- Home

- »

- Renewable Chemicals

- »

-

Europe Essential Oils Market Size, Industry Report, 2030GVR Report cover

![Europe Essential Oils Market Size, Share & Trends Report]()

Europe Essential Oils Market Size, Share & Trends Analysis Report By Product (Orange, Eucalyptus), By Application (Medical, Spa & Relaxation), By Sales Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-305-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Europe Essential Oils Market Size & Trends

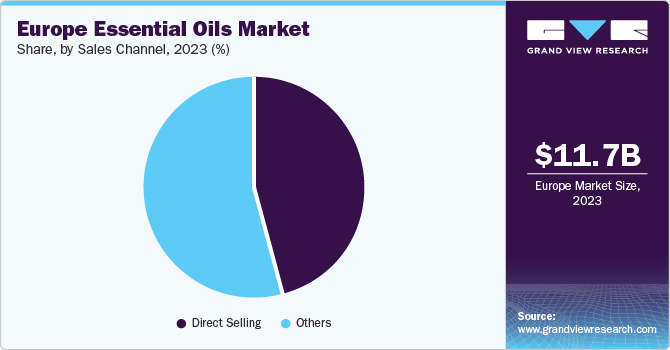

The Europe essential oils market size was estimated at USD 11.72 billion in 2023 and is projected to grow at a CAGR of 8.4% from 2024 to 2030. Increasing consumer awareness concerning natural and organic personal care products has compelled manufacturers to direct their focus to natural ingredients from their synthetic counterparts, which has become a major factor driving the expansion of the essential oils market in the region. In addition, the increasing focus of citizens on wellness activities such as spa & aromatherapy has emerged as a very attractive avenue for essential oil manufacturers to market their offerings. The personal care & cosmetics segment is highly developed in Europe, with countries such as Germany and France being noted for their high-quality production processes and use of premium ingredients.

The European region accounted for a 49.4% revenue share of the global essential oil market in 2023. The well-established pharmaceutical sector in the region holds the key to a strong market expansion in the coming years. Medical and pharmaceutical applications of essential oils are expected to witness substantial growth in terms of penetration. Essential oils are utilized in the pharmaceutical industry as a tablet binder owing to their excellent cohesive property.

The rising application scope of essential oils in tissue engineering and artificial skin production is anticipated to boost market growth. The growing penetration of bio-derived products in other industries, including agrochemicals, pulp and paper, and textiles, is expected to have a positive impact on industry expansion. Moreover, stringent regulations are in place to ensure that the quality and safety of essential oils are maintained across different verticals, leading to increased confidence regarding product usage among regional consumers.

The increasing popularity of chemical-free, sustainable, and premium cleaning products among households is another major avenue for market expansion. Household cleaning agents and disinfectants are increasingly utilizing fragrant oils to create consumer interest and appeal to their olfactory senses. For instance, lemon, clove, peppermint, bergamot, cinnamon, cilantro, orange, lavender, lime, and Melaleuca are some of the most popularly used essential oils in cleaning and home applications. These oils help in breaking down toxins, cleaning and purifying the air, supporting healthy respiratory function, and relieving seasonal discomfort.

Other ingredients such as tea tree and eucalyptus essential oils are widely utilized for bathroom cleaning applications owing to their antifungal and antibacterial properties, which are effective in controlling the spread of staph germs, influenza, and pneumonia. Such wide-ranging use cases of essential oils have driven their popularity among consumers in Europe, driving market growth.

Product Insights

Orange-based essential oils emerged with the largest revenue share in 2023. Rising awareness regarding the health benefits of this product has led to increasing demand for such essential oils. The fast pace of development of notable end-use segments such as medical and spa & relaxation in Europe is anticipated to significantly boost segment expansion in the coming years. Orange essential oil is extensively utilized in the medical field due to its perceived antioxidant and anticancer properties. The Mediterranean Basin region, which includes the economies of Spain, France, Italy, Portugal, and Greece, among others, is a leading producer of orange oil. For instance, in Italy, Moro, Tarocco, Naveline, Sanguinello, and Valencia are the most widely cultivated varieties of orange. Thus, a positive production outlook, along with its advantages for health, has made this segment a major revenue generator in the region.

