- Home

- »

- Alcohol & Tobacco

- »

-

Europe Draught Beer Market Size, Industry Report, 2033GVR Report cover

![Europe Draught Beer Market Size, Share & Trends Report]()

Europe Draught Beer Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Keg Beer, Cask Beer), By Category (Super Premium, Premium, Regular), By End-use (Commercial Use, Home Use), By Production Type, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-238-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Draught Beer Market Summary

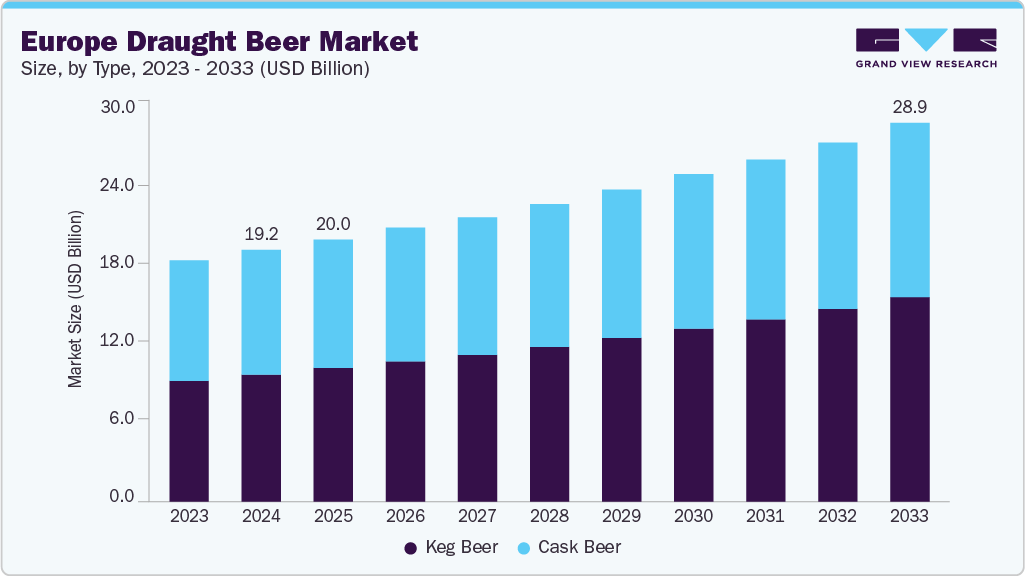

The Europe draught beer market size was valued at USD 19.2 billion in 2024 and is projected to reach USD 28.9 billion in 2033, growing at a CAGR of 4.7% from 2025 to 2033. A primary driver is the ongoing premiumization trend, where consumers are increasingly willing to pay more for high-quality, unique, and artisanal draught options, moving beyond mainstream lagers.

Key Market Trends & Insights

- The UK dominated the European draught beer market in 2024 with a revenue share of 56.9%.

- France draught beer market is expected to grow at the fastest CAGR over the forecast period.

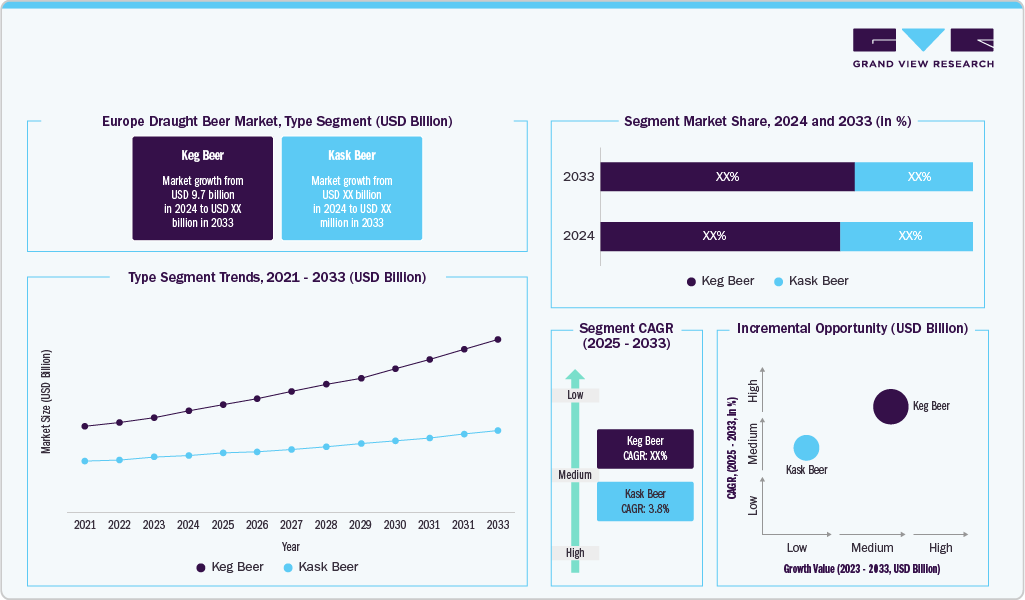

- Based on type, the keg beer segment accounted for a revenue share of 50.5% in 2024.

