- Home

- »

- Medical Devices

- »

-

Europe Funeral Homes And Services Market, Report, 2030GVR Report cover

![Europe Funeral Homes And Services Market Size, Share, & Trends Report]()

Europe Funeral Homes And Services Market Size, Share, & Trends Analysis Report By Services (Funeral Homes, Funeral Services), By Ownership (Corporate-Owned Funeral Homes, Family-Owned Funeral Homes), By Payment Model, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-484-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

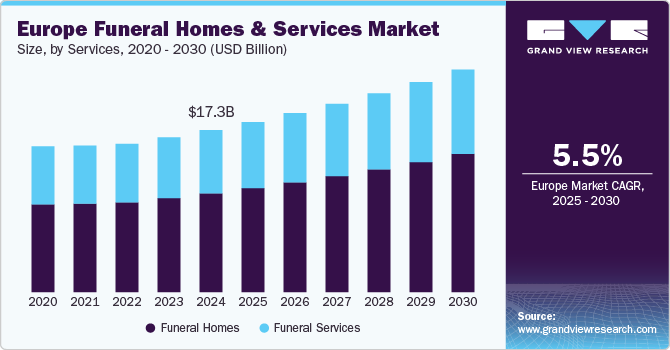

The Europe funeral homes and services market size was valued at USD 17.28 billion in 2024 and is expected to grow at a CAGR of 5.52% during the forecast period. The growth is attributed to the cultural shifts toward personalized & eco-friendly funerals and the increasing digital transformation with evolving consumer expectations. This shift impacts how funeral services are offered and managed. Moreover, the rising demand for funeral planning significantly drives the market. As populations in European countries continue to age, the death rate is gradually increasing, resulting in a growing need for funeral services.

Cultural shifts toward personalized and eco-friendly funerals drive increased demand for funeral homes and services. As society becomes more environmentally conscious, many seek funeral practices reflecting their values, particularly in reducing their carbon footprint. Traditional practices such as embalming and cremation, which have the potential to harm the environment, are being reconsidered in favor of more sustainable alternatives.

According to a survey by The Natural Burial Company, around 73% of survey participants preferred funeral service providers adhering to rigorous environmental standards, with 25% indicating they would likely choose such services. Furthermore, 98% of participants asserted the necessity for funeral service providers to transparently provide information on eco-friendly products and services, with 67% advocating this as a compulsory practice. This has led to a rise in eco-friendly options such as natural burials, where bodies are placed without chemical preservatives in biodegradable materials, allowing for natural decomposition.

Moreover, the increasing digital transformation is fueling market growth as consumer expectations are evolving, and this shift impacts how funeral services are offered and managed. The growing use of digital platforms for pre-arrangement services has become increasingly popular. People now use online platforms to plan and organize funerals, making it easier to customize services and choose options remotely. For instance, according to SunLife’s Cost of Dying 2024 Report, approximately 28% of the respondents preferred social media platforms to invite people in 2022, which increased to 43% in 2023. This has created a surge in demand for funeral homes that can provide tech-savvy solutions and offer easy-to-use online booking systems, digital memorials, and other related services.

Market Concentration & Characteristics

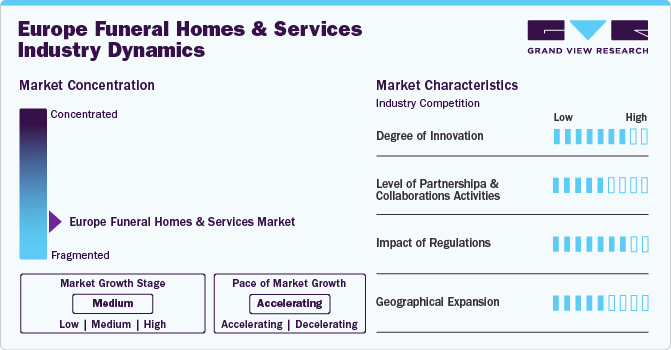

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including the impact of regulations, degree of innovation, industry competition, regional expansion, and level of partnerships & collaboration activities. The market is fragmented, with presence of many local providers in the market. Furthermore, the degree of innovation is high, and the level of partnerships and collaboration is moderate to high. The impact of regulations on the market is high, while geographic expansion is moderate.

