- Home

- »

- Advanced Interior Materials

- »

-

Europe Gypsum Board Market Size, Industry Report, 2030GVR Report cover

![Europe Gypsum Board Market Size, Share & Trends Report]()

Europe Gypsum Board Market Size, Share & Trends Analysis Report By Product (Wallboard, Ceiling Board, Pre-decorated), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-320-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Europe Gypsum Board Market Size & Trends

The Europe gypsum board market size was estimated at USD 8.6 billion in 2023 and is projected to grow at a CAGR of 10.5% from 2024 to 2030. The surge in construction activities, particularly in Eastern Europe, coupled with the increasing demand for sustainable building materials, has significantly contributed to this growth. Furthermore, the rising trend of interior decoration and remodeling in residential sectors and the implementation of stringent regulations regarding energy efficiency and fire safety in buildings have fueled the demand for gypsum boards.

The Europe gypsum board market accounted for a share of 15.4% of the global gypsum board marketrevenue in 2023. Stringent regulations regarding fire safety, sustainability, and building performance pose challenges for gypsum board manufacturers. These regulations necessitate ongoing research and development efforts to ensure gypsum boards meet the latest standards. The Green Public Procurement (GPP) Criteria for Wall Panels was developed by the European Gypsum Industry in collaboration with the European Commission. This criterion establishes environmentally sound purchasing practices for wall panels, including gypsum plasterboard wall panels. Furthermore, the complex and constantly evolving European regulatory landscape for construction materials and waste management issues can also pose challenges for manufacturers. However, these regulations also drive innovation and the development of high-performance gypsum boards, thereby contributing to market growth.

Product Insights

The wallboard segment held over 50.0% of the total revenue in 2023. This dominance can be attributed to the extensive use of wallboards in residential and commercial construction due to their cost-effectiveness, durability, and ease of installation. Wallboards are also favored for their fire-resistant properties, which meet Europe's stringent fire safety regulations. The demand for wallboards is particularly high in the renovation sector, where they are used to improve buildings' thermal and acoustic insulation. Moreover, the ongoing trend of sustainable construction and the increasing awareness about energy efficiency have further boosted the demand for wallboards.

On the other hand, the pre-decorated board segment is projected to grow at a CAGR of 11.2% from 2024 to 2030. Pre-decorated boards, also known as decorative panels, are gaining popularity due to their aesthetic appeal and the convenience they offer. These boards come with a finished surface, eliminating the need for additional decoration or painting, thereby saving time and reducing labor costs. The rising trend of interior decoration and the growing demand for personalized and unique designs in residential and commercial spaces are driving the growth of this segment. Furthermore, advancements in digital printing technology have enabled manufacturers to offer pre-decorated boards with a wide range of designs and finishes, catering to consumers' diverse tastes and preferences.

Application Insights

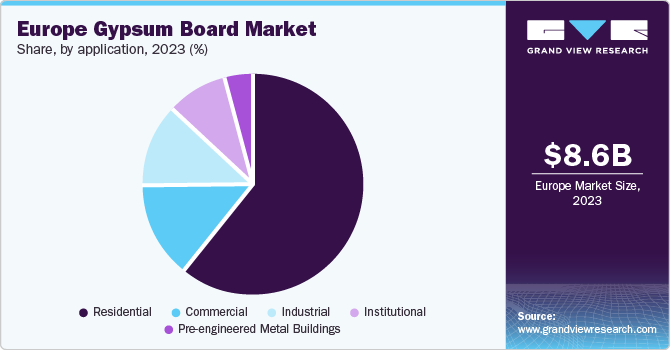

The residential segment held a 61.2% revenue share in 2023. This can be attributed to the extensive use of gypsum boards in residential construction due to their versatility, cost-effectiveness, and ease of installation. Gypsum boards are commonly used in homes for walls and ceilings, and their fire-resistant properties make them a preferred choice for meeting stringent fire safety regulations in Europe. The demand for gypsum boards in the residential sector is also driven by the ongoing trend of home renovation and remodeling, where they are used to improve buildings' thermal and acoustic insulation.

The institutional segment is projected to witness the fastest revenue growth of CAGR of 11.2% from 2024 to 2030. Institutional buildings, such as schools, hospitals, and government buildings, require high-performance materials that meet strict safety and sustainability standards. Gypsum boards are ideally suited for these applications due to their fire-resistant and sound-insulating properties. The increasing investment in public infrastructure across Europe drives the growth of this segment. Furthermore, the trend of green building practices in the institutional sector is expected to further fuel the demand for gypsum boards. As institutions prioritize sustainability and energy efficiency, the demand for gypsum boards in this sector is expected to grow rapidly.

Country Insights

Russia Gypsum Board Market Trends

The gypsum board market in Russia held a share of 13.7% in 2023. This can be attributed to the robust growth in the construction sector in Russia, driven by government initiatives to improve infrastructure and housing. Furthermore, Russia’s vast gypsum reserves provide a steady supply of raw materials for gypsum board production, contributing to the growth of the market. The trend towards sustainable construction and energy-efficient buildings in Russia is also driving the demand for gypsum boards.

UK Gypsum Board Market Trends

The gypsum board market in UK is projected to witness the second-fastest CAGR of 10.1% from 2024 to 2030. The growth in the UK market can be attributed to the increasing demand for sustainable and energy-efficient building materials in line with the UK government’s commitment to reducing carbon emissions. The rising trend of home renovation and remodeling, coupled with the growing demand for personalized and unique interior designs, is also driving the growth of the gypsum board market in the UK.

Key Europe Gypsum Board Company Insights

Some of the key players operating in the market include Etex, Knauf, Saint Gobain, and Georgia-Pacific LLC:

-

Saint-Gobain provides a comprehensive suite of gypsum-based building products, encompassing plasters, plasterboards, ceilings, and all necessary ancillary materials for a complete installation system

-

Knauf provides high-quality and sustainable gypsum board products. Its product offerings include standard-setting gypsum plasterboard and drywall systems with benefits spanning the spectrum of performance - fire protection, acoustics optimization, energy efficiency, bullet resistance, and more

Key Europe Gypsum Board Companies:

- Saint Gobain

- Georgia-Pacific LLC

- Knauf

- Etex Group

- Fermacell

- Continental BP

- Hengshenglong

- Holcim Ltd

- National Gypsum Services Company

- Osman Group

Recent Developments

-

In June 2024, Knauf Group announced plans to divest its Russian operations to local management, ensuring continuity for its customer base and safeguarding over 4,000 jobs

-

In January 2023, British Gypsum announced that all its construction systems have achieved CCPI accreditation, signifying adherence to the industry's highest standards for product information clarity and accuracy

Europe Gypsum Board Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 17.3 billion

Growth rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million square meters, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, trends

Segments covered

Product, application, country

Country scope

Germany; UK; Poland; Russia

Key companies profiled

Saint Gobain; Georgia-Pacific LLC; Knau; Etex Grou; Fermacel; Continental B; Hengshenglon; Holcim Ltd.; National Gypsum Services Company; Osman Group

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Gypsum Board Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe gypsum board market report based on product, application, and country:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Wallboard

-

Ceiling Board

-

Pre-decorated Board

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Pre-engineered Metal Buildings

-

Residential

-

Industrial

-

Commercial

-

Institutional

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Germany

-

UK

-

Poland

-

Russia

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."