- Home

- »

- Consumer F&B

- »

-

Europe Functional Water Market Size, Industry Report, 2030GVR Report cover

![Europe Functional Water Market Size, Share & Trends Report]()

Europe Functional Water Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Vitamin-infused Water, Mineral-infused Water), By Flavor (Fruit, Herbal & Botanical), By Packaging (PET, Cans), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-492-4

- Number of Report Pages: 165

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Functional Water Market Trends

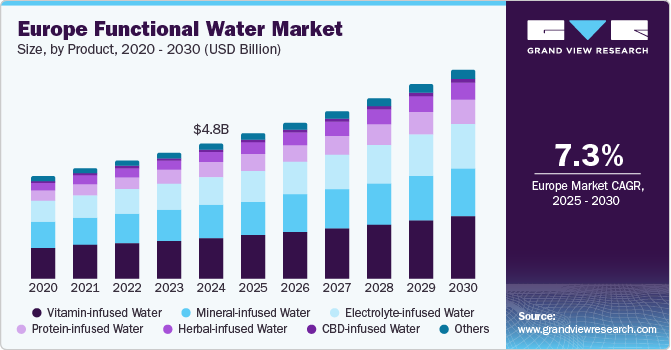

The Europe functional water market size was estimated at USD 1.4 billion in 2024 and is expected to grow at a CAGR of 7.5% from 2025 to 2030. The demand and consumption for functional water in Europe is rising due to a combination of health, lifestyle, and market trends that align well with consumer preferences in the region. As European consumers become more health-conscious, they are increasingly looking for beverages that offer functional benefits beyond hydration, such as enhanced nutrition, immune support, and improved physical performance. Functional water often fortified with vitamins, minerals, antioxidants, electrolytes, and plant extracts appeals to these health-focused consumers who prefer low-calorie, naturally flavored drinks over traditional sugary sodas or juices.

The functional water industry is primarily driven by increasing consumer interest in health and wellness trends, leading to a shift toward beverages that offer added health benefits. The industry benefits from growing consumer awareness of the adverse effects of sugary beverages, which encourages individuals to choose healthier alternatives such as functional water.

As consumers become increasingly health-conscious, there is a growing demand for beverages that provide added nutritional benefits. Functional water, enriched with vitamins, minerals, and electrolytes, aligns perfectly with this trend. Brands can capitalize on this opportunity by developing products that cater to specific health needs, such as hydration for athletes, immune support, or beauty-enhancing ingredients. Marketing these products effectively to highlight their health benefits can attract a broader consumer base looking for healthier alternatives to sugary drinks and traditional bottled water.

In addition, the global pandemic accelerated this trend, as it underscored the importance of maintaining good health. With many people forced into sedentary lifestyles during lockdowns, there was a renewed focus on improving physical activity and adopting healthier dietary practices. In Europe, the heightened awareness of the link between health and immunity has further solidified the demand for products that promote well-being, a trend that is expected to continue shaping consumer choices in the future.

There is a significant opportunity for product differentiation through flavor innovation and customization in the functional water industry. Consumers are increasingly looking for unique and exciting flavor combinations that enhance their drinking experience. By experimenting with natural flavors, herbal infusions, and exotic ingredients, brands can create distinctive offerings that capture consumer interest. The trend toward personalization allows consumers to select products that cater to their specific tastes and health goals. Brands that offer customizable functional water products can tap into this growing demand for personalized beverages, increasing customer engagement and satisfaction.

Moreover, the fast-paced, on-the-go lifestyle common in many European cities creates a strong demand for convenient, portable hydration options. Functional water meets this need effectively by offering a low-calorie, accessible means for consumers to stay hydrated while also addressing specific health and wellness objectives.

Product Insights

Vitamin based functional water accounted for a revenue share of 30.3% in 2024. The demand for vitamin-infused water in Europe is largely driven by increasing health consciousness among consumers. As people become more aware of the importance of hydration and nutrition, they seek convenient ways to incorporate vitamins into their daily routines. The growing prevalence of lifestyle diseases and a focus on preventative health measures have led to a surge in the popularity of functional beverages that offer added health benefits. Moreover, the appeal of products that combine hydration with essential vitamins is increasingly gaining attention, especially for busy urban dwellers looking for on-the-go solutions.

CBD-infused functional water is expected to grow at a CAGR of 9.3% from 2025 to 2030. The increasing acceptance of CBD (cannabidiol) and its purported health benefits is a key factor driving demand for CBD-infused water in Europe. As more consumers seek natural remedies for stress relief, anxiety reduction, and overall wellness, CBD products are gaining traction. The appeal of CBD-infused water lies in its potential to provide a discreet and easy way to consume CBD while staying hydrated. This trend is particularly popular among younger consumers and wellness enthusiasts who are keen to explore innovative functional beverages.

