- Home

- »

- Medical Devices

- »

-

Europe Hypodermics Market Size And Share, Report, 2030GVR Report cover

![Europe Hypodermics Market Size, Share & Trends Report]()

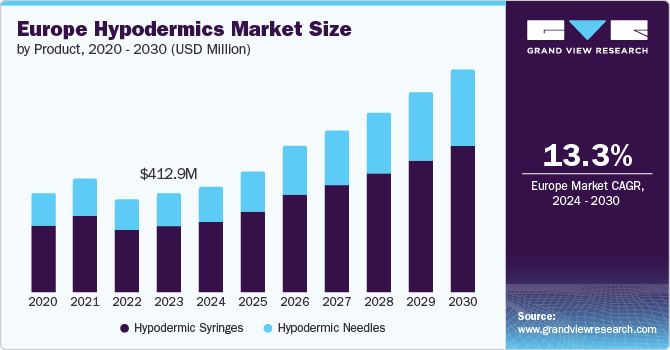

Europe Hypodermics Market Size, Share & Trends Analysis Report By Product (Hypodermic Needles, Hypodermic Syringes), By End-use (Hospitals, Clinics, Ambulatory Surgical Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-463-3

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Hypodermics Market Size & Trends

The Europe hypodermics market size was estimated at USD 412.91 million in 2023 and is projected to grow at a CAGR of 13.3% from 2024 to 2030. The growth can be attributed to the increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, necessitating frequent use of hypodermic needles for insulin delivery and other treatments. In addition, the growing demand for vaccinations and the expansion of healthcare services in European countries contribute to the high utilization of hypodermic needles.

Moreover, technological innovations, such as improved needle designs that reduce pain & enhance safety features to prevent needle-stick injuries, drive market growth. The increasing number of needlestick injuries is expected to drive the demand for hypodermic products.

According to data published by the NHS Resolution in March 2023, the NHS Litigation Authority recorded 2,600 claims for needlestick injuries from incidents occurring between 2012 and 2022. Of these claims, around 1,947 were successful and cost the NHS around USD 14.25 million. The growing vaccination rates for preventing several infectious diseases are anticipated to drive the demand for hypodermic syringes and needles in the coming decade.

The governments of several countries have focused on improving COVID-19 and other diseases, such as flu vaccination. Numerous efforts are underway to raise awareness about vaccination. For instance, in April 2024, the Health Service Executive (HSE) of Ireland initiated the COVID-19 Spring booster vaccination campaign. As part of this campaign, free COVID-19 vaccines will be provided to recommended groups, including those aged 80 or older and individuals aged five or older with a weakened immune system.

Advancements in hypodermic needles and syringes are anticipated to propel market growth in the coming decade. Companies utilize advanced technologies to enhance patient care. For instance, the BD Eclipse Needle has SmartSlip Technology to safely assemble these needles into slip syringes. In addition, the same company offers SafetyGlide Safety Needles with Activation Assist Technology to provide immediate coverage of the needle by a single finger stroke after injection. Hence, the availability of such advanced products is anticipated to support market growth in the coming decade.

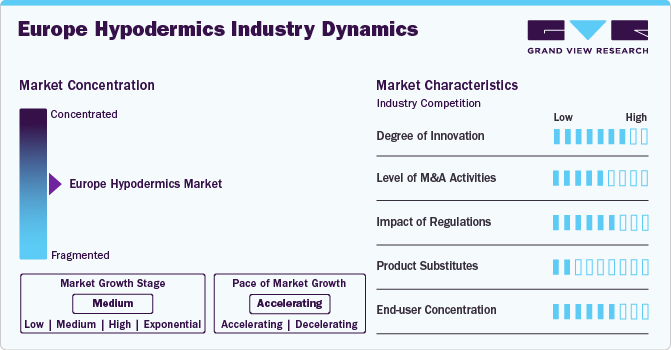

Market Concentration & Characteristics

The market growth stage is medium, with an accelerating pace. The hypodermics market is expected to witness notable advancements, with a growing emphasis on safety products. These products include needles with protective safety sheaths and blunting technologies to prevent needlestick injuries. In addition, there are products with one-handed activation and a textured thumb press design to improve patient care.

The hypodermics industry is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. These major players acquire small players to enhance their service portfolios and improve their geographic presence.

The hypodermics industry is also subject to increasing regulatory scrutiny. The regulatory framework governing the hypodermics market in the UK is shaped by domestic regulations and compliance with EU standards, even post-Brexit. This framework ensures the safety, efficacy, and quality of hypodermic needles, syringes, and other related products in the market. Medicines and Healthcare Products Regulatory Agency (MHRA) is the UK’s primary regulatory body overseeing medical devices, including hypodermic needles and syringes. All hypodermic products must be registered with the MHRA before being marketed in the UK. This involves a rigorous assessment of the product’s safety and performance.

