- Home

- »

- Next Generation Technologies

- »

-

Europe Immersive Technology Market, Industry Report, 2030GVR Report cover

![Europe Immersive Technology Market Size, Share & Trends Report]()

Europe Immersive Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software/Platform, Services), By Technology, By Application, By Industry, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-286-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Immersive Technology Market Trends

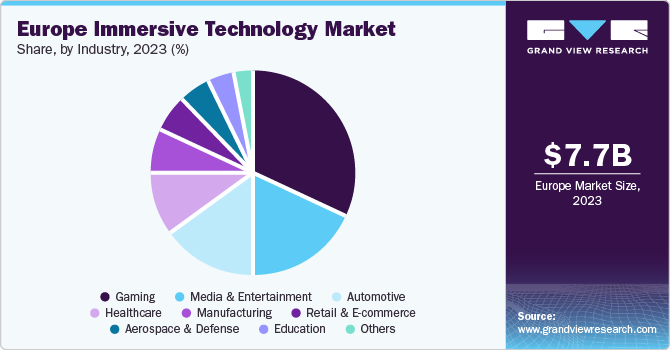

The Europe immersive technology market size was estimated at USD 7.66 billion in 2023 and is projected to grow at a CAGR of 28.2% from 2024 to 2030. Market growth is driven by several factors, such as increased demand for immersive experiences in gaming and entertainment, education, healthcare, and other industries. The technology offers innovative solutions, such as VR and AR that enhance education, training, and entertainment experiences.

The education industry is utilizing augmented reality (AR) and virtual reality (VR) technologies to better understand and keep students interested while learning, driving the adoption of immersive technology in the industry. GoStudent, a digital platform that connects students to teachers in a virtual learning environment, is transforming language learning in Germany and Austria through GoStudent VR. This immersive platform simulates real-life settings for language classes. Its innovative approach allows students to interact live with native-speaking tutors and classmates, enhancing their foreign language speaking abilities and confidence.

Industries such as healthcare utilize immersive training, simulation, and visualization technology. In October 2023, France-based AVATAR MEDICAL, an XR software platform provider, created software that converts medical images from scanners and MRIs into three-dimensional virtual reality representations. This technology enhances the visualization of anatomical structures for educational purposes in medical and nursing schools, universities, and other academic institutions globally.

The COVID-19 pandemic positively impacted the European market, as organizations adopted innovative solutions to maintain business continuity through remote collaboration tools, entertainment platforms, and training solutions. The rise in demand for virtual and cloud-based technologies led to increased investments in augmented reality (AR) and virtual reality (VR) solutions, particularly in sectors like virtual events, remote work setups, and telemedicine.

Enhanced internet connectivity is crucial in various applications such as VR gaming, remote collaboration, and AR-enhanced navigation. Integrating 5G technology can unlock new opportunities in healthcare, education, media and & entertainment, and industries where immersive technology is increasingly utilized for training, simulation, and innovative solutions. As 5G networks expand, they are expected to enhance immersive experiences, ushering in driving the growth of a new era of interconnected and dynamic virtual worlds.

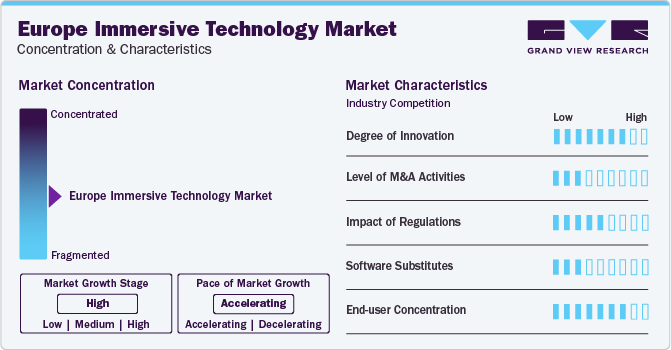

Market Concentration & Characteristics

The European immersive technology industry is significantly fragmented, the growth stage is high, and the pace is accelerating. This market is characterized by a high level of innovation driven by continuous advancements in hardware, software, and content creation. The rapid evolution of technology, combined with growing demand across various industries, creates a dynamic environment. The constant drive for innovation, fueled by emerging applications and enhanced user experiences, defines this market as highly innovative.

Innovation in AR and VR technologies plays a significant role in driving competition and differentiation within the industry. Companies continually strive to develop cutting-edge features and functionalities to meet evolving user needs and stay ahead of competitors. Companies continuously invest in research and development, leading to the introduction of new hardware devices, software applications, and content experience. In August 2023, Magic Leap, Inc. launched the AR Cloud feature on Magic Leap, Inc. 2, enabling multiple users to access shared, large-scale digital content integrated with their physical surroundings in real-time. This innovation allows users from different locations to interact with the same virtual content simultaneously, regardless of their geographical distances.