The degree of innovation in the industry is high. The rise of digital memorialization is driving the demand. Families are increasingly looking for ways to create lasting digital tributes for their loved ones, such as online memorial pages, virtual services, or live-streamed funerals. For instance, according to SunLife’s Cost of Dying 2024 Report, around 31% people in the UK preferred sharing web links/video apps for live streaming in 2023. This shift opens new revenue streams for funeral homes and broadens the audience beyond local or regional borders, enabling participation from those who cannot attend in person.

In the European funeral services market, the moderate to high level of partnerships and collaborations reflects the specialized nature of the industry. Funeral homes often collaborate with various stakeholders, such as florists, memorial product suppliers, and transportation services, to enhance their service offerings. For instance, in February 2024, Funecap announced a strategic collaboration with the Könsgen family regarding the Rhein-Taunus crematorium.

The impact of regulations on the market is high. The variation in regulations across Europe significantly limits the demand for funeral homes and services due to the complex landscape of legal requirements and cultural practices. Each European country has its own set of regulations governing funeral services, including licensing requirements, the handling of remains, burial or cremation standards, and pricing transparency.

The industry's regional expansion level is moderate as market players are acquiring local players to enhance geographical presence. For instance, in August 2024, Klarahill acquired Malung-Sälen Begravningsbyrå, strengthening its investment strategy in the Dalarna region. This acquisition enhances Klarahill's regional presence and service offerings, marking a significant step in the company's expansion efforts.

Services Insights

Based on services, the funeral homes segment held the largest revenue share of over 60.97% in 2024 and is anticipated to grow at the fastest growth rate over the forecast year. The growth is attributed to the increasing adoption of cremation and eco-friendly practices among funeral homes. According to the World Population Review, the demand for cremation is increasing in nations such as Sweden, and the cremation rate in this country is 82.95%. This evolution reflects changing societal attitudes toward death, where personalized memorials and sustainability are becoming important factors in decision-making. Hence, many funeral homes are expanding their offerings to include direct cremation services and green funerals, ensuring they meet the diverse needs of their communities while addressing environmental concerns. This adaptability makes funeral homes vital players in Europe's evolving landscape of funeral services.

However, the funeral services segment is anticipated to grow at a significant growth rate over the forecast year. The increasing demand for customized funeral experiences is fueling innovation within this sector, leading to diverse service packages catering to varying cultural and religious preferences across Europe. In addition, technology integration is enabling funeral service providers to offer online planning tools and virtual memorial services, further driving market growth. For instance, in May 2022, Norwegian technology company Memcare is advancing the digitization of the funeral industry with its latest offering: virtual reality live streaming of funeral ceremonies. Using VR glasses and a 360-camera setup, guests who cannot attend in person can experience the ceremony as if they were in the room. This technological adoption not only enhances accessibility for families but also streamlines the planning process.

Ownership Insights

Based on ownership, the family-owned funeral homes segment held the largest revenue share of over 52.36% in 2024 and is anticipated to grow at the fastest growth rate over the forecast year. The growth of this segment is driven by the increasing demand for personalized services and the desire for continuity in service quality. Consumers seek meaningful ways to honor their loved ones, and family-run establishments are well-positioned to offer tailored solutions that reflect individual preferences. For instance, F.A. Albin & Sons has been a family-run funeral service provider for more than 200 years, consistently delivering a high standard of service characterized by personal attention, respect, and dignity, which is expected from a company with such a long-standing reputation.

The corporate-owned funeral homes segment is anticipated to grow at a significant growth rate over the forecast year. This growth is attributed to demographic shifts, particularly the aging population across Europe, which is projected to lead to increased demand for funeral services. For instance, in May 2024, Funecap invested approximately USD 1.09 billion to acquire over 300 crematoriums and funeral centers, capitalizing on the high organic growth rates of around 5% to 7% annually in the cremation market.

