Europe Glamping Market Size, Share & Trends Analysis Report By Accommodation (Cabins & Pods, Tents, Yurts, Treehouses), By Age Group (18-32 Years, 33-50 Years, 51-65 Years, Above 65 Years), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-052-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Europe Glamping Market Size & Trends

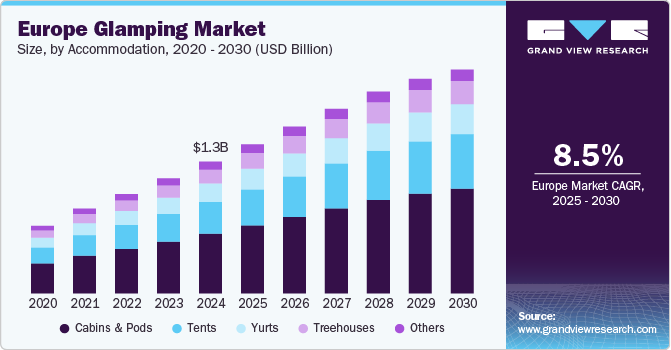

The Europe glamping market size was valued at USD 1,280.5 million in 2024 and is expected to grow at a CAGR of 8.5% from 2025 to 2030. A key driver behind this expansion is the increasing demand for unique and sustainable travel experiences. Travelers today are more conscious of their environmental impact and are seeking ways to immerse themselves in nature without compromising on comfort. Glamping, with its blend of luxury and outdoor living, satisfies this demand by offering upscale, eco-friendly accommodation in scenic, natural settings. This trend aligns with the growing emphasis on sustainable tourism, as consumers look for travel experiences that minimize environmental footprints while providing a memorable and unique stay.

The availability and variety of glamping sites across Europe have also played a crucial role in the market’s growth. Countries like France, Italy, and the United Kingdom, which are popular for their picturesque landscapes, have seen a significant increase in the number of glamping accommodations. These range from eco-lodges and yurts to treehouses and safari-style tents, each offering distinct experiences that cater to different preferences. The diversification of glamping offerings has expanded the appeal to a wider audience, from families and couples to luxury travelers and nature enthusiasts. As the range of options continues to grow, so does the accessibility of glamping, making it a mainstream choice for those looking for an upscale alternative to traditional camping or conventional hotel stays.

Government initiatives across Europe have further bolstered the glamping market. Recognizing the economic potential of eco-tourism, several European countries have implemented policies that support the development of sustainable travel infrastructure, including glamping. Local and national governments have eased restrictions and provided incentives for setting up eco-friendly lodging, driving investment in this sector. In addition, sustainable tourism is becoming a core focus of many European tourism strategies, with several countries encouraging the preservation of natural environments through responsible travel practices. This supportive policy landscape has encouraged private sector participation, leading to the establishment of new glamping sites and the modernization of existing ones, further driving market growth.

Despite the significant impact of the COVID-19 pandemic on the market, the gradual easing of restrictions in key European countries such as the UK, Germany, France, Italy, Spain, and the Netherlands is expected to support steady growth in the glamping sector over the coming years. The resurgence of summer staycations has gained substantial traction among consumers across Europe as travel restrictions have been lifted. In response to this rising demand, many glamping providers are introducing innovative accommodation options to differentiate themselves in an increasingly competitive market. For example, Canopy & Stars, a leading platform for booking unique stays in treehouses, yurts, and cabins throughout Europe, has expanded its offerings by introducing bell tents at music festivals across various locations, catering to the growing preference for distinctive outdoor experiences.

Glamping is expected to gain further prominence as social media continues to influence consumer behavior, amplifying awareness of its benefits. Additionally, the industry is likely to experience substantial growth as a result of attractive discounts and exclusive holiday packages offered by various travel platforms. Over the next few years, several factors will drive significant expansion in the glamping market, including shifting consumer preferences toward experiential travel over traditional luxuries, increased leisure time, and a growing willingness to invest in high-end travel experiences.

Leading outdoor camping and tourism companies are enhancing their offerings by providing luxurious amenities such as portable toilets, indoor bathrooms, comfortable beds, cooking facilities, televisions, wi-fi, and air conditioning, all while maintaining the allure of camping in nature. These features allow for a blend of outdoor adventure with comfort, particularly appealing to families. Safari operators and adventure tourism companies are increasingly catering to consumers willing to pay for premium experiences, offering these upscale accommodations as part of their packages. Moreover, the rising demand for companion experiences that combine comfort with outdoor activities has been a key driver of increased camping participation among millennials. This trend is expected to have a positive impact on the growth of the regional market throughout the forecast period.

