- Home

- »

- Biotechnology

- »

-

Europe Genomics Market Size, Share, Industry Report, 2030GVR Report cover

![Europe Genomics Market Size, Share & Trends Report]()

Europe Genomics Market (2024 - 2030) Size, Share & Trends Analysis Report By Application & Technology, By Deliverables, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-288-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Genomics Market Size & Trends

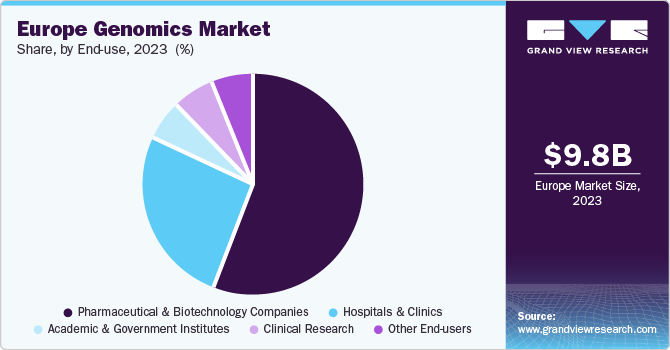

The Europe genomics market size was estimated at USD 9.8 billion in 2023 and is projected to grow at a CAGR of 16.3% from 2024 to 2030. This surge can be attributed to several key factors including the advancements in genomic research and technology that have paved the way for personalized medicine, enabling tailored treatments based on an individual’s genetic makeup. Additionally, increased awareness about genetic disorders and the potential benefits of genomics has fueled demand for testing services. Furthermore, collaborations between research institutions, pharmaceutical companies, and healthcare providers have accelerated innovation and adoption. As Europe continues to invest in genomics research and infrastructure, the market is set to revolutionize healthcare delivery and improve patient outcomes.

Europe accounted for 30.2% of the revenue share of the global genomics market in 2023. Regulations have significantly impacted this market. European Union's General Data Protection Regulation (GDPR) ensures that genomic data is handled securely and with respect to individual privacy rights. This regulation has implications for how genomics companies collect, store, and share genetic information.

The European Parliament has recently backed the deregulation of new Genetically Modified Organisms (GMOs), subjecting them to lighter-touch regulation. However, this decision has sparked debate about the potential risks associated with genetically modified crops and whether they should be patentable. The rise of novel genome editing technologies, such as CRISPR-Cas9, has revolutionized genome editing. However, the European Court of Justice ruled that gene-edited plants should be regulated similarly to transgenic plants, impacting research and commercial applications.

Application & Technology Insights

The functional genomics segment held the largest revenue share of 31.8% in 2023. This dominance reflects the crucial role of functional genomics in deciphering gene function and regulation. By employing various techniques, researchers delve into the inner workings of genes, unlocking their mechanisms in health and diseases. This knowledge base is instrumental in developing gene therapies, particularly for cancers, paving the way for more targeted treatments. Functional genomics empowers researchers to not only identify disease-causing genes but also understand their interactions with cellular pathways.

The pathway analysis segment is projected to experience the fastest revenue growth, with a CAGR of 17.0% from 2024 to 2030. This segment focuses on unraveling the intricate networks of interacting genes and molecules within cells. By analyzing these pathways, scientists gain a holistic understanding of biological processes. This knowledge is proving to be highly lucrative, particularly in drug discovery. By pinpointing key players within disease pathways, researchers can develop more effective therapeutics that target specific steps in the disease process. The synergy between functional genomics and pathway analysis is fuelling significant advancements in personalized medicine, promising a future of tailored treatments based on an individual's unique genetic makeup.

Deliverable Insights

The products segment held 69.7% of the total revenue share in 2023. This segment primarily includes the sale of genomics-related products such as sequencing instruments, reagents, and consumables. The robust growth in this segment can be attributed to the increasing adoption of next-generation sequencing (NGS) technologies, which enable researchers and clinicians to analyze genetic information more efficiently and accurately. Factors driving the growth of the products segment include advancements in NGS platforms, rising demand for personalized medicine, and the use of genomics in drug discovery. As the field of genomics continues to evolve, companies are investing in research and development to enhance product offerings and expand their market presence.

The services segment is expected to witness the second-fastest revenue growth with a CAGR of 14.4% from 2024 to 2030. Services refer to genomic testing, data analysis, and interpretation provided by specialized laboratories and service providers. The growth of the services segment is driven by several factors, including the increasing demand for clinical genetic testing, population-scale genomics initiatives, and the need for accurate diagnostic services. As more individuals seek genetic testing for disease risk assessment, personalized treatment recommendations, and ancestry information, the services segment is expected to witness sustained growth.

End-use Insights

The pharmaceutical and biotechnology companies held 55.8% of the total revenue share in 2023. These companies play a pivotal role in drug discovery, development, and personalized medicine. Genomics data is crucial for identifying potential drug targets, understanding disease mechanisms, and optimizing therapeutic interventions. Factors driving the dominance of this segment include increased investment in genomics research by pharmaceutical giants, collaborations with academic institutions, and the integration of genomics into clinical trials. As precision medicine gains prominence, pharmaceutical companies are leveraging genomics insights to create targeted therapies that address individual patient needs.

The clinical research segment is projected to experience the fastest revenue growth, with a CAGR of 22.0% from 2024 to 2030. Clinical research encompasses studies conducted in healthcare settings, academic institutions, and research centers. Genomics plays a vital role in understanding disease susceptibility, treatment response, and disease progression.