Payment Model Insights

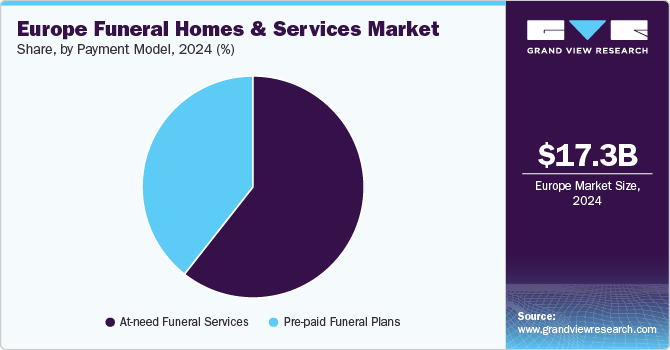

Based on payment model, the at-need funeral services segment held the largest revenue share of over 60.60% in 2024. The segment growth is attributed to the increasing mortality rates. Cultural changes regarding death and funerals led to more personalized and diverse service offerings. Families increasingly seek unique memorial experiences reflecting the deceased’s life and values, prompting funeral homes to adapt their service models accordingly.

The pre-paid funeral plans segment is anticipated to grow at the fastest CAGR over the forecast year. Pre-paid funeral plans allow individuals to arrange and pay for their funerals in advance, ensuring their preferences are respected while easing the financial burden on their families. This segment gained traction due to increasing consumer awareness of the benefits of pre-planning, including locking in current service prices and reducing stress for loved ones during a challenging time. For instance, Golden Leaves International offers pre-paid plans covering various funeral arrangements, including cremation and burial costs. This ensures families are spared from making difficult decisions when they cannot cope.

Regional Insights

The Europe funeral homes & services market is primarily driven by an aging population and increasing death rates, particularly in countries with higher elderly demographics. As per a report by the Barcelona Institute for Global Health (ISGlobal), over 47,000 people lost their lives in Europe due to extreme heat in 2023, with the southern countries being the most affected. Cultural shifts towards personalized and eco-friendly funerals are anticipated to grow the industry. Consumers increasingly seek tailored services, including green burials and cremation alternatives, prompting funeral service providers to diversify offerings to align with these evolving preferences and environmental concerns.

UK Funeral Homes and Services Market Trends

UK Funeral Homes and Services Market held a significant market share in 2024. The technological advancements are revolutionizing the industry, making services more accessible and efficient through online platforms and digital tools. For instance, in November 2023, Choice Funeral Plans, a division of Funeral Partners and the UK's third-largest funeral service provider, launched a new Unattended Cremation Plan. This plan targets individuals looking for Direct to Cremation services, promising high-quality care through their extensive network of Funeral Directors, catering to the preference for non-traditional funeral arrangements made in advance.

Germany Funeral Homes and Services Market Trends

Germany Funeral Homes and Services Market held a significant market share in 2024. A noticeable trend towards personalization and eco-friendly funeral services reflects broader societal shifts towards sustainability and individual expression. Consumers increasingly seek unique and meaningful ways to honor their loved ones, including green burials and bespoke memorial services. This demand for customization and environmental consideration is aiding funeral service providers in expanding their offerings and adopting more sustainable practices, thereby distinguishing themselves in a competitive market.

Spain Funeral Homes and Services Market Trends

Spain Funeral Homes and Services Marketis expected to witness the fastest growth over the increasing incorporation of technology in funeral services, such as live streaming of ceremonies and digital memorials, accelerated by the COVID-19 pandemic's social distancing measures. This digital transformation is opening new avenues for service delivery and customer engagement, making funeral services more accessible and adaptable to the needs of modern consumers.

Key Europe Funeral Homes And Services Company Insights

The market is highly fragmented, with large players and emerging players operating in this space adopting various strategies such as collaborations, acquisitions, partnerships, and launching new services. Some emerging market players in the Europe funeral homes and services market include Memento Funeral Chapel, Friedhöfe Wien GmbH, Sereni NV, among others.

Key Europe Funeral Homes And Services Companies:

- Service Corporation International (Dignity Memorial)

- Funecap Group

- OGF Groupe

- Dignity

- Mémora Group

- Mapfre's Funespaña (Enalta)

- Albia Servicios Funerarios

- Co-op Funeralcare

- Westerleigh Group

- Funeral Partners Ltd. (Includes LM Funerals after acquisition)

- Pütz-Roth

- Àltima

- Fonus

- Grupo ASV Funeral Services

- Ahorn Group

- Berlin Memorial Funeral Home

- mymoria GmbH

- Pure Cremation

- Memento Funeral Chapel

- Friedhöfe Wien GmbH

- Sereni NV

Recent Developments

-

In October 2024, the Funecap group acquired ARNAL Pompes Funèbres. The acquisition of this dynamic and well-known operator in the region allows the Group to strengthen its territorial presence and to provide the best service to families.

