Europe Gamma Butyrolactone Market Size, Share & Trends Analysis Report By Purity (Industrial, Electric Capacitance), By Application (Electrical, Agrochemical), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-316-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Europe Gamma Butyrolactone Market Trends

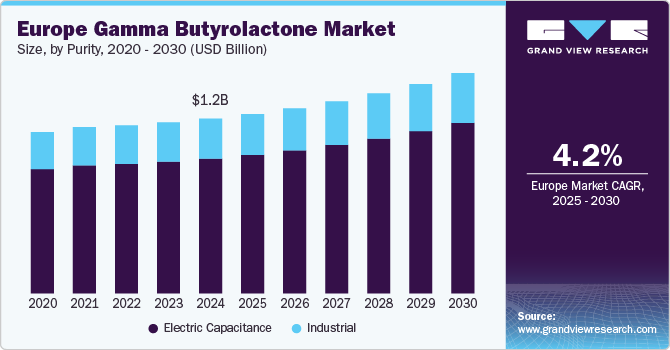

The Europe gamma butyrolactone market size was estimated at USD 1.19 billion in 2024 and is projected to grow at a CAGR of 4.2% from 2025 to 2030. The market is expected to grow due to the increasing demand for organic agrochemicals and electronic products. In Europe, the demand for gamma-butyrolactone largely depends on trends in its application markets. There is an increasing demand for semiconductors in electronic devices, including various electronic products and electric vehicles. Additionally, a rising awareness of the harmful effects of chemical-based pesticides and herbicides is boosting the demand for organic agrochemicals. This combination of factors will drive market growth over the forecast period.

The compound is a viscosity modifier for polyurethane and is used in plant growth regulators, rubber additives, and paint-stripping solvents. It finds applications across various industries, including pharmaceuticals, agrochemicals, electrical, food & beverages, petroleum, personal care and cosmetics. In recent years, the European market for gamma-butyrolactone (GBL) has experienced significant demand, driven by the increasing use of agrochemicals such as pesticides and herbicides resulting from growing agricultural activities across Europe.

Gamma-butyrolactone (GBL) is primarily produced from 1,4-butanediol (BDO) using various catalysts, such as nickel and copper. BDO faces significant supply and price volatility in the global market, as it is derived from liquefied petroleum gas or butane. Changes in the prices and availability of these raw materials are anticipated to affect the pricing of gamma-butyrolactone during the forecast period negatively.

The demand for gamma-butyrolactone is greatly influenced by its production and consumption, which are closely linked to the needs of end-use industries. Consequently, any changes in demand from these industries are expected to affect the demand for gamma-butyrolactone directly.

Drivers, Opportunities & Restraints

Chemicals are crucial in our daily lives, as everything around us comprises chemicals. To produce these essential chemicals, various raw materials are needed. Each chemical has its specific raw materials and intermediates. Everyday products such as food, medicines, personal care, cosmetics, fuels, electronics, paints, and many others comprise chemical compounds derived from one or more raw materials. Several factors are driving the growth of the chemical products market, including favorable regulatory frameworks, an increase in foreign direct investment in developing economies, rising consumer demand, and intense competition among manufacturers of chemical products.

Gamma butyrolactone is a well-known chemical with various applications across various industries, including petroleum, pharmaceuticals, cosmetics, agrochemicals, and personal care products. It is an intermediate in producing several other chemicals, such as phenyl butyric acid, polyvinyl pyrrolidone, and DL-methionine. Additionally, gamma-butyrolactone is utilized as a solvent for methyl methacrylate, cellulose acetate, and other polymers.

The machines or engines installed in plants and the automotive industry are designed for long-term use and operate regularly. This consistent use leads to increased wear and tear on engine parts. The sealing products used in these machines must function under varying pressures and temperatures, further contributing to their deterioration. Additionally, various types of lubricants with different chemical compositions are used in the machinery, and these can sometimes negatively affect the composition of the sealing products.

