- Home

- »

- Network Security

- »

-

Europe IT Services Market Size, Industry Report, 2030GVR Report cover

![Europe IT Services Market Size, Share & Trends Report]()

Europe IT Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Approach (Proactive, Reactive), By Type, By Technology, By Enterprise Size, By End-use, By Deployment, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-297-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe IT Services Market Size & Trends

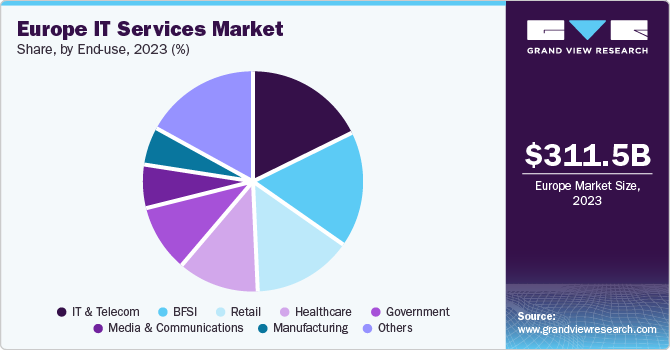

The Europe IT services market was estimated at USD 311.5 billion in 2023 and is projected to grow at a CAGR of 9.7% from 2024 to 2030. Businesses across Europe are undergoing digital transformation to stay competitive; the growing need for cloud computing, data analytics, cybersecurity, IOT (Internet of Things) devices, and technological innovations is the driving factor for the market growth of IT services.

IT services refer to the application of businesses and technical expertise to enable organizations to create, optimize, and manage information and business processes. IT services are crucial for modern companies' efficient operation, helping them leverage technology to improve productivity, enhance customer satisfaction, and drive growth. The rapid digital transformation of businesses is one of the significant factors driving the market growth of the IT services. As businesses grow, they need to adapt to new digital transformations to stay competitive, IT services provide resources to businesses in the form of AI (artificial intelligence) and machine learning, cloud computing, cybersecurity, and others.

The growing importance of cybersecurity and data privacy drives demand for IT security services. With the proliferation of cyber threats and the increasing risk of data breaches, organizations prioritize investments in cybersecurity solutions and services to protect their sensitive information and mitigate risks. It includes services such as network security, endpoint security, threat intelligence, and security consulting, which help organizations strengthen their security posture, comply with regulatory requirements, and safeguard their digital assets. The rising awareness of cybersecurity threats and the potential impact of data breaches drive continuous demand for IT security services across industries.

Moreover, the rising complexity of IT environments and the growing need for specialized expertise drive demand for IT services. Many organizations need more in-house resources and expertise to manage and support their IT infrastructure effectively. As a result, they turn to external IT service providers to fill this gap and access the skills and capabilities needed to design, implement, and manage complex IT systems. It includes managed IT services, IT consulting, and system integration, which help organizations optimize their IT operations and navigate the rapidly evolving technology landscape.

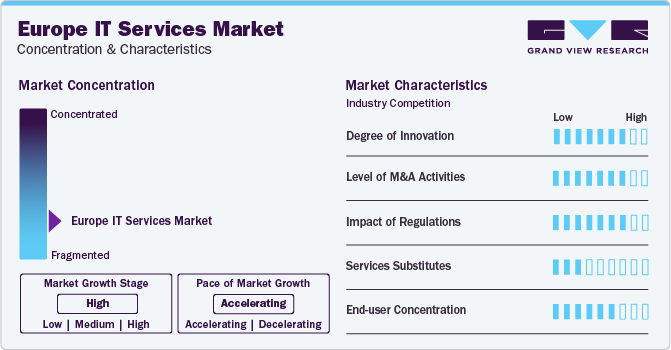

Market Concentration & Characteristics

The industry growth stage is high, and the pace is accelerating. A growing emphasis on the digitalization of businesses characterizes the industry. The rapid boost in data explosion drives the growth of the industry's increasing demand for its services.

The industry is fragmented in nature, featuring several regional players. The industry players are investing in IT infrastructure to gain a competitive edge in the market. Moreover, they are entering into partnerships and mergers & acquisitions as the industry is characterized by innovation, disruption, and rapid change. The end user concentration is higher as IT services have vast applications in different sectors like BFSI, government, retail, manufacturing, media and communications, IT and telecom, and others.

Technology Insights

Based on technology, the AI and machine learning segment led the market with the largest revenue share of 32.4% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The rise in data generation through the Internet, social media, business operations, and IOT (Internet of Things) devices is driving the demand for AI and ML in the market. AI and ML have seen significant improvements in computational power, accessibility of cloud computing, advancement in AI and machine learning algorithms, and increasing demand for personalization. These help businesses understand their customers' behavioral patterns and provide them with better service.

The big data analytics segment is anticipated to witness a significant CAGR during the forecast period. The increase in data volume from various sources, technological advancements that enhance data processing and analysis, and the need for competitive advantage through data-driven insights are the key factors driving the market growth. Big data analytics helps businesses make quicker and more informed decisions in real-time.