-

In December 2023, Funeral Partners’ Funeral Plan division introduced a new service for Unattended Cremations, also called Direct to Cremation services, ensuring clients receive exceptional care from their network of Funeral Directors. This launch is expected to strengthen their market position.

-

In October 2023, SAIF (the National Society of Allied and Independent Funeral Directors) and Westerleigh Group entered into a partnership. This is a strategic partnership designed to improve the service offerings available to funeral service providers across Great Britain.

-

In August 2022, Grupo Catalana Occidente acquired Mémora Group, a funeral service provider in the Iberian Peninsula, for USD 424.96 million, pending certain financial adjustments. This acquisition is expected to expand Grupo Catalana Occidente’s market share in the region.

Europe Funeral Homes And Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.13 billion

Revenue forecast in 2030

USD 23.72 billion

Growth Rate

CAGR of 5.52% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, ownership, payment model, country

Country scope

UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Switzerland; Netherland; Czech Republic; Hungary; Belgium.

Key companies profiled

Service Corporation International (Dignity Memorial); Funecap Group; OGF Groupe; Dignity; Mémora Group; Mapfre's Funespaña (Enalta); Albia Servicios Funerarios; Co-op Funeralcare; Westerleigh Group; Funeral Partners Ltd. (Includes LM Funerals after acquisition); Pütz-Roth; Àltima; Fonus; Grupo ASV Funeral Services; Ahorn Group; Berlin Memorial Funeral Home; mymoria GmbH; Pure Cremation; Memento Funeral Chapel; Friedhöfe Wien GmbH; Sereni NV

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Funeral Homes And Services Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe funeral homes and services market report based on services, ownerships, payment model, and country.

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Funeral Homes

-

Traditional Funeral Services

-

Cremation Services

-

Green/Environmental Funerals

-

Pre-planned/Pre-paid Funeral Services

-

-

Funeral Services

-

Funeral Planning Services

-

Direct Cremation

-

Memorial Services

-

Other Services

-

-

-

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

-

Corporate-Owned Funeral Homes

-

Family-Owned Funeral Homes

-

-

Payment Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-paid Funeral Plans

-

At-need Funeral Services

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

Switzerland

-

Netherland

-

Czech Republic

-

Hungary

-

Belgium

-

Frequently Asked Questions About This Report

b. The Europe funeral homes and services market size was estimated at USD 17.28 billion in 2024 and is expected to reach USD 18.13 billion in 2024.

b. The Europe funeral homes and services market is expected to grow at a compound annual growth rate of 5.52% from 2025 to 2030 to reach USD 23.72 billion by 2030.

b. Based on ownership, the family-owned funeral homes segment held the largest revenue share of over 52.36% in 2024 and is anticipated to grow at the fastest growth rate over the forecast year. The growth of this segment is driven by the increasing demand for personalized services and the desire for continuity in service quality. Consumers seek meaningful ways to honor their loved ones, and family-run establishments are well-positioned to offer tailored solutions that reflect individual preferences.

b. Some prominent players in the Europe funeral homes and services market includes Service Corporation International (Dignity Memorial); Funecap Group; OGF Groupe; Dignity; Mémora Group; Mapfre's Funespaña (Enalta); Albia Servicios Funerarios; Co-op Funeralcare; Westerleigh Group; Funeral Partners Ltd. (Includes LM Funerals after acquisition); Pütz-Roth; Àltima; Fonus; Grupo ASV Funeral Services; Ahorn Group; Berlin Memorial Funeral Home; mymoria GmbH; Pure Cremation; Memento Funeral Chapel; Friedhöfe Wien GmbH; Sereni NV

b. Key factors that are driving the Europe funeral homes and services market growth attributed to the cultural shifts toward personalized & eco-friendly funerals and the increasing digital transformation with evolving consumer expectations. This shift impacts how funeral services are offered and managed. Moreover, the rising demand for funeral planning significantly drives the market. As populations in European countries continue to age, the death rate is gradually increasing, resulting in a growing need for funeral services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."