Market Size & Trends

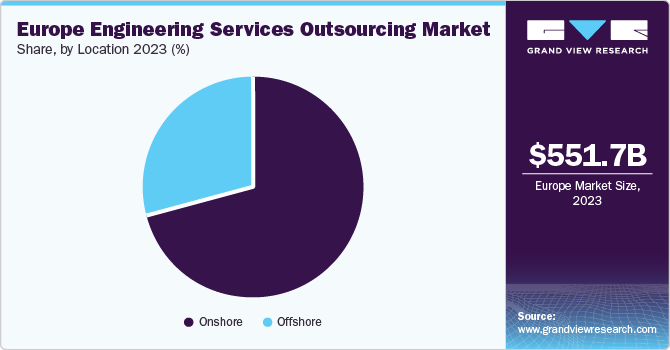

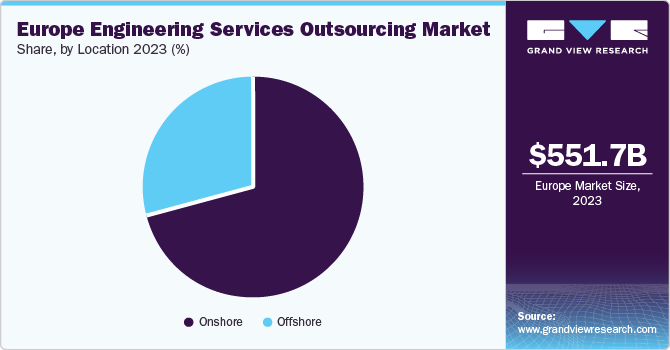

The Europe engineering services outsourcing market reached a valuation of USD 551.7 billion in 2023 and is anticipated to expand at a CAGR of 27.0% from 2023 to 2030. This expansion is propelled by the increasing demand for cost-efficient and high-quality engineering solutions. The trend of digital transformation across industries, coupled with the need for businesses to stay competitive in the global market, has led to a surge in outsourcing engineering services. In addition, the growing emphasis on innovation and the rapid pace of technological advancements in Europe have further fueled this market expansion.

The Europe region accounted for approximately 27.1% revenue share of the global engineering services outsourcing market in 2023.Regulatory frameworks significantly impact the European engineering services outsourcing industry. For instance, the European Securities and Markets Authority (ESMA) published guidelines on outsourcing to cloud service providers in 2021.

Application Insights

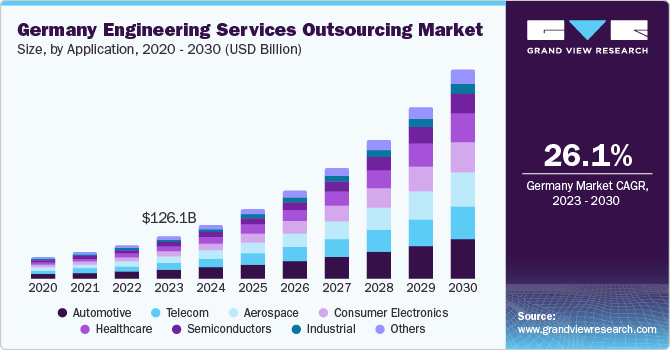

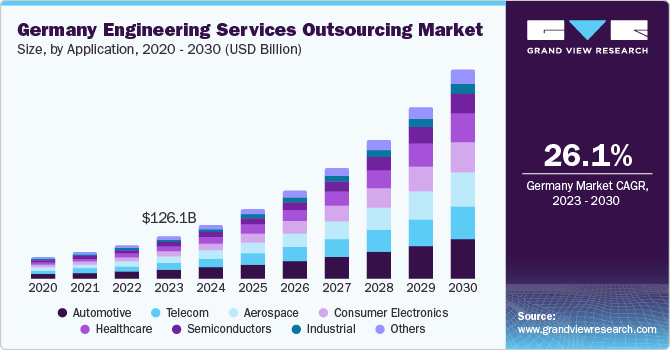

The automotive sector held the largest market share, accounting for 19.3% in 2023. This dominance is primarily driven by the rising demand for advanced and improved connectivity solutions among automotive manufacturers. The integration of advanced technology solutions such as Artificial Intelligence (AI), Internet of Things (IoT), and others has evolved the automotive ESO industry from delivering mechanical services to offering research and development (R&D) and product innovation. In addition, government initiatives to promote green vehicles aimed at reducing harmful emissions are driving the growth of the market. The increasing preference of Original Equipment Manufacturers (OEMs) for digital solutions is expected to further fuel market expansion.

On the other hand, the healthcare sector is predicted to grow at the fastest CAGR from 2023 to 2030. The growth of the European healthcare market and the growing acceptance of tech solutions in healthcare fuel the demand for healthtech solutions. Healthcare companies are increasingly collaborating to improve clinical ability and cut operating costs. The healthcare industry is witnessing a significant shift in outsourcing practices, as numerous medical device companies are revamping their insourced operating models to enhance efficiency throughout the entire product lifecycle. This transformation spans from design and advanced manufacturing to supply chain management and post-production services.