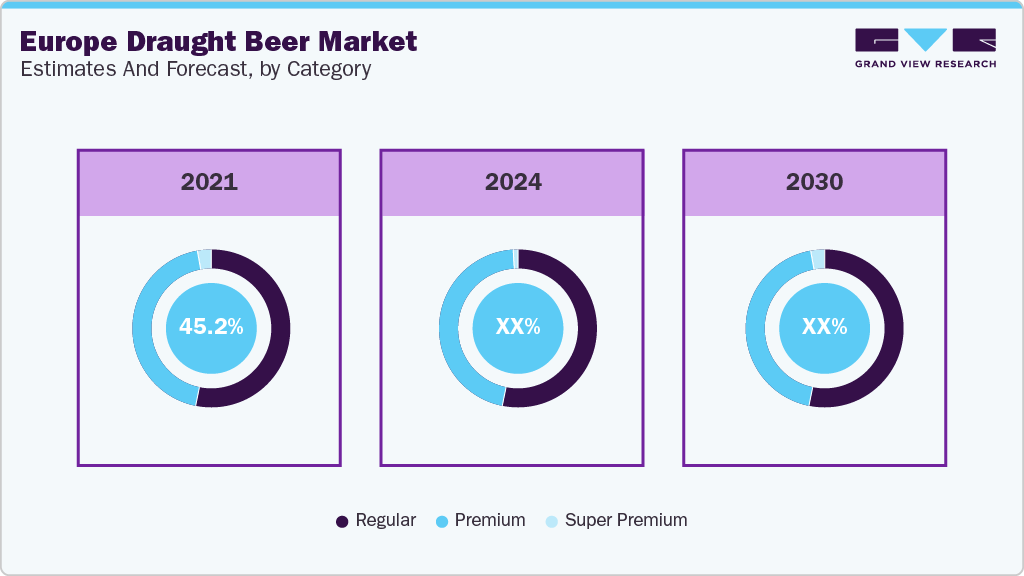

- Based on category, the regular draught beer segment dominated the market with a revenue share of 50.5% in 2024.

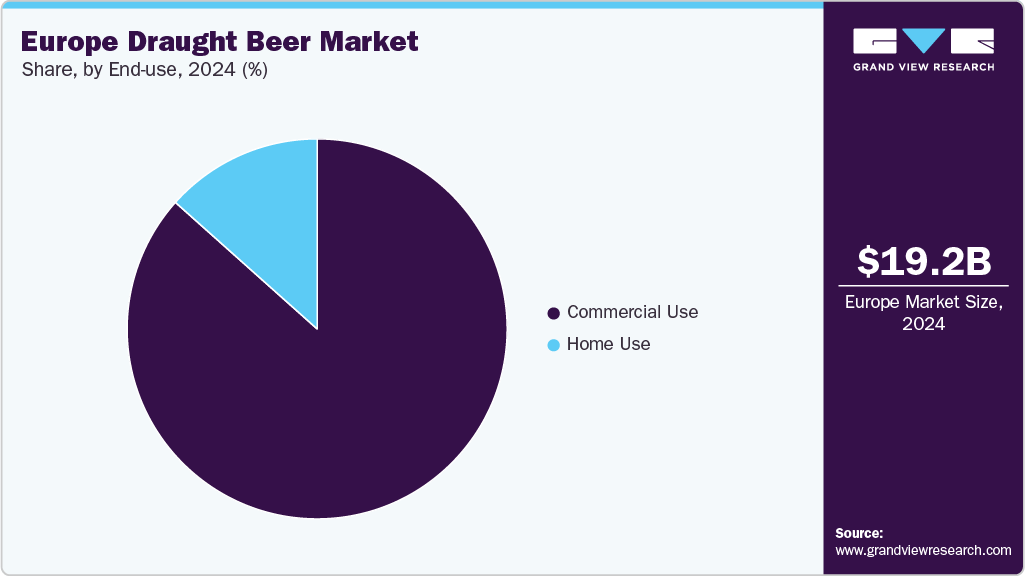

- Based on end-use, the commercial segment dominated the industry, accounting for a share of 86.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.2 Billion