End-use Insights

Based on end-use, The IT and telecom segment led the market with the largest revenue share of 17.8% in 2023. The increasing adoption of cloud computing, data volume growth, network expansion, and growing emphasis on customer experience are the key factors driving the demand for IT services in the IT and telecom segment. IT sector companies rely on IT services for data management, cybersecurity, and infrastructure management to improve operational efficiency. Telecom companies need IT services to develop new products and services and maintain customer relationship management.

The retail segment is expected to grow at the fastest CAGR during the forecast period. The rapid growth in E-commerce and the need for retail brands to enhance customer experience are expected to increase demand for the segment. Retail brands rely on IT services to manage customer data, understand consumer behavior with AI and machine learning, and improve user applications.

Type Insights

Based on type, the operations and maintenance segment held the market with the largest revenue share of 63.9% in 2023. The growth in IT services for operations and maintenance is driven by businesses focusing more on digital transformation, leading to complex IT systems that require expert handling. Companies prefer to concentrate on their core business and outsource IT maintenance to ensure efficiency and security, especially with increasing cyber threats. Compliance with strict regulations and the need for systems to be always on without downtime also push the demand for these services. Moreover, as more organizations move to the cloud and adopt new technologies like AI, the need for specialized maintenance services to manage these modern infrastructures grows.

The design and implementation segment is anticipated to witness at a significant CAGR during the forecast period. The demand for design and implementation in the IT services market is expected to grow as businesses are diving deep into digital transformation to stay competitive and meet consumer expectations. The design and implementation move to cloud platforms for better flexibility and efficiency, using data analytics to drive decisions and ramping up cybersecurity measures against increasing threats. The shift towards remote work is pushing for better collaboration tools, and rapid tech advances like AI and machine learning are becoming a staple in modern IT setups.

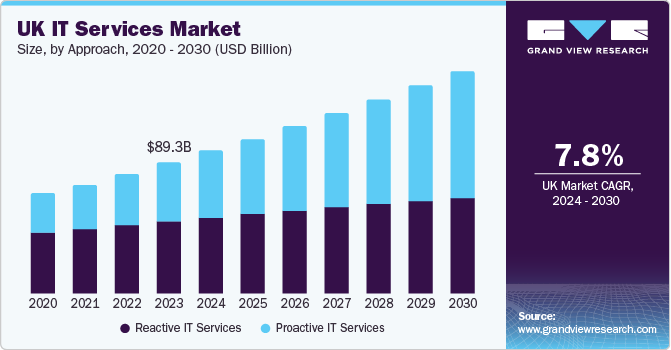

Approach Insights

Based on approach, the reactive IT segment held the market with the largest revenue share of 55.3% in 2023. As IT infrastructure becomes increasingly complex and integrated with various technologies and platforms, the potential for issues increases, necessitating reactive support. Reactive IT services are more cost-effective for smaller businesses, reducing operation costs.

The proactive IT services segment is expected to witness at the fastest CAGR during the forecast period. The increasing number of cyber-attacks and threats has raised the demand for proactive IT services. Businesses and governments need proactive IT services to protect sensitive data and against cyber-attacks.

Application Insights

Based on application, the application management segment held the market with the largest revenue share of 31.5% in 2023. These solutions are instrumental in proactively monitoring, optimizing, and maintaining application ecosystems, ensuring they operate efficiently. Beyond performance enhancements, application management contributes to significant cost reductions by streamlining operations and eliminating inefficiencies. As businesses navigate the complexities of the digital landscape, the strategic implementation of application management services emerges as a vital component for maximizing the value and longevity of their application investments, aligning with the evolving market demands.

The data management segment is expected to witness at the fastest CAGR during the forecast period. The rise of cloud computing and adopting hybrid IT environments contribute to the demand for data management services. With organizations increasingly embracing cloud technologies for data storage, processing, and analytics, there is a need for data management solutions that can seamlessly integrate with cloud platforms and on-premises systems. Data management services provide organizations with the expertise and tools to manage data across hybrid environments, enabling seamless data migration and synchronization and ensuring data consistency and availability across disparate IT infrastructures.

Deployment Insights

Based on deployment type, the on-premises segment led the market with the largest revenue share of 52.6% in 2023. Customization and control are essential factors driving on-premises IT services. Based on their requirements, businesses can customize the on-premises infrastructure to their specific needs, allowing them to manage data more effectively.

The cloud segment is expected to witness at the fastest CAGR during the forecast period. The accessibility and convenience of cloud deployment are driving its adoption in IT services. Cloud-based IT services are accessed from anywhere with an internet connection, enabling remote access to data and information from anywhere. Cloud-based IT services are cost-effective as they don’t need infrastructure setup and don’t require maintenance.

