- Home

- »

- Medical Devices

- »

-

Europe Funeral Products And Services Market, Report, 2030GVR Report cover

![Europe Funeral Products And Services Market Size, Share & Trends Report]()

Europe Funeral Products And Services Market Size, Share & Trends Analysis Report By Type (Funeral Products, Funeral Services), By Country (UK, Germany, France, Italy, Spain), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-484-0

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

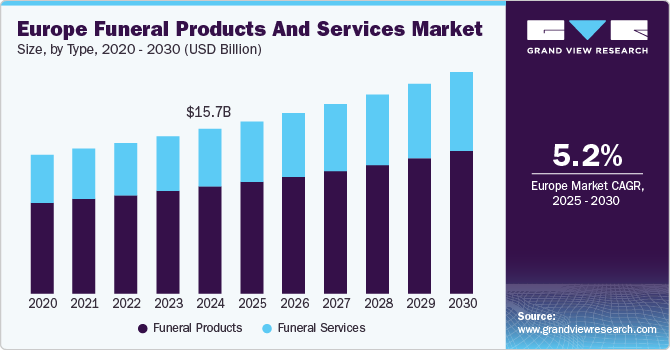

The Europe funeral products and services market was valued at USD 15.66 billion in 2024 and is projected to grow at a CAGR of 5.17% from 2025 to 2030. This growth can be attributed to the increasing consumer demand for sustainable and eco-friendly products, driving companies to innovate and adapt their offerings to meet these expectations. Moreover, technological advancements are crucial in driving market growth. Digitalization has transformed how businesses operate, enabling them to enhance efficiency, improve customer experiences, and expand their reach through e-commerce platforms.

The increasing demand for sustainable and eco-friendly funerals fuels the funeral products and services market. This shift stems from growing consumer environmental awareness and increasing concerns about climate change and ecological preservation. People are seeking more sustainable options to minimize the environmental impact of traditional burial and cremation practices, known for their heavy use of materials, chemicals, and energy.

As a result, there is a rising demand for biodegradable coffins, urns made from natural materials, and shrouds crafted from organic fabrics. For instance, Ecoffins UK LLP offers eco-friendly coffins made from pandanus, willow, and pine. These products are designed to decompose naturally without leaving harmful residues, aligning with the eco-conscious values of many Europeans. Furthermore, natural burial grounds, which avoid embalming chemicals and concrete grave liners in favor of simple, green burials, are gaining popularity. This has spurred the growth of new services offering eco-friendly plots and personalized, sustainable burial plans.

Moreover, the COVID-19 pandemic significantly impacted Europe's market. The surge in mortality rates due to the virus led to a marked increase in demand for funeral services, such as burials and cremations. Funeral homes faced unprecedented challenges, including needing more rapid service delivery due to overwhelmed morgues and hospitals. Restrictions on gatherings and social distancing measures forced changes in traditional funeral practices, leading to smaller, private ceremonies and a rise in virtual memorial services. This shift also fuelled the demand for digital tools and services, such as online obituaries and virtual condolence platforms.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including the impact of regulations, degree of innovation, industry competition, geographical expansion, and level of partnerships & collaboration activities. The market is fragmented, with many providers dominating. The market is highly fragmented, with many local and regional key players. Furthermore, the degree of innovation is medium, and the level of M&A activities is high. The impact of regulations on the market is high. However, product & service expansion is moderate in the market.

The industry is experiencing significant technological innovation, with the integration of digital technologies into traditional funeral practices becoming more prevalent. Innovations such as online memorials, live-streaming funeral services, and digital grief are gaining traction over the years. In addition, the increasing emphasis on sustainability drives innovation in biodegradable funeral products.

The industry is experiencing a high level of merger and acquisition activities undertaken by several key players. Larger funeral service providers are acquiring smaller, independent players to expand their reach and services. For instance, in October 2023, Coöperatie DELA announced its plans to acquire DFW Group B.V., which operates in the same sector. The acquisition is expected to be completed in early 2025. This acquisition is part of DELA’s strategic plan to expand its market presence and enhance its service offerings in the funeral industry.

The market experiences a high level of regulation with local laws and regulatory authorities such as the Funeral Act (Bestattungsgesetz), General Code of Local Authorities (CGCT), Competition and Markets Authority (CMA), etc., governing the industry. Due to strict regulations and high operational costs, regulatory requirements around burial and cremation practices and environmental and public health standards impose compliance costs on providers.