The impact of regulations such as the General Data Protection Regulation (GDPR) is essential for companies collecting and processing user data in immersive experiences. As AR and VR technologies utilize and collect real-time data, the company must adhere to GDPR compliances while ensuring users' data privacy.

End-use concentration varies across different sectors and industries, such as gaming, media, and entertainment, with a large consumer base and widespread adoption of immersive technology. Understanding different end-user segment-specific needs and preferences is crucial for companies, as it can help them modify their products and services to cater to the rapidly changing industry dynamics.

Component Insights

Based on component, the hardware segment led the market with the largest revenue share of 48.5% in 2023. Advancements in hardware capabilities, including improved processing power, higher screen resolution, and better motion tracking, drive the demand for immersive technology hardware. The growing demand for an immersive experience in gaming, education, healthcare, and business environments has also led to sales of advanced hardware products. As immersive technologies continue to expand into various industries, the importance of this field underscores the critical role of robust and innovative hardware solutions in delivering immersive and realistic experiences to users.

The software/platform segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the regions continuous VR, AR, and MR application development. Software/platform upgrades become necessary as hardware capabilities evolve to provide a better user experience. Industries such as gaming, military and defense, healthcare, and education increasingly rely on advanced software/platform solutions to unlock the full potential of immersive technology.

Technology Insights

Based on technology, the virtual reality (VR) segment led the market with the largest revenue share of 46.1% in 2023. The market is driven by the adoption of VR technology across various sectors, such as gaming, entertainment, healthcare, automotive, architecture, and education. The considerable adoption of VR headsets by regional gamers for gaming and other entertainment purposes in the gaming and entertainment industries is expected to drive the segment growth and demand in the VR market.

The Mixed Reality (MR) segment is expected to grow at the fastest CAGR during the forecast period. Combining the two components of features of AR and VR technologies, MR offers users a combination of clients a consistent reconciliation of the computerized and actual universes of life, giving unmatched intuitiveness and inundation experienced. Advancements in MR hardware and software, such as improved displays, better tracking systems, and more sophisticated content creation tools, are driving the adoption of MR technologies across various industries.

Application Insights

Based on applications, the training & learning segment led the market with the largest revenue share of 40.0% in 2023. MR technologies provide an immersive and interactive learning environment that enhances the learning experience. Features such as 3D visualizations, simulations, and interactive elements make complex concepts easier to understand and retain. MR enables organizations to create realistic training simulations for various industries, such as healthcare, manufacturing, aviation, and defense. These simulations help train employees in complex tasks, emergency procedures, equipment handling, and safety protocols more efficiently and effectively. MR-based training reduces costs associated with traditional training methods, such as physical equipment setup, travel expenses, and instructor fees.

The emergency services segment is expected to grow at the fastest CAGR over the forecast period. AR is crucial in providing real-time data visualization for emergency personnel, facilitating seamless access to critical information during crises. This immersive technology empowers emergency service providers to enhance their skills, make better decisions under pressure, and improve overall preparedness through simulated disaster response drills and medical emergency simulations.

Industry Insights

Based on industry, the gaming segment led the market with the largest revenue share of 32.2% in 2023. The growing popularity of esports and competitive gaming fuels the demand for immersive technology solutions in Europe. Esports tournaments and events are played by millions across Europe, driving demand for immersive gaming experiences that offer a competitive edge. VR and AR technologies enable esports players to train in realistic virtual environments, analyze gameplay data, and collaborate with teammates in new and innovative ways, enhancing their performance and driving the adoption of immersive technology solutions in the European esports market.

The healthcare segment is expected to grow at the fastest CAGR over the forecast period. The growing emphasis on patient-centered care and personalized medicine is driving demand for immersive technology in Europe. Healthcare providers are leveraging VR and AR applications to create immersive patient education materials, interactive therapy programs, and virtual rehabilitation experiences that enable patients to participate in therapy actively. By offering immersive and engaging experiences, healthcare providers improve patient understanding and adherence to treatment plans, driving the adoption and utilization of immersive technology solutions in the European healthcare market.

Country Insights

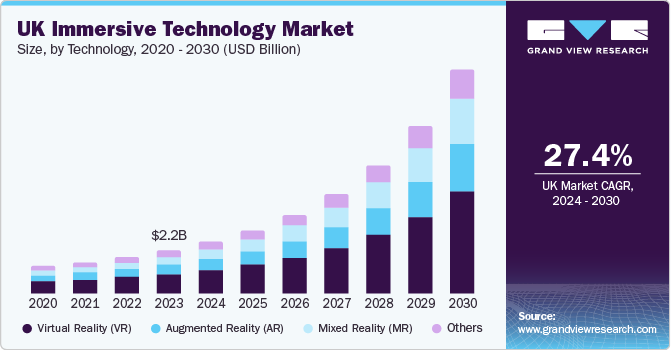

UK Immersive Technology Market Trends

The UK immersive technology market accounted for the largest revenue share of 29.2% in 2023, owing to the strong adoption and ongoing investments in AR and VR technologies. The gaming industry and innovative startups led the country's market growth, according to a Dealroom. Co's 2022 data, London, has emerged as a central hub for Europe's growing immersive technology ecosystem, attracting over USD 1.5 billion in venture capital funding over the past five years.

