- Home

- »

- Medical Devices

- »

-

Europe Electroencephalography Devices Market, Report, 2030GVR Report cover

![Europe Electroencephalography Devices Market Size, Share & Trends Report]()

Europe Electroencephalography Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (32-Channel, Multichannel), By Type, By Application (Trauma & Surgery, Disease Diagnosis), By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-304-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

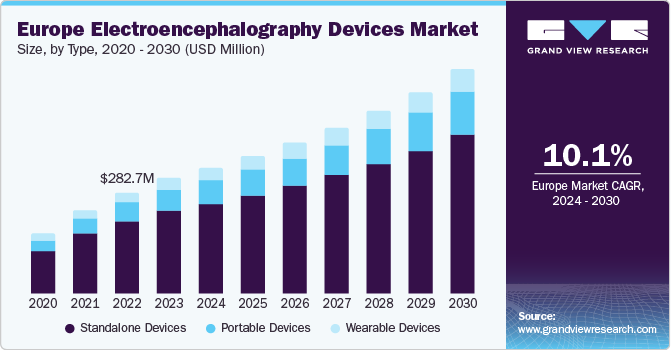

The Europe electroencephalography devices market size was estimated at USD 322.7 million in 2023 and is expected to grow at a CAGR of 10.11% from 2024 to 2030. Major factors contributing to the market growth include the increasing prevalence of neurological disorders, growing R&D activities, technological advancements, and growing awareness. For instance, according to EBRAINS, the incidence of neurological conditions is steadily increasing and is expected to place a growing strain on healthcare systems as population’s age.

Collaborative research projects and partnerships among European universities, research institutes, and medical device companies are expected to lead to technological advancements and introduction of new applications for EEG in both clinical and non-clinical settings. These developments are expected to improve patient outcomes and expand the market by increasing the use of EEG in areas such as mental health, sleep research, and cognitive studies, thus driving growth in the European electroencephalography market.

In April 2024, researchers from Drexel University’s Creativity Research Lab developed an artificial intelligence (AI) technique that can effectively estimate an individual’s brain age using EEG brain scans. This technology could make early and regular screening for degenerative brain diseases more accessible. Drexel University has licensed this brain-age estimation technology to DiagnaMed Holdings, a Canadian healthcare company, for integration into a new digital health platform.

Market players focusing on the development of cost-effective Electroencephalography (EEG) devices and accessories are also expected to drive market growth. For instance, in May 2024, Viamed, a manufacturer and distributor of medical devices to the NHS, announced a new range of disposable, single-use EEG sensors. These sensors, compatible with existing Bispectral Index (BIS) monitors, offer a cost-effective alternative while also maintaining standards of care. Designed to monitor anesthesia depth using BIS derived from EEG signals, these sensors provide real-time insights into patients' consciousness and brain activity during surgeries. This is expected to reduce healthcare costs while ensuring quality care.

Neurological conditions such as epilepsy, Alzheimer's disease, Parkinson's disease, and many others are becoming increasingly common due to factors such as aging population, lifestyle changes, and improved diagnostic capabilities. For instance, the European Brain Council reports that about 7 million people in Europe currently live with Alzheimer’s disease. With the population aging rapidly, this number is expected to double to 14 million by 2030, presenting a significant public health concern.

This rise in neurological disorders necessitates advanced diagnostic tools like EEG, which are crucial for accurate diagnosis, monitoring, and treatment planning. Electroencephalography devices offer details of brain's electrical activity, helping healthcare professionals detect abnormalities, assess the severity of conditions, and monitor treatment effectiveness. As awareness of these disorders increases and healthcare systems focus on early detection and intervention, the demand for EEG devices is expected to rise.

