Europe LED Lighting Market Size, Share & Trends Analysis Report By Design (Lamps, Luminaires), By Application (Indoor, Outdoor), By End-use (Commercial, Residential, Industrial, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-481-9

- Number of Report Pages: 93

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Europe LED Lighting Market Size & Trends

The Europe LED lighting market size was valued at USD 16.06 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. The rise in stringent government regulations, such as the ban on less-efficient lighting sources and incentives & rebates on LED lighting, is expected to drive the market significantly over the forecast period. The region also has several standards that govern the safety and performance of indoor commercial lighting, garage illumination, roadway lighting, and parking lighting. Moreover, increasing awareness about energy conservation is further driving market growth.

The European commercial & industrial sector is flourishing owing to the growth of the regional automotive and IT industries. The region has also fully recovered from the 2008 financial crisis, and most industries affected by it have been recording steady growth over the years. The region witnessed the lowest office vacancy rates in 2018 since the financial crisis. Favorable business conditions and growing individual economies are expected to improve the demand for LED lighting in the region over the forecast period.

Similarly, the construction industry has observed notable growth from the commercial & industrial sectors in the past few years, as the need for commercial spaces is rising. To benefit from this trend, electricity supply companies have collaborated with the government to distribute subsidized LED lights to the commercial sector. As LED lighting considerably brings down electricity and maintenance costs compared to traditional technologies such as gas-discharge, incandescent, and compact fluorescent lights, such collaborations are expected to encourage further the adoption of LED lighting solutions in the enterprise sector.

LED lights offer a greener, sustainable, and viable alternative to their traditional counterparts owing to their high energy efficiency and longer lifespan. LED lights also score very low in terms of any hazardous chemicals associated with them, which significantly reduces the probability of a ban or phase-out. While LED lighting solutions can be integrated or embedded with lighting controllers, they are also recyclable.

European LED manufacturers benefit from the stringent regulations levied on the import of lighting products. The American market has emerged as one of the prominent consumers of European lighting, with growing trade tensions between the U.S. and China positively benefitting European companies. The trend is likely to continue to benefit the European LED lighting market.

Design Type Insights

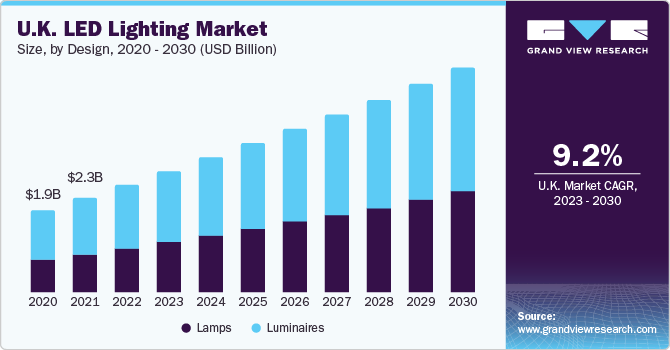

The lamp segment accounted for the largest share in 2022, with a market share of 54.7%. The rising demand for A-type and T-type lamps in residential and commercial sectors is expected to help the lamps segment acquire a significant market share throughout the forecast period. The rising demand for advanced lamps such as MR-16 and reflector lamps, especially in retail applications such as small stores, retail shops, and malls, is also expected to help the segment retain dominance.

The luminaire segment is expected to register the highest CAGR of 9.5% over the forecast period. The adoption of advanced LED luminaires, such as downlights and troffers, is rising in the commercial sector. Moreover, many European countries are replacing conventional halogen lamp street lights with LED lights as a part of the European Union’s green initiative, which will likely drive the segment growth further. The rising popularity of designer luminaires for architectural applications in Western European countries, as the construction of modern and sustainable homes grows in the region, is also likely to drive segment growth.