Flavor Insights

Fruit flavor accounted for a revenue share of 58.1% in 2024 in the European functional water industry. The demand for fruit-flavored functional water in Europe is significantly driven by consumers’ desire for healthy, flavorful hydration options. As people become more health-conscious, they are actively seeking alternatives to sugary drinks, and fruit flavors provide a naturally sweet and refreshing choice. The appeal of fruit flavors lies not only in their taste but also in the health benefits associated with fruits, such as vitamins, antioxidants, and hydration. This trend aligns well with the growing emphasis on wellness and preventative health, prompting brands to develop fruit-infused waters that combine enjoyable flavors with functional benefits.

Herbal & mushroom flavors are expected to grow with a CAGR of 8.6% from 2025 to 2030. The rise in demand for herbal and botanical functional water in Europe is largely driven by consumers' increasing interest in natural wellness solutions. Ingredients such as chamomile, hibiscus, and mint are known for their potential health benefits, including relaxation, digestive support, and antioxidant properties. As the wellness trend gains momentum, consumers are turning to these herbal flavors as a way to enhance their hydration while promoting overall well-being. The shift towards clean and natural ingredients further fuels the appeal of herbal-infused waters, as people seek products that align with their health-conscious lifestyles.

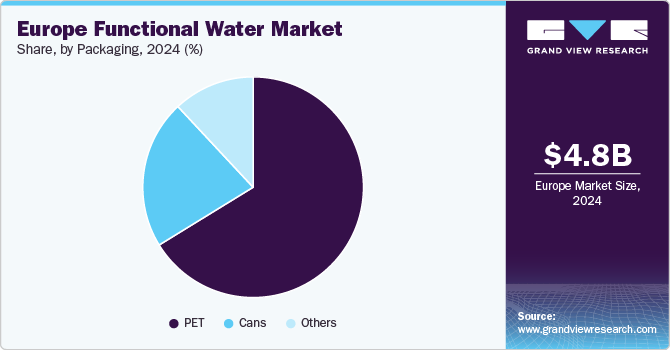

Packaging Insights

PET bottles accounted for a revenue share of 66.2% in 2024. The demand for functional water in PET (polyethylene terephthalate) packaging is significantly driven by its lightweight nature, durability, and recyclability. PET is widely recognized for its ability to preserve the freshness and quality of beverages, making it an ideal choice for functional waters that often contain sensitive ingredients like vitamins and herbal extracts. In addition, consumers are increasingly looking for convenient on-the-go options, and PET bottles cater to this demand with their portability and ease of use. The emphasis on sustainability also plays a crucial role; many brands are now using recycled PET (rPET) in their packaging, appealing to environmentally conscious consumers who prioritize eco-friendly practices.

The canned functional water segment is expected to grow at a CAGR of 8.5% from 2025 to 2030. The rising demand for functional water in cans is fueled by consumer preference for sustainable packaging and the perception of canned beverages as healthier options. Aluminum cans are easily recyclable and can be produced using a higher percentage of recycled materials, appealing to environmentally conscious consumers. This sustainability aspect aligns with the broader trend towards eco-friendly products, making cans an attractive choice for brands looking to position themselves as green and responsible. In addition, cans are known for their ability to protect contents from light and oxygen, which can help preserve the flavor and nutritional value of functional waters.

Distribution Channel Insights

Sales through supermarkets & hypermarkets accounted for a revenue share of 47.5% in 2024 in the Europe functional water industry. In Europe, hypermarkets and supermarkets are pivotal in driving the distribution of functional water due to their vast selection and consumer accessibility. Stores such as Carrefour, Tesco, and Aldi offer extensive aisles dedicated to bottled water, showcasing both mainstream and premium brands. Popular choices include Evian, known for its mineral content, and Smartwater, which appeals to health-conscious consumers with its vapor-distillation process. The scale and marketing power of these retailers allow for effective promotional strategies, such as discounts and bundled offers, attracting a wide customer base and encouraging bulk purchases.

Sales through convenience stores are expected to grow with a CAGR of 7.8% from 2025 to 2030. Convenience stores play a crucial role in the distribution of functional water, particularly among consumers seeking quick, on-the-go hydration options. Outlets like 7-Eleven and SPAR cater to busy lifestyles, offering a curated selection of functional waters, including brands such as Coco Water and AquaHydrate. These retailers focus on immediate consumption, making functional water appealing for impulse buys. Their strategic locations in urban centers and near transport hubs also facilitate access for commuters and those looking for a refreshing beverage during their daily routines, driving the sales of functional water.

