Europe Funeral Insurance Market Size, Share & Trends Analysis Report By Age Group (Over 50, Over 60, Over 70, Over 80), By Distribution Channel (Direct-to-Consumer, Funeral Homes), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-484-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Europe Funeral Insurance Market Trends

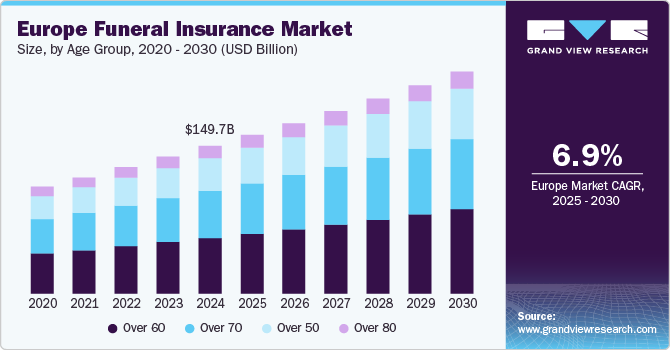

The Europe funeral insurance market size was estimated at USD 149.68 billion in 2024 and is expected to grow at a CAGR of 6.95% from 2025 to 2030. This growth can be attributed to the aging population across many European countries, which leads to an increased demand for funeral services and associated insurance products. As life expectancy rises, more individuals seek ways to manage the financial burden of end-of-life expenses, driving significant interest in funeral insurance policies. Moreover, increasing awareness about the costs associated with funerals led consumers to consider preplanning their arrangements, further driving demand for these insurance products.

The adoption of funeral insurance in Europe is driven by rising government initiatives to encourage financial preparedness for end-of-life expenses. Governments in countries such as the UK, France, and Spain are promoting greater awareness of funeral costs and encouraging citizens to consider insurance options. According to data published by Kenna and Turner as of October 2024, the UK government administers the Funeral Expenses Payment scheme, designed to assist individuals with specific benefits and the financial responsibilities of organizing a funeral, particularly those with low income.

Moreover, the rising cost of funeral expenditures is fueling the adoption of funeral insurance. Funeral costs, including services such as burial or cremation, flowers, and administrative fees, have steadily risen due to inflation, more elaborate ceremonies, and the higher price of cemetery plots, particularly in urban areas. According to a study published by SunLife, in 2023, the aggregate expenditure associated with end-of-life arrangements, encompassing estate administration fees, essential funeral services, and additional discretionary expenses such as memorial gatherings, increased by 5% to USD 12,673.9 (£9,658), marking a record peak. This increase translates to an average additional cost of USD 601.02 (£458) compared to the previous year.

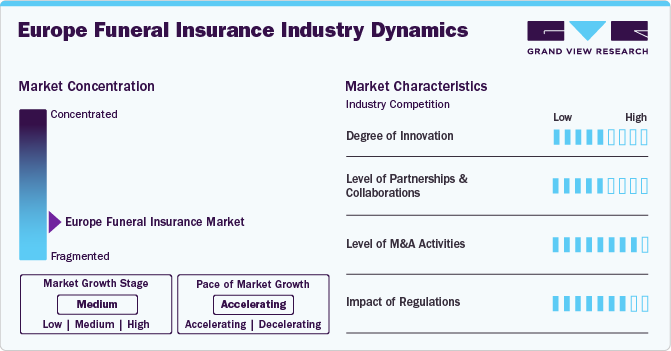

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various characteristics, including a degree of innovation, level of M&A activities, impact of regulations, service expansion, and impact of partnerships & collaborations. For instance, the market is fragmented, with many small players entering the market. The degree of innovation is medium, the level of partnerships and collaborations is medium, the level of M&A activities is high, and the impact of regulations is high.

Innovation in the European market is considered medium, driven by the increasing demand for customized and flexible insurance products. Companies are leveraging technology to enhance their service offerings, such as simplifying the underwriting process and providing digital platforms for policy management. Introducing user-friendly mobile applications and online calculators allows potential policyholders to tailor their coverage based on individual needs, thereby enhancing customer engagement and satisfaction.

Partnerships and collaborations improve the value proposition of funeral insurance products by simplifying the claim process and integrating funeral services into the insurance package. For instance, in October 2022, Everest, a firm specializing in funeral planning and concierge services, entered a strategic partnership with MetLife for the UK market. This three-year agreement enables MetLife to provide funeral support services to over 1.4 million UK employees through its Group Life insurance plans.

