled by innovations in AI, data security, legal research automation, contract management, and legal chatbots. For instance, in March 2024, Wolters Kluwer’s Legal & Regulatory department launched advanced AI-enhanced capabilities for Legisway, an inclusive SaaS contract management and legal information solution for corporate legal departments. This new feature improved the contract review process by allowing legal departments to search for their contracts easily through enhanced natural language processing (NLP) technology.

The legal technology market in Europe is witnessing a surge in merger and acquisition (M&A) activity as key competitors aim to strengthen their market positions. With the demand for legal technology solutions rising across sectors, including law firms, corporate legal departments, and regulatory agencies, major players actively seek to enhance their portfolios through strategic acquisitions. These M&A transactions are driven by the need to integrate complementary technologies that can address the evolving needs of legal professionals and organizations. For instance, STP Group, a German legal tech platform, has made five acquisitions since December 2020. The latest acquisition in October 2023 was Knowliah, an AI-powered enterprise legal management software specialist based in Belgium. This acquisition reinforces STP Group's capacity to serve law firms, notaries, insolvency administrators, and corporate legal departments.

Regulatory challenges and privacy concerns present significant hurdles, necessitating the establishment of comprehensive frameworks to ensure legal tech solutions' ethical and secure deployment. Governments across the region are actively developing and enforcing regulations that balance fostering innovation and safeguarding individual rights to privacy and data protection. Complex issues such as compliance with data protection laws such as the General Data Protection Regulation (GDPR), jurisdictional considerations, and ethical implications of AI-powered legal tools demand careful legal scrutiny and policy development.

Solution Insights

Based on solution, the market is bifurcated into software and services. The software segment held the largest revenue share of 74.8% in 2023 due to the increasing demand for efficiency and automation within legal processes. With the implementation of stringent data protection regulations such as the GDPR, legal organizations in Europe are increasingly seeking software solutions that ensure compliance with regulatory requirements. Legal software platforms equipped with features for data encryption, secure document storage, and audit trails help law firms and corporate legal departments mitigate legal and regulatory risks associated with handling sensitive information. The demand for software solutions that facilitate compliance and risk management grows as regulatory scrutiny intensifies.

The services segment is anticipated to witness the fastest CAGR over the forecast period due to the increasing demand for consulting and advisory services related to legal technology adoption. Legal technology consulting firms offer services such as technology assessments, implementation planning, and change management support to help law firms and corporate legal departments effectively integrate technology into their workflows.

Type Insights

Based on type, the market is segmented into e-discovery, legal research, practice management, analytics, compliance, document management, contract lifecycle management, time-tracking & billing, and others. The e-discovery segment held the largest revenue share in 2023 due to the growth in the volume of digital data generated by legal proceedings and investigations. E-discovery solutions offer capabilities for collecting, processing, and reviewing electronic documents, emails, and other digital evidence, enabling legal teams to identify relevant information and build stronger cases. For instance, according to the State of eDiscovery Technology Adoption Report 2023, corporate legal teams primarily used the 'Classification of documents' and 'concept search' features to respond to inquiries or litigation in 2022. On the other hand, law firms relied more on the 'Technology Assisted Review' and 'Classification of documents' features to respond to inquiries or litigation during the same period.

The analytics segment is anticipated to witness the fastest CAGR during the forecast period due to the increasing emphasis on data-driven decision-making within legal practice. There is a growing demand for integrating data analytics and artificial intelligence in the legal industry, as it can assist lawyers and legal professionals in making better decisions and streamlining their workflow. Analytics software can manage and analyze vast amounts of data, from case documents and contracts to financial records and client information. For instance, in March 2023, KPMG LLP and Icertis collaborated to assist businesses in leveraging the value of their contract data with contract intelligence. Through this partnership, KPMG offered Icertis Contract Intelligence (ICI) through its established contracting practice, allowing mutual customers to connect contract data across the organization and uncover valuable insights to increase revenue, decrease costs, manage risks, and ensure compliance.

End-user Insights

Based on end-user, the market is segmented into law firms, corporate legal departments, and others. The law firms segment held the largest revenue share in 2023. Law firms increasingly adopt legal tech solutions to streamline operations, improve client service, and stay competitive in a rapidly evolving industry. These technologies help law firms automate routine tasks, manage large volumes of data more effectively, and enhance collaboration among team members.

The corporate legal departments segment is anticipated to grow significantly during the forecast period due to growing cybersecurity and data protection concerns. With the increasing frequency and sophistication of cyber threats, corporate legal departments must prioritize data security and protection. Legal technology solutions offer encryption, access controls, and data loss prevention to safeguard sensitive legal information and mitigate cybersecurity risks. For instance, in September 2023, Fieldfisher, a London-based law firm specializing in data protection and privacy issues across Europe, partnered with Lawcadia to launch a data breach management and assessment tool. This tool aims to help clients manage compliance obligations in addition to the legal advice Fieldfisher offers. The solution is expected to reduce the risk of adverse regulatory action.