There are a limited number of direct product substitutes for hypodermic needles and syringes. However, a number of technologies can be used to achieve similar outcomes to these products, such as oral and transdermal delivery products. Advancements in transdermal patches and oral drug formulations can reduce reliance on needles and syringes for some drugs.

Product Insights

Hypodermic syringes dominated the market and accounted for a revenue share of 66.7% in 2023. Rapid technological advancements are driving the growth of the hypodermic syringes segment by improving safety, comfort, and efficiency in medical procedures. Innovations such as safety-engineered syringes featuring retractable needles or shielded tips help reduce the risk of needlestick injuries and infections, addressing significant concerns in healthcare environments. For instance, in May 2024, Hindustan Syringes and Medical Devices (HMD) introduced Dispojekt single-use syringes with safety needles, designed to lower the incidence of accidental needlestick injuries among healthcare workers. Moreover, the development of prefilled syringes enhances medication administration by reducing dosing errors and offering greater convenience for both healthcare providers & patients.

The hypodermic needles segment is projected to grow at the fastest CAGR over the forecast period. Growing prevalence of chronic conditions such as diabetes, cancer, and cardiovascular diseases necessitates frequent injections for treatment and monitoring, thereby boosting demand for hypodermic needles. For instance, according to a report by Diabetes UK, in 2022 - 2023, more than 5.6 million individuals in the UK were living with diabetes, of which 1.2 million people may have type 2 diabetes. Moreover, according to the International Diabetes Federation, there will be a 13% rise in the number of diabetic patients in Europe by 2045. The region also has the highest number of children and adolescents with type 1 diabetes. With the rising number of diabetes cases, especially type 1 and type 2, there is an increasing need for hypodermic needles for insulin injections, which drives the market growth over the forecast period.

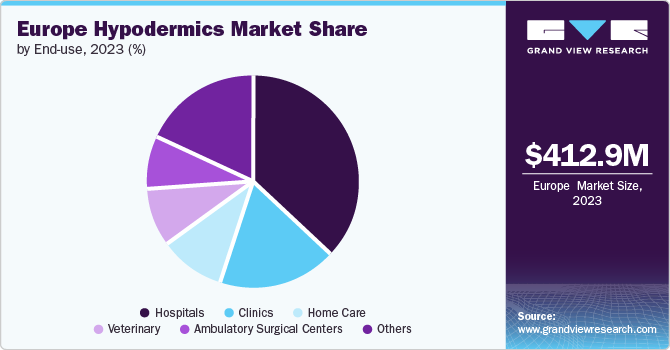

End-use Insights

Hospitals accounted for the largest market revenue share of 36.9 % in 2023. The hospitals segment significantly influences the market by generating a high and steady demand for hypodermic needles & syringes due to the large volume of medical procedures performed. For instance, as per a report by the National Institute for Health and Care Research (NIHR) in January 2022, the NHS conducts over 5 million surgical procedures annually. Hospitals frequently conduct various procedures requiring injections, such as administering medications, drawing blood for tests, and providing anesthesia. The broad spectrum of patient needs, from routine care to complex emergency treatments, requires a wide range of hypodermic products, which drives market demand. The high patient turnover in hospitals further increases the use of these medical devices, contributing to market growth.

In addition, hospitals lead in adopting advanced hypodermic technologies, including safety-engineered syringes and needle-free systems, to improve patient safety and procedural efficiency. Rigorous regulatory standards and a commitment to reducing needlestick injuries & infections prompt hospitals to invest in high-quality, innovative hypodermic products. The growing focus on safety and rapid technological advancements, along with the expansion of hospital services & rising clinical research, accelerate market growth by promoting the use of advanced, reliable needle & syringe solutions. In August 2022, the government of the UK planned to open 50 new surgical hubs in the country that will provide a minimum of 100 operation theatres and 1000 beds. This initiative is expected to reduce the waiting list and deliver nearly 2 million extra routine operations by 2025.

The home care segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment can be attributed to the increasing prevalence of chronic diseases and the growing preference for managing health conditions at home. As conditions such as diabetes, rheumatoid arthritis, and multiple sclerosis become more common, patients require regular injections for medication administration, which fuels the demand for hypodermic syringes & needles. The shift toward home-based care provides patients with greater autonomy and convenience, leading to a higher consumption of self-injection devices, such as prefilled syringes and insulin pens. This trend toward at-home treatment options directly contributes to the growth of the market by increasing the need for user-friendly, reliable injection solutions.

In addition, advancements in hypodermic technology, such as safety features and ergonomic designs, drive market growth in the home care segment. The development of syringes with safety-engineered features and minimal pain or discomfort enhances patient compliance and safety during self-injections. As home care continues to expand due to its cost-effectiveness and improved patient outcomes, the need for innovative and high-quality hypodermic syringes grows, supporting the overall market development in this segment.