On the other hand, cornmint essential oil is expected to contribute significantly to the regional market with the second-largest revenue share. Cornmint oil has been perceived to provide several health benefits to users, such as curing insomnia, treating headaches, improving circulation, and alleviating digestive issues. Furthermore, it has also been shown to reduce toxicity and perform body cleansing through enhanced sweating. It has moreover been used to treat sore throats, common cold, nausea, muscle aches, and constipation. In the personal care space, cornmint essential oil, when used as a facial scrub, has been claimed to effectively address acne in individuals. The increasing number of end-users for this product is expected to result in substantial market growth in Europe.

Application Insights

The spa & relaxation segment held the largest revenue share of 45.5% in 2023. The personal care sub-segment within the spa & relaxation segment is projected to witness noticeable growth over the forecast period. Key companies involved in the personal care industry are incorporating essential oils in their offerings to address the health and wellness demands of consumers. Tooth oils made with spearmint and peppermint, Eucalyptus shaving foam, and Patchouli hair powders are some of the major examples of essential oil-based cosmetic products. New product development and increasing applications of natural ingredients in personal care products are likely to bolster the demand for essential oils & floral extracts in personal care products.

The food & beverage segment is projected to advance at the fastest CAGR of 8.7% during the forecast period. There has been an increasing awareness among consumers in Europe regarding the importance of purchasing natural and minimally processed food items, which has widened the scope of the application of essential oils in this sector. Moreover, rising consumer preference for natural products over their synthetic counterparts and extensive demand for superior quality food products in European economies are factors prompting manufacturers to include healthy essential oils in their offerings. Basil, fennel, lemon, cassia, and peppermint emerged as the most popular essential oils for food & beverage applications owing to their suitability for internal use. For instance, lemon and orange can be used to add citrusy notes, while peppermint can offer a refreshing and cool flavor.

Sales Channel Insights

The direct selling channel emerged with a significant revenue contribution to the European market for essential oils in 2023. Direct selling has proven to be a very effective business model for companies looking to promote their essential oils. There is a significant consumer base in the region that demands to feel and smell essential oil products so that they can make the best purchase decision. Moreover, it gives companies a chance to educate consumers about the benefits of their product, how to use it, and understand its benefits over products from competitive brands. This helps in establishing customer loyalty and generating sales in the long run, driving segment growth.

Other sales channels, such as convenience stores and online platforms, have emerged as viable options for essential oil manufacturers to sell their products. As essential oil ingredients from Europe are well-known globally for their premium quality, companies have launched their websites along with effective marketing strategies to drive their geographical presence. As a result, the online segment is anticipated to have a substantial impact on the market expansion in the coming years.

Country Insights

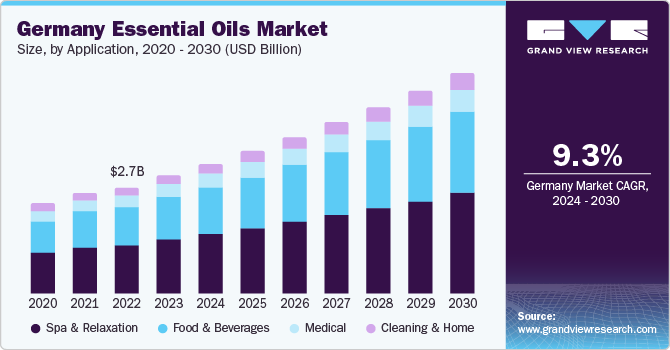

Germany Essential Oils Market Trends

Germany essential oils market held the largest revenue share of 25.7% in the European market in 2023. Growth in the GDP and expanding population are projected to boost the advancement of various sectors, including food & beverage, medical services, and spas, which are the key end-users of essential oils. Germany plays a significant role in the production of essential oils across Europe. The country has a well-established extraction sector, which leverages cutting-edge extraction processes (supercritical extraction) to produce superior-quality essential oils. Increasing revenue is attracting the attention of various global players to establish and expand their operations and distribution facilities in Germany. Growing competitiveness in the country owing to the rising number of market players is poised to drive the essential oil & floral extract market during the projection period.

France Essential Oils Market Trends

The France essential oils market is expected to witness significant growth in product demand in the coming years. Rising consumer awareness regarding the various benefits of essential oils is propelling product demand in the country. Moreover, citizens in the country are tackling an increasing number of health issues; this, along with rising consumer awareness regarding the benefits of essential oils, are factors influencing food & beverage manufacturers to incorporate essential oils in safe proportions in their products. Thus, essential oils are expected to find increased applications in this industry along with other major applications, such as spa & relaxation, thereby driving market growth during the forecast period.

