- Home

- »

- Medical Devices

- »

-

Europe Facial Injectable Market Size & Share, Report, 2030GVR Report cover

![Europe Facial Injectable Market Size, Share & Trends Report]()

Europe Facial Injectable Market Size, Share & Trends Analysis Report By Product (Collagen & PMMA Microspheres, Hyaluronic Acid), By Application (Facial Line Correction, Face Lift), By End-use (Dermatology Clinics, MedSpa), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-199-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

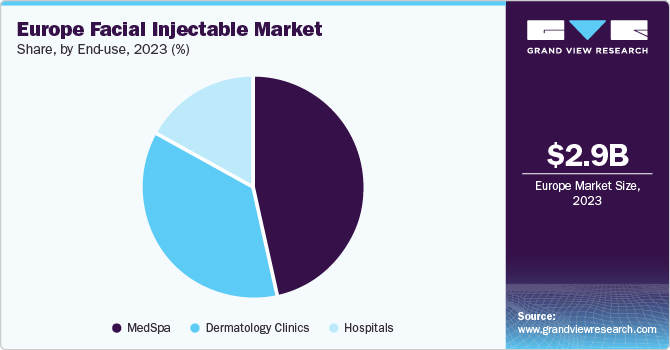

The Europe facial injectable market size was estimated at USD 2.88 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.8% from 2024 to 2030. A growing focus on physical appearance among consumers has led to a surge in demand for facial injectables in recent years. Signs of aging, including wrinkles and sagging of the skin due to low facial elasticity, dark spots, and others, start appearing between 25 and 30 years of age and become more prominent from 30 to 65 years of age. The presence of a large population susceptible to various signs of aging has boosted the demand for facial injectable treatment.

Dermal fillers or soft tissue fillers, especially nonsurgical procedure-based fillers, such as HA, collagen, Calcium Hydroxylapatite (CaHA), and polymer fillers, are gaining popularity in European countries. HA-based, dermal products are dominating the European market owing to growing consumer demand coupled with a simple approval process established by the European Medicines Agency.

Currently, there are over 140 HA-based facial injectables approved in Europe. HA-based facial injectables such as JUVÉDERM VOLUMA (Allergan plc) and Restylane SubQ (Galderma S.A.), Juvéderm (Allergan plc), Mac Dermol (La Centrale des Peeling), Matridur (Florelle), Puragen (Mentor, U.S.), Rofilan (Rofil Medical International), TEOSYAL️ (Teoxane Laboratories), and Visagel (Dermatech) are significantly contributing to the market growth.

The presence of skilled professionals and rise in the geriatric population in the region is further fueling the market growth. Further, increasing awareness of minimally invasive procedures occurring due to several beauty campaigns organized by key players in the market is also driving the market growth. Rising demand for advanced treatment technologies is likely to create new growth avenues for this market.

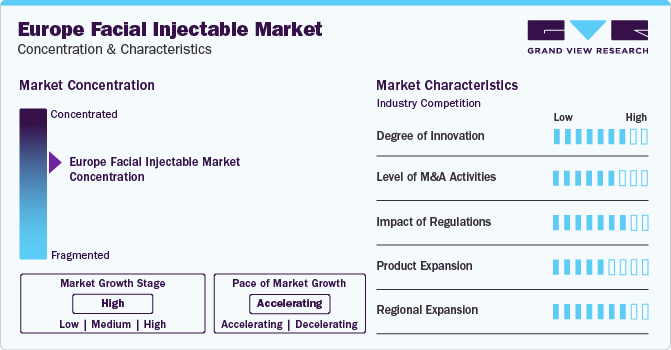

Market Concentration & Characteristics

Technological advancements are expected to be a major factor driving growth and innovation. These advancements have revolutionized aesthetic medicine, leading to safer, more effective, and minimally invasive treatments. For instance, in May 2023, the approval of SKINVIVE by JUVÉDERM by the FDA showcased a major advancement in the industry. It was the first hyaluronic acid intradermal microdroplet injection approved for enhancing cheek smoothness. Such approvals can help introduce a range of targeted solutions for individuals seeking to improve their appearance. In addition, the development of combination therapies has emerged as a significant technological advancement in the market. Combining botulinum toxin with other treatments, such as dermal fillers or laser therapies, achieves a more comprehensive approach to facial rejuvenation, resulting in enhanced outcomes for patients.

