- Home

- »

- Medical Devices

- »

-

Europe In Vitro Fertilization Market, Industry Report, 2030GVR Report cover

![Europe In Vitro Fertilization Market Size, Share & Trends Report]()

Europe In Vitro Fertilization Market Size, Share & Trends Analysis Report By Instrument, By Procedure (Fresh Nondonor, Frozen Nondonor), By Providers, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-295-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe In Vitro Fertilization Market Trends

The Europe in vitro fertilization market was anticipated at USD 9.3 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. One of the key factors driving the growth of this market is a rise in the prevalence of female and male infertility. According to Fertility Europe, 1 in 6 couples, or approximately 25 million people, have been suffering from infertility. This has increased the demand for in vitro fertilization (IVF) technology and treatments.

In 2023, the Europe in vitro fertilization market accounted fora 36.7% revenue share of the global in vitro fertilization market. The rise in infertility is among the major problems faced by the world population, and Europe is no exception to that. The lifestyle changes, increasing hours of work, sedentary nature of routines, consumption of chemicals and other harmful substances through food products that remain unnoticed, increasing prevalence of polycystic ovary syndrome, pelvic inflammatory disease, over/underactive thyroid glands, ovarian failure, conditions such as endometriosis, side effects caused by medicines and drugs, poor-quality semen in men, and hypogonadism are some of the major causes behind infertility. The growing occurrence of these aspects is expected to drive the growth of the market.

Technological advancements in IVF, supportive and encouraging government funding, the emergence of Physiological Intra-cytoplasmic Sperm Injection (PICSI), and strategic initiatives such as mergers & acquisitions (M&A) adopted by key companies have also been generating growth for this industry in Europe. In recent years, companies and governments have been concentrating on research and development associated with assistive technology to enhance the success rate of IVF. Some of the techniques introduced through the research include assisted hatching, egg/sperm freezing, vitrification, Percutaneous Epidydimal Sperm Aspiration & Testicular Sperm Extraction (PESA & TESE), three-parent IVF, genetic diagnosis, and mini-IVF.

Instrument Insights

The culture media segment dominated the market in 2023, with the largest revenue share. This can be attributed to aspects such as the availability of funding and an upsurge in research efforts to enhance the culture media. The culture media segment includes cryopreservation media, embryo culture media, ovary processing media, and sperm processing media.

The disposable devices segment is anticipated to witness the fastest CAGR over the forecast period. This segment is mainly driven by factors such as industry participants launching disposable devices, such as needles, chambers, and slides, to meet regulatory requirements. Such portfolio expansions are anticipated to increase the acceptance of disposable IVF devices.

Providers Insights

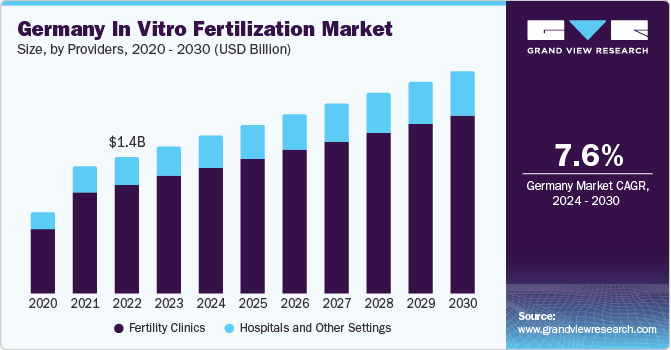

The fertility clinics segment held the largest revenue share of 79.9% in 2023. A key factor attributing to this growth is the constantly growing demand for assisted reproductive technology (ART). In addition, the assistance provided by experts, cost-effectiveness, and less or no possibility of exposure to Hospital-Acquired Infections (HAIs) is generating growth for this segment.

The hospitals and other settings segment is expected to witness a CAGR of 4.6% from 2024 to 2030. Several specialty and multispecialty hospitals in the region offer helpful treatments for infertility, including In-vitro Fertilization (IVF). Increased availability and accessibility of such technology-assisted treatments have increased the inclination toward hospitals.

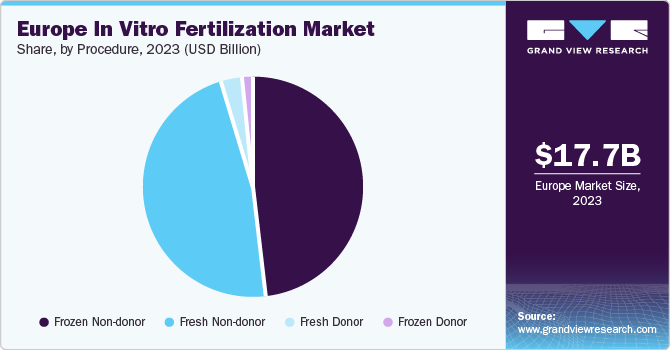

Procedure Insights

The frozen nondonor segment dominated the market with a revenue share of 48.3% in 2023. One of the main factors behind this larger share is cost-effectiveness. The less invasive nature of this procedure has also acted as an encouraging factor. The number of IVF cycles with the aid of frozen nondonor procedures is increasing compared to other procedures. This technique does not require fertility drug stimulation.