Prevalence of dementia in Europe, by country

Country

Men

Women

Total

% of population in 2018

% of population in 2050

UK

356,741

674,656

1,031,396

1.56

2.67

Germany

511,050

1,074,115

1,585,166

1.91

3.43

France

374,260

853,298

1,227,558

1.83

3.31

Italy

402,965

876,402

1,279,366

2.12

4.13

Spain

271,984

580,758

852,741

1.83

3.99

Denmark

30,228

57,148

87,377

1.51

2.65

Sweden

58,222

110,021

168,243

1.66

2.63

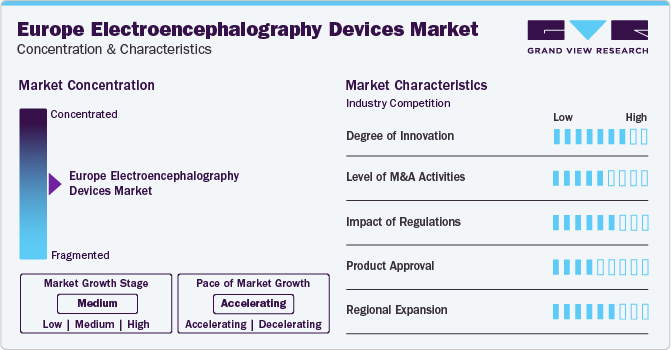

Market Concentration & Characteristics

The industry growth stage is high. This is primarily owing to the increasing cases of neurological disorders and the increasing number of healthcare providers adopting EEG devices. Advancements in EEG technology have made these devices more accessible and user-friendly. Advanced EEG systems are available in portable and wireless formats, making them easier to use in various clinical settings, including outpatient and remote environments.

Enhanced software for data analysis and interpretation simplifies the process for healthcare professionals, allowing for quicker and more accurate diagnoses. These technological improvements make it easier for healthcare providers to start using EEG devices, encouraging more of them to include EEG in their practices.

The growing number of partnerships and collaborative efforts among companies is expected to significantly boost industry growth. This trend can be seen in various industries, where players are realizing the benefits of working together to improve their competitiveness. By partnering, companies can combine resources, share knowledge, and utilize each other's strengths, which helps in innovation and the creation of new products or services. For instance, in August 2022, Zeto announced a partnership with Next Gen Neuro, a company specializing in continuous and routine EEG monitoring, to offer remote EEG monitoring services.

The industry is experiencing a high degree of innovation, driven by advancements in technology, integration of AI, and improvements in device design and functionality. For instance, in April 2024, Soterix Medical Inc. announced the launch of the MxN-GO EEG, a combined High-Definition transcranial Electrical Stimulation (HD-tES) and EEG system featuring a unique untethered design. This system is intended for research applications that require electrical stimulation and brain activity recording in mobile and natural environments. The MxN-GO EEG offers a lightweight, wire-free design, enabling rapid setup and ease of use.

EEG manufacturing companies are engaging in mergers and acquisitions as a strategic move to enhance their technological capabilities, broaden their industry presence, and stay competitive. For instance, in January 2024, Aditxt, Inc. announced the acquisition of a portfolio of EEG brain monitoring technologies and devices previously owned by Brain Scientific, Inc.

Regulations in Europe ensure the safety, efficacy, and quality of EEG devices, impacting their development, manufacturing, and commercialization. Compliance with regulatory requirements, such as CE marking under the Medical Device Regulation (MDR), is essential for market access and gain trust among healthcare providers and patients.

Manufacturers are pursuing government approvals for their products to maintain competitiveness in the industry owing to the increasing demand and adoption of EEG devices. For instance, in May 2023, Cumulus Neuroscience received FDA 510(k) clearance, for its dry-sensor electroencephalograph (EEG) headset for use in adults and adolescents for the storage of EEG data, remote acquisition, and display.

The geographical reach of EEG in Europe has been expanding at a moderate to high level.

Product Insights

The 32-channel EEG segment dominated the market in 2023 by capturing a share of around 27.7% and is further expected to continue its dominance over the forecast period. 32-channel EEG systems provide superior spatial resolution compared to lower-channel systems, enabling more precise monitoring of brain activity, which is essential for accurate diagnosis and treatment planning in clinical applications. Moreover, their versatility allows for use across various settings, including hospitals, clinics, and research laboratories, making them highly desirable among healthcare providers and researchers.

The multichannel EEG segment is expected to witness the fastest growth over the forecast period.Advancements in technology have made multichannel EEG systems more accessible and user-friendly, enabling their adoption across a wide range of healthcare settings. These systems are increasingly being integrated with other diagnostic modalities and technologies, such as functional magnetic resonance imaging (fMRI) and magnetoencephalography (MEG), to provide a more comprehensive assessment of brain function and connectivity.