The Europe facial injectable market is characterized by a high level of M&A activities undertaken by leading players. This is due to factors including the increasing focus on enhancing companies' products & services portfolio, the need to consolidate in a rapidly growing market, and the increasing strategic importance of aesthetic treatments. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in June 2022, Prollenium Medical Technologies acquired a French innovative cosmetics company SoftFil. The integration of medical devices and Revanesse dermal fillers from SoftFil affirmed Prollenium’s primary focus on innovation to deliver practitioners with robust solutions and patients with the finest results.

The market is expected to face significant challenges due to stringent regulatory constraints. Regulatory authorities have established strict guidelines to ensure patient safety & track product usage. For instance, in 2021, the UK government drafted the Botulinum Toxin and Cosmetic Fillers (Children) Act, which made any form of injectable procedure performed on patients aged 18 or below a criminal offense. In September 2023, the UK government proposed to ban unlicensed providers of cosmetic treatments, such as Botulinum toxin and injectable fillers. The regulation makes related illicit procedures a criminal offense when offered by a non-licensed practitioner. Adhering to regulations requires extensive documentation, approvals, testing, and continuous monitoring. This process may create a barrier to entering this market, especially for small companies with limited capabilities.

Collagen injectables are intended for wrinkles, laugh lines, creases, lip border restoration, crow’s feet, facial rejuvenation, volume loss, face contouring, and acne scars. Botulinum Toxin Type A (BoNTA) is a purified substance (neurotoxic protein) derived from bacteria. There are three types of BoNTA injections: BOTOX, Dysport, and Xeomin. BOTOX contains onabotulinumtoxinA, which blocks muscular nerve signals, prevents muscle contraction, and reduces facial wrinkles. Hyaluronic Acid (HA) is a glycosaminoglycan with the unique capacity to maintain skin stability, protection, and ongoing rejuvenation. HA possesses the ability to bind moisture to the skin, contributing to the enhancement and preservation of the essential moisture responsible for the fullness of facial skin. The other types of products include calcium hydroxylapatite (CaHA), poly-L-Lactic (PLLA), dermal fillers made from alkyl-imide, Poly-ɛ-caprolactone (PCL), and various fillers that are used for providing volume to the face but are not made from a single key ingredient.

Companies such as Galderma S.A., La Centrale des Peeling, and Florelle among others have a strong presence in the European market and have established production facilities in the region. However, these companies are also focusing on market expansion in the U.S. and Asian countries.

End-use Insights

Based on end-use, the med Spa segment dominated the market and accounted for the largest revenue share of 46.7% in 2023. It is anticipated to continue its dominance with a significant CAGR over the forecast period. MedSpa is a facility where cosmetic services are provided under the supervision of a licensed physician. All non-invasive treatments are performed in these facilities, which include facial injections, non-invasive body contouring, skin rejuvenation, and laser treatments by experienced professionals.

These facilities follow all the regulatory policies and standards set by the government and have to be mandatorily owned by a physician. MedSpas are increasingly adopting novel treatment systems to gain a higher market share. The employees in medspas need to have a license in aesthetics as well as medical education.

Product Insights

The botulinum toxin segment dominated the market and accounted for the largest revenue share of 47.2% in 2023. Middle-aged women are increasingly opting for fillers and injectables including the popular Botox to reverse the signs of aging. The growth of the segment can be attributed to increasing adoption of BoNTA in cosmetic (aesthetic) procedures, its role in enhancing facial aesthetics, and its demonstrated effectiveness in mitigating the signs of aging.

The Hyaluronic Acid (HA) segment is projected to witness the fastest CAGR during the forecast period. HA is known for its ability to store moisture in the skin, thus making the skin look healthier. It has a moisture-binding characteristic that helps enhance and maintain the vital moisture responsible for the plumpness of the facial skin. The cosmetic-grade HA has a low molecular weight that facilitates deep penetration of the product in the epidermis, which further helps retain water in the cells and releases antioxidants that delay the aging process.

Application Insights

Facial line correction dominated the market and accounted for the largest revenue share of 33.7% in 2023. It is also projected to grow at the fastest CAGR over the forecast period. Facial line correction caters to the preferences of individuals seeking nonsurgical cosmetic enhancements. This growth is attributed to the increasing use of facial injectables for aesthetic procedures such as facial lines, wrinkles on the face, and lip lines.

