Europe Fluorosilicic Acid Market Size, Share & Trends Analysis Report By Grade (25%, 35%, 40%), By Application (Hydrogen Fluoride, Aluminum Fluoride), By Country, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-688-2

- Number of Report Pages: 79

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

The Europe fluorosilicic acid market size was estimated at USD 52.38 million in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 4.5% from 2020 to 2027. High consumption of the product for manufacturing hydrogen fluoride-primarily used as an industrial raw material for manufacturing aluminum, gasoline, and refrigerants-is anticipated to drive the growth of the market. Fluorosilicic acid is a key byproduct obtained from the production process of phosphate fertilizer; wherein sulfuric acid is treated with phosphate rock. This substance is widely used across multiple industries and is preliminarily consumed to formulate various herbicides, refrigerants, gasoline, pharmaceuticals, kitchen utensils, electrical components, plastic products, and others.

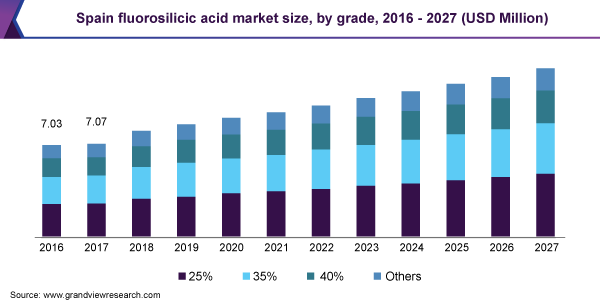

Spain was the major consumer of fluorosilicic acid in Europe in 2019 with a revenue share of 16.5%. Derivados del Flúor (DDF), a major manufacturer in the country, caters to the demand from surface treatment, drinking water fluoridation, electroplating, and lead refining industries. Rising preference of the product in surface treatment, electroplating, and lead refining industries is expected to propel the product consumption in near future.

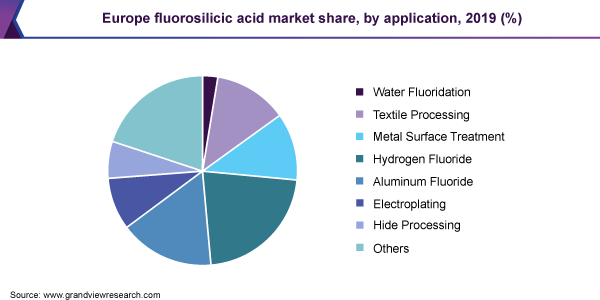

Fluorosilicic acid finds numerous applications across several industries; however, its primary application is in the synthesis of hydrogen fluoride. However, in Europe, due to stringent regulations on fluoridation agents used in water, the chemical finds its major application in formulating hydrogen fluoride, aluminum fluoride, and others.

Hydrogen fluoride which is one of the major application industries catered by fluorosilicic acid is used to manufacture hydrofluorocarbons used in refrigerants The consumption for fluorosilicic acid is driven by the rising demand for refrigerants. European countries have reflected high penetration of FMCG companies into the market space, which has resulted in parallelly high consumption of various industrial refrigerants in the region. High sales of packaged food products, canned beverages, and more have resulted in the construction of multiple supermarkets and organized groceries across all European countries. This resulted in higher demand for refrigerants and, therefore, subsequently higher hydrogen fluoride demand in Europe.

In spite of the strong product demand, the region is import-reliant to meet the demand of fluorosilicic acid. European countries have limited reserves of phosphate rock which increases their reliance on imports. Russia and countries from North America and Middle East are the major exporters of phosphate rock in the European Union. However, constant demand for phosphate rock from fertilizer manufacturers in Europe has helped them establish a stable network to ensure ease in terms of phosphate rock availability across Europe.

However, lack of technological innovation is one of the key challenges faced by the fluorosilicic acid manufacturers in the region. From a global standpoint as well, manufacturers traditionally produce it as a byproduct of the phosphoric acid formulation process. Moreover, lower dependency on technology and low investments in the field has been a major challenge faced by the formulators in the region.

Grade Insights

Fluorosilicic acid is mainly categorized into four grades that are 25%, 35%, 40%, and others. 25% grade of the product is highly consumed across the globe and accounted for 35.7% of total volume consumption in the Europe fluorosilicic acid market in 2019.

Lower concentration of the product is highly preferred in water treatment applications. Solvay, a leading fluorosilicic acid manufacturer, manufactures the product with 25% concentration, which is specifically targeted toward water treatment facilities as its end consumer. On the other hand, The Mosaic Company manufactures the same grade and markets it as an industrial chemical for its application in textile detergent manufacturing and hide processing.

Fluorosilicic acid with a 40% concentration is highly used in metal surface treatment applications. Aluminum is treated with fluorides, such as fluorosilicic acid, to penetrate through the aluminum oxide layer that forms over the surface of the metal. The process enables fluoride ions to form a protective layer over the aluminum surface, which prevents further oxidation of the metal. However, the limited application scope of the product has resulted in a moderate growth of 3.5% from 2020 to 2027.

Application Insights

Hydrogen fluoride was the dominant application of the product with a volume share of over 20% in 2019 and is expected to witness the fastest CAGR of 5.2%, in terms of value, from 2020 to 2027. Apart from its consumption in the refrigerant industry, hydrogen fluoride is utilized in the pharmaceutical industry and to produce several other commodities such as plastic components, and steel products.