Accommodation Insights

In 2024, cabins and pods led the accommodation category with a dominant share of 45.32%, primarily due to the enhanced safety features these accommodations offer, including lockable windows and doors, spacious kitchens and living areas, and private bathrooms. The increasing demand for luxury camping options like cabins and pods reflects campers' growing preference for immersive outdoor experiences that do not compromise on comfort. This trend is evident from the significant rise in reservations at Pitchup.com, a UK-based startup, which recorded a 102% increase in cabin bookings and a 73% rise in pod bookings in January 2018. Furthermore, the average booking lead time extended from 29 days in 2018 to 35 days in 2021, highlighting the sustained interest in these premium accommodations.

The demand for glamping tents is anticipated to grow with a CAGR of 8.6% from 2025 to 2030. The glamping industry is poised for substantial growth in the tent accommodation segment, encompassing options such as bell tents, luxury tents, tented cabins, and safari tents. This surge is largely driven by strategic initiatives from companies and parks expanding into this sector, reflecting a rising consumer interest in these unique lodging experiences. A notable example is Pensthorpe Natural Park, a distinguished 700-acre nature reserve in Fakenham, Norfolk, which has announced plans to introduce its first-ever camping and glamping site in 2024. This marks the park’s initial foray into overnight accommodation, offering 24 tent pitches available for pre-booking and six luxury bell tents designed to provide a premium glamping experience in a natural setting. These developments are expected to further fuel the demand for glamping tents across Europe, as more destinations adopt similar offerings to cater to the growing appetite for immersive, yet comfortable, outdoor stays.

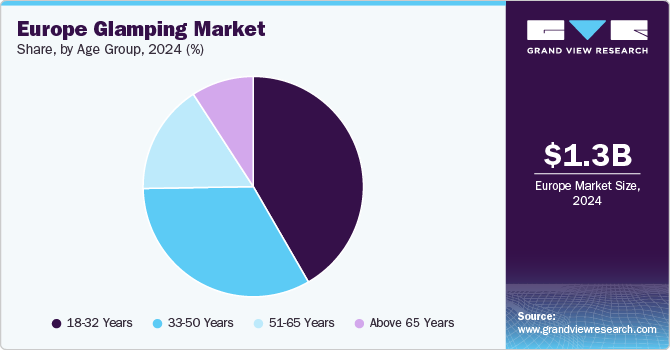

Age Group Insights

In 2024, the demand for glamping among the age group 18 to 32 years accounted for a market share of 41.66%. The growing trend of travel and tourism among millennials is significantly driving the demand for glamping within this demographic. Younger generations, in particular, have played a pivotal role in transforming traditional camping into a more luxurious and comfortable experience. Millennials, aged 26 to 40, now lead the demand for luxury camping vacations and represent the fastest-growing segment in this market. A 2020 survey by Glampitect, conducted among 150 individuals aged 18 to 40 in the UK, revealed that 41% of respondents would opt for glamping accommodations, underscoring the strong preference for this type of travel experience among the younger population.

The demand among the age group 33 to 50 years is poised to register a CAGR of 8.6% from 2025 to 2030. The increasing trend of family outings aimed at fostering children's learning through interaction with natural environments is expected to drive significant growth in the glamping market over the forecast period. This segment is fueled by both millennials and Gen X, who are seeking luxury camping options that offer enhanced amenities such as Wi-Fi, kitchens, private bathrooms, linen services, pools, and various leisure activities. Notably, 50% of glampers express a preference for Wi-Fi at their accommodations. As a result, glamping is projected to grow in importance within these age groups in the coming years, as demand for upscale outdoor experiences continues to rise.

Country Insights

France Glamping Market Trends

The glamping market in France held a share of 25.57% of the regional revenue in 2024. The rising popularity of eco-tourism and sustainable travel has driven French consumers to seek outdoor experiences that blend luxury with environmental responsibility. Glamping offers a unique solution, allowing tourists to enjoy nature without sacrificing comfort, making it an attractive option for those looking for sustainable, high-end accommodations. Also, the French government has been actively promoting rural tourism and nature-based travel, particularly in regions such as Provence, Dordogne, and the French Alps, which are renowned for their natural beauty. Initiatives aimed at boosting domestic tourism, including the development of infrastructure and incentives for eco-friendly accommodations, have fueled interest in glamping as a desirable alternative to traditional hotels or camping.

Additionally, the post-pandemic shift in consumer preferences toward domestic travel and staycations has further contributed to the rise of glamping in France. Many French travelers are now opting for local travel experiences that offer privacy and safety, and glamping sites, with their spacious, self-contained accommodations, provide an ideal solution. This shift has attracted not only couples and solo travelers but also families looking for unique, comfortable ways to reconnect with nature.

Spain Glamping Market Trends

The glamping market in Spain is expected to grow at a CAGR of 9.5% from 2025 to 2030. The rising demand for glamping in the country is driven by its cost-effectiveness compared to traditional hotel accommodations, while still offering a comprehensive range of modern amenities. For instance, the glamping tents at Can Elisa in Tàrbena, Spain are fully equipped with conveniences such as a dining area, modern kitchen, lounge, and television in the living space. The bedroom features a queen-sized bed, along with a private en-suite bathroom complete with a shower, toilet, and sink. Additionally, many glamping sites are pet-friendly and offer outdoor activities in natural surroundings, which are particularly appealing to families seeking immersive yet comfortable travel experiences.