The industry is witnessing moderate product and service expansion. Funeral service providers are expanding beyond traditional services to include grief counseling as part of comprehensive aftercare programs. Moreover, as consumer preferences shift towards more unique and meaningful farewell experiences, providers are expanding their offerings to include customized services and sustainable products, such as biodegradable coffins and natural burials.

Type Insights

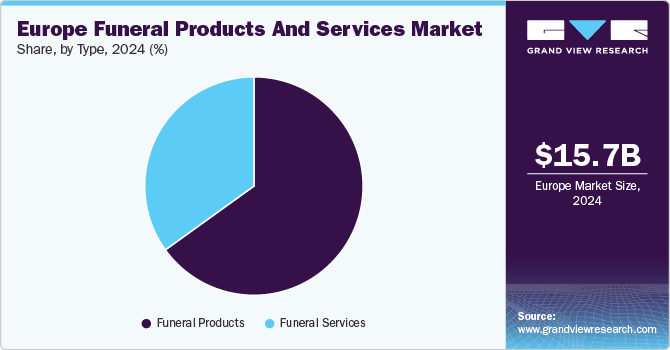

Based on type, the funeral products segment dominated the market with the largest revenue share of 65.07% in 2024. This segment includes coffins and caskets, urns and ash containers, flowers, memorial jewelry, and headstones & monuments. The demand for high-quality burial containers has increased, reflecting a growing consumer preference for personalized and customized options. In addition, there is an increasing acceptance of cremation across Europe, which has led to a surge in the popularity of urns designed for cremated remains. The market is also witnessing significant growth due to technological advancements that enhance delivery services, such as digital platforms for planning funerals and memorialization. Furthermore, the emphasis on sustainability drives innovation in biodegradable funeral products, aligning with broader environmental goals. This is expected to drive the demand for funeral products during the forecast period.

The funeral services segment is expected to grow fast during the forecast period. Several key factors and trends drive the segment’s growth. One of the most significant drivers is the aging population across Europe, with countries such as Germany, Italy, and France witnessing a steady rise in elderly populations. This demographic shift is resulting in a growing demand for funeral services, as the proportion of deaths is expected to increase over the coming years.

Regional Insights

The Europe funeral products & services market is driven by several key factors. The aging population across Europe significantly impacts market growth, with countries such as Germany, Italy, and France experiencing higher mortality rates. This demographic shift has increased demand for funeral services, cremation, burial products, and ancillary services such as memorials and flowers.

UK Funeral Products And Services Market Trends

The funeral products & services market in UK is driven by evolving consumer preferences, with a growing demand for personalized and eco-friendly funeral solutions. As individuals seek unique ways to commemorate their loved ones, there is a shift towards customized caskets, urns, and biodegradable products, reflecting a broader sustainability trend. For instance, in June 2024, Oasis Coffins introduced an eco-friendly jute coffin at the UK National Funeral Exhibition, constructed with premium jute fabric over a bamboo frame and a paulownia base, designed for easy assembly and tool-free setup in less than two minutes.

Germany Funeral Products And Services Market Trends

The funeral products & services market in Germany held the largest revenue share of 18.44% in 2024, driven by the Demographic shifts that influence the demand and preferences for funeral products and services. The country's population is characterized by an increasing proportion of elderly individuals, naturally leading to a higher demand for funeral products and services. This demographic change prompts service providers to adapt their offerings to cater to an aging population, potentially influencing the types of services and products in demand. In addition, integrating digital technologies into traditional funeral practices is becoming more prevalent, with innovations such as online memorials, live-streamed funeral services, and digital grief counseling gaining traction. This shift towards digital services aligns with broader societal trends toward online consumption, allowing funeral service providers to offer more personalized and accessible services.

Key Funeral Products And Services Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key Funeral Products And Services Companies:

- Funeral Products B.V

- Limbo

- Matthews International Corporation

- Stoneletters

- Golden Charter

- Menina

- JOH Holdings

- SendFlowersWorldwide

- Steve Soult Limited

- DFW Europe

- Hesselmans & van Willegen

- Roc Eclerc Group

- Resomation Ltd

- Ataudes Gallego SL

- Pompes Funèbres Générales

- Vezzani spa

- Facultatieve Technologies

- IFZW GmbH & Co. KG

- Aninco

- Funico

- Van der Lans & Busscher

- Karsol Ltd.

- Verstraaten Groep

- Den Hollandsche (The Dutch Memorials)

- WEVERLING & WIJTMAN

- Neomansio

- Bertis Uitvaart B.V.

- Unigra bv

Recent Developments

- In October 2024, Foundation Partners Group launched a new digital platform named Afterall and acquired Cake, a company known for its innovative online end-of-life planning tools. This move indicates a broader trend toward modernization within the funeral industry, which is traditionally viewed as slow to adapt to technological advancements.