Factors such as growing awareness about aesthetic procedures and rising disposable income are expected to boost market growth. An increase in the use of facial injectables for parentheses lines, wrinkles on the face, lip lines, lip augmentation, lip border restoration, perioral lines, and crow’s feet lines is expected to assist in market growth.

Country Insights

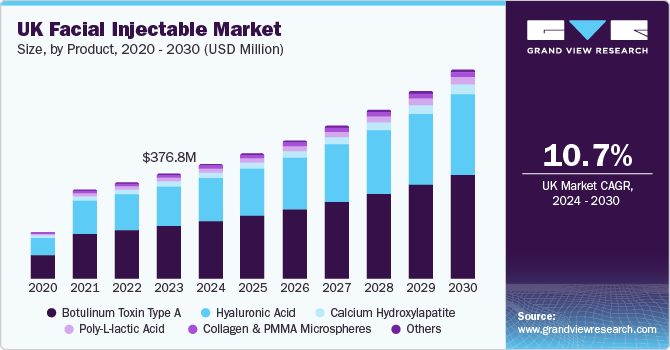

UK Facial Injectable Market Trends

The growing number of nonsurgical procedures is expected to boost the facial injectables market in UK over the forecast period. According to the ISAPS 2022 report, nearly 77,924 nonsurgical procedures were performed in the country, of which nearly 64,000 were injectable procedures. In addition, nearly 35,000 botulinum toxin and 27,000 HA-based procedures were performed in 2022. According to the same report, it was estimated that nearly 600 surgeons were registered in the country.

Germany Facial Injectable Market Trends

Germany is one of the major countries spearheading the market. Various factors, such as an increase in the popularity of cosmetic procedures, technological advancements, and a rise in beauty consciousness, are driving the facial injectables market in Germany. Furthermore, rising urban population, novel product approvals, advancements in noninvasive procedures, and availability of skilled professionals are some of the other factors leading to market growth. According to the ISAPS report, in 2022, over 496,785 injectable filler procedures were performed in Germany, of which 293,736 were botulinum toxin filler procedures, while nearly 7,000 procedures were related to CaHA. This highlights the high demand for filler procedures in the country.

France Facial Injectable Market Trends

Increased awareness among customers about the potential benefits of aesthetic procedures, coupled with the growing adoption of minimally invasive procedures, is boosting the facial injectables market in France. Furthermore, rising purchasing power, growing involvement of international players, increasing spending on cosmetics and personal care, and rising number of beauty clinics are among the factors fueling the market growth in France.

Italy Facial Injectable Market Trends

Increasing aesthetic consciousness is boosting the demand for cosmetic procedures in Italy. According to the International Society of Plastic Surgery (ISAPS) report, in 2022, approximately 386,754 injectable procedures were performed in Italy, of which 212,671 involved HA fillers, 161,254 involved botulinum toxin fillers, and 12,830 involved CaHa fillers. The rising geriatric population, increasing aesthetic consciousness, rising interest of consumers in minimally invasive injectable procedures, and easy availability of certified practitioners have resulted in improved accessibility to aesthetic procedures, thereby fueling the growth of facial injectables market in Italy.

Spain Facial Injectable Market Trends

In Spain, aesthetics is a flourishing industry. The country ranks fifth among European countries in terms of cosmetics and perfume consumption, which can be attributed to increasing aesthetic consciousness. Moreover, the growing urban population, rising number of novel approved products, easy availability of affordable treatments, rapid advancements in noninvasive procedures, and increasing number of cosmetic professionals are among the factors contributing to the facial injectables market in Spain.

Denmark Facial Injectable Market Trends

The Denmark Society of Cosmetic Plastic Surgery regulates the usage of fillers and BOTOX for aesthetic procedures. In addition, semi-permanent fillers such as Radiesse are recommended by the board to smooth out wrinkles and improve facial contours. Moreover, the growing influence of social media in the general population is expected to drive demand of facial injectables market in Denmark.

Sweden Facial Injectable Market Trends

Aesthetic procedures in Sweden have become highly regulated and malpractices are actively reported to healthcare agencies. According to the Swedish Association of Plastic Surgeons article in July 2021, only licensed doctors, nurses, and dentists are able to perform aesthetic injectable solutions, such as dermal fillers and botulinum toxin injections in facial injectables market in Sweden. Before the regulation, facial injectables were administered by individuals without medical training, which significantly impeded market growth by lowering consumer confidence.