Country Insights

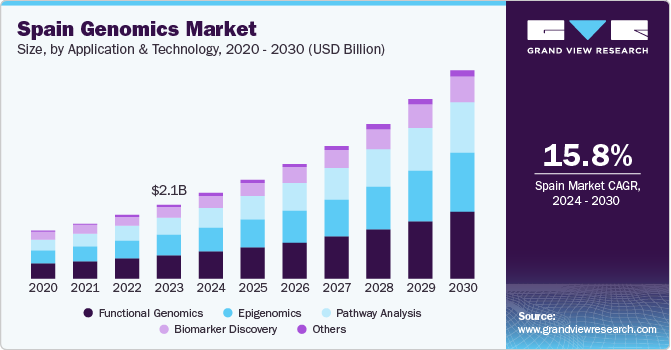

Spain Genomics Market Trends

The Spain genomics market dominated the Europe genomics market, capturing the biggest revenue share of 25.0% in 2023. This dominance suggests a strong foundation for genomics research and development within Spain, potentially due to established infrastructure or government support. Further investigation into the reasons behind Spain's market share could be fruitful for understanding successful strategies in this field.

Germany Genomics Market Trends

The Germany genomics market is expected to grow at a CAGR of 17.9% from 2024 to 2030. While not currently the market leader, Germany appears to be a rising star. This significant growth rate suggests a rapidly developing genomics market in Germany, possibly fueled by factors like increased investment or a growing focus on personalized medicine. By analyzing the drivers behind Germany's impressive growth rate, we can gain insights into potential future trends for the Europe market as a whole.

Key Europe Genomics Company Insights

The Europe genomics market is a mix of established players and innovative startups.

-

Illumina: A global leader in next-generation sequencing (NGS) technology, Illumina provides the tools and services needed for large-scale genomic analysis.

-

Thermo Fisher Scientific: Another major player in life sciences, Thermo Fisher offers a comprehensive range of genomics products and services, from instruments to software.

Key Europe Genomics Companies:

- Oxford Nanopore Technologies

- Qiagen

- Creative Biogene

- Thermo Fisher Scientific

- Illumina

- Bio-Rad Laboratories

- Danaher Corporation

- Agilent Technologies

- F. Hoffmann-La Roche Ltd.

- Eurofins Scientific Group

Recent Developments

-

In October 2023, Oxford Nanopore and Saphetor partnered to deliver an integrated nanopore sequencing analysis solution, connecting EPI2ME research software with VarSome Clinical for end-to-end workflows and comprehensive variant interpretation.

-

In October 2023, Thermo Fisher Scientific partnered with Boehringer Ingelheim to develop companion diagnostics for identifying NSCLC patients with specific mutations for targeted therapies, aiming to improve patient outcomes through broader access to reliable genomic testing.

-

In October 2023, Monte Rosa Therapeutics and Roche partnered to discover and develop MGDs for previously undruggable targets in cancer and neurological diseases.

Europe Genomics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 28.2 billion

Growth rate

CAGR of 16.3% from 2024 to 2030

Base year for estimation

2023

Historic data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application & technology, deliverable, end-use, country

Country scope

Germany; France; Italy; Spain; Denmark; Sweden; Norway; UK

Key companies profiled

Oxford Nanopore Technologies; Qiagen; Creative Biogene; Thermo Fisher Scientific; Illumina; Bio-Rad Laboratories; Danaher Corporation; Agilent Technologies; F. Hoffmann-La Roche Ltd.; Eurofins Scientific Group

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Genomics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe genomics market report based on application & technology, deliverable, end-use, and country:

-

Application & Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Functional Genomics

-

Transfection

-

Real-Time PCR

-

RNA Interference

-

Mutational Analysis

-

SNP Analysis

-

Microarray Analysis

-

-

Epigenomics

-

Bisulfite Sequencing

-

Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

-

Methylated DNA Immunoprecipitation (MeDIP)

-

High-Resolution Melt (HRM)

-

Chromatin Accessibility Assays

-

Microarray Analysis

-

-

Pathway Analysis

-

Bead-Based Analysis

-

Microarray Analysis

-

Real-time PCR

-

Proteomics Tools (2-D PAGE; yeast 2-hybrid studies)

-

-

Biomarker Discovery

-

Mass Spectrometry

-

Real-time PCR

-

Microarray Analysis

-

Statistical Analysis

-

Bioinformatics

-

DNA Sequencing

-

-

Others

-

-

Deliverables Outlook (Revenue, USD Billion, 2018 - 2030)

-

Products

-

Instruments/Systems/Software

-

Consumables & Reagents

-

-

Services

-

NGS-based Services

-

Core Genomics Services

-

Biomarker Translation Services

-

Computational Services

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical Research

-

Academic & Government Institutes

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Other End-uses

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

U.K.

-

Frequently Asked Questions About This Report

b. The Europe genomics market was valued at USD 9.8 billion in 2023.

b. The Europe genomics market is projected to expand at a CAGR of 16.3% from 2024 to 2030 to reach USD 28.2 billion by 2030.

b. The functional genomics segment held the largest revenue share, accounting for 31.8% in 2023, owing to its crucial role in deciphering gene function and regulation. By employing various techniques, researchers delve into the inner workings of genes, unlocking their mechanisms in health and disease.

b. Some of the key players operating in the Europe genomics market include Oxford Nanopore Technologies; Qiagen; Creative Biogene; Thermo Fisher Scientific; Illumina; Bio-Rad Laboratories; and Danaher Corporation.

b. The Europe genomics market growth can be attributed to several key factors including the advancements in genomic research and technology that have paved the way for personalized medicine, enabling tailored treatments based on an individual’s genetic makeup.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.