Country Insights

The UK hypodermics market dominated the Europe region with a share of 43.1% in 2023. The country has a rapidly aging population, with the number of individuals aged 65 and over increasing significantly. As of 2022, there were around 12.7 million people aged 65 or over in the UK, which is about 19% of the total population. This number is expected to increase to 27% of the population by 2072. This demographic shift is a major driver for the hypodermics market as older adults require more frequent medical interventions, including injections for chronic conditions such as diabetes, arthritis, and cardiovascular diseases.

In addition, the UK government has been proactive in expanding its immunization programs, particularly in response to public health challenges, such as influenza, COVID-19, and other infectious diseases. For instance, in July 2024, the UK government announced a national respiratory syncytial virus (RSV) vaccine programme to protect both infants and adults from RSV. These initiatives are expected to drive the demand for hypodermic needles & syringes, which are essential for vaccine administration.

The reimbursement for hypodermic products in the UK is managed by the National Health Service (NHS), the main public healthcare provider. The NHS plays a crucial role in determining the accessibility and affordability of medical devices, including hypodermic needles and syringes. This scenario is governed by a combination of NHS policies, procurement strategies, and regulatory frameworks, ensuring that hypodermic products meet the required safety, efficacy, and cost-effectiveness standards before being made available to healthcare providers.

The Ireland hypodermics market is anticipated to witness significant growth in the coming years. Ireland has witnessed a significant rise in the prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer. This increase is expected to drive the demand for hypodermic needles & syringes, as these conditions often require regular administration of medication through injections. The rising incidence of cancer in Ireland, with new cases diagnosed annually, is expected to necessitate frequent administration of chemotherapy drugs and other injectable treatments, thereby increasing the demand for hypodermic needles & syringes.

The Irish government has been proactive in improving healthcare access and quality, including better chronic disease management and increased funding for public health programs. These initiatives directly impact the market. The Sláintecare strategy aims to reform the Irish healthcare system by ensuring universal access to care. As part of this strategy, the government is increasing investment in primary care services, where the use of hypodermic products is common for administering vaccines, antibiotics, and other treatments.

Key Europe Hypodermics Company Insights

Some of the key companies in the include BD (Becton, Dickinson & Corporation), Cardinal Health, B. Braun SE, ICU Medical, Terumo Corporation, Nipro Europe Group Companies (Nipro Corporation), and others. Organizations are focusing on technological advancements, sustainability, and increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

BD is a global medical technology company committed to advancing healthcare through improved medical discovery, diagnostics, and care delivery. It empowers healthcare professionals by developing innovative technologies, services, and solutions that enhance clinical therapies for patients and optimize clinical processes for providers.

Key Europe Hypodermics Companies:

- BD (Becton, Dickinson & Corporation)

- Cardinal Health

- B. Braun SE

- ICU Medical

- Terumo Corporation

- Nipro Europe Group Companies (Nipro Corporation)

- SolM

- GBUK Group Ltd.

Recent Developments

-

In July 2024, GBUK, a portfolio company of A&M Capital Europe, acquired Care & Independence (“C&I”), a rapidly expanding UK provider of patient handling and mobility devices.

-

In August 2024, the Medical Technology and Devices S.p.A. (“MTD“) group acquired Ypsomed AG’s pen needles and blood glucose monitoring systems businesses to enhance the diabetes and obesity care portfolio.

Europe Hypodermics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 936.0 million

Growth Rate

CAGR of 13.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

Europe

Country scope

UK, Ireland, Denmark, Finland, Iceland, Norway, Sweden.

Key companies profiled

BD (Becton, Dickinson & Corporation); Cardinal Health; B. Braun SE; ICU Medical; Terumo Corporation; Nipro Europe Group Companies (Nipro Corporation); SolM; GBUK Group Ltd.; Troge Medical GmbH; Secured Medical Direction UK Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Hypodermics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe hypodermics market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypodermic Needles

-

Conventional Needles

-

Safety Needles

-

-

Hypodermic Syringes

-

Conventional Syringes

-

Safety Syringes

-

Retractable Safety Syringes

-

Non-retractable Safety Syringes

-

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Veterinary

-

Home Care

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Ireland

-

Denmark

-

Finland

-

Iceland

-

Norway

-

Sweden

-

Frequently Asked Questions About This Report

b. The Europe hypodermics market size was estimated at USD 412.91 million in 2023 and is expected to reach USD 442.07 million in 2024.

b. The Europe hypodermics market is expected to grow at a compound annual growth rate of 13.3% from 2024 to 2030 to reach USD 936.01 million by 2030.

b. UK dominated the Europe hypodermics market with a share of 43.11% in 2023. This is attributable due to UK has a rapidly aging population, with the number of individuals aged 65 and over increasing significantly.

b. Some key players operating in the Europe hypodermics market include BD; B. Braun SE; ICU Medical; Nipro Medical Europe; Cardinal Health; Terumo; SolM; Troge Medical GmbH; GBUK Group Ltd; Secured Medical Direction UK Co., Ltd.

b. Key factors that are driving the market growth include increase In number of needlestick injuries, rising vaccination rates and campaigns, & advancements in hypodermic syringes and needles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."