Enterprise Insights

Based on enterprise, the large enterprise segment led the market with the largest revenue share of 61.0% in 2023. The increasing adoption of cloud computing and data management solutions and services, owing to the growing need for digital transformation among businesses, is driving the demand for IT services in large enterprises. Increasing investments in IT infrastructure and the need for customized services based on specific operational requirements are other factors boosting the market demand in this segment.

The small and medium enterprise segment is expected to grow at the fastest CAGR during the forecast period. Scalability, cost-effectiveness, digital transformation, remote access, and the need for innovation and competitiveness are expected to increase demand for IT services in the segment. SMEs adopt cloud-based services as they are cost-effective and require lower setup costs.

Country Insights

UK IT Services Market Trends

The UK dominated the Europe IT services market with the revenue share of 28.7% in 2023. The country's rapid growth in the retail market is driving IT services growth. With the increase in online shopping, retail companies need IT services to manage customer data, understand their buying patterns, and target customer-specific needs to increase customer retention.

French IT Services Market Trends

The IT services market in French is expected to grow at the fastest CAGR over the forecast period. France is a major medical device hub, and the government heavily invests in the healthcare sector, which accounts for 3% of the country's GDP. In 2023, the French government launched a roadmap to position France as a frontrunner in healthcare by 2027 while simultaneously fostering the development of a robust digital health sector. This initiative is anticipated to create significant growth prospects for the IT services industry in the future.

Key Europe IT Services Company Insights

Some of the key players operating in the market include Oracle; Huawei Cloud Computing Technologies Co., Ltd.; Cisco Systems, Inc.,Accenture, SAP, Capgemini

-

Oracle Corporation is a multinational computer technology company that provides products and services to address enterprise information technology environments worldwide. The company offers cloud-based solutions, including Infrastructure-as-a-Service (IaaS) and Software-as-a-Service (SaaS), database and middleware, application, cloud infrastructure, and hardware systems

-

Capgemini is a French multinational information technology company that provides products and services to address enterprise information technology environments worldwide. To maximize the business outcomes of cloud adoption, Capgemini offers cloud services through its three core categories: cloud for enterprise management, cloud for customer first, and cloud for intelligent enterprise

Key Europe IT Services Companies:

- Oracle

- Amazon Web Services, Inc.

- SAP

- Accenture

- Capgemini

- Huawei Cloud Computing Technologies Co. Ltd.

- Cisco Systems, Inc.

- Atos SE

Recent Developments

-

In October 2023, SAP SE announced collaboration with India-based technology, procurement, engineering, and construction company, Tata Projects Limited. Tata Projects Limited aims to accelerate its business transformation journey by adopting cloud solutions from SAP, specifically the RISE with SAP solution and SAP S/4HANA Cloud. This move will provide Tata Projects access to SAP's latest cloud innovations in augmented analytics and intelligence. It will enable the company to modernize its IT landscape, simplify complex data sources, and create a single source of truth for its teams

-

In April 2023, Image Relay launched Marketing Delivery, a unified solution for managing product information and digital assets. This cloud-based platform enhances and combines features from both digital asset management (DAM) and Europe IT Services (PIM) systems, enabling businesses to efficiently organize, connect, supervise, and share all their digital assets and product data with ease and accuracy

Europe IT Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 344.7 billion

Revenue forecast in 2030

USD 600.0 billion

Growth rate

CAGR of 9.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Approach, type, application, technology, deployment, enterprise size, end use, country

Regional scope

Europe

Country scope

UK; Germany; France

Key companies profiled

Oracle; Amazon Web Services, Inc.; SAP; Accenture; Capgemini; Huawei Cloud Computing Technologies Co. Ltd.; Cisco Systems, Inc.; Atos SE

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe IT Services Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the Europe IT servicesmarket research report based on approach, type, application, technology, enterprise size, deployment, end use, and country:

-

Approach Outlook (Revenue, USD Billion, 2017 - 2030)

-

Reactive IT services

-

Proactive IT services

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Design & Implementation

-

Operations & Maintenance

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Systems & Network Management

-

Data Management

-

Application Management

-

Security & Compliance Management

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

AI & Machine Learning

-

Big Data Analytics

-

Threat Intelligence

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-Premises

-

Cloud

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Media & Communications

-

Retail

-

IT & Telecom

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2017 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

-

Frequently Asked Questions About This Report

b. The Europe IT services market size was valued at USD 311.5 billion in 2023 and is expected to reach USD 344.7 billion in 2024

b. The Europe IT services market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 600.0 billion by 2030

b. The AI and Machine Learning segment held the market with the largest revenue share of 32.4% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The rise in data generation through the Internet, social media, business operations, and IoT (Internet of Things) devices is driving the demand for AI and ML in the market.

b. Oracle, Amazon Web Services, Inc., SAP, Accenture, Capgemini, Huawei Cloud Computing Technologies Co. Ltd., Cisco Systems, Inc., Atos SE

b. The growing need for cloud computing, data analytics, cybersecurity, IoT (Internet of Things) devices, and technological innovations is the driving factor for the growth of IT services in the market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.