Europe E-Cigarette And Vape Market Size, Share & Trends Analysis Report By Product (Disposable, Rechargeable, Modular Devices), By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-302-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Europe E-Cigarette And Vape Market Trends

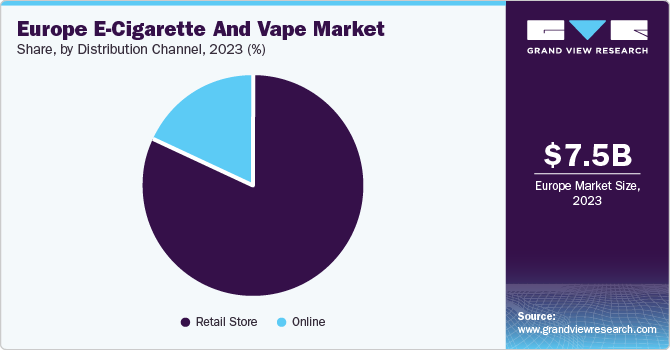

The Europe e-cigarette and vape market size was estimated at USD 7.5 billion in 2023 and is anticipated to grow at a CAGR of 29.4% from 2024 to 2030. The lucrative growth witnessed by the industry is attributed to the perception that e-cigarettes are a lower-risk alternative to traditional tobacco products. This perception is particularly significant in countries like the UK, where health authorities support e-cigarettes to help people quit smoking. Moreover, aggressive social media marketing by e-cigarette companies has contributed to brand awareness and product adoption, with companies successfully targeting adult smokers and improving the public perception of e-cigarettes as a harm-reduction tool.

The Europe region accounted for 26.6% revenue share of the global e-cigarette and vape market in 2023. The market is influenced by government initiatives and product innovation. Support from health authorities and governments has contributed to market growth, with organizations like Action on Smoking & Health (ASH) reporting significant adoption rates among young adults and adolescents. Moreover, in August 2023, the UK government launched a consultation on including inserts with advice on quitting smoking in cigarette packaging as part of its ongoing efforts to combat smoking. The move potentially increased the demand for alternative nicotine products among smokers seeking to quit.

Continuous development of new products and flavors, such as customized e-liquid flavors and innovative technologies like water-based e-cigarettes, has further driven market growth. Economic factors such as the availability of e-cigarettes at affordable prices and the convenience of online shopping have also contributed to the market growth. In the UK, for instance, the rise of online shopping has made it easier for consumers to access e-cigarettes, contributing to the market growth. Accordingly, the market is expanding across various European countries, including France, Germany, Italy, Russia, and Spain. The presence of several significant players in the market drives innovation and competition, with companies like Nicocig offering a wide range of products and flavors.

Product Insights

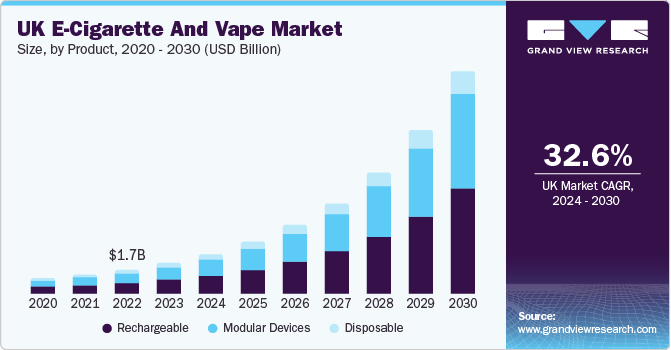

In 2023, rechargeable e-cigarettes and vapes led the market with over 40.0% of the total revenue generated. Their popularity is expected to grow as they offer affordability and convenience, eliminating the need for frequent cartridge purchases. Seasoned vapers appreciate the cost-effectiveness of rechargeable devices, making them a preferred choice.

Modular e-cigarettes and vapes are expected to grow at the fastest CAGR of 30.7% over the forecast period. These high-end, advanced devices are used primarily by professional vapers. They feature advanced functions like temperature control and variable wattage control, making them a popular choice among enthusiasts.

Distribution Channel Insights

Retail stores held the largest market share in 2023, generating 82.0% of the total revenue. The region has experienced a remarkable surge in recent years, with vape shops across the region experiencing a significant increase in demand.

The online segment is anticipated to exhibit rapid growth from 2024 to 2030, with a projected CAGR of 34.4%. Online vape shops have gained popularity as they offer customers the convenience of purchasing e-cigarettes online. Furthermore, their compact packaging size allows for lower shipping rates, making e-cigarettes an attractive option for buyers. Online marketplaces in Europe have also become a one-stop-shop for consumers, offering a vast range of e-cigarette products to choose from, catering to diverse preferences and needs.

Country Insights

UK E-Cigarette And Vape Market Trends

The UK e-cigarette and vape market held the largest market share in 2023, accounting for 29.5% of the European region's total revenue. Several factors contributed to its growth, including the growing popularity of e-cigarettes for quitting smoking, their widespread availability through various channels such as retail stores and online platforms, and the convenience they provide to consumers.

Germany E-Cigarette And Vape Market Trends

The e-cigarette and vape market in Germany is expected to experience rapid growth over the forecast period, with a CAGR of 19.7% from 2024 to 2030. The Germany e-cigarette and vape market continues to grow, fueled by consumer demand for alternatives to traditional cigarettes and leading brands’ ongoing product innovation.

Key Europe E-Cigarette And Vape Company Insights

Market players are undertaking various strategies such as product innovation, strategic mergers and acquisitions, and aggressive marketing campaigns. Some key players in this market include British American Tobacco Plc; Juul Labs Inc.; Japan Tobacco International; and Philip Morris International Inc.

-

British American Tobacco plc is a multinational tobacco company with a global presence. Its diverse portfolio of brands, including Vype, has a significant presence in the UK and Europe. The company focuses on innovation and product development to cater to evolving consumer preferences, driving growth in the Europe e-cigarette and vape market.

-

Juul Labs Inc. is a San Francisco-based e-cigarette company that has garnered significant media attention and criticism due to its widespread appeal among young consumers. The UK, where the government promotes vaping as a means to quit smoking, is the company’s primary European market.

Key Europe E-Cigarette And Vape Companies:

- British American Tobacco plc

- Juul Labs Inc.

- Japan Tobacco International

- Philip Morris International Inc.

- Altria Group Inc.

- Imperial Brands plc

- Reynolds American Inc.

- Fontem Ventures

- Logic Technology Development LLC

Recent Developments

- In May 2024, Altria's subsidiary NJOY submitted a Premarket Tobacco Product Application to the FDA for its NJOY ACE 2.0 device, which incorporates Bluetooth-enabled technology to restrict access to minors.

Europe E-cigarette And Vape Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 45.4 billion |

|

Growth rate |

CAGR of 29.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical Data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, country |

|

Regional scope |

Europe |

|

Country scope |

Germany, UK |

|

Key companies profiled |

British American Tobacco plc; Juul Labs Inc.; Japan Tobacco International; Philip Morris International Inc.; Altria Group Inc.; Imperial Brands plc; Reynolds American Inc.; Fontem Ventures; Logic Technology Development LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe E-Cigarette And Vape Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe e-cigarette and vape market report based on product, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Rechargeable

-

Modular Devices

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Retail Store

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

RoE

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."