Europe Ice Hockey Equipment Market Size, Share & Trend Analysis Report By Product (Protective Wear, Sticks, Skates, Others), By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-283-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Europe Ice Hockey Equipment Market Trends

The Europe ice hockey equipment market size was estimated at USD 614.8 million in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030. Active efforts to promote youth and grassroots participation in ice hockey contribute to the market growth. Investments in youth development programs and community initiatives create a continuous demand for equipment as new players enter the sport.

Several companies offer ice hockey equipment to address the growing demand among professionals and amateurs. For instance, Czechia-based sports equipment company STŘÍDA SPORT offers a wide range of ice hockey equipment. This includes essential items like sticks, skates, helmets, gloves, pads, and other accessories.

The presence of professional ice hockey leagues in Europe, such as the Kontinental Hockey League (KHL) and national leagues, is positively favoring the demand for high-quality equipment. The visibility of these leagues and events is anticipated to boost the market for both professional and amateur players to invest in quality gear. For instance, Women’s Hockey Partnership for Progress (WHPP) was launched in Europe's Danube region in 2023, aiming to provide equal opportunities for young girls in ice hockey. This joint initiative involves national ice hockey associations from Austria, Bosnia & Herzegovina, Croatia, Serbia, and Slovenia, along with the Sport Institute of Finland, the University of Ljubljana, the Ice Hockey Federation of North Macedonia, and the International Ice Hockey Federation (IIHF).

In addition, the rise in the number of companies offering ice hockey equipment with advancements in technology and materials used in manufacturing ice hockey equipment is also favoring the growth of the market. For instance, U.K.-based Willies, an online store, offers a wide range of ice hockey and figure skating equipment.

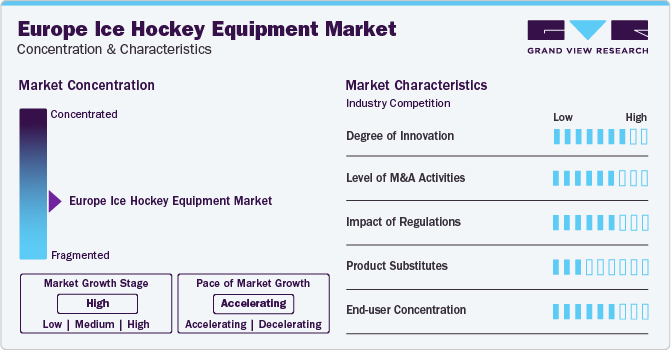

Market Concentration & Characteristics

The market for ice hockey in Europe is driven by a combination of historical tradition, increasing popularity, and a growing infrastructure for the sport. Ice hockey has deep roots in Europe, with a rich history that spans several decades. Countries like Sweden, Finland, Russia, and the Czech Republic have a strong tradition of producing skilled players who have excelled on the international stage. This legacy has contributed to a sustained interest in the sport, with communities embracing ice hockey as an integral part of their cultural identity.

Moreover, the increasing popularity of ice hockey in Europe can be attributed to the global nature of the sport. The exposure to high-level competitions such as the IIHF World Championship and the Olympics has fueled interest among fans. The sport's fast-paced nature, physicality, and skillful plays have captured the imagination of a diverse audience, drawing in not only traditional hockey markets but also new fans.

Product Insights

The ice hockey protective wear market accounted for a share of 22.0% of Europe revenues in 2023. The demand for protective wear in ice hockey, including helmets, shoulder pads, elbow pads, gloves, and shin guards, is primarily driven by the need for player safety. For instance, helmets stand as a critical component of ice hockey protective wear, serving as the primary safeguard against head injuries and concussions. The awareness of the potential long-term consequences of head trauma has significantly increased, prompting players and regulatory bodies to prioritize the use of technologically advanced helmets that offer superior impact protection without compromising comfort or visibility.

The ice hockey skates market is anticipated to grow at a CAGR of 6.7% from 2024 to 2030. The ice hockey equipment industry's skate market is mainly influenced by technological advancements and innovations intended to enhance players' performance and comfort. Manufacturers consistently invest in research and development to introduce state-of-the-art technologies that enhance the overall design and functionality of hockey skates. These innovations often center around lightweight materials, advanced blade technologies, and customizable features tailored to meet players' specific needs and preferences.

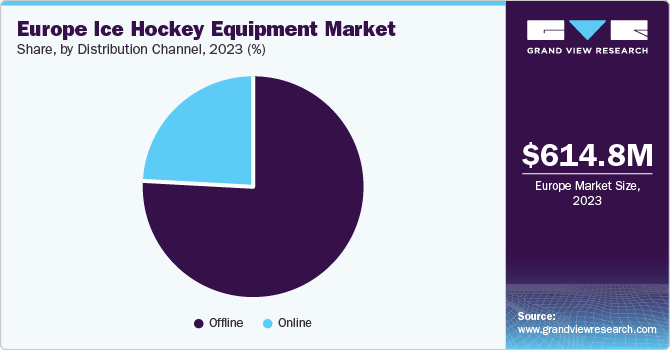

Distribution Channel Insights

Sales of ice hockey equipment through offline channels accounted for a share of around 76.0% of Europe's revenues in 2023. In offline retail outlets, customers could interact with the products directly, test the fit, and receive personalized assistance from knowledgeable staff. This hands-on experience allows players to make more informed decisions about their purchase, ensuring that the equipment meets their specific requirements and preferences. The tactile experience of trying on equipment and feeling the materials firsthand can instill greater confidence in the product, addressing concerns related to sizing and comfort that may not be as easily addressed through online channels.