Textile processing was the third largest application of fluorosilicic acid with a share of 12.67% in 2019. The product is witnessing increased demand in textile applications owing to its superior cleansing properties. It is used as a laundry chemical or laundry sour as it helps remove rust, stains, and mold from the fabric. The chemical also helps in pH regulation during the rinse cycle. It protects the fiber by forming a thin film coating around the fabric, which results in the reduction of surface tension. These factors are anticipated to fuel the demand from textile processing applications over the forecast period.

Laundry industry has been gaining traction in recent years owing to the changing lifestyle of people and increasing awareness about clean and hygienic clothes. This has created a high demand for clean and fragrant clothes. In addition, the rising prevalence of allergies and other skin diseases is expected to generate high demand for detergents in the near future. Detergent manufacturers are focused on developing high-quality products for efficient cleaning and increasing fabric life along with maintaining hygiene. Owing to these factors, fluorosilicic acid is expected to witness healthy demand in textile applications over the forecast period.

Country Insights

The U.K. is one of the major importer fluorosilicic acid in the region to cater to domestic demand. The country held a volume share of over 13% in 2019. Water supply companies such as Anglian Water Services Limited, Northumbrian Water Limited, South Staffordshire Water plc, Severn Trent Plc, and United Utilities Group PLC provide fluoridated water to consumers and, thus, they are the major consumers of the product in the water treatment segment.

U.K. imports fluorosilicic acid and other fluoride compounds from countries such as China, Germany, and Japan for application in various end-use industries. However, the increasing regulations post the Brexit outcome is anticipated to hinder the growth of the chemical in water treatment activities. The country is, however, projected to have a strong demand for the product with a CAGR of 4.9% from 2020 to 2027 mainly due to its demand from the hydrogen fluoride and aluminum fluoride applications.

France has the third-largest textile market in Europe and is popularly known as the global fashion capital. The market growth has been aided by presence of leading textile brands such as Louis Vuitton, Chanel S. A., Lacoste, Hermès, and Charvet Place Vendome. Fluorosilicic acid is expected to exhibit healthy penetration in this sector over the coming period as it is highly-efficient in fabric cleaning and conditioning. The high consumption in textiles has made the country the third largest consumer of the chemical with a share of 12.16%, in 2019.

Key Companies & Market Share Insights

The common strategies undertaken by leading manufacturers all over the world are mergers, acquisitions, and strategic tie-ups to capture new geographical markets. Merger or acquisition helps companies to combine research strengths of R&D departments and complement the company with additional production capacities and supply or distribution channels in order to develop innovative products and solutions and cater to the end user across various geographies in the world. Companies such as Minersa Mining Group acquired Derivados del Flúor to add fluoride compound manufacturing and distribution division to the company.

Growing consumption of fluorosilicic acid in multiple applications has positively affected the market which has resulted in increasing presence of new entrants in the industry to cater to the domestic and regional demand of the product. Europe is home to a few small & medium-scale manufacturers with limited technological adoptions and limited product availability. This reflects space for market penetration for multinational companies with broader portfolio holdings and a larger customer base in Europe. Some of the prominent players in the Europe fluorosilicic acid market are:

-

Solvay

-

The Mosaic Company

-

VWR International, Inc.

-

Honeywell International, Inc.

-

Ixom

-

Hydrite Chemical Company

-

Gelest, Inc.

Europe Fluorosilicic Acid Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2020 |

USD 54.83 million |

|

Market size volume in 2020 |

44,713.92 tons |

|

Revenue forecast in 2027 |

USD 74.27 million |

|

Volume forecast in 2027 |

58,484.94 tons |

|

Growth Rate |

CAGR of 4.5% (revenue-based) from 2020 to 2027 |

|

Base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Volume in tons, revenue in USD Thousand and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Grade, application, country |

|

Regional scope |

Europe |

|

Country scope |

Germany; U.K.; France; Italy; Spain; Denmark; Russia; Sweden |

|

Key companies profiled |

Solvay; The Mosaic Company; VWR International, Inc.; Honeywell International, Inc.; Ixom; Hydrite Chemical Company; Gelest, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts volume and revenue growth at the regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the Europe fluorosilicic acid market report on the basis of grade, application, and country:

-

Grade Outlook (Volume, Tons; Revenue, USD Thousand, 2016 - 2027)

-

25%

-

35%

-

40%

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2016 - 2027)

-

Water Fluoridation

-

Textile Processing

-

Metal Surface Treatment

-

Hydrogen Fluoride

-

Aluminum Fluoride

-

Electroplating

-

Hide Processing

-

Others

-

-

Country Outlook (Volume, Tons; Revenue, USD Thousand, 2016 - 2027)

-

Denmark

-

France

-

Germany

-

Italy

-

Russia

-

Spain

-

Sweden

-

The U.K.

-

Frequently Asked Questions About This Report

b. The Europe fluorosilicic acid market size was estimated at USD 52.38 million in 2019 and is expected to reach USD 54.84 million in 2020.

b. The Europe fluorosilicic acid market is expected to grow at a compound annual growth rate of 4.5% from 2020 to 2027 to reach USD 74.27 million by 2027.

b. Hydrogen fluoride dominated the Europe fluorosilicic acid market with a share of 19.8% in 2019. This is attributable to rising demand for hydrogen fluoride in pharmaceutical industry and production of plastic components and steel products.

b. Some key players operating in the Europe fluorosilicic acid market include Solvay, The Mosaic Company, VWR International, Inc, Honeywell International, Inc, Ixom, Hydrite Chemical Company and Gelest, Inc.

b. Key factors that are driving the market growth include increasing production of hydrogen fluoride, which is primarily used as an industrial raw material for manufacturing aluminum, gasoline, and refrigerants.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."