Country Insights

UK Legal Technology Market Trends

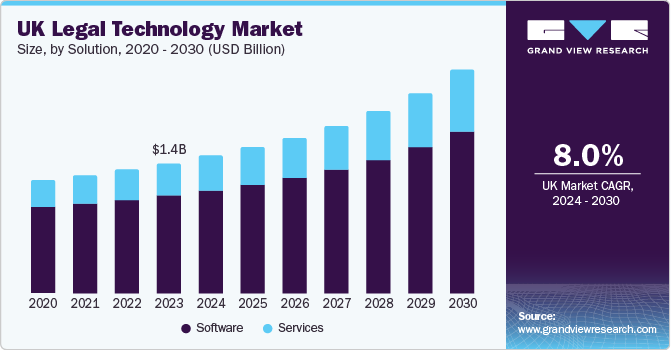

The UK legal technology market dominated the European region with a revenue share of 22.0% in 2023 due to increasing technological innovation and adoption. As advancements in artificial intelligence, machine learning, and natural language processing continue to reshape the legal landscape, there is a growing demand for innovative technology solutions among legal entities in the UK. For example, AI-powered legal research platforms, predictive analytics tools, and virtual legal assistants are gaining adoption in the UK legal sector, enabling legal professionals to work more efficiently and make data-driven decisions. For instance, in March 2023, the UK government announced to provide USD 3.64 million in funding to CodeBase and Legal Geek to accelerate the development and adoption of technology in the legal industry. The LawtechUK program, which the government backs, is a key player in driving innovation, and the newly announced providers aim to help maintain the country's position in emerging technologies.

Spain Legal Technology Market Trends

The legal technology market in Spain is expected to grow over the forecast period due to AI adoption in various industries, including the legal sector. Many legal tech firms such as Gavel, Dentons, LexBlog, and Henchman are using AI to automate different aspects of legal work, such as drafting, document, and workflow automation. In the legal arena, knowledge management has become increasingly important. The industry continuously improves functionalities through software updates, such as in Tiger Eye to Clio.

Key Europe Legal Technology Company Insights

Some of the key players operating in the market include Icertis, LexisNexis Risk Solutions, Anaqua, Inc., and others:

-

Icertis is a contract lifecycle management (CLM) software company. The company offers a cloud-based platform that helps organizations manage their contracts more efficiently, improve compliance, mitigate risks, and enhance business outcomes. Icertis provides features such as contract creation, negotiation, e-signature, and analytics to streamline business contract management operations.

-

LexisNexis Risk Solutions is a leading provider of data and analytics solutions for the legal technology market. LexisNexis Risk Solutions offers various solutions, including LexisNexis Legal Research, LexisNexis CourtLink, LexisNexis CounselLink, and Lex Machina. These offerings provide legal professionals with tools for legal research, case tracking, matter management, and legal analytics.

-

Anaqua, Inc., is a leading intellectual property management software provider and provider of services for corporations and law firms. The company offers solutions that help organizations manage their patents, trademarks, licensing, and other intellectual property assets efficiently. Its offerings include software solutions for IP portfolio management, IP analytics, IP asset management, and IP cost management.

Key Europe Legal Technology Companies:

- Anaqua, Inc.

- Casetext Inc.

- DocuSign, Inc.

- Everlaw

- Filevine, Inc.

- Icertis

- Knovos LLC

- Paradigm

- ProfitSolv

- LexisNexis Risk Solutions

Recent Developments

-

In February 2024, Anaqua launched a new platform called AnaquaGov, which is specifically designed to assist U.S. defense contractors and other clients in handling Controlled Unclassified Information (CUI) and managing their sensitive intellectual property data in a specialized environment.

-

In May 2023, Sandline Global, a provider of eDiscovery, iManage, and Litera services, partnered with Everlaw to bring its cloud-based eDiscovery platform to Germany and the broader European market. The partnership enables Sandline to offer services to German legal teams, law firms, and corporations through Everlaw's advanced AI, collaboration features, and intuitive interface. The initiative caters to regulations enforcing new policies and GDPR requirements in Germany and the EU, making it essential for legal teams to quickly and efficiently uncover evidence for litigation and investigations.

-

In April 2023, DocuSign launched a digital identity verification (IDV) solution for EU Qualified in Europe. The IDV solution, powered by AI, complies with EU and UK regulations for Qualified Electronic Signatures (QES). QES requires face-to-face identification or an equivalent method, which DocuSign aims to address with this new solution. The IDV service uses AI to verify the identity of individuals without the need for time-consuming in-person checks, video verification, or physical document exchanges.

Europe Legal Technology Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 11.58 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, type, end-user, country

Country scope

U.K.; Germany; France; Italy; Spain

Key companies profiled

Anaqua, Inc., Casetext Inc., DocuSign, Inc., Everlaw, Filevine, Inc., Icertis, Knovos LLC, Paradigm, ProfitSolv, LexisNexis Risk Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Europe Legal Technology Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe legal technology marketreport based on solution, type, end-user, and country:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Cloud-based

-

On-Premises

-

-

Services

-

Consulting Services

-

Support Services

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

E-discovery

-

Legal research

-

Practice management

-

Analytics

-

Compliance

-

Document management

-

Contract lifecycle management

-

Time-tracking & billing

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Law firms

-

Corporate legal departments

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. The Europe legal technology market size was estimated at USD 6.38 billion in 2023 and is expected to reach USD 6.80 billion in 2024

b. The Europe legal technology market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 11.58 billion by 2030

b. UK dominated the Europe legal technology market with a share of 22.0% in 2023 due to increasing technological innovation and adoption. As advancements in artificial intelligence, machine learning, and natural language processing continue to reshape the legal landscape, there is a growing demand for innovative technology solutions among legal entities in the UK.

b. Some key players operating in the field force automation market include Anaqua, Inc., Casetext Inc., DocuSign, Inc., Everlaw, Filevine, Inc., Icertis, Knovos LLC, Paradigm, ProfitSolv, LexisNexis Risk Solutions

b. Regulatory compliance requirements is a key factor driving the legal technology market growth in the region

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."