Service Insights

The testing service segment held the largest revenue share of 31.7% in 2023. This can be attributed to the growing emphasis on creating and refining product prototypes with enhanced optimization and zero-defect processes. Furthermore, the rising demand for outsourced testing services to leverage manual expertise and expedite turnaround times is fueling continued growth within the testing services market. Testing services include various procedures such as creating drawings, designing components and modules, calculating specifics, and conducting testing procedures. These services are essential in verifying and validating the performance, reliability, and durability of products, thereby ensuring their compliance with industry standards.

The designing services are predicted to witness the fastest CAGR of 29.2% from 2023 to 2030. The growth of the designing services can be attributed to the increasing adoption of automation and integrated solutions for designing and analyzing engineering systems. The surge in popularity of computer-aided designing software (CAD) and computer-aided engineering software (CAE) across diverse industries is also a significant factor contributing to this growth. Designing services are crucial in the initial stages of product development, including project management, concept development, and design and series engineering. These services play a vital role in transforming an idea into a tangible product, thereby driving innovation and competitiveness among businesses.

Location Insights

The onshore segment held the largest revenue share of 70.9% in 2023. This dominance can be attributed to the convenience and efficiency of onshore services, which refer to the provision of services to an Original Equipment Manufacturer (OEM) located in the same country as the Engineering Service Providers (ESP). The onshore model offers several advantages, such as ease of communication, cultural compatibility, similar time zones, and a better understanding of the local market, which contribute to its large market share.

On the other hand, the offshore service segment is predicted to grow at the fastest CAGR of 29.8% from 2023 to 2030. The growth of offshore services can be attributed to the cost-effectiveness of offshore outsourcing, which allows companies to access skilled expertise at a lower cost. Offshore ESPs often have a large talent pool and can offer round-the-clock services, thereby reducing the time-to-market. Furthermore, the increasing digitalization of various industries and the execution of Industry 4.0 are extending possibilities for IT integration with the service offerings of ESPs, thereby propelling the demand for offshore engineering services.

Country Insights

Germany Engineering Services Outsourcing Market Trends

The German engineering services outsourcing market held the largest revenue share, 22.9%, in 2023. The country's strong manufacturing sector, particularly in automotive and industrial equipment, has been a key driver for this growth. Furthermore, Germany's robust infrastructure, high level of technological advancement, and stringent quality standards have also contributed to its leading position in the market.

UK Engineering Services Outsourcing Market Trends

The engineering services outsourcing marketin the UK is predicted to witness the fastest CAGR of 29.6% from 2023 to 2030. This can be attributed to the country's strong focus on innovation and technology. The UK has a vibrant tech sector and is home to many tech startups and established companies, which are increasingly relying on outsourced engineering services to accelerate their product development cycles and reduce costs.

Key Europe Engineering Services Outsourcing Company Insights

Some of the key players operating in the market include Wipro, HCL, and Capgemini:

- Wipro Limited, a global provider of information technology, consulting, and business process services, has facilitated the digital transformation of major brands across Europe's key industries. These sectors include retail, utilities, finance, telecommunications, manufacturing, and engineering.

Key Europe Engineering Services Outsourcing Companies:

- Wipro Limited

- HCL Technologies Ltd.

- Capgemini SE

- Infosys Limited

- AKKA Technologies SE

- Tata Consultancy Services Ltd.

- Tech Mahindra Limited

- Entelect Software (Pty) Ltd.

- Tata Elxsi Limited

- ALTEN

Recent Developments

-

In May 2024, Accenture acquired Objectivity, enhancing its operations across the UK, Poland, Germany, and Mauritius. With expertise in platform engineering, cloud-native computing, and application modernization, Objectivity is expected to strengthen Accenture’s Cloud First capabilities, enabling clients to leverage more open and adaptable platform models and services to accelerate digital transformation.

-

In July 2023, HCL Technologies completed the strategic acquisition of ASAP Group. This move strengthens HCL's presence in the European and global automotive engineering landscape, particularly in high-growth areas like e-mobility, autonomous driving, and connectivity.

Europe Engineering Services Outsourcing Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 2,910.9 billion

|

|

Growth rate

|

CAGR of 27.0% from 2023 to 2030

|

|

Base year for estimation

|

2022

|

|

Forecast period

|

2023 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2023 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Application, services, location, country

|

|

Key companies profiled

|

Wipro Limited; HCL Technologies Ltd.; Capgemini SE; Infosys Limited; AKKA Technologies SE; Tata Consultancy Services Ltd.; Tech Mahindra Limited; Tata Elxsi Limited; Entelect Software (Pty) Ltd.; ALTEN,

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Europe Engineering Services Outsourcing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe engineering services outsourcing market report based on application, services, location, and country:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace

-

Automotive

-

Industrial

-

Consumer Electronics

-

Semiconductors

-

Healthcare

-

Telecom

-

Others

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Designing

-

Prototyping

-

System Integration

-

Testing

-

Others

-

Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)