Application Insights

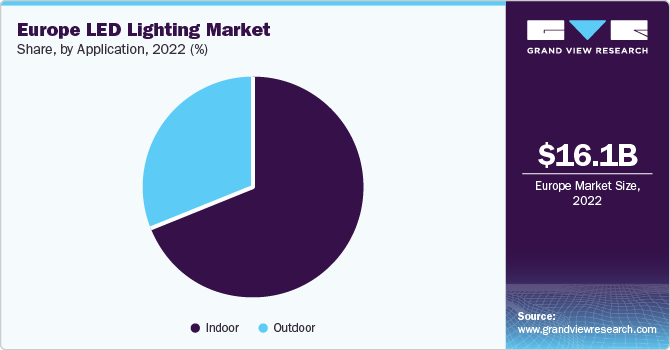

The indoor application segment dominated the market in 2022 with a market share of 68.8%. This growth can be attributed primarily to the growing use of LED light products in household lighting. Decreased prices, customer-centric product designs, and availability of various options have encouraged users to opt for LED light products for indoor applications. Furthermore, visually comforting, and soothing experience through LED lighting within commercial office spaces has broadened the use of indoor LED applications.

The outdoor application segment is expected to register the highest CAGR of 11.1% over the forecast period. Encouraging government policies for adopting energy-efficient lighting products has led to the surging adoption of streetlight applications. Street, roadway, and walkway lighting are integral to cities and are among the highest energy consumption points. Traditionally, HID light sources dominated these applications due to high lumens output and hence could be mounted at distances. However, this can be compensated by LED lighting products, particularly for outdoor applications, as they exhibit features such as high durability, excellent directional light sources, and greater efficiency.

End-use Insights

Based on end-use, the European market for LED lighting has been segregated into commercial, residential, industrial, and others. The commercial segment accounted for the largest share of 52.0% in 2022 and is expected to continue to dominate over the forecast period. Factors such as the increasing need for energy & cost-efficient and environment-friendly lights are driving the demand for LED lights in this sector.

The residential segment in the European LED lighting market has experienced rapid growth, with a CAGR of 10.3% in 2022. The growth is attributed to various factors, such as increased awareness and adoption of energy-efficient lighting solutions among homeowners, government regulations and initiatives promoting energy efficiency, advancements in LED technology providing improved performance and a wider range of options, declining prices making LED lighting more affordable, and the longer lifespan of LED bulbs reducing maintenance costs. These factors have contributed to the residential segment's swift growth in the European LED lighting market.

Country Insights

The Europe LED lighting market has been segmented into four prominent regions: the UK, Germany, and the rest of Europe (RoE). RoE dominated the market in 2022 with a market share of 73.6%. The growth is attributed to initiatives promoting energy efficiency, increasing consumer awareness and demand, established manufacturers, and supportive policies and incentives. These factors have created a favorable environment for adopting LED lighting technology, leading to regional market dominance.

Germany is one of the leading LED manufacturers in Europe and is expected to grow at a significant CAGR during the forecast period. The presence of prominent players such as OSRAM GmbH and Signify Holdings and the availability of technologically advanced manufacturing facilities are favoring the growth prospects of the regional LED lighting market.

Key Companies & Market Share Insights

Market leaders focus on expanding their capabilities and entering new application areas such as horticultural lighting and UV lighting to gain greater market share. New entrants focus on disrupting the industry with technologically advanced lighting solutions such as Li-Fi and sensor-based lighting. Mergers and acquisitions are practiced in the lighting industry to expand product portfolio and geographical reach and gain market share.

The industry players are also undertaking strategies such as product launches and collaborations to increase their global reach. For instance, in March 2023, Cree LED, a subsidiary of SGH, launched its latest innovation, the J Series 5050C E Class LEDs. These LEDs set a new industry standard for high-power LEDs by achieving a remarkable efficacy of 228 LPW at typical conditions of 70 CRI, 4000K, and 1W. These advanced LEDs are also designed with exceptional corrosion resistance, making them well-suited for operation in challenging environments.

Key Europe LED Lighting Companies:

- Acuity Brands Lighting, Inc.