Key Europe Glamping Company Insights

The competitive landscape of the European glamping industry is characterized by a growing number of established operators and new entrants vying to capture market share in an increasingly dynamic and lucrative sector. Key players range from specialized glamping providers to large hospitality groups, all of whom are expanding their portfolios to meet rising consumer demand for luxury outdoor accommodations. Companies like Huttopia, Canopy & Stars, and Feather Down Farms are at the forefront, offering a variety of unique, high-end glamping experiences across the continent.

Additionally, competition is intensifying as traditional camping operators and resort chains introduce premium glamping options to diversify their offerings. These businesses are investing heavily in upgrading their facilities to include luxurious tents, treehouses, and eco-friendly accommodations, catering to consumers' growing preference for experiential and sustainable travel. Technological integration, such as enhanced online booking platforms and tailored marketing strategies, is also playing a critical role in differentiating companies within this competitive landscape.

Moreover, strategic partnerships with local tourism boards, eco-initiatives, and collaborations with adventure and wellness companies are helping glamping operators distinguish themselves in a crowded market. As the sector continues to grow, driven by shifting travel preferences and increasing environmental awareness, the competitive dynamics are expected to intensify, with innovation and sustainability emerging as key differentiators.

Key Europe Glamping Companies:

- Feather Down Farms

- Huttopia

- Arena Campsites

- Canopy & Stars

- Under Canvas

- Killarney Glamping

- Wigwam Holidays Ltd

- Bond Fabrications

- Bond Fabrications

- Texel Yurt’s

Recent Developments

-

In February 2024, Glampitect announced the launch of one of the UK's largest glamping sites, "AvantGlamp at NEC," slated for opening at the National Exhibition Centre in Birmingham. Positioned by Pendigo Lake, adjacent to the NEC Birmingham and Resorts World Arena, this exceptional site was designed to offer an unparalleled experience. The site featured 59 luxury pods, including 13 exclusive over-water pods with private balconies, alongside a picturesque communal area set over a water lily pad. Each pod was meticulously crafted by Glampitect to deliver a unique and memorable staycation, blending modern comfort with natural beauty.

-

In September 2024, open-air hospitality operator Wecamp announced its entry into the Portuguese market through the acquisition of two premium properties, São Miguel, and Reserva Alecrim, both located in Odeceixe. Spanning over 21 hectares, these two sites collectively offer approximately 300 accommodation units. Now under the ownership of alternative investment manager Meridia, the resorts will be rebranded and managed under the wecamp banner. This acquisition marks a significant milestone in Wecamp's growth, bolstering its presence in the Iberian market and initiating its international expansion. Iberia’s prime location and distinctive offerings have already positioned it as one of Europe’s leading glamping destinations.

Europe Glamping Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1,449.8 million |

|

Revenue forecast in 2030 |

USD 2,176.0 million |

|

Growth Rate |

CAGR of 8.5% from 2025 to 2030 |

|

Actual Data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Accommodation, age group, country |

|

Country scope |

UK; Italy; Spain; Netherlands; France; Germany |

|

Key companies profiled |

Feather Down Farms; Huttopia; Arena Campsites; Canopy & Stars, Under Canvas, Killarney Glamping, Wigwam Holidays Ltd, Bond Fabrications, Long Valley Yurts, and Texel Yurt’s |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Glamping Market Report Segmentation

This report forecasts revenue growth regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe glamping market on the basis of accommodation , age group, and country:

-

Accommodation Outlook (Revenue, USD Million, 2018 - 2030)

-

Cabins and Pods

-

Tents

-

Yurts

-

Treehouses

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

18-32 years

-

33-50 years

-

51-65 years

-

Above 65 years

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Italy

-

Spain

-

Netherland

-

France

-

Germany

-

Frequently Asked Questions About This Report

b. The Europe glamping market was estimated at USD 1,280.5 million in 2024 and is expected to reach USD 1,449.8 million in 2025.

b. The Europe glamping market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030, reaching USD 2,176.0 million by 2030.

b. France dominated the Europe glamping market with a share of over 25.57% in 2024. This is owing to the wellness treatments at glamping sites and custom-tailored retreats, and a wide range of other services at glamping sites.

b. Some key players operating in the Europe glamping market include Arena Campsites; Chateau Ramšak; Concierge Camping; The Forge; Killarney Glamping; Le Camp; Bot-Conan Lodge; Texel Yurt’s; Zon Zee Strand; and Netl Kallumaan Camping.

b. Key factors driving the European glamping market's growth include the growing popularity of tourism coupled with consumer willingness to spend on modern amenities while camping, the growing ethical consumerism and consumer awareness regarding the new trend of glamping, and the increasing popularity of staycations among campers, solo travelers, and families.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."