Purity Insights

The electrical capacitance segment accounted for the largest revenue share of 77.2% in 2024 and is expected to continue to dominate the industry over the forecast period. This product's high market share is due to the growing demand for compact and technologically advanced electronic devices. With a purity level of 99.9%, it is used as a solvent in producing semiconductor devices, including transistors, operational amplifiers (op-amps), diodes, capacitors, integrated circuits (ICs), resistors, and electric batteries.

Industrial-grade gamma butyrolactone possesses a purity level of 99.5%. It is commonly used as a solvent across various industries and is a key ingredient in formulating products such as paints, coatings, medicines, and agrochemicals. Gamma butyrolactone is utilized to produce organic agrochemicals, including pesticides and herbicides. Additionally, it serves as a plant growth regulator and weed killer. In the pharmaceutical industry, industrial-grade gamma butyrolactone is employed as a precursor in the formulation of various medications. The demand for organic pesticides and herbicides will rise in Europe during the forecast period.

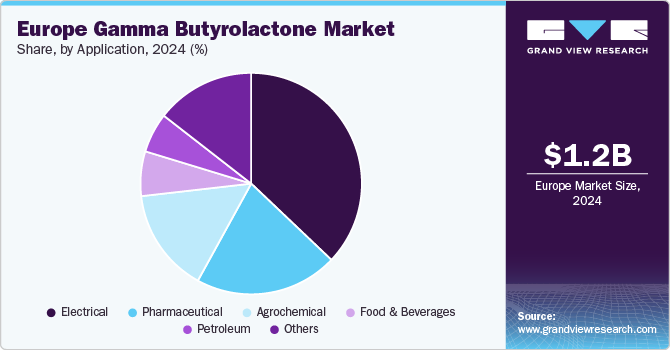

Application Insights

The electrical segment dominated the market with a revenue share of 38.6% in 2024, during the forecast period. The significant share in this market can be attributed to the rising demand for semiconductor devices. This growing demand is driven by their use in various electronic products, such as washing machines, televisions, and light-emitting diode (LED) bulbs. Additionally, the increasing demand for electric vehicles is expected to further fuel growth in this segment over the forecast period.

In pharmaceutical, Gamma-butyrolactone is commonly found in supplements that promote clear thinking, relax muscles, and aid in hormone release. In the sports industry, it is used to enhance athletic performance. The growing demand for supplements among athletes and young individuals, driven by the increasing trend towards fitness and healthy living, is expected to boost the consumption of this product.

Country Insights

France gamma butyrolactone market held over 28.0% revenue share of the overall Europe gamma butyrolactone market. The rising demand for cosmetics and personal care products, along with increasing agricultural activities, is driving the growth of gamma-butyrolactone. France stands out as the significant producer of organic and inorganic farm products in Europe and is the global significant producer and exporter of perfumes and cosmetics.

In addition to the expanding agricultural cosmetics and personal care industries, the electronics sector is also a significant contributor to the demand for gamma-butyrolactone. The government’s efforts to foster innovative and technologically advanced electronic products through initiatives like the Important Project of Common European Interest (IPCEI) on Microelectronics are expected to boost the electronics industry further during the forecast period. This will, in turn, increase the demand for gamma-butyrolactone.

Key Europe Gamma Butyrolactone Company Insights

Some key players operating in the market include BASF SE and Dairen Chemical Corp.

-

BASF SE is a globally recognized German chemical company that operates as the largest chemical producer in the world. The company operates through six main business segments, namely, industrial solutions, chemicals, materials, surface technologies, agricultural solutions, and nutrition and care. Its diverse portfolio encompasses a wide array of chemical products such as performance products, plastics, functional solutions, and others. One of the company’s main areas of expertise is the production of carotenoids and beta-carotene and its related products, which are utilized in the food and beverages, pharmaceuticals, and animal feed industries.