Online distribution channels are projected to grow at a CAGR of 7.4% from 2024 to 2030. The accessibility of user-generated reviews allows potential buyers to gather insights into the performance, durability, and overall satisfaction levels associated with different brands and models of ice hockey equipment. This wealth of information empowers consumers to make more informed decisions, enhancing their confidence in purchasing online. Positive reviews and endorsements can significantly influence a buyer's perception of a product, contributing to the growth of online sales.

Sweden-based Hockeystore.com offers a vast selection of high-quality hockey gear, including skates, sticks, jerseys, and helmets. The store provides quick home delivery throughout Europe. The online store offers hockey sticks and other equipment from major players such as CCM, Bauer, and Warrior

Country Insights

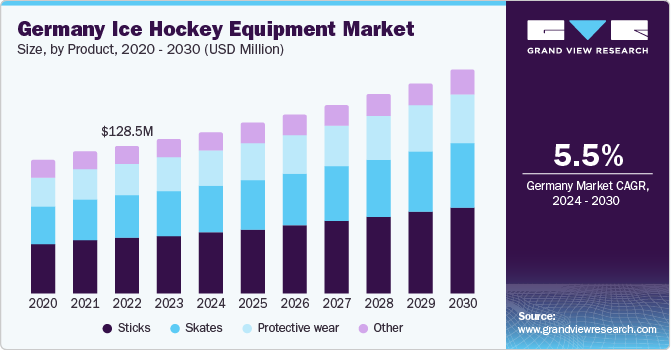

Germany Ice Hockey Equipment Market Trends

Germany ice hockey equipment market accounted for a share of 21.8% of the Europe ice hockey equipment market in 2023. The presence of professional ice hockey leagues, such as the Deutsche Eishockey Liga (DEL), brings about a high level of competition and entertainment. Fans are drawn to the enthusiasm of watching competitive ice hockey at the professional level, and this helps drive interest in playing the sport. Ice Hockey is a popular spectator sport in Germany. This increased fan base contributes to a growing pool of individuals inspired to participate actively in playing ice hockey, which further drives the market in this country.

Czech Republic Ice Hockey Equipment Market Trends

The ice hockey equipment market in the Czech Republic is expected to grow at a CAGR of 7.8% from 2024 to 2030. Ice hockey's cultural significance in the Czech Republic is anticipated to drive the demand for associated equipment. The sport is deep-seated in the national identity, and the popularity of ice hockey events, both at professional and amateur levels is driving the demand for equipment among enthusiasts and aspiring players in the country.

Key Europe Ice Hockey Equipment Company Insights

Europe market is highly competitive owing to a large number of industry players. The market provides various opportunities for new entrants due to changing consumer preferences and the easy availability of raw materials. Companies are involved in product retailing through e-commerce, supermarkets, and hypermarkets. Furthermore, major players engage in competitive strategies such as new product launches, joint ventures, strengthening of online presence, and capacity expansions among others.

Key Europe Ice Hockey Equipment Companies:

- Bauer (Peak Achievement Athletics Inc.)

- CCM (Birch Hill Equity Partners)

- STX

- Warrior (New Balance)

- SherWood (Canadian Tire Corp)

- TRUE

- ROCES SPORT S.R.L

- Vaughn Hockey

- Winwell

- Grafskates AG

Recent Developments

-

In October 2023, CCM Hockey partnered with Professional Women's Hockey League (PWHL) for the supply of hockey equipment, aimed at supporting athlete by equipping them with gear engineered for peak performance. This contributed to the advancement and success of women's hockey at all levels

-

In September 2022, True Temper (TRUE) became the official partner of the North American Hockey League (NAHL), making TRUE the exclusive provider of goalie sticks from 2023-24

Europe Ice Hockey Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 650.0 million |

|

Revenue forecast in 2030 |

USD 949.0 million |

|

Growth rate |

CAGR of 6.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, country |

|

Country scope |

Czech Republic; Sweden; Finland; Germany; Austria |

|

Key companies profiled |

Bauer (Peak Achievement Athletics Inc.); CCM (Birch Hill Equity Partners); SherWood (Canadian Tire Corp); Warrior Sports (New Balance); True Temper Sports; STX; Grafskates AG; Winnwell; Vaughn Hockey; ROCES SPORT S.R.L |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Ice Hockey Equipment Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe ice hockey equipment market report based on product, distribution channel, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protective wear

-

Sticks

-

Skates

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Czech Republic

-

Sweden

-

Finland

-

Germany

-

Austria

-

Frequently Asked Questions About This Report

b. Europe ice hockey equipment market size was valued at USD 614.8 million in 2023 and is expected to reach 650.0 million in 2024.

b. Europe ice hockey is expected to grow at a compounded growth rate of 6.5% from 2024 to 2030 to reach USD 949.0 million by 2030.

b. Protective wear accounted for a share of 22.0% of the global revenues in 2023. The demand for protective wear in ice hockey, including helmets, shoulder pads, elbow pads, gloves, and shin guards, is primarily driven by the need for player safety. Ice hockey is a fast-paced, physical sport that involves constant movement and the use of a hard puck and can result in collisions. Ice hockey is a contact sport, and players are at risk of various injuries due to collisions, falls, and the high-speed nature of the game. Protective gear helps minimize the risk of injuries such as concussions, fractures, cuts, and bruises.

b. Some key players operating in the Europe ice hockey market are Bauer (Peak Achievement Athletics Inc.), CCM (Birch Hill Equity Partners), SherWood (Canadian Tire Corp), Warrior Sports (New Balance), True Temper Sports, STX, Grafskates AG, Winnwell, Vaughn Hockey, ROCES SPORT S.R.L

b. Active efforts to promote youth and grassroots participation in ice hockey contribute to the market growth. Investments in youth development programs and community initiatives create a continuous demand for equipment as new players enter the sport.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."