Norway Facial Injectable Market Trends

Increasing emphasis on beauty and aesthetics, as well as a growing desire for youthful appearance, drives the demand for facial injectables. Furthermore, Norway's reputation for high-quality healthcare and cosmetic procedures is likely to attract numerous medical tourists seeking facial injectables. This is expected to contribute to facial injectables market in Norway by bringing in international clientele.

Key Europe Facial Injectable Company Insights

The key players are focusing on growth strategies, such as enhancements in existing technologies, geographical expansion, product launches, and product approvals. For instance, in March 2023, Allergan Aesthetics, a subsidiary of AbbVie, partnered with IFundWomen, a funding marketplace for women-owned businesses, to celebrate International Women’s Day. As part of this collaboration, they aimed at launching a grant program to support female entrepreneurs in their business ventures.

Key Europe Facial Injectable Companies:

- Ispen

- Abbvie

- Medytox Inc.

- Merz GmbH and Co. KGaA

- Revance Therapeutics, Inc.

- Galderma

- Sinclair Pharma

Recent Developments

-

In August 2023, LPharm Overseas Ltd., a UK-based distributor, and CGBio, a South Korean bio-regenerative medical company, entered into a collaboration. As per this transaction, CGBio’s HA-based dermal fillers were planned to be launched in the international market. HA dermal filler range was decided to be sold under the brand AiLEENE constituting three products with different viscosity and elasticity.

-

In June 2023, Evolus, Inc. commercialized its product made of botulinum toxin type A, Nuceiva, in Italy. The product is approved by the European Commission to temporarily treat the appearance of vertical lines between the eyebrows. Furthermore, the company entered into a partnership with GP Dermal Solution to market its product in Italy.

-

In June 2023, Bloomage Biotech announced a project to construct an ecosystem focused on HA production. Consequently, Bloomage Biotech and Jinan High-tech Zone aimed at jointly develop the project, and the former firm planned to contribute USD 37 billion to the project.

-

In May 2023, Merz Aesthetics aimed to establish a global agreement prioritizing the safe usage of botulinum toxin. With this initiative, the company planned to take a leadership role in ensuring the safe and responsible use of these products in aesthetics, emphasizing the importance of patient safety & adherence to best practices.

Europe Facial Injectable Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.16 billion

Revenue forecast in 2030

USD 5.83 billion

Growth rate

CAGR of 10.8% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, application, country

Country scope

UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden

Key companies profiled

Ispen; Abbvie; Medytox Inc.; Merz GmbH and Co. KGaA; Revance Therapeutics, Inc.; Galderma; Sinclair Pharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Facial Injectable Market Report Segmentation

This report forecasts revenue growth in the European market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe facial injectable market report based on product, end-use, application, and country:

-

Product (Revenue, USD Million, 2018 - 2030)

-

Collagen & PMMA Microspheres

-

Botulinum Toxin Type A

-

Hyaluronic Acid (HA)

-

Calcium Hydroxylapatite (CaHA)

-

Poly-L-lactic Acid (PLLA)

-

Others

-

-

End-use (Revenue, USD Million, 2018 - 2030)

-

MedSpa

-

Dermatology Clinics

-

Hospitals

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Facial Line Correction

-

Lip Augmentation

-

Face Lift

-

Acne Scar Treatment

-

Lipoatrophy Treatment

-

Others

-

-

Country (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe facial injectable market size was estimated at USD 2.88 billion in 2023 and is expected to reach USD 3.16 million in 2024.

b. The Europe facial injectable market is expected to grow at a compound annual growth rate of 10.8% from 2024 to 2030, reaching USD 5.83 billion by 2030.

b. The botulinum toxin segment dominated the market and accounted for the largest revenue share of 47.2% in 2023.

b. Key players operating in this market are Ispen; Abbvie; Medytox Inc.; Merz GmbH and Co. KGaA; Revance Therapeutics, Inc.; Galderma; Sinclair Pharma

b. A growing focus on physical appearance among consumers has led to a surge in demand for facial injectables in recent years. Signs of aging, including wrinkles and sagging of the skin due to low facial elasticity, dark spots, and others, start appearing between 25 and 30 years of age and become more prominent from 30 to 65 years of age.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."