Europe Equine Healthcare Market Size, Share & Trends Analysis Report By Product Type, By Indication (Musculoskeletal Disorders, Parasitic Infections, Equine Influenza), By Activity Type, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-262-0

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Equine Healthcare Market Trends

The Europe equine healthcare market size was estimated at USD 1.13 billion in 2023 and is projected to grow at a CAGR of 6.87% from 2024 to 2030. The market is primarily driven by factors such as high prevalence of equine diseases in Europe, growth of equestrian activities, use of advanced technologies in equine healthcare management, and increasing horse population across Europe. The European region is seeing a rise in the population of horses and a consequent increase in spending on horse-related activities.

As per January 2024 statistics presented by PetKeen, horse population in the UK is estimated to be around 1 million, and around GBP 4 billion (USD 5.1 billion) is spent annually in the country on horse-related activities. With the growing horse population, the incidence of various diseases, such as equine influenza & herpes, is also increasing. This drives the need for presence of proper healthcare infrastructure for treatment of equine population. Horses are most used for sports, followed by labor, food, as well as recreational activities. Therefore, it is crucial to ensure the good health of these horses.

Horses in the region are largely prone to some conditions like parasitic infections, musculoskeletal disorders, equine influenza, etc. These infections can have a detrimental impact on a horse's health and performance. Regular health monitoring is crucial to keep these infections under control. These disorders can cause lameness, pain, and decreased performance. Some very common musculoskeletal disorders in horses include osteoarthritis, tendonitis, and navicular disease. Proper management, exercise, and veterinary care can help prevent and manage these conditions. Diseases like equine influenza cause fever, nasal discharge, cough, depression, loss of appetite, and weakness.

The growing prevalence of such diseases leads to a rise in the adoption of various products like pharmaceuticals, vaccines, medicinal feed additives, orthobiologics, etc. These products are used to manage these conditions and maintain good health in horses. An increase in the consumption of diagnostic products like test kits and instruments also happens owing to their use in determining the type of disease present in the equine population.

As per a 2023 publication from MDPI, prevalence of Leishmania infantum infection was present in 27.5% horses from Spain. Furthermore, as per a 2021 study from PubMed, seroprevalence of different parasitic infections was as follows: T. equi - 30% and B. caballi - 8%. This highlights the need for a structured treatment regime for equine population, which will increase the overall consumption of equine healthcare products.

In addition, a December 2023 research study from Equine Veterinary Journal reported prevalence of osteoarthritis of articular processes (APJs) was 90% in warmblood horses. The rising prevalence of these conditions will impact the equine healthcare market in the region by driving demand for pharmaceuticals, vaccines, medicinal feed additives, orthobiologics, diagnostic products, and other products to increase their detection & treatment. This ultimately may drive the need for prevention, management, and monitoring of these conditions.

Europe has been witnessing significant growth in start-ups in the field of equine healthcare. For example, Coho, a France-based company, has developed a unique application that tracks and monitors horses when in stables. A physical camera records their gestures, movements, etc., and uses Artificial Intelligence (AI) systems to analyze any abnormalities in the same. This allows owners to provide timely intervention for their horses' health conditions.

Furthermore, Equilab from Sweden has developed an application that monitors horse activities during training, analyzes it using AI, and then sends the data back to the rider/owner. Advancements like these help in promoting accurate and timely detection & intervention of equine healthcare ailments and contribute to market growth.

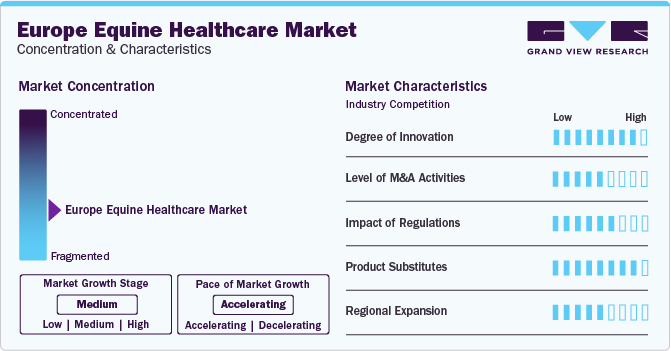

Market Concentration & Characteristics

Equine health product companies are expanding into additional regions to capitalize on emerging markets and broaden their customer base. By establishing partnerships and distribution networks in regions that have high equestrian activities, distributors can enhance product availability and industry penetration, thereby driving overall market expansion.

In this industry, buyers have multiple options to choose any type of product they want based on factors like features, cost-effectiveness, availability, etc. Products like parasiticides, anti-infectives, anti-inflammatory and analgesics, and feed additives have multiple substitute products. In addition, when it comes to diagnostic kits, veterinary software, etc., buyers can conveniently opt for a product that better suits their needs. This drives the competition between different companies in the industry.

The equine healthcare industry in Europe is experiencing heightened competition due to companies engaging in mergers and acquisitions. Companies are strategically broadening their product offerings, enhancing their research and development capabilities, and leveraging synergies to attain economies of scale by acquiring other businesses. Such actions enhance competitiveness among leading players, stimulate innovation, and expedite industry consolidation.