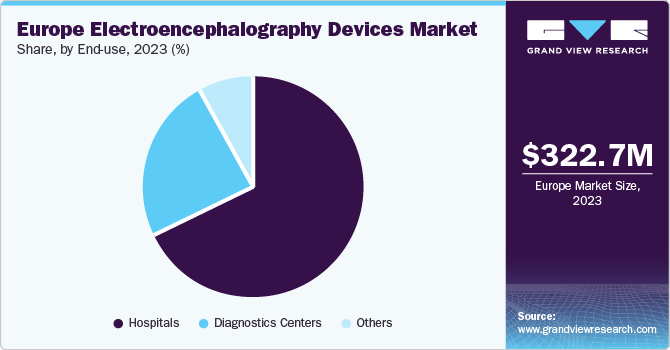

End-use Insights

Hospitals held the largest market share of about 67.8% in 2023.Hospitals are the primary facilities where patients visit for different medical procedures, including those that necessitate EEG monitoring. Many medical specialties and services are offered in hospitals, electroencephalography devices can be used across various departments, such as neurology, neurosurgery, intensive care units (ICUs), and emergency rooms. Moreover, hospitals have a higher patient volume compared to other healthcare settings, leading to a greater demand for EEG devices in hospitals.

The diagnostic centers segment is expected to grow at fastest rate during the forecast period. The growing incidence of neurological disorders and its growing awareness is expected to contribute to the segment growth. Diagnostic centers play an essential role in delivering specialized neurological diagnostic services to patients by offering EEG services, they help in early diagnosis and effective management of neurological conditions, which ultimately enhances patient outcomes and quality of care.

Type Insights

The standalone devices segment held the largest market share of 71.9% in 2023 and is expected to continue its dominance over the forecast period. Standalone EEG devices are more cost-effective than integrated systems, expanding their accessibility to a wider range of healthcare settings, including smaller clinics and outpatient facilities. Furthermore, standalone Electroencephalography (EEG) devices commonly feature user-friendly interfaces and controls, allowing healthcare professionals to operate them with ease. Thus, the aforementioned benefits are expected to contribute to the segment growth.

The portable device segment is expected to grow at the fastest CAGR over the forecast period. The rising need for remote patient monitoring and home-based healthcare solutions is increasing the adoption of portable Electroencephalography

(EEG) devices. These devices enable convenient and non-invasive monitoring of brain activity beyond traditional clinical settings, allowing patients to undergo EEG tests in the comfort of their homes. Additionally, technological advancements have resulted in the development of compact, lightweight, and battery-powered portable EEG devices, enhancing their portability and user-friendliness.

Application Insights

The disease diagnosis segment held the largest market share of about 32.0% in Europe's market. electroencephalography devices offer valuable insights into brain function and activity by detecting and recording the electrical signals generated by neurons in the brain. This enables healthcare professionals to evaluate a wide range of neurological conditions. EEG is particularly effective in diagnosing disorders like epilepsy, sleep disorders, and specific brain injuries or tumors. Through the analysis of brain wave patterns and frequencies, EEG helps in identifying abnormalities that may indicate these conditions.

The trauma & surgery segment is expected to grow at the fastest CAGR over the forecast period, this is primarily due to the rising incidence of injuries and accidents, which consequently leads to an increase in surgical interventions. Moreover, as the number of traumatic incidents rises, the need for surgical procedures to address resulting injuries also increases. Thus, Electroencephalography devices are essential in helping medical professionals monitor brain function during surgeries and trauma management.

Country Insights

The electroencephalography devices market in UK held a significant share in 2023. The UK has a well-defined healthcare system that consists of advanced medical technologies, including EEG devices. These devices are extensively used across hospitals, clinics, and research institutions for diagnosing and tracking a range of neurological conditions like epilepsy, sleep disorders, and brain injuries. Furthermore, the rising geriatric population and growing awareness regarding neurological disorders are increasing the need for electroencephalography devices in the country.

Germany Electroencephalography Devices Market Trends

Germany electroencephalography devices market is expected to grow owing to the growing prevalence of neurological disorders in the country and different strategic initiatives undertaken by market players in the country. For instance, in September 2022 , Brainlab announced the acquisition of Dr. Langer Medical GmbH. Headquartered in Waldkirch, Germany, this strategic acquisition signifies Brainlab's commitment to expanding its portfolio of innovative medical technologies, particularly in the realm of intraoperative neurosurgery.