-

The company manufactures and sells insecticides, fungicides, herbicides, miticides, harvest aids, and other crop enhancement products. Insecticides, fungicides, and herbicides are the major focus areas of the company. Its agrochemical products are suitable for various crops, including alfafa, corn-seed corn, cotton, citrus, corn-field corn, cucurbits, potatoes, peanuts, grapes, pulse crops, rice, small fruits, small grains, sorghum, soybeans, sunflowers, tree fruit, sweet corn, tree nuts, tobacco, and vegetables. It has operations in over 50 countries globally. It operates through 23 manufacturing plants across the world.

Key Europe Gamma Butyrolactone Companies:

- Ashland

- BASF SE

- Mitsubishi Chemical Corporation

- LyondellBasell Industries Holdings B.V.

- TCI Chemicals (India) Pvt. Ltd.

- Dairen Chemical Corp.

- Genomatica Inc.

- Jigs Chemical Ltd.

- Nan Ya Plastic Corp.

- Saudi International Petrochemical Company

Recent Developments

-

In September 2023, BASF partnered with Qore LLC, a joint venture between Cargill and HELM AG, to secure a long-term supply of QIRA, a bio-based 1,4-butanediol (BDO) derived from renewable feedstocks. Produced via fermentation of plant-based sugars, QIRA reduces the product carbon footprint (PCF) by up to 86% compared to fossil-based BDO. This collaboration enables BASF to expand its portfolio of sustainable solutions, including bio-based derivatives such as PolyTHF and THF, used in textiles, thermoplastic polyurethanes, and pharmaceuticals. The agreement, aligned with BASF's commitment to sustainability, ensures larger volumes of low-carbon products, with initial commercial quantities available by early 2025.

-

In June 2022, The UK government revoked the 2021 regulations that placed stricter controls on GBL and 1,4-BD, allowing industrial use without a controlled drugs license while maintaining their Class B drug status.

Europe Gamma Butyrolactone Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.23 billion |

|

Revenue forecast in 2030 |

USD 1.51 billion |

|

Growth rate |

CAGR of 4.2% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative Units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Purity, application, region |

|

Regional scope |

Europe |

|

Country scope |

Germany; UK; France; Italy; Spain; Netherlands |

|

Key companies profiled |

Ashland; BASF SE; Mitsubishi Chemical Corporation; LyondellBasell Industries Holdings B.V.; TCI Chemicals (India) Pvt. Ltd.; Dairen Chemical Corp.; Genomatica Inc.; Jigs Chemical Ltd.; Nan Ya Plastic Corp.; and Saudi International Petrochemical Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Gamma Butyrolactone Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Europe gamma butyrolactone market report based on the purity, application, and region:

-

Purity Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Electrical Capacitance

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Agrochemical

-

Food & Beverage

-

Electrical

-

Petroleum

-

Pharmaceuticals

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Frequently Asked Questions About This Report

b. The Europe gamma butyrolactone market was valued at USD 1.19 billion in 2024 and is expected to reach USD 1.23 billion in 2025.

b. The Europe gamma butyrolactone market is expected to grow at a compounded annual growth rate (CAGR) of 4.2% from 2025 to 2030 to reach 1.51 billion by 2030.

b. Electrical application dominated the Europe gamma butyrolactone market with a share of 38.6% in 2024. This is attributed to the high use of GBL as a solvent to manufacture semiconductors due to its high solubility.

b. Key players in the Europe gamma butyrolactone market are Ashland, BASF SE, Mitsubishi Chemical Corporation, LyondellBasell Industries Holdings B.V., TCI Chemicals (India) Pvt. Ltd., Dairen Chemical Corp., Genomatica Inc., Jigs Chemical Ltd., Nan Ya Plastic Corp., and Saudi International Petrochemical Company.

b. Growing demand for electronic products due to increasing trends to have compact and technologically advance devices is expected to boost the demand for gamma butyrolactone.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."