- Home

- »

- Organic Chemicals

- »

-

Europe Hydrocarbon Solvents Market Size Report, 2025GVR Report cover

![Europe Hydrocarbon Solvents Market Size, Share & Trends Report]()

Europe Hydrocarbon Solvents Market Size, Share & Trends Analysis Report By Product (White Spirits, Hexane, Aromatic), By Application (Agriculture, Pharmaceutical), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-015-6

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Bulk Chemicals

Report Overview

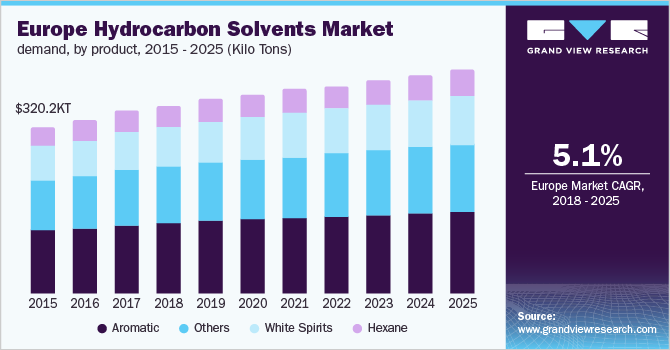

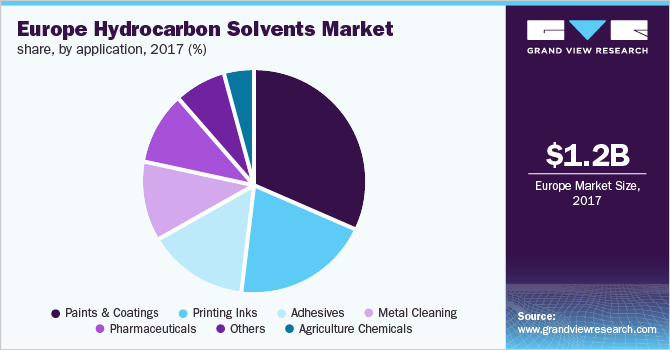

The Europe hydrocarbon solvents market size to be valued at USD 1.93 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% during the forecast period. Sustained consumption of petrochemical solvents in rapidly growing end-use industries such as paints & coatings, printing inks, metal cleaning, and adhesives has primarily driven the market. This category of diluents also covers a large range of cleaning products including daily-use consumer products to several tailored industrial cleaners.

The stringent regulatory scenario and end-user industry preferences have driven the industry to develop and formulate multi-functional solutions. Strong demand from the building and construction industry in the region has been a major factor in the rebound in demand in terms of volume. Hence, the growth of the European paints & coatings industry is anticipated to drive the demand for hydrocarbon solvents over the forecast period.

The aromatic product category has witnessed varying applications in paints and coatings, printings, and several other end-use industries. Though oxygenated and bio-based solvents have been gaining importance in the present industry scenario, direct alternative to these diluents is not as compatible with them in terms of their characteristics and product desired output properties.

The products such as white spirits, hexane, and other aromatics are some of the most significant petrochemical derivatives. The Europe hydrocarbon solvents market has witnessed varying levels of value addition across different stages of the value chain. Raw material prices are one of the most crucial parameters largely determining the new production within the market.

The product portfolios of the key industry participants are also rapidly changing to adjust to the changing demand scenarios. The market is highly diverse and includes numerous individual compounds and chemicals. The chemical companies take a few basic raw chemicals and transform them into substances that are valuable to other end-use industries, such as pharmaceuticals and agrochemicals.

Europe Hydrocarbon Solvents Market Trends

Automotive paint consumption is directly related to the development of new vehicles, particularly commercial vehicles, and two-wheelers. The increased manufacturing of electric vehicles is increasing the use of automotive paints. This is expected to drive the demand for coatings and adhesives and fast-drying paints. As a result, the hydrocarbon solvents market is anticipated to expand during the forecast period.

In textile printing, hydrocarbon solvents are widely used as carriers. Printing inks are broadly used in the manufacturing sector, primarily for labelling, and printing on cartons. Increased trading activity and increased industrial production are both likely to drive the growth of packaging demand, thereby expanding the market for printing inks during the forecast period.

VOCs are hydrocarbon solvents, which are found in paints, inks, adhesives, and coatings. As a result, one of the major sources of pollution is VOC emissions from manufacturing processes. To limit VOC emissions from diverse sources, including items that comprise solvents, several governmental and regulatory bodies passed rules and regulations. This resulted in a negative impact on the global market for hydrocarbon solvents and are expected to limit growth during the forecast period.

In the past few years, the demand for oxidized and bio-based solvents has grown significantly. Although hydrocarbon solvents in Europe is diversified, the increased use of hydrocarbon solvents in the pharmaceutical and agrochemical industries is anticipated to fuel market expansion. Additionally, the advancements in products with negligible impact on the environment are expected to boost the market for hydrocarbon solvents in Europe.

Product Insights

White spirits are among the fastest-growing product type and the segment is estimated to expand at a CAGR of 2.2% in terms of volume from 2018 to 2025. These primarily consist of aliphatic compounds and in some amount contain aromatic compounds. The aromatics components typically include toluene and xylene. Such compounds find significant applications in industrial paints, adhesives, resins, and detergents.

Aromatic hydrocarbon solvents are widely used for manufacturing several petrochemical-based formulations, as the product category possesses a very high degree of dissolution. It is the dominant product segment and accounted for around 35% of the market share in terms of volume. These diluents possess some exceptional chemical and physical properties compared to their aliphatic counterparts. However, when in contact with the atmosphere, the emissions from these compounds can be carcinogenic and fatal.