Key Europe Essential Oils Company Insights

Some of the notable companies developing innovative essential oils for the European market include Biolandes SAS, Givaudan International SA, H. Reynaud & Fils (HRF), and FLAVEX Naturextrakte GmbH.

-

Symrise offers flavorings, fragrances, cosmetic ingredients, raw materials, functional ingredients, and nutritional & sensorial solutions. The essential oils developed by the company are utilized across all the business segments to formulate products. The company develops essential oils from sources such as patchouli, clove, citrus, and vanilla, which are then utilized in the food, beverage, perfume, and pharmaceutical sectors.

-

Flavex Naturextrakte GmbH manufactures and distributes flavors, fragrances, and essential oils. The company caters to the food, nutraceutical, skincare, and perfumery industries. The company offers an extensive range of botanical extracts and CO2-based extracts, such as Black Cumin CO2-to Extract, Clove Bud CO2-se Extract, and Peppermint Leaf CO2-se Extract, to be used in the production of food flavors and natural remedies.

Key Europe Essential Oils Companies:

- Biolandes SAS

- H. Reynaud & Fils

- Farotti S.r.l. Società Benefit

- dōTERRA

- FLAVEX Naturextrakte GmbH

- Young Living Essential Oils

- Givaudan

- Enio Bonchev

- Symrise

- KMI Brands Limited

Recent Developments

-

In October 2023, Azelis, a Belgium-based service provider catering to the food ingredients and specialty chemicals industry, announced the acquisition of BLH SAS, a flavor & fragrance solution distributor based in France. The development is anticipated to strengthen the former’s foothold in the flavors & fragrances space globally, following the acquisition of other companies in the U.S., France, and India.

-

In September 2023, dōTERRA announced the launch of several essential oils and essential oil blends, along with the expansion of their sleep and gut health systems. One of the newly introduced products was birch oil, which the company claims to be completely unadulterated and pure. Other essential oils that were introduced include Blue Lotus Touch and the Shinrin-Yoku, which combines essential oils such as patchouli, magnolia, cypress, lemon, and Siberian fir.

Europe Essential Oils Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 20.6 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, sales channel, country

Country scope

Germany; UK; France; Italy; Spain

Key companies profiled

Biolandes SAS; H. Reynaud & Fils; Farotti S.r.l. Società Benefit; FLAVEX Naturextrakte GmbH; dōTERRA; Young Living Essential Oils; Givaudan; Enio Bonchev; Symrise; KMI Brands Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Essential Oils Market Report Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe essential oils market report based on product, application, sales channel, and country:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Acorus Calamus

-

Ajowan

-

Basil

-

Black Pepper

-

Cardamom

-

Carrot Seed

-

Cassia

-

Cedarwood

-

Celery

-

Cinnamon

-

Citronella

-

Ciz-3 Hexanol

-

Clove

-

Cornmint

-

Cumin Seed

-

Curry Leaf

-

Cypress

-

Cypriol

-

Davana

-

Dill Seed

-

De-Mentholised Peppermint

-

Eucalyptus

-

Fennel

-

Frankincense

-

Garlic

-

Ginger

-

Holy Basil

-

Juniper Berry

-

Lavender

-

Lemon

-

Lemongrass

-

Lime

-

Mace

-

Mustard

-

Neem

-

Nutmeg

-

Orange

-

Palmarosa

-

Patchouli

-

Pepper Mint

-

Rosemary

-

Spearmint

-

Tangerine

-

Tea Tree

-

Turmeric

-

Vetiver

-

Ylang Ylang

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Medical

-

Pharmaceutical

-

Nutraceuticals

-

-

Food & Beverages

-

Bakery

-

Confectionery

-

Dairy

-

RTE Meals

-

Beverages

-

Meat, Poultry & Seafood

-

Snacks & Nutritional Bars

-

-

Spa & Relaxation

-

Aromatherapy

-

Massage Oil

-

Personal Care

-

Cosmetics

-

Hair Care

-

Skin Care

-

Sun Care

-

Makeup And Color Cosmetics

-

-

Toiletries

-

Soaps

-

Shampoos

-

Men's Grooming

-

Oral Care

-

Baby Care

-

-

Fragrances

-

Perfumes

-

Body Sprays

-

Air Fresheners

-

-

-

-

Cleaning & Home

-

Kitchen Cleaners

-

Floor Cleaners

-

Bathroom Cleaners

-

Fabric Care

-

-

-

Sales Channel Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Direct Selling

-

Others

-

-

Country Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."