Country Insights

Germany Functional Water Market Trends

The functional water market in Germany accounted for a revenue share of 25.4% in 2024. In Germany, the demand for functional water is primarily driven by a growing health-conscious population that increasingly seeks beverages with added health benefits. The trend towards wellness and preventive healthcare has led consumers to prefer products that offer hydration along with functional benefits such as vitamins, minerals, and electrolytes.

Romania Functional Water Market Trends

The functional water market in Romania is expected to grow at a CAGR of 9.7% from 2025 to 2030. The introduction of a deposit-refund scheme (DRS) in November 2023, for beverage bottles in Romania is poised to significantly impact the demand for functional water. This initiative, which offers consumers USD 0.11 for each returned bottle, aligns with the principles of the circular economy and reflects a growing awareness of environmental issues among Romanian consumers. As they become more eco-conscious, many are likely to favor brands that prioritize sustainability, including those that use eco-friendly packaging and promote recycling. This makes functional water brands that actively engage in sustainable practices more appealing to consumers who want to support products that benefit both their health and the environment.

Key Europe Functional Water Company Insights

The European functional water market is characterized by numerous well-established and emerging players. Manufacturers in this market are engaging in a variety of strategic initiatives to keep pace with evolving consumer demands and market trends.

Key Europe Functional Water Companies:

- Nestlé

- The Coca-Cola Company

- Protein2o

- Vieve Protein Water

- BiPro Protein Water

- Nutramino

- WOW HYDRATE

- Biotech USA

- The Hut.com Limited (Myprotein)

- XXLnutrition

Recent Developments

-

In March 2024, Nestlé-owned brand Essentia Water launched a new line of flavored and functional water called Essentia Hydroboost, available in lemon lime, peach mango, and raspberry pomegranate flavors. Each bottle contains hydrolates, B-complex vitamins, and 400mg of electrolytes, which is 30 times more than the leading premium still water. Essentia Hydroboost aims to provide supercharged hydration for people with busy lifestyles, offering a delicious and functional water option.

-

In July 2024, Vieve, a brand known for its protein-infused waters, successfully secured a new listing with Holland & Barrett, which will see its products available in 612 stores across the UK and Ireland. This partnership aims to enhance Vieve's visibility and accessibility in the health and wellness market, aligning with Holland & Barrett's commitment to offering innovative health products. The collaboration is expected to significantly boost Vieve's growth and reach among health-conscious consumers.

Europe Functional Water Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.51 billion

Revenue forecast in 2030

USD 2.16 billion

Growth rate

CAGR of 7.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/ billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, packaging, distribution channel, region

Regional scope

Europe

Country scope

Germany; Belgium; Spain; France; Italy; Poland; Hungary; Romania; Netherlands; Austria

Key companies profiled

Nestlé; The Coca-Cola Company; Protein2o; Vieve Protein Water; BiPro Protein Water; Nutramino; WOW HYDRATE; Biotech USA; The Hut.com Limited (Myprotein); XXLnutrition

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Functional Water Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segments the Europe functional water market report on the basis of product, flavor, packaging, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin-infused Water

-

Mineral-infused Water

-

Protein-infused Water

-

Electrolyte-infused Water

-

Herbal-infused Water

-

CBD-infused Water

-

Others

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit Flavor

-

Berry

-

Citrus

-

Tropical

-

Pineapple

-

Others

-

-

Herbal & Botanical

-

Others

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

PET

-

Cans

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

Belgium

-

Spain

-

France

-

Italy

-

Poland

-

Hungary

-

Romania

-

Netherlands

-

Austria

-

-

Frequently Asked Questions About This Report

b. The Europe functional water market size was estimated at USD 1.40 billion in 2024 and is expected to reach USD 1.51 billion in 2025.

b. The Europe functional water market is expected to grow at a compounded growth rate of 7.5% from 2025 to 2030 to reach USD 2.16 billion by 2030.

b. CBD-infused functional water is expected to growth with a CAGR of 9.6% from 2025 to 2030. The demand for CBD-infused water in Europe is also significantly influenced by the trend of reduced alcohol consumption among consumers. As people increasingly seek healthier lifestyles and look for alternatives to alcoholic beverages, CBD-infused water offers a refreshing option that promotes relaxation without the drawbacks associated with alcohol.

b. Some key players operating in Europe functional water market include Nestlé, The Coca-Cola Company, Protein2o, Vieve Protein Water, BiPro Protein Water, and others.

b. Key factors that are driving the market growth include rising product innovation and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.