Application Insights

Paints and coatings are the largest application segment and held over 30% of the market share in terms of revenue in 2017. Paints make use of many organic thinners, such as aromatics, aliphatic, ketones alcohols, and white spirits. These thinners are used as per the type of paint formulated, for instance, a solvent-borne paint would make use of more white spirits and high aromatic components than the water-based paints. Paints and coatings are among one the most dynamic industries globally due to advancements in manufacturing technologies, evolving consumer preferences, and product formulations complying with various regulatory changes.

Printing ink is the second most significant application area for hydrocarbon solvents. In printing inks, diluters can account for approximately 40% of the total ink formulation. These are primarily used in printing inks to carry or dissolve particulate matters, such as pigments, resins, and dyes.

Hydrocarbon solvents are used along with adhesives in applications ranging from vehicle tires to shoe soles. They are also widely used in industrial and household adhesives, as well as applications where high performance and durability are required, such as metal-to-metal bonding.

Country Insights

Germany holds the largest share of the market for hydrocarbon solvents in Europe. Germany is an attractive market for several industries and constitutes around 21% of European GDP. The nation's welcoming attitude towards Foreign Direct Investment (FDI) and with business free from regulations of confining day-to-day business has made the German market open for investment in practically all the industry sectors. Some of the growing end-use industries for petrochemicals include automotive adhesive, pharmaceuticals, and the paint industry. In addition, the country has rapidly developed in terms of the shift from commodities to specialty products.

France has also highlighted a broad prospect of growth for the chemicals industry ranging from specialty to fine chemicals. The industry in the country is strong in terms of consumer chemicals, such as cosmetics, detergents, and soaps. Thus, hydrocarbon solvent industry in the country is also growing at an optimal rate. Some of the geographical advantages, such as the strategic location make it a brilliant trade destination with other European Union (EU) countries. This is further supported by excellent transportation infrastructure both domestically and internationally and cordial relationships with the Italy, Switzerland, and Germany.

Key Companies & Market Share Insights

The top players in the regional market have implemented sustainable solutions coupled with maintaining long-term profits and complying with manufacturing standards in the dynamic regulatory scenario. Some companies are now concentrating on sustainable approaches to manufacture chemical intermediates with very low Volatile Organic Content (VOC) to prevent serious environmental impact.

Mergers and acquisitions are some of the most significant strategic moves adopted by the companies to boost their market share. The European hydrocarbon solvent companies face stiff competition in terms of technological, raw material (crude oil) quality & supply, and new product innovations.

Some of the significant companies predominant in the region include multinational companies, such as Dow Dupont, Total SA, Royal Dutch Shell, Eastman Chemical Company, Chevron Corporation, and Ashland.

Europe Hydrocarbon Solvents Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 1.45 billion

Revenue forecast in 2025

USD 1.93 billion

Growth Rate

CAGR of 5.1% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

Germany; Italy; France; Poland; Czech Republic; Austria; Ukraine; Romania; Bulgaria; South Slavic Region

Key companies profiled

Dow Dupont; Total SA; Royal Dutch Shell; Eastman Chemical Company; Chevron Corporation; Ashland

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

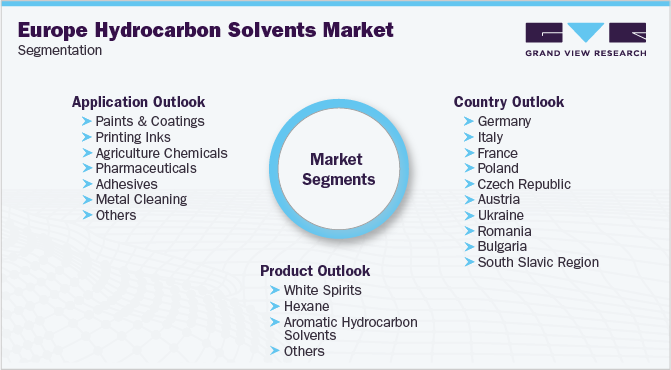

Europe Hydrocarbon Solvents Market SegmentationThis report forecasts volume and revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the Europe hydrocarbon solvents market report on the basis of product, application, and country:

-

Product Outlook (Volume Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

White Spirits

-

Hexane

-

Aromatic Hydrocarbon Solvents

-

Others

-

-

Application Outlook (Volume Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Paints & Coatings

-

Printing Inks

-

Agriculture Chemicals

-

Pharmaceuticals

-

Adhesives

-

Metal Cleaning

-

Others

-

-

Country Outlook (Volume Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Germany

-

Italy

-

France

-

Poland

-

Czech Republic

-

Austria

-

Ukraine

-

Romania

-

Bulgaria

-

South Slavic Region

-

Frequently Asked Questions About This Report

b. The global Europe hydrocarbon solvents market size was estimated at USD 1.45 billion in 2019 and is expected to reach USD 1.53 billion in 2020.

b. The global Europe hydrocarbon solvents market is expected to grow at a compound annual growth rate of 5.1% from 2018 to 2025 to reach USD 1.93 billion by 2025.

b. Aromatics dominated the Europe hydrocarbon solvents market with a share of 38.6% in 2019. This is attributable to their wide application scope in manufacturing of several petrochemical-based formulations and high degree of dissolution.

b. Some key players operating in the Europe hydrocarbon solvents market include Dow, Total SA, Royal Dutch Shell, Eastman Chemical Company, Chevron Corporation, and Ashland.

b. Key factors that are driving the market growth include increasing paint & coating demand from various end-use industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."