- 2033 Projected Market Size: USD 28.9 Billion

- CAGR (2025-2033): 4.7%

This is intrinsically linked to the enduring craft beer boom, which has significantly diversified the offerings on tap, introducing a vast array of local, experimental, and specialty brews. Furthermore, a growing emphasis on authentic experiences and a desire to support local economies are pushing consumers towards establishments that offer locally sourced and sustainably produced draught beers, aligning with broader ethical consumption patterns.As out-of-home socialising continues to rebound across Europe, pubs, bars, and restaurants serve as critical venues for draught beer sales, benefiting from consumers' desire for communal experiences and the unique ambiance associated with a freshly poured pint. Innovation in brewing, including the expansion of low and no-alcohol options on tap, also broadens the market's appeal to health-conscious consumers. At the same time, technological advancements in dispense systems ensure optimal beer quality, further enhancing the consumer experience and solidifying the robust trajectory of the European draught beer market.

Beyond traditional preferences, the market is increasingly shaped by significant trends towards premiumization and a burgeoning craft beer scene. European consumers are showing a growing willingness to pay a higher price for unique, high-quality, and often locally sourced brews, reflecting a broader shift from quantity to quality consumption. This demand for variety extends across diverse beer styles, including IPAs, stouts, sours, and various seasonal offerings, driving innovation among brewers. Furthermore, the rising health and wellness trend has notably spurred the introduction and acceptance of low-alcohol and no-alcohol draught options, broadening the market's accessibility and appeal to a wider demographic seeking healthier choices without compromising on the social experience.

The sustained demand for draught beer also hinges on the on-premise sector's ability to consistently deliver quality and an engaging experience. Efficient supply chains, robust partnerships between breweries and hospitality venues, and continuous innovation in dispense technology are crucial for meeting consumer expectations for fresh, well-maintained beer. As consumer preferences continue to diversify and the desire for authentic, experiential consumption remains strong, the European draught beer market is poised for continued evolution, underscored by its inherent social appeal and the constant pursuit of the perfect pint in an inviting setting.