"From an increase in cremation to a myriad of non-traditional celebrations of life, families are seeking choice in all facets of end-of-life care," "The goal of Afterall is to make this once complicated and overwhelming process easy and simple, allowing families more space and energy to honor their loved ones."

- Lee Senderov, Chief marketing and digital officer of Foundation Partners Group.

-

In February 2023, Matthews International Corporation acquired Eagle Granite Company, Inc. This acquisition aligns with Matthews International’s strategic vision to enhance its capabilities within the granite memorialization sector. Matthews’ Memorialization segment is already recognized as a leading provider of memorialization products and solutions tailored for the funeral and cemetery industries. By integrating Eagle’s offerings, Matthews aims to expand its product range and improve customer service delivery.

-

In January 2023, Funecap acquired the Facultatieve Group to expand its operations and enhance its service offerings in the funeral services sector. The acquisition is seen as transformational due to its strategic advantages, including increased market share, enhanced operational capabilities, and an expanded geographical footprint.

-

In February 2018, Matthews International Corporation acquired Star Granite & Bronze to integrate Star into its Matthews Cemetery Products business, which falls under its Memorialization Segment. This integration aims to enhance service offerings by combining the strengths of both companies.

Europe Funeral Products And Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.38 billion

Revenue forecast in 2030

USD 21.08 billion

Growth rate

CAGR of 5.17% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; Switzerland; Netherlands; Hungary; Czech Republic; Belgium

Key companies profiled

Funeral Products B.V; Limbo; Matthews International Corporation; Stoneletters; Golden Charter; Menina; JOH Holdings; SendFlowersWorldwide; Steve Soult Limited; DFW Europe; Hesselmans & van Willegen; Roc Eclerc Group; Resomation Ltd; Ataudes Gallego SL; Pompes Funèbres Générales; Vezzani spa; Facultatieve Technologies; IFZW GmbH & Co. KG; Aninco; Funico; Van der Lans & Busscher; Karsol Ltd.; Verstraaten Groep; Den Hollandsche (The Dutch Memorials); WEVERLING & WIJTMAN; Neomansio; Bertis Uitvaart B.V.; Unigra bv

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Funeral Products And Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe funeral products and services market report based on type and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Funeral Products

-

Coffins And Caskets

-

Urns And Ash Containers

-

Flowers

-

Memorial Jewelry

-

Headstones And Monuments

-

-

Funeral Services

-

Floral Arrangements

-

Transportation Services

-

Grief Counseling Services

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Switzerland

-

Netherlands

-

Hungary

-

Czech Republic

-

Belgium

-

-

Frequently Asked Questions About This Report

b. Based on type, the funeral products segment dominated the market with the largest revenue share of 65.07% in 2024. This segment includes products such as coffins and caskets, urns and ash containers, flowers, memorial jewelry, and headstones & monuments. The demand for high-quality burial containers has increased, reflecting a growing consumer preference for personalized and customized options. In addition, there is an increasing acceptance of cremation across Europe, which has led to a surge in the popularity of urns designed for cremated remains.

b. Some prominent players in the Europe funeral products & services market includes Funeral Products B.V; Limbo; Matthews International Corporation; Stoneletters; Golden Charter; Menina; JOH Holdings; SendFlowersWorldwide; Steve Soult Limited; DFW Europe; Hesselmans & van Willegen; Roc Eclerc Group; Resomation Ltd; Ataudes Gallego SL; Pompes Funèbres Générales; Vezzani spa; Facultatieve Technologies; IFZW GmbH & Co. KG; Aninco; Funico; Van der Lans & Busscher; Karsol Ltd.; Verstraaten Groep; Den Hollandsche (The Dutch Memorials); WEVERLING & WIJTMAN; Neomansio; Bertis Uitvaart B.V.; Unigra bv

b. Key factors that are driving the Europe funeral products & services market growth can be attributed to the increasing consumer demand for sustainable and eco-friendly products, driving companies to innovate and adapt their offerings to meet these expectations. Moreover, technological advancements play a crucial role in driving market growth as digitalization has transformed how businesses operate, enabling them to enhance efficiency, improve customer experiences, and expand their reach through e-commerce platforms.

b. The Europe funeral products and services market size was estimated at USD 15.66 billion in 2024 and is expected to reach USD 16.38 billion in 2025.

b. The Europe funeral products and services market is expected to grow at a compound annual growth rate of 5.17% from 2025 to 2030 to reach USD 21.08 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."