The fresh donor segment is anticipated to experience a significant CAGR of 5.3% from 2024 to 2030. The fresh donor eggs fertilize fresh oocytes. A greater number of people prefer this procedure as it tends to offer a greater success rate than the frozen eggs procedure.

Country Insights

Germany In Vitro Fertilization Market Trends

Germany in vitro fertilization market dominated the regional industry with a revenue share of 16.3% in 2023. This is primarily due to advancements in medical technologies and growing awareness regarding infertility and the availability of treatments for it. According to the National Library of Medicine, in Germany, 3% of children are conceived with the assistance of in vitro fertilization (IVF) technology.

Switzerland In Vitro Fertilization Market Trends

The in vitro fertilization market in Switzerland is expected to experience a CAGR of 6.0% from 2024 to 2030. According to the Federal Statistical Office, the number of children born in Switzerland through ART, specifically IVF, increased by 13% in 2021 compared to that of the previous year. The data indicates that approximately 2,500 children were born due to IVF treatments during that period.

Key Europe In Vitro Fertilization Company Insights

Some of the key and emerging companies in the Europe market include Vitrolife, Bayer AG, Ferring B.V., Thermo Fisher Scientific Inc., and others. To establish a competitive edge, companies have been relying on heavy investment in R&D to launch products and services characterized by innovation.

-

Vitrolife was among the first companies to offer ready-to-use culture media for IVF laboratories. It has a wide range of IVF products, a global presence with more than ten offices and 80 distributors, and worldwide production. Vitrolife maintains a high-quality distribution channel that includes product retrieval and transfer.

-

Bayer AG, a pharmaceutical and chemical establishment, has more than 150 years of experience in the healthcare industry. Its core business includes pharmaceuticals (human and veterinary), biotechnology products, human healthcare products, and agricultural chemicals. Bayer AG promotes four verticals: crop science, animal health, consumer care, and pharmaceuticals.

Key Europe In Vitro Fertilization Companies:

- Vitrolife

- Bayer AG

- Ferring B.V.

- Thermo Fisher Scientific Inc.

- LG Chem

- Merck KGaA

Recent Developments

- In May 2024, Vitrolife, one of the key market participants in the in vitro fertilization industry, completed the acquisition of eFertility, a prominent company in the system and software industry, renovating IVF clinic management with its cutting-edge innovations and solutions.

Europe In Vitro Fertilization Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 13.1 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

Germany; France; Spain; Italy; UK; Belgium; Netherlands; Switzerland

Segments covered

Procedure, providers, instruments, country

Key companies profiled

Vitrolife; Bayer AG; Ferring B.V.; Thermo Fisher Scientific Inc.; LG Chem; Merck KGaA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe In Vitro Fertilization Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe in vitro fertilization market report based on procedure, providers, instruments, and country.

-

Instrument Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Devices

-

Culture Media

-

Cryopreservation Media

-

Embryo Culture Media

-

Ovum Processing Media

-

Sperm Processing Media

-

-

Equipment

-

Sperm Analyzer Systems

-

Imaging Systems

-

Ovum Aspiration Pumps

-

Micromanipulator Systems

-

Incubators

-

Gas Analyzers

-

Laser Systems

-

Cryosystems

-

Sperm Separation Devices

-

IVF Cabinets

-

Anti-vibration Tables

-

Witness Systems

-

Others

-

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Fresh Donor

-

Frozen Donor

-

Fresh Non-donor

-

Frozen Non-donor

-

-

Providers Outlook (Revenue, USD Million, 2018 - 2030)

-

Fertility Clinics

-

Hospitals & Other Settings

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

Spain

-

Italy

-

UK

-

Belgium

-

Netherlands

-

Switzerland

-

Frequently Asked Questions About This Report

b. The Europe in vitro fertilization market was anticipated at USD 9.3 billion in 2023.

b. The Europe in vitro fertilization market is expected to grow at a CAGR of 5.0% from 2024 to 2030 to reach USD 13.1 billion by 2030

b. The culture media segment dominated the European in vitro fertilization market, with the leading revenue share in 2023. This can be attributed to aspects such as funding availability and an upsurge in research efforts to enhance the culture media.

b. Some of the key and emerging companies in the European in vitro fertilization market include Vitrolife, Bayer AG, Ferring B.V., Thermo Fisher Scientific Inc., and others.

b. The key factor driving the growth of this market is a rise in the prevalence of male and female infertility. According to Fertility Europe, 1 in 6 couples, or approximately 25 million people, have been suffering from infertility. This has increased demand for in vitro fertilization (IVF) technology and treatments.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."