Germany Immersive Technology Market Trends

The immersive technology market in Germany is expected to witness at the fastest CAGR during the forecast period. There is a growing demand for immersive experiences among consumers, businesses, and institutions in Germany. Digital transformation, customer experience enhancement, remote collaboration needs, entertainment preferences, and training requirements drive this demand.

Key Europe Immersive Technology Company Insights

Some of the key companies operating in the European market include Unity Technologies, Alphabet Inc.

-

Alphabet Inc. operates across various segments like Google Play Services, Google Cloud, and Google AR & VR, which strongly emphasizes augmented reality (AR) and virtual reality (VR) solutions. These technologies enable users to access information and content visually, significantly expanding the capabilities of Google's devices in assisting users with daily activities such as information search, shopping, and self-expression

-

Unity Technologies is a video game software development company. The company's focus on providing end-to-end solutions for game creation, launch, and ongoing support emphasizes its commitment to fostering innovation and facilitating immersive experiences for users. These technologies enable users to access information and content visually, significantly expanding the capabilities of Google's devices in assisting users with daily activities such as information search, shopping, and self-expression

Key Europe Immersive Technology Companies:

- Ariyln

- Holo-Light GmbH

- Immersive factory

- INITION

- Magic Leap, Inc.

- Mindesk Inc.

- Realcast

- Ubisoft Entertainment

- Unity Technologies

- Varjo

- Virtuix

Recent Developments

-

In March 2024, Unity Technologies partnered with Mazda to revolutionize the in-cabin car experience for its Phase 2 car models, which are expected to be launched in 2025. This development focuses on enhancing the cockpit Human Machine Interface (HMI) and Graphic User Interface (GUI) through Unity Industry and Runtime tools. Through this partnership, Unity Technology will offer a versatile and powerful platform for developing and integrating cutting-edge solutions across various aspects of automotive technology

-

In July 2023, Atlas Copco acquired Extend3D GmbH, a German company specializing in augmented reality worker guidance for industrial clients through laser and video projection. This strategic move aims to strengthen Atlas Copco's process and quality control capabilities by incorporating a diverse range of augmented reality products tailored for assembly operations with highly complex and stringent quality requirements

-

In June 2023, Airbus launched an immersive remote collaboration to streamline the definition of aircraft cabins. Through holograms in a 3D environment, users explore various cabin equipment options and experiment with different interior configurations, materials, and colors, all in real time and from any location. This initiative marks a significant step towards digitalizing Airbus' industrial operations to enhance aircraft design quality, support production efficiency, and elevate customer satisfaction

Europe Immersive Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.24 billion

Revenue forecast in 2030

USD 40.97 billion

Growth rate

CAGR of 28.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, industry, region

Regional scope

Europe

Country scope

Germany; UK; France; Italy; Spain

Key companies profiled

Ariyln; Holo-Light GmbH; Immersive factory; INITION; Magic Leap, Inc.; Mindesk Inc.; Realcast; Ubisoft Entertainment; Unity Technologies; Varjo; Virtuix

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Immersive Technology Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe immersive technology market report based on component, technology, application, industry, and country.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

HMD

-

GTD

-

PDW

-

-

Software/Platform

-

Services

-

Professional Services

-

Managed Services

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Virtual Reality (VR)

-

Augmented Reality (AR)

-

Mixed Reality (MR)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Training & Learning

-

Emergency Services

-

Product Development

-

Sales & Marketing

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Manufacturing

-

Automotive

-

Education

-

Media & Entertainment

-

Gaming

-

Healthcare

-

Retail & E-commerce

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe immersive technology market size was estimated at USD 7.66 billion in 2023 and is expected to reach USD 9.24 billion in 2024

b. The Europe immersive technology market is expected to grow at a compound annual growth rate of 28.2% from 2024 to 2030 to reach USD 40.97 billion by 2030

b. UK dominated the Europe immersive technology market with a share of 29.2% in 2023, owing to the strong adoption and on-going investments in the AR and VR technologies.

b. Some key players operating in the Europe immersive technology market include Ariyln, Holo-Light GmbH, Immersive factory, INITION, Magic Leap, Inc., Mindesk Inc., Realcast, Ubisoft Entertainment, Unity Technologies, Varjo, Virtuix.

b. Factors such as increasing demand for virtual and augmented reality applications across various industries, technological advancements and decreasing costs of immersive hardware, growing interest in immersive experiences and storytelling driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.