M&A activities in the European market are high as companies seek to consolidate their positions and expand their coverage offerings. Mergers and acquisitions allow larger insurance firms to acquire smaller players or enter new geographic markets. This consolidation strengthens the market presence of key players and enables them to access new customer bases, boosting market growth. For instance, in May 2024, Acrisure, an insurance firm based in the U.S., expanded its operations in the U.K. by acquiring FinCred and Global Broking Solutions (GBS), enhancing its market position in Southern England.

The impact of regulations on the European market is high, given that regulatory frameworks significantly influence coverage offerings and operational practices. Regulations impact the market, with strict guidelines on consumer protection and coverage marketing enforced by regulatory bodies. The emphasis on fair sales practices facilitated insurers to strengthen compliance measures, invest in agent training, and adopt technology solutions.

Age Group Insights

The over-60 segment held the largest revenue share of 37.68% in 2024, driven by the increasing awareness of mortality and the financial implications of end-of-life arrangements among this age group. This age group is a crucial demographic increasingly focused on end-of-life planning. As individuals in this age group approach retirement and beyond, they seek financial security and peace of mind regarding funeral arrangements. This segment is characterized by a desire to alleviate their family's emotional and financial burdens, making funeral insurance an essential consideration for many. Consumers over 60 value personalized guidance and comprehensive information when exploring funeral insurance options.

The over-50 segment is expected to grow at the fastest CAGR from 2025 to 2030. This age group and above exhibit a shift towards more extensive coverage options. Individuals in these age brackets are increasingly aware of the rising costs of funerals and are motivated to secure peace of mind for themselves and their families. They tend to favor policies that provide extensive services, including burial arrangements and grief support resources. Overall, understanding these minute preferences across different age groups is essential for insurers aiming to effectively cater to the diverse needs within the European funeral insurance market.

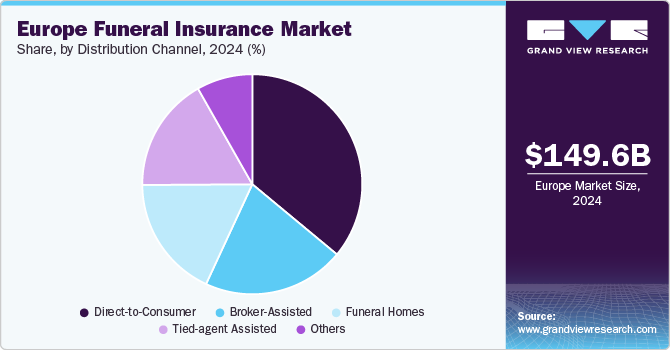

Distribution Channel Insights

The direct-to-customer segment held the largest revenue share of 36.02% in 2024. This refers to a distribution channel where insurers sell their products directly to consumers without involving intermediaries such as brokers or agents. This approach offers transparency and competitive pricing, as consumers interact directly with providers to understand their options without incurring the additional costs associated with intermediary commissions. The emergence of digital platforms facilitated this trend, allowing consumers to research, compare, and purchase funeral insurance policies online. This shift is particularly relevant in a market where consumers increasingly prioritize convenience and accessibility.

The funeral homes represented a significant market share over the forecast period. They provide the physical space and logistical support for conducting funerals and offer various insurance products tailored to the financial needs associated with these services. These homes benefit from their established relationships with clients, enabling them to present insurance options in a trusted and sensitive manner. By discussing funeral insurance during the planning process, professionals guide families in selecting appropriate coverage that aligns with their preferences and financial situations. This personalized approach enhances customer satisfaction and facilitates a sense of security, as clients are supported in making informed decisions during a challenging time.

Country Insights

France Funeral Insurance Market Trends

The funeral insurance market in France held the largest share of 17.99% in 2024. In France, funeral insurance has become increasingly popular as the cost of funerals rises and families seek ways to reduce the financial burden during grief. Funeral expenses in France can range from USD 3,280.53 (Euro 3,000) to USD 6,561.06 (Euro 6,000), depending on the region, services chosen, and the type of burial or cremation. The awareness surrounding these costs has driven demand for funeral insurance policies in France.

Spain Funeral Insurance Market Trends

The funeral insurance market in Spain witnessed significant growth, driven by an aging population, which increased the demand for pre-need funeral services and insurance products. As life expectancy rises, more individuals seek financial solutions to ease the burden of funeral costs on their families. This demographic shift has led to a growing awareness of the importance of planning for end-of-life expenses, prompting a surge in funeral insurance policies that cater to diverse needs and preferences.