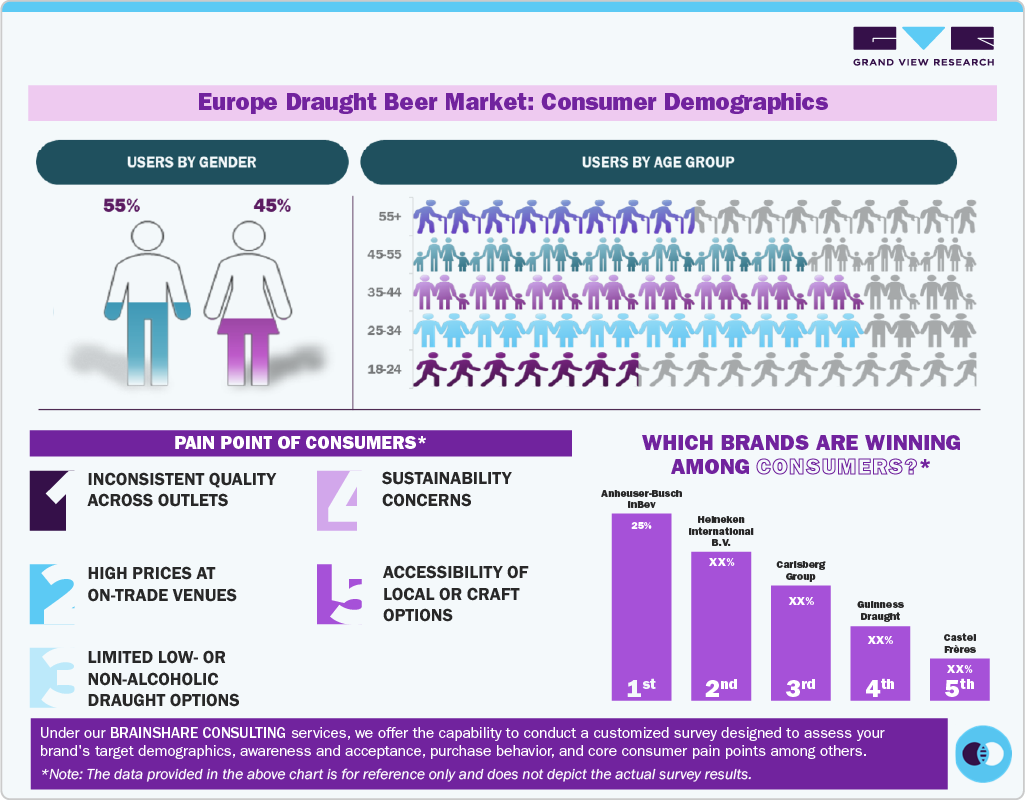

Consumer Insights for Europe Draught Beer

European consumers continue to show strong loyalty to traditional alcoholic drink formats, with draught beer remaining a symbol of authenticity and premium quality. There is a growing preference for locally brewed and craft options, especially among younger drinkers aged 25-55. Sustainability is becoming a key factor in purchase decisions, with consumers favoring eco-conscious breweries. Health-conscious trends have also increased demand for low-alcohol and alcohol-free draught variants. In addition, consumers seek immersive experiences, leading to the rising popularity of brewpubs and pro-rooms offering fresh, on-tap beer directly from the source.

Consumption habits in Europe are heavily tied to social and cultural experiences. Draught beer is most popular in on-trade establishments like pubs, bars, and restaurants, where it is perceived as fresher and more enjoyable. Western European countries such as Germany, the UK, and Belgium dominate draft beer sales due to strong pub cultures. Meanwhile, Eastern European nations are catching up with growing urban bar scenes. Festivals, sports events, and live music venues also drive consumption. However, economic uncertainties and inflation have made value-for-money offerings more appealing, influencing brand switching and demand for mid-range options.

Type Insights

Keg beer accounted for a revenue share of 50.5% in 2024. Keg beer is known for being pasteurised and filtered, and supplied in small barrels. The standard keg size in the UK is 11 gallons. A keg consists of 50 liters or 88 pints of beer. These kegs are used to store the beers as well as other non-alcoholic beverages. The characteristic of having consistent taste and prolonged shelf life makes them a popular choice among the two.

The demand for cask beer is expected to grow at a CAGR of 3.8% from 2025 to 2033. Cask beer has a deeper flavour attained through the natural and soft carbonation. Brew manufacturers are capitalizing on this opportunity by highlighting custom brews crafted in distinct casks. In February 2024, Norwich-based Woodforde’s Brewery unveiled a fresh lineup of cask beers called the Brewers Signature range, showcasing custom brews crafted by individual brewers within the team. The new range will feature a unique cask ale designed by a different brewery team member each month for the remainder of the year, exclusively available for on-trade customers.

Category Insights

Regular draught beer accounted for a revenue share of 50.5% in 2024. The affordability aspect associated with them primarily drives the increasing consumption of regular beers. Beers in this category are mass-produced beers that are brewed on a very large scale while managing to attain taste, quality, and appearance that will be liked and preferred by many. The regular beer industry utilizes standard brewing practices. In Europe, the regular category beers are widely distributed through supermarkets, hypermarkets, convenience stores, and bars. These places are easily accessible to consumers. Brands that operate in the regular category of the alcoholic drink market often have a worldwide presence. At the same time, their efficient distribution networks and global marketing campaigns help them maintain their level of popularity.

The demand for super premium draught beer is expected to grow at a CAGR of 5.8% from 2025 to 2033. The beers in this category are primarily developed by craft breweries, which focus on small-batches of production, inclusion of inventive ingredients, diligently established brewing technologies and effort to maintain the authenticity and diversity in terms of flavors. The key companies in this industry often introduce limited editions of their products through various campaigns. The advertising strategies adopted by makers of these beers also create a significant impact on the consumer in this category. In October 2023, Peroni Nastro Azzurro unveiled its inaugural global advertising campaign, promoting the iconic Italian brand with the message "Live Every Moment, All Year Round.”