- Digital Lumens, Incorporated

- OSRAM GmbH.

- WOLFSPEED, INC.

- Dialight

- Eaton

- General Electric

- Zumtobel Group

- Signify Holding

- Seoul Semiconductor Co., Ltd.

Recent Developments

-

In June 2023, Philips introduced a range of LED lights designed specifically for outdoor spaces such as gardens, offering durability and energy efficiency in various weather conditions. These LED outdoor lights, including posts, spotlights, pedestals, and wall lights, are equipped with UltraEfficient Solar technology.

-

In June 2023, OSRAM launched the latest generation of its OSLON Square Hyper Red horticulture LED. This latest iteration was specifically designed to enhance plant growth rate and optimize system costs. The new OSLON Square Hyper Red LED suits various horticultural lighting applications, including inter-lighting, greenhouse top lighting, vertical farming, and sole source lighting.

-

In February 2023, LEDVANCE GmbH introduced the LED TUBE EXTERNAL SYSTEM, a highly efficient lighting solution with an external DALI-2 driver and an LED tube. This system enables the upgrade of existing T8 and T5 fluorescent lamps to dimmable LED lighting while also providing emergency lighting capabilities. With its replaceable components, the LED TUBE EXTERNAL SYSTEM is cost-effective and contributes to sustainability and the principles of the circular economy.

-

In October 2021, LTF, LLC. announced the launch of its latest controller module that features five channels and a power output of 300W. It is designed to provide RGBW+WW capability, enabling full-color customization for LED strip lighting. With these modules, users can effortlessly achieve their desired lighting effects and create dynamic lighting environments.

Europe LED Lighting Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 18.17 billion |

|

Revenue forecast in 2030 |

USD 33.88 billion |

|

Growth rate |

CAGR of 9.3% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Design, application, end-use, region |

|

Country scope |

UK; Germany; RoE |

|

Key companies profiled |

Acuity Brands Lighting, Inc.; Digital Lumens, Incorporated; OSRAM GmbH.; WOLFSPEED, INC.; Dialight; Eaton; Digital Lumens, Incorporated.; General Electric;Zumtobel Group; Signify Holding; Seoul Semiconductor Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe LED Lighting Market Report Segmentation

This report forecasts country-level revenue growth and analyzes the latest industry trends in each sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe LED lighting market report based on design, application,end-use, and region:

-

Design Outlook (Revenue in USD Billion, 2017 - 2030)

-

Lamps

-

A-Lamps

-

T-Lamps

-

Others

-

-

Luminaires

-

Street lights

-

Downlights

-

Troffers

-

Others

-

-

-

Application Outlook (Revenue in USD Billion, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

End-use Outlook (Revenue in USD Billion, 2017 - 2030)

-

Commercial

-

Residential

-

Industrial

-

Others

-

-

Regional Outlook (Revenue in USD Billion, 2017 - 2030)

-

Europe

-

UK

-

Germany

-

RoE

-

-

Frequently Asked Questions About This Report

b. Europe LED lighting market size was estimated at USD 16.06 billion in 2022 and is expected to reach USD 18.17 billion in 2023.

b. Europe LED lighting market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 33.88 billion by 2025.

b. Lamps dominated the Europe LED lighting market by product, with a share of 54.7% in 2022. This is attributable to the increasing demand for energy-efficient lighting solutions, compliance with EU regulations, better lifespan, cost savings, and government incentives.

b. Some key players operating in the Europe LED lighting market include Acuity Brands Lighting, Inc., Digital Lumens, Incorporated, OSRAM GmbH., WOLFSPEED, INC., Dialight, Eaton, General Electric, Zumtobel Group, Signify Holding, and Seoul Semiconductor Co., Ltd.

b. Key factors that are driving the market growth include the rise in the number of stringent government regulations and increasing awareness about energy conservation, improved lifespan, lower costs, versatility, smart lighting, and increased consumer awareness.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."