Key Europe Funeral Insurance Company Insights

Key companies adopt innovative technologies to streamline operations and enhance customer experience. This includes the implementation of digital platforms for managing policies and processing claims. Strategic partnerships and collaborations are on the rise, allowing companies to extend their reach and broaden their range of services. For instance, in May 2024, BNP Paribas Cardif and Neuflize OBC initiated exclusive negotiations to form a strategic partnership focused on life insurance in France. This collaboration aims to enhance their offerings in the life insurance sector, leveraging each other’s strengths and expertise.

Key Europe Funeral Insurance Companies:

- Allianz

- AXA

- Avalon Group Companies

- Diaspora Insurance

- Banco Santander S.A.

- Monuta

- Co-op Funeralcare

- Swiss Life AG

- Mutualidad

- Menzis

- Seguros y pensiones para todos (MAPFRE)

- Legal & General Group plc

- DELA

- Banco Bilbao Vizcaya Argentaria S.A.

- Golden Leaves

- BNP Paribas Cardif

- CNP

- Crédit Agricole

- Golden Charter

- a.s.r.

Recent Developments

-

In April 2024, BNP Paribas Cardif agreed with Fosun Group, a Chinese investment firm, to acquire its stake in Ageas, a prominent international insurance group. This acquisition is part of BNP Paribas’s strategy to enhance its presence in the insurance sector and expand its financial services portfolio.

-

In May 2024, BNP Paribas Cardif and Neuflize OBC initiated exclusive negotiations to form a strategic partnership focused on life insurance in France. This collaboration aims to enhance their offerings in the life insurance sector, leveraging each other’s strengths and expertise.

Europe Funeral Insurance Market Report Scope

|

Report Attribute |

Details |

|

Market Revenue Size in 2025 |

USD 160.93 billion |

|

Revenue Forecast in 2030 |

USD 225.22 billion |

|

Growth rate |

CAGR of 6.95% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast data |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Age group, distribution channel, country |

|

Country scope |

UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; Switzerland; Netherlands; Hungary; Czech Republic; Belgium |

|

Allianz; AXA; Avalon Group Companies; Diaspora Insurance; Banco Santander S.A.; Monuta; Co-op Funeralcare; Swiss Life AG; Mutualidad; Menzis; Seguros y pensiones para todos (MAPFRE); Legal & General Group plc; DELA; Banco Bilbao Vizcaya Argentaria S.A.; Golden Leaves; BNP Paribas Cardif; CNP; Crédit Agricole; Golden Charter; a.s.r. |

|

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Funeral Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe funeral insurancemarket report based on age group, distribution channel, and country.

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Over 50

-

Over 60

-

Over 70

-

Over 80

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct-to-Consumer

-

Online

-

Others

-

-

Broker-Assisted

-

Tied-agent Assisted

-

Funeral Homes

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Switzerland

-

Netherlands

-

Hungary

-

Czech Republic

-

Belgium

-

Frequently Asked Questions About This Report

b. The Europe funeral insurance market size was estimated at USD 149.68 billion in 2024 and is expected to reach USD 160.93 billion in 2025.

b. The Europe funeral insurance market is expected to grow at a compound annual growth rate of 6.95% from 2025 to 2030 to reach USD 225.22 billion by 2030.

b. The over-60 segment held the largest revenue share of 37.68% in 2024, driven by the increasing awareness of mortality and the financial implications of end-of-life arrangements among this age group. This age group is a crucial demographic increasingly focused on end-of-life planning. As individuals in this age group approach retirement and beyond, they seek financial security and peace of mind regarding funeral arrangements. This segment is characterized by a desire to alleviate their family's emotional and financial burdens, making funeral insurance an essential consideration for many. Consumers over 60 value personalized guidance and comprehensive information when exploring funeral insurance options.

b. Some prominent players in the Europe funeral insurance market includes Allianz, AXA, Avalon Group Companies, Diaspora Insurance, Banco Santander S.A., Monuta, Co-op Funeralcare, Swiss Life AG, Mutualidad, Menzis, Seguros y pensiones para todos (MAPFRE), Legal & General Group plc, DELA, Banco Bilbao Vizcaya Argentaria S.A., Golden Leaves, BNP Paribas Cardif, CNP, Crédit Agricole, Golden Charter, a.s.r.

b. Key factors that are driving the Europe funeral insurance market growth include the aging population across many European countries, which leads to an increased demand for funeral services and associated insurance products. As life expectancy rises, more individuals seek ways to manage the financial burden of end-of-life expenses, driving significant interest in funeral insurance policies. Moreover, increasing awareness about the costs associated with funerals led consumers to consider preplanning their arrangements, further driving demand for these insurance products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."