France Electroencephalography Devices Market Trends

The electroencephalography devices market in France is expected to grow owing to technological advancements and the growing incidence of neurological disorders in the country. For instance, according to statistics from NCBI, stroke ranks as the second leading cause of mortality in France, with approximately 30,000 fatalities annually and around 110,000 hospitalizations each year.

Key Europe Electroencephalography Devices Company Insights

The presence of both established and emerging players in the Europe EEG market, coupled with their various initiatives to stay competitive, is expected to significantly drive overall market growth. These market leaders are consistently engaging in strategic efforts to enhance their offerings, broaden their market reach, and maintain a competitive edge. For instance, Cumulus Neuroscience, recognized as one of 2024’s most innovative medical device companies, utilizes an EEG headset and tablet to assess brain function. In 2023, their headset received FDA 510(k) clearance and was swiftly adopted by nine studies, ranging from observational research with universities to clinical trials sponsored by biopharma companies.

Key Europe Electroencephalography Devices Companies:

- Natus Medical, Inc.

- Medtronic

- Nihon Kohden America, Inc.

- Brain Products GmbH

- Neurosoft

- Compumedics Ltd.

- ANT Neuro

- Lifelines neuro

- Emotiv

Recent Developments

-

In April 2024, Neurovalens received £2.1 million (USD 2.65 million) in funding and obtained clearance from the FDA for their Modius Stress headband, a wearable device that uses electronic brain stimulation to treat anxiety

-

In March 2023, Ceribell, Inc., the developer of the world's first brain monitor for point-of-care seizure detection, was honored by Fast Company in its prestigious annual list of the World's Most Innovative Companies for 2023. Ceribell's groundbreaking point-of-care EEG technology has earned it a spot among the top 10 most innovative medical device companies of the year

"We are honored to receive this recognition and hope that it will further support our efforts to improve access to EEG and benefit more patients."

- Jane Chao, Ph.D., Ceribell's Co-founder and CEO

-

In November 2022, EMOTIV, a bioinformatics company dedicated to enhancing the understanding of the human brain through electroencephalography (EEG), is partnering with X-trodes to develop a new solution for simultaneous brain and physiological measurement that can be utilized outside of laboratory settings

“Our community will immediately benefit from the ability to study how the brain works in a range of new circumstances and environments. Adding new sensors to our platform that can accurately measure brain signals in natural settings creates exciting new opportunities for clinical research. The freedom to continuously measure and analyze real-world data without the limitations of the lab is a game-changer."

-Tan Le, founder and CEO of EMOTIV

Europe Electroencephalography Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 351.1 million

Revenue forecast in 2030

USD 625.8 million

Growth rate

CAGR of 10.11% from 2024 to 2030

Actual period

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use, country

Country scope

Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Natus Medical, Inc.; Medtronic; Nihon Kohden America, Inc.; Brain Products GmbH; Neurosoft; Compumedics Ltd.; ANT Neuro; Lifelines neuro; Emotiv

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Europe Electroencephalography Devices Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Europe electroencephalography devices market report based on product, type, application, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

8-channel EEG

-

21-channel EEG

-

25-channel EEG

-

32-channel EEG

-

40-channel EEG

-

Multichannel EEG

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone Devices

-

Portable Devices

-

Wearable Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Trauma & Surgery

-

Disease Diagnosis

-

Anesthesia Monitoring

-

Sleep Monitoring

-

Others

-

-

End Use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics Centers

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe electroencephalography devices market size was estimated at USD 322.7 million in 2023 and is expected to reach USD 351.1 million in 2024.

b. The Europe electroencephalography devices market is expected to grow at a compound annual growth rate of 10.11% from 2024 to 2030 to reach USD 625.8 million by 2030.

b. In 2023, Disease diagnosis segment held the largest market share of about 32.0% in Europe electroencephalography devices market. EEG devices offer valuable insights into brain function and activity by detecting and recording the electrical signals generated by neurons in the brain.

b. Some key players operating in the Europe electroencephalography devices market include Natus Medical, Inc.; Medtronic; Nihon Kohden America, Inc.; Brain Products GmbH; Neurosoft; Compumedics Ltd.; ANT Neuro; Lifelines neuro; Emotiv

b. Key factors that are driving the market growth include increasing prevalence of neurological disorders, advancements in EEG technology, and growing awareness about mental health. The rising incidence of neurological disorders, such as epilepsy, Alzheimer’s disease, and other dementias, is a major driver for the EEG devices market in Europe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.