In September 2022, Zoetis acquired a Scottish company known as NewMetrica, which develops instruments meant to capture health-related quality-of-life metrics in non-verbal species like horses, cats, and dogs.

To introduce innovative, technologically advanced products that address the needs in Europe's equine healthcare industry uniquely, businesses are making significant investments in research and development. Many players are starting to explore & implement the use of AI for diagnosis & treatment of equine healthcare conditions.

Compliance with regulatory frameworks ensures the safety, efficacy, and quality of treatment for animal conditions, which significantly impacts the European equine healthcare industry. Industry access and product approval hinge on observance of laws governing equine pharmaceuticals, diagnostic products, and biologics. Stricter regulatory requirements may necessitate additional preclinical and clinical testing, thereby prolonging development time and increasing costs for manufacturers.

Product Type Insights

The pharmaceuticals segment held the largest market share of over 25.61% in 2023. The wide range of health issues in horses, such as pain management, respiratory problems, and musculoskeletal disorders, necessitate various medications. Veterinarians primarily prescribe pharmaceuticals, including anti-infectives and anti-inflammatories, to address these conditions. If the disease progresses, advanced interventions may be required. In addition, a rise in equestrian as well as other horse-related activities has been seen in recent years, which is also boosting the market share.

The software segment is expected to grow at the fastest CAGR over the forecast period. This is primarily attributed to high adoption of telehealth software by the veterinarians. This allows effective communication between the horse owners and, for example, a specialist veterinarian consulting remotely through the means of teleconsultations.

Distribution Channel Insights

By distribution channel, the veterinary hospitals & clinics segment held the largest share in 2023. With the growing popularity of horse riding and equine sports, there is a rising demand for specialized healthcare services for horses. Veterinary hospitals and clinics are well-equipped to provide these services, leading to a larger market share. These institutions offer a high level of expertise and quality of care, making them a preferred choice for horse owners seeking healthcare services for their animals.

The E-commerce segment is anticipated to witness the fastest CAGR over the forecast period due to the increasing popularity of online sales platforms, which offer convenience and accessibility for horse owners. The COVID-19 pandemic further accelerated the growth of e-commerce, as social distancing measures and lockdowns led to a surge in online shopping. In addition, the e-commerce segment benefits from a wider range of products and competitive pricing, making it an attractive option for individuals seeking equine healthcare products.

Indication Insights

By indication, parasitic infections held the largest market share of over 26.69% in 2023. Parasitic infections are the most common indications for treatment in Europe. Some of the frequently prevalent parasitic infections among horses in Europe are stomach worms, Horse ascardis, horse bots, blood worms, etc. Growing prevalence of these infections will result in more effective diagnostic tools, treatments, and preventive measures and further increase competitiveness among manufacturers, to develop appropriate products for the equine population.

The equine influenza segment is estimated to grow at the fastest CAGR over the forecast period. This is a highly contagious type of disease that affects the respiratory system of the horse. This is supported by the growing need for equids to maintain optimal performance levels in races and sports horses, as well as rising awareness of prophylactic measures against equine diseases is driving the demand for equine healthcare solutions, including those for equine influenza.

Activity Type Insights

By activity type, the sports/racing segment held the largest market share in 2023 and is anticipated to register the fastest CAGR over the forecast period. Equestrian activities like racing and sports are among the most popular types of sports across various countries in Europe. The region is home to one of the leading Equestrian bodies, the European Equestrian Federation (EEF), which promotes and manages equestrian sports activities. Furthermore, another driving factor is that equestrian activities contribute around GBP 4.1 billion (USD 5.2 billion) to the economy of countries like the UK, according to the October 2023 data from the House of Commons Library. Furthermore, the same source states that, in 2022, these sports/racing events registered a higher attendance of 4.8 million people. Such activities act as boosting factors for the growth of this segment.

Country Insights

UK Equine Healthcare Market Trends

The UK Equine Healthcare market held the largest share, 23.94%, in the Europe region in 2023. This is primarily due to the country's high adoption of horses as pets. As per PetKeen statistics from 2024, around 374,000 households in the UK own a horse as a pet. Furthermore, around 8,000 - 10,000 horse races are conducted in the country every year.

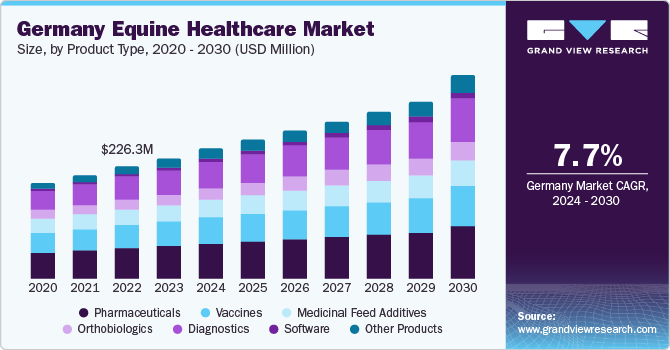

Germany Equine Healthcare Market Trends

The equine healthcare market in Germany held the second-largest share in 2023. The primary drivers of this market are the increasing popularity of horse racing and equestrian sports. This has led to a rise in the demand for veterinary services and healthcare products for horses. In addition, the focus of the government on animal welfare and stringent regulations regarding horse health and safety also contribute to market growth.

Sweden Equine Healthcare Market Trends

The Sweden equine healthcare market is home to many leading startups in the field of equine health, which is leading it to lucrative market growth. For example, a company called Sleip AI AB has developed a tool that detects lameness in horses using AI motion analysis.

Switzerland Equine Healthcare Market Trends

The equine healthcare market in Switzerland is primarily driven by the high awareness of horse health and welfare among horse owners. The country has a significant number of horse owners who are willing to spend on high-quality healthcare products and services for their horses. Moreover, the growing trend of horse riding and equestrian sports, coupled with the government's support for animal welfare, contributes to the market's growth.

Key Europe Equine Healthcare Company Insights

Some of the key players operating in the market include Reichert, Inc., Boehringer Ingelheim, Merck & Co., Inc., Zoetis, Dechra Pharmaceuticals, and Ceva Sante Animale.

In the Europe equine healthcare industry, businesses are actively participating in various initiatives to enhance their product offerings and market share. These efforts involve strategic partnerships to increase market penetration, product portfolio diversification through acquisitions, and launching innovative products utilizing advanced technologies. In addition, businesses are focusing on creating products that address specific needs within the European equine healthcare industry. By combining these initiatives, businesses are contributing to the growth and development of the European equine healthcare industry and meeting the evolving demands of both veterinarians and horse owners.

Key Europe Equine Healthcare Companies:

- Zoetis

- Arthrex Inc.

- Dechra Pharmaceuticals

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- Heska Corporation

- Merck & Co. Inc

- Esaote SPA

- IDEXX Laboratories, Inc.

- Covetrus Inc.

- Elanco

- Cargill

Recent Developments

-

In January 2024, Boehringer Ingelheim and Sleip AI AB partnered to enhance use of AI in detection, diagnosis as well as treatment of disorders like lameness in equine population

-

In July 2022, Dechra Pharmaceuticals acquired Zimeta brand from Elanco Animal Health. This drug is used for limiting pyrexia in horses

-

In April 2022, Boehringer Ingelheim launched a new stem cell therapy product for use in horses known as RenuTend to improve tendons & ligaments

-

In March 2023, Zoetis expanded its VetScan Imagyst Platform by adding new portfolios, AI Dermatology and AI Equine Fecal Egg Count Analysis.

Europe Equine Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.26 billion |

|

Revenue forecast in 2030 |

USD 1.88 billion |

|

Growth rate |

CAGR of 6.87% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, indication, activity type, distribution channel, region |

|

Regional scope |

Europe |

|

Country scope |

Germany; UK; France; Italy; Spain; Sweden; Norway; Denmark; Netherlands; Russia; Switzerland |

|

Key companies profiled |

Zoetis; Arthrex Inc.; Dechra Pharmaceuticals; Boehringer Ingelheim International GmbH; Ceva Sante Animale; Heska Corporation; Merck & Co. Inc; Esaote SPA; IDEXX Laboratories, Inc.; Covetrus Inc.; Elanco; Cargill |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Equine Healthcare Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe equine healthcare market report based on product type, indication, activity type, distribution channel, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Vaccines

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory & Analgesics

-

Other Pharmaceuticals

-

-

Medicinal Feed Additives

-

Orthobiologics

-

Diagnostics

-

Diagnostic Test Kits

-

Diagnostic Equipment

-

-

Software

-

Practice Management Software

-

Imaging Software

-

Telehealth Software

-

Other Software

-

-

Other Products

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Musculoskeletal Disorders

-

Parasitic Infections

-

Equine Herpes Virus

-

Equine Viral Arteritis (EVA)

-

Equine Influenza

-

West Nile Virus

-

Tetanus

-

Other Indications

-

-

Activity Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports/Racing

-

Recreation

-

Other Activities

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Equestrian Facilities

-

Other Channels

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Netherlands

-

Russia

-

Switzerland

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe equine healthcare market size was estimated at USD 1.13 billion in 2023 and is expected to reach USD 1.26 billion in 2024

b. The Europe equine healthcare market is expected to grow at a compound annual growth rate of 6.87% from 2024 to 2030 to reach USD 1.88 billion by 2030.

b. By product type, pharmaceuticals segment dominated market with a share of over 25.61% in 2023 and is expected to grow at CAGR of 6.34% during forecast period due to rising prevalence of equine health conditions and different types of pharmaceuticals being the primary form of treatment prescribed by veterinarians to treat these conditions.

b. Some key players operating in the Europe equine healthcare market include Zoetis, Arthrex Inc., Dechra Pharmaceuticals, Boehringer Ingelheim International GmbH, Ceva Sante Animale, Heska Corporation, Merck & Co. Inc, Esaote SPA, IDEXX Laboratories, Inc., Covetrus Inc., Elanco, Cargill

b. High prevalence of equine diseases in Europe, growth of equestrian activities, use of advance technologies in equine health management and increasing horse population across Europe are expected to drive market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."