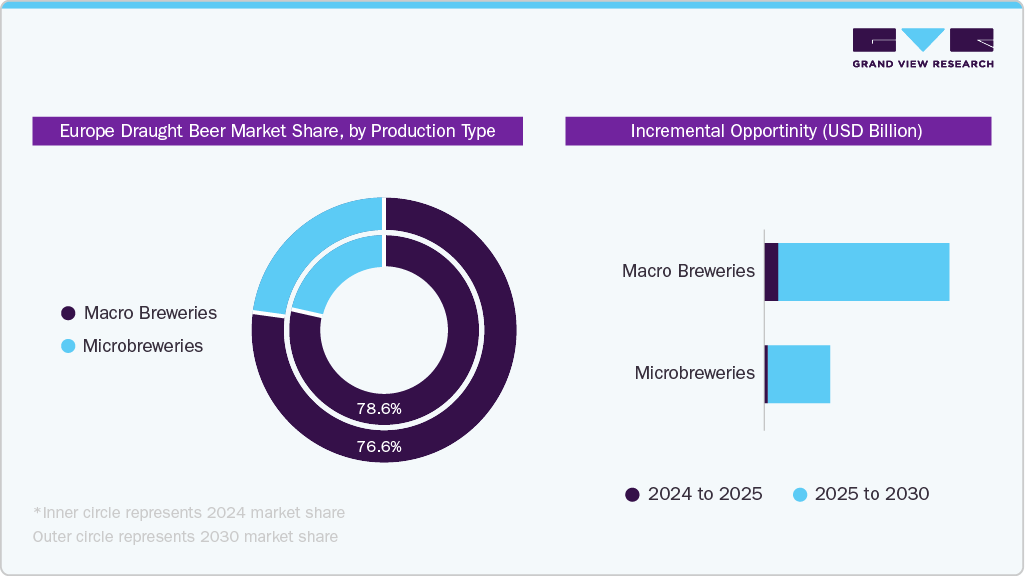

Production Type Insights

Macro-breweries accounted for a share of 78.6% in 2024. The industry has a significant impact on macro-breweries since these breweries produce draught beers on a large scale, catering to the demand from the mass market. Macro breweries produce beers in larger quantities while investing heavily in aspects such as infrastructure, manufacturing units, equipment, and advanced technologies, which can be adopted without disturbing the authenticity of the product they make.

The demand for draft beer from microbreweries is expected to grow at a CAGR of 5.7% from 2025 to 2033, propelled by a surging consumer demand for unique, high-quality, and experiential offerings. The "craft beer revolution" has shifted preferences away from mass-produced lagers toward diverse, artisanal styles, with draught being the preferred format for experiencing the full intended flavor profile and freshness. Consumers are increasingly seeking novelty and authenticity, driving the demand for limited-edition brews, experimental styles, and locally sourced ingredients that microbreweries are uniquely positioned to provide, amplifying the premiumization trend within the overall beverage market.

End-use Insights

Commercial draught beer segment accounted for a share of 86.6% in 2024. The industry's constant growing response to on-premise beer servings, increasing crowd at pubs, clubs, and an upsurge in the number of tourists visiting nations across the world post-pandemic period has resulted in growth for the commercial market of draught beer. The industry is primarily impacted by these factors, which include aspects such as social media trends, groups of young consumers in the region, and growing disposable income levels. In addition, brewing brands have been collaborating with different resorts and luxury hotels to unveil their premium range of limited edition products.

Draught beer for home consumption is anticipated to grow at a CAGR of 5.2% from 2025 to 2033. Advances in home beer dispensing technology, like compact kegerators and user-friendly beer taps, have made it easier for consumers to replicate the bar experience at home. Additionally, the rise of social gatherings and events hosted at home has fueled this trend, making it a convenient and appealing option for beer enthusiasts.

Country Insights

The UK draught beer market accounted for a share of 56.9% in 2024. According to research conducted by Co-Operatives UK in October 2023, there has been a remarkable increase in community-owned pubs over the past five years in the UK. The country has a strong brewing heritage, with a noteworthy history of beer production and consumption, which has been contributing to the increasing demand for draught beer. According to statistics from the Society of Independent Brewers (SIBA) British Craft Beer Report 2020, there is a positive trend in consumer awareness and recognition of genuine craft beer. In addition, key international brands are expanding their presence and product portfolio in the regional markets.

The draught beer market in Germany is expected to grow at a CAGR of 4.2% from 2025 to 2033. The popularity of draught beer in Germany has been fueled by the numerous beer festivals held in the country, such as the world-famous Oktoberfest. These festivals attract millions of visitors every year, who come to experience traditional German culture and delicious European draft beer. These festivals are also a great way to showcase the variety of European draught beers available in Germany, with each region having its unique brew.

France draught beer market is expected to grow at a CAGR of 7.5% from 2025 to 2033. The industry is experiencing growth owing to the increasing inflow of tourists in the country, the growing presence of French brands across different regional markets, local tie-ups, partnerships with cafes, bars, and restaurants, and trends associated with home consumption of draught beer.

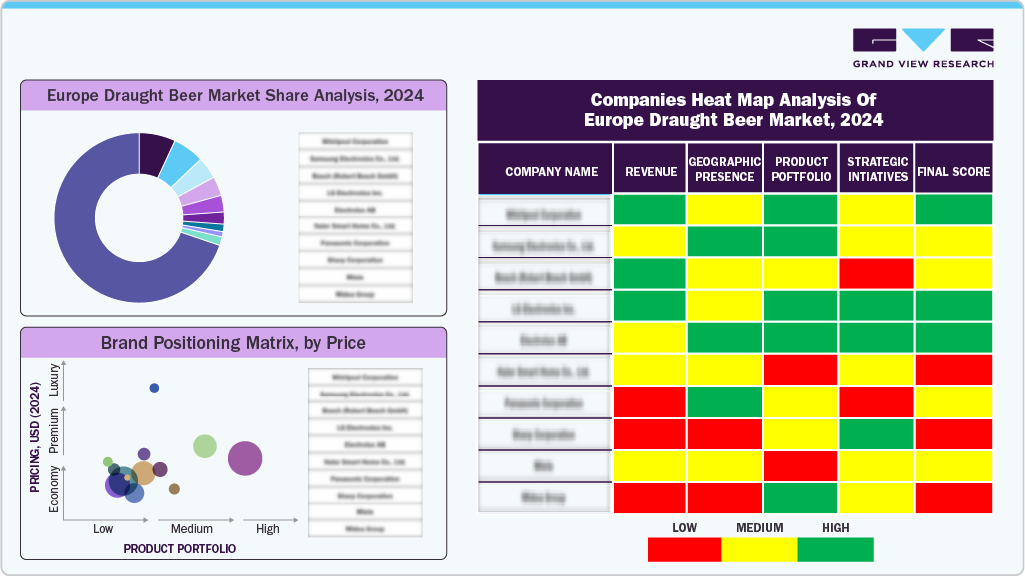

Key Europe Draught Beer Company Insights

Key players operating in the Europe draught beer market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Europe Draught Beer Companies:

- Anheuser Busch InBev

- Heineken International B.V.

- Carlsberg

- Castel Frères

- CHIMAY BEERS AND CHEESES

- Bitburger Brewery

- Staatliches Hofbräuhaus in München

- Guinness Draught

- Duvel

- Peroni

Recent Developments

-

In January 2024, Molson Coors Beverage Company announced the introduction of Madrí Excepcional in Canada, bringing over the U.K.'s rapidly expanding beer brand. Madrí Excepcional will be available on tap at selected on-premise venues.

-

In June 2023, Heineken acquired full ownership of the Amsterdam-based craft brewery Oedipus. Having previously held a minority stake in the brewery, Heineken completed the purchase of the remaining shares.

Europe Draught Beer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.0 billion

Revenue Forecast in 2033

USD 28.9 billion

Growth rate

CAGR of 4.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, category, end-use, production type, country

Country scope

Germany; UK; France; Italy; Spain; Ireland

Key companies profiled

Anheuser Busch InBev; Heineken International B.V.; Carlsberg; Castel Frères; CHIMAY BEERS AND CHEESES; Bitburger Brewery; Staatliches Hofbräuhaus in München; Guinness Draught; Duvel; Peroni

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Draught Beer Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the Europe draught beer market report on the basis of type, category, end use, production, and country:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Keg Beer

-

Cask Beer

-

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Premium

-

Premium

-

Regular

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Use

-

Home Use

-

-

Production Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Macro Breweries

-

Microbreweries

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Ireland

-

Frequently Asked Questions About This Report

b. The Europe draught beer market size was estimated at USD 19.22 billion in 2024 and is expected to reach USD 20.01 billion in 2030.

b. The Europe draught beer market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 to reach USD 28.9 billion by 2033.

b. The UK dominated the Europe draught beer market with a share of 56.9% in 2024. This is attributable to the increasing penetration of community-owned pubs and the growing brewing culture in the country.

b. Some key players operating in the European draught beer market include AAnheuser Busch InBev, Heineken International B.V., Carlsberg, Castel Frères, CHIMAY BEERS AND CHEESES, Bitburger Brewery, Staatliches Hofbräuhaus in München, Guinness Draught, Duvel, and Peroni.

b. Key factors that are driving the market growth include the growing number of consumers prefer high-quality and well brewed beers, inventive dispensing alternatives